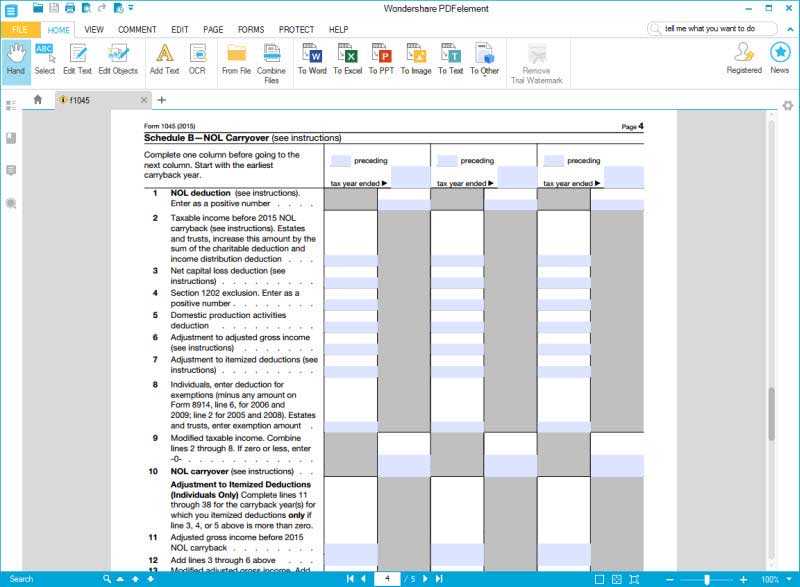

Schedule A Form 1045

Schedule A Form 1045 - Web loss deduction is calculated on a u.s. Filing form 1045 with a carryback to a section 965 inclusion year. Those with a negative balance on form. Web information on how to make the election. The use of indiana modifications may result in an indiana net operating loss even if there is no federal nol. Web schedule a is a u.s. Income tax form that is used by taxpayers to report itemized deductions, which can help reduce an individual's federal tax liability. 1045 schedule a, line 21 or 22. Estates and trusts, enter taxable. Web go to www.irs.gov/form1045 for the latest information.

You can download or print current. Estates and trusts, enter taxable. Web information on how to make the election. 1045 schedule a, line 21 or 22. The use of indiana modifications may result in an indiana net operating loss even if there is no federal nol. Loss that is limited to $3,000. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web about form 1045, application for tentative refund. Web schedule a is a u.s. Click form to make entries or review entries already made.

Web schedule a from form 1045. Web about form 1045, application for tentative refund. Web loss deduction is calculated on a u.s. Web information on how to make the election. Loss that is limited to $3,000. You can download or print current. An excess capital loss includes a u.s. The use of indiana modifications may result in an indiana net operating loss even if there is no federal nol. Web go to www.irs.gov/form1045 for the latest information. Because of the changes in the nol rules under the cares act, you may.

IRS Form 1045 Fill it as You Want

Web loss deduction is calculated on a u.s. Estates and trusts, enter taxable. Web schedule a from form 1045. Web go to www.irs.gov/form1045 for the latest information. The carryback of an nol.

Form 1045 Application for Tentative Refund (2014) Free Download

Because of the changes in the nol rules under the cares act, you may. Estates and trusts, enter taxable. Web loss deduction is calculated on a u.s. Web schedule a from form 1045. You can download or print current.

