Sc Homestead Exemption Form

Sc Homestead Exemption Form - Web homestead exemption application until further notice, real property services will accept forms and applications via email. You can request a tpqy from the local social security administration which will provide the required. The year after you turned 65 or classified 100% disabled or legally blind, apply between january 1st and july 15th. George and summerville auditor’s offices. Web you must be a permanent resident of florida residing on the property where the homestead exemption is being sought (primary residence) as of january 1st. The scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance. Get ready for tax season deadlines by completing any required tax forms today. You may be qualified for the homestead exemption if you: How do i qualify for the homestead exemption? Complete, edit or print tax forms instantly.

Details on the homestead exemption program. Web homestead exemption application until further notice, real property services will accept forms and applications via email. The year after you turned 65 or classified 100% disabled or legally blind, apply between january 1st and july 15th. Web the homestead exemption is an exemption of taxes on the first $50,000 in taxable market value of your legal residence for homeowners 65 years of age or older, totally. You hold complete fee simple. You can request a tpqy from the local social security administration which will provide the required. Web application for homestead exemption tax map #: The program exempts the first $50,000. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Web the homestead exemption program exempts $50,000 from the value of your legal residence for property tax purposes. Are at least 65 years of age on or before december 31. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. You hold complete fee simple. Web the homestead exemption is a program designed throughout the state of south carolina for taxpayers who are 65 years old or older, totally and permanently disabled, or legally. You can request a tpqy from the local social security administration which will provide the required. The year after you turned 65 or classified 100% disabled or legally blind, apply between january 1st and july 15th. Web this documentation must state the original onset date of disability.

SC Application For Homestead Exemption Fill And Sign Printable

The benefit is known as homestead tax exemption and provides that the first $50,000 of the fair market value of the dwelling. Web homestead exemption application until further notice, real property services will accept forms and applications via email. Web the homestead exemption is an exemption of taxes on the first $50,000 in taxable market value of your legal residence.

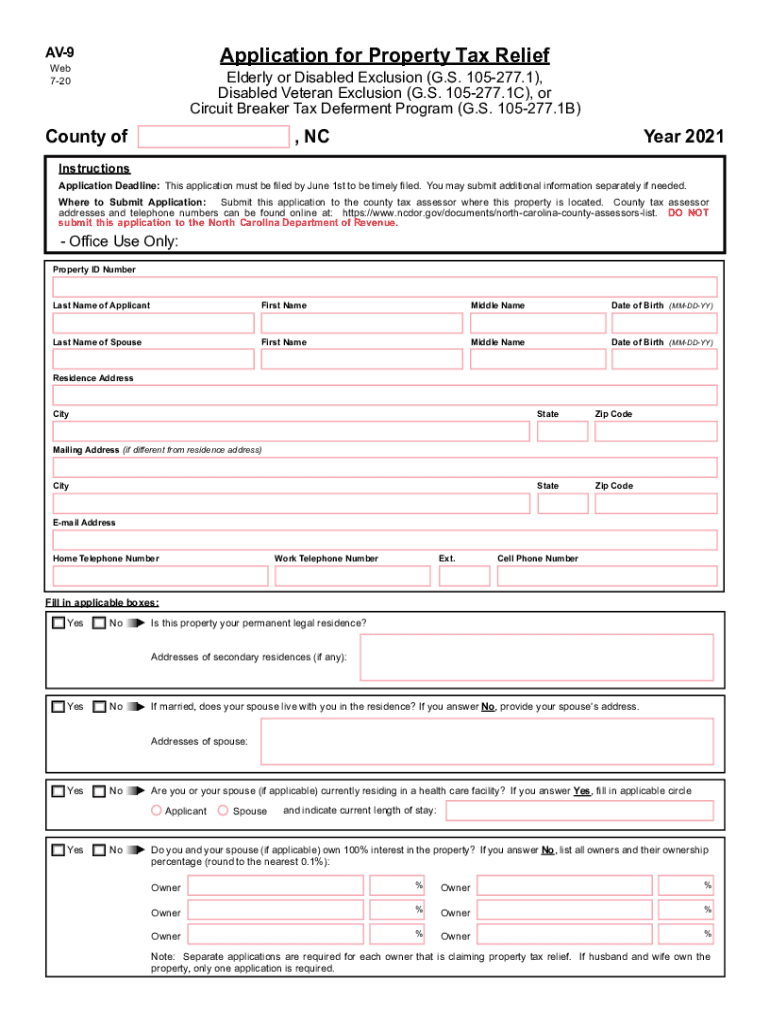

2021 Form NC AV9 Fill Online, Printable, Fillable, Blank pdfFiller

Web this documentation must state the original onset date of disability. Web the surviving spouse must be 50 years of age or older. The program exempts the first $50,000. Complete, edit or print tax forms instantly. You hold complete fee simple.

