Schedule B 941 Form 2023

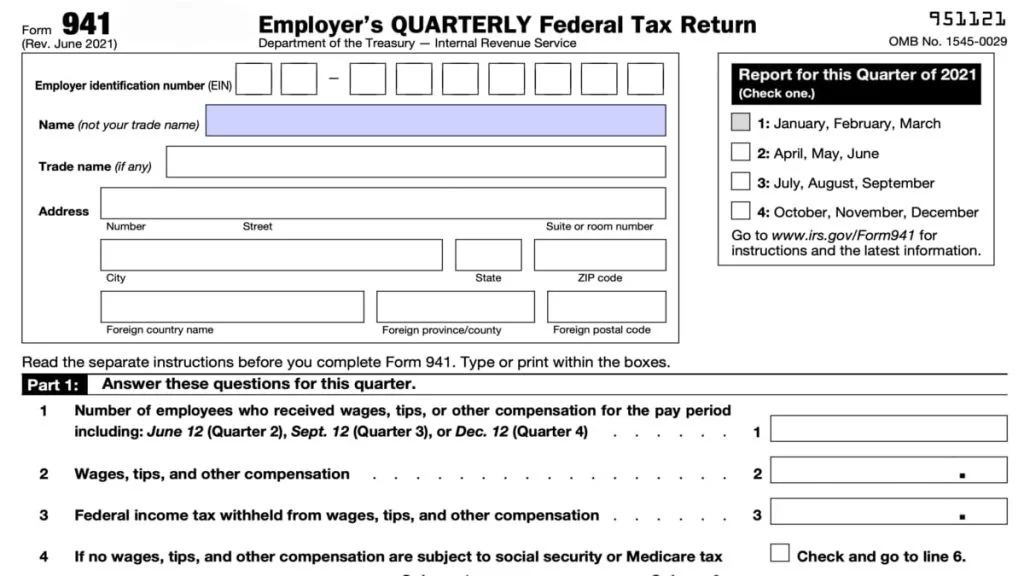

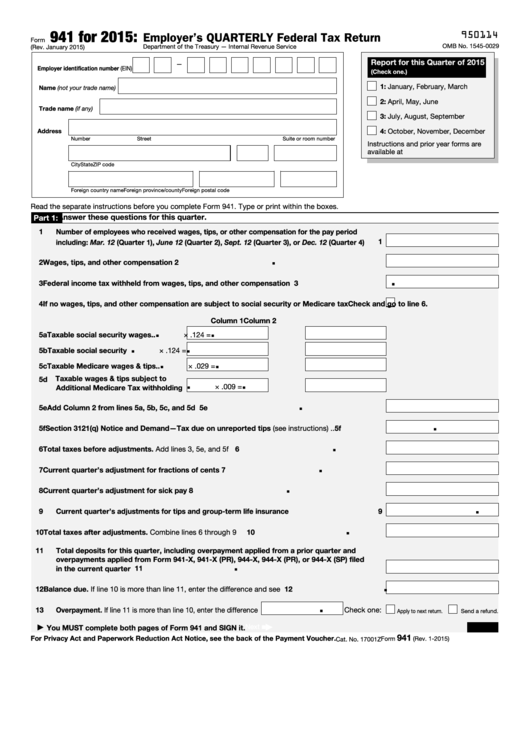

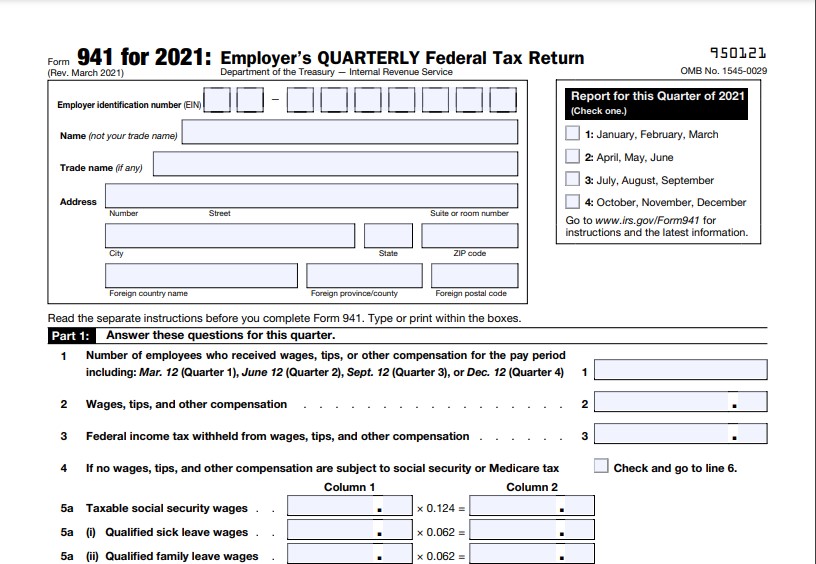

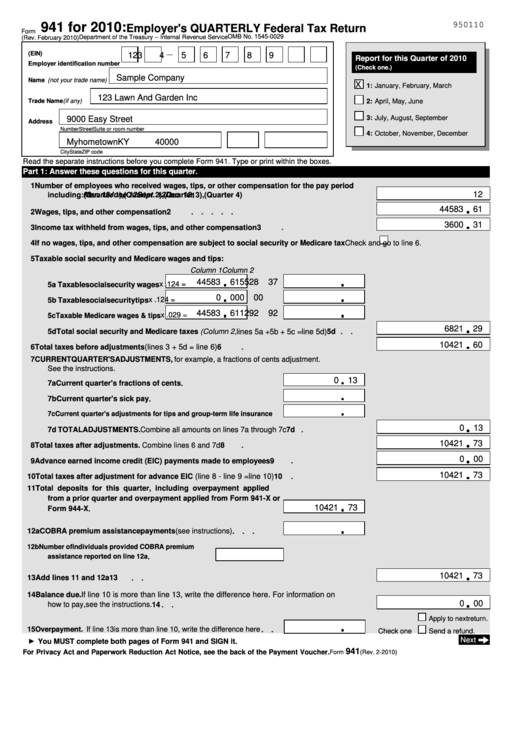