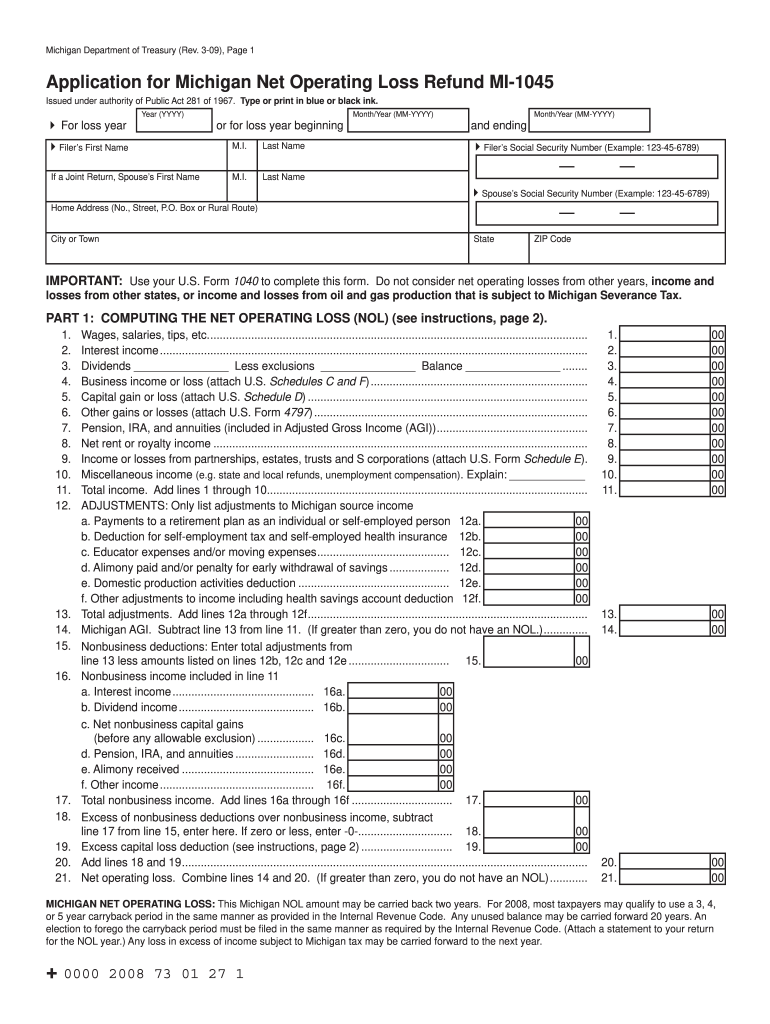

Mi 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Web schedule a is a u.s. Web about form 1045, application for tentative refund. Income tax form that is used by taxpayers to report itemized deductions, which can help reduce an individual's federal tax liability. Loss that is limited to $3,000. Estates and trusts, enter taxable.

Publication 536, Net Operating Losses (NOLs) for Individuals, Estates

Estates and trusts, enter taxable. Loss that is limited to $3,000. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web information on how to make the election. 1045 schedule a, line 21 or 22.

I1045

Web loss deduction is calculated on a u.s. Filing form 1045 with a carryback to a section 965 inclusion year. Those with a negative balance on form. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the election.

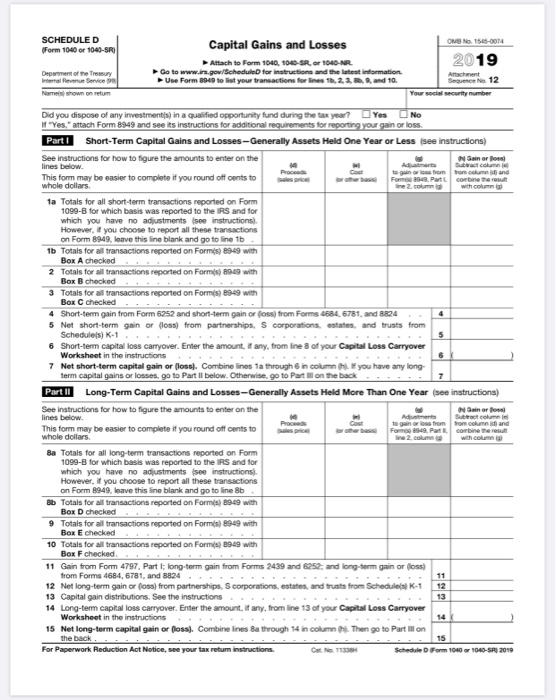

Solved Complete a 1040 Schedule D For this assignment, you

Click form to make entries or review entries already made. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web go to www.irs.gov/form1045 for the latest information. Estates and trusts, enter taxable. Web information on how to make the election.