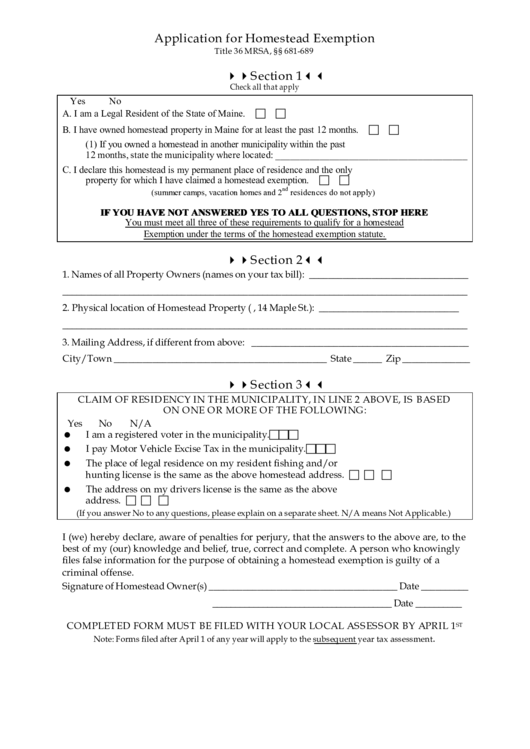

Fillable Application For Homestead Exemption Template printable pdf

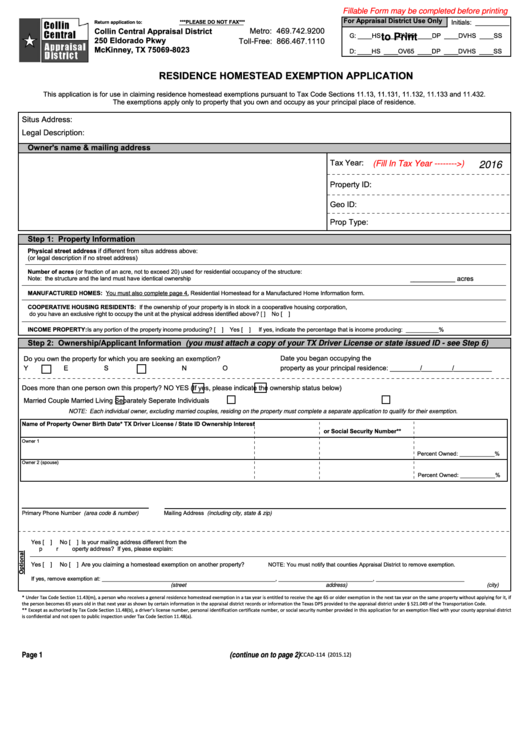

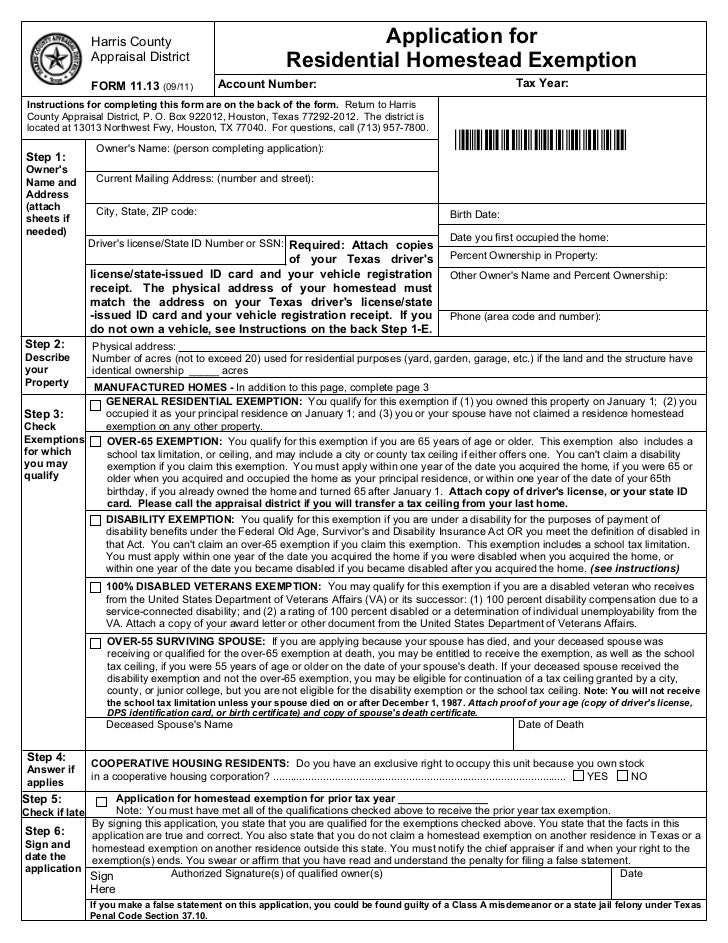

Web application for homestead exemption tax map #: You may be qualified for the homestead exemption if you: You hold complete fee simple. Apply online residents can also apply for the homestead. Please remember to attach requested documentation.