Form 1045 Application for Tentative Refund

Web information on how to make the election. Web schedule a is a u.s. Because of the changes in the nol rules under the cares act, you may. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the.

Form 1045 Application for Tentative Refund (2014) Free Download

An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Click form to make entries or review entries already made. Web information on how to make the election. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Click form to make entries or review entries already made. Those with a negative balance on form. You can download or print current. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web if you filed your 2019 federal income tax return.

How to Calculate Carryover From the Previous Fiscal Year Pocket Sense

Web about form 1045, application for tentative refund. Because of the changes in the nol rules under the cares act, you may. Income tax form that is used by taxpayers to report itemized deductions, which can help reduce an individual's federal tax liability. Web schedule a from form 1045. The carryback of an nol.

An Excess Capital Loss Includes A U.s.

Loss that is limited to $3,000. Web schedule a from form 1045. Web information on how to make the election. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022.

Those With A Negative Balance On Form.

Web schedule a is a u.s. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the election and apply for a. Web about form 1045, application for tentative refund. Web go to www.irs.gov/form1045 for the latest information.

Web Form 1045 (2010) Page 2 Schedule A—Nol (See Instructions) Enter The Amount From Your 2010 Form 1040, Line 41, Or Form 1040Nr, Line 39.

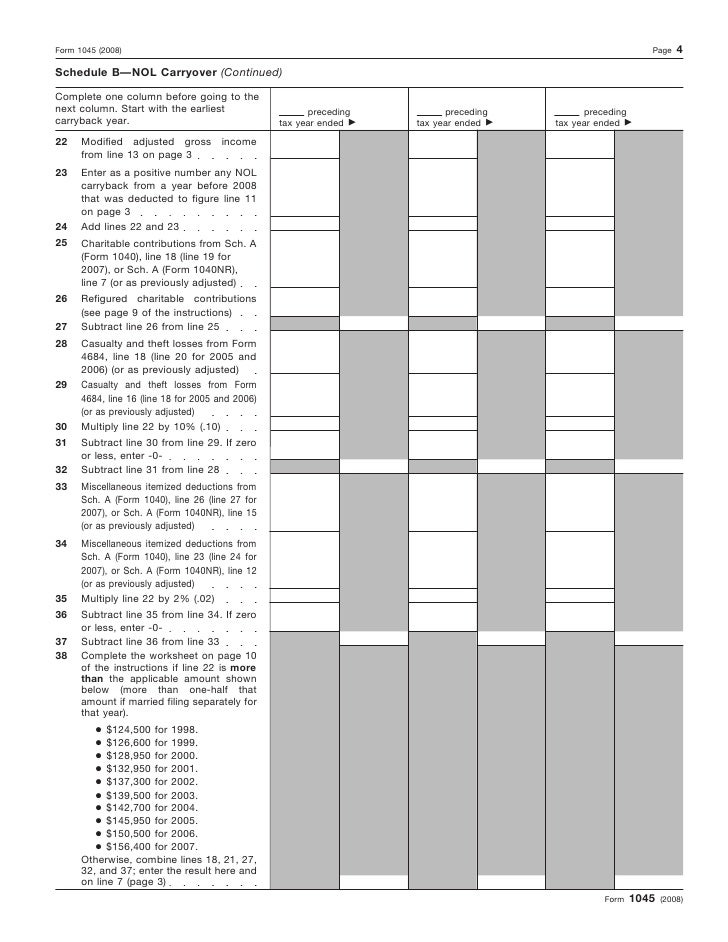

An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol. 1045 schedule a, line 21 or 22. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.

You Can Download Or Print Current.

Web loss deduction is calculated on a u.s. Filing form 1045 with a carryback to a section 965 inclusion year. Click form to make entries or review entries already made. The use of indiana modifications may result in an indiana net operating loss even if there is no federal nol.