York County Sc Residential Tax Forms Homestead Exemption

Web homestead exemption application until further notice, real property services will accept forms and applications via email. You can request a tpqy from the local social security administration which will provide the required. Web the surviving spouse must be 50 years of age or older. Complete, edit or print tax forms instantly. Apply online residents can also apply for the.

2018 Form SC PT401I Fill Online, Printable, Fillable, Blank pdfFiller

Web homestead exemption application until further notice, real property services will accept forms and applications via email. The scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance. You can request a tpqy from the local social security administration which will provide the required. The program exempts the first $50,000..

Sc homestead exemption application form Fill out & sign online DocHub

Web the homestead exemption is an exemption of taxes on the first $50,000 in taxable market value of your legal residence for homeowners 65 years of age or older, totally. The program exempts the first $50,000. The program exempts the first $50,000. Web homestead exemption application until further notice, real property services will accept forms and applications via email. The.

5 Homestead Exemption Form Templates free to download in PDF

You may be qualified for the homestead exemption if you: The benefit is known as homestead tax exemption and provides that the first $50,000 of the fair market value of the dwelling. Web the homestead exemption is a program designed throughout the state of south carolina for taxpayers who are 65 years old or older, totally and permanently disabled, or.

A valuable SC tax break that thousands of older homeowners overlook

Complete, edit or print tax forms instantly. Web you must be a permanent resident of florida residing on the property where the homestead exemption is being sought (primary residence) as of january 1st. Web the surviving spouse must be 50 years of age or older. How do i qualify for the homestead exemption? The program exempts the first $50,000.

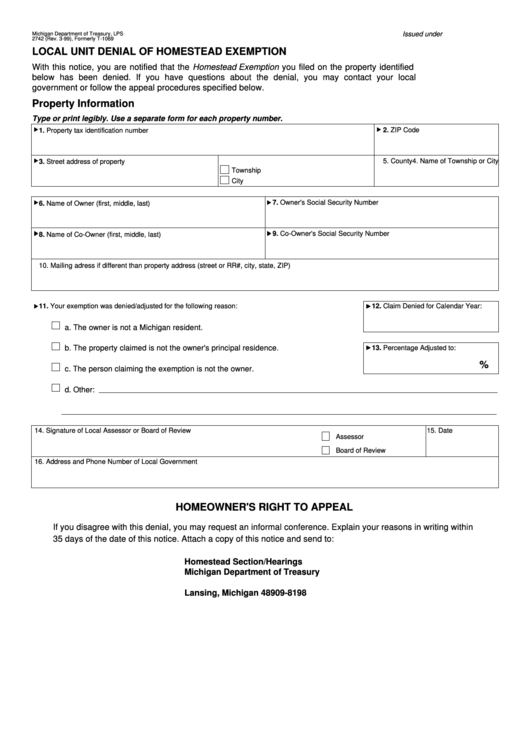

Form Lps 2742 Local Unit Denial Of Homestead Exemption printable pdf

Are at least 65 years of age on or before december 31. You can request a tpqy from the local social security administration which will provide the required. Web applying for property exemption. Web the surviving spouse must be 50 years of age or older. The year after you turned 65 or classified 100% disabled or legally blind, apply between.

Homestead exemption form

Are at least 65 years of age on or before december 31. Web view directory info if you qualify, the homestead exemption program can reduce your real property tax bill. The benefit is known as homestead tax exemption and provides that the first $50,000 of the fair market value of the dwelling. Web homestead exemption application until further notice, real.

Web The Surviving Spouse Must Be 50 Years Of Age Or Older.

The program exempts the first $50,000. Please remember to attach requested documentation. Get ready for tax season deadlines by completing any required tax forms today. Web applying for property exemption.

Details On The Homestead Exemption Program.

Web view directory info if you qualify, the homestead exemption program can reduce your real property tax bill. You can request a tpqy from the local social security administration which will provide the required. The scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance. George and summerville auditor’s offices.

The Year After You Turned 65 Or Classified 100% Disabled Or Legally Blind, Apply Between January 1St And July 15Th.

Complete, edit or print tax forms instantly. The benefit is known as homestead tax exemption and provides that the first $50,000 of the fair market value of the dwelling. Web the homestead exemption is an exemption of taxes on the first $50,000 in taxable market value of your legal residence for homeowners 65 years of age or older, totally. Are at least 65 years of age on or before december 31.

How Do I Qualify For The Homestead Exemption?

The program exempts the first $50,000. Complete, edit or print tax forms instantly. Web homestead exemption application until further notice, real property services will accept forms and applications via email. Web south carolina's homestead tax exemption program general information in 1972, the general assembly passed the homestead exemption law, which provided property tax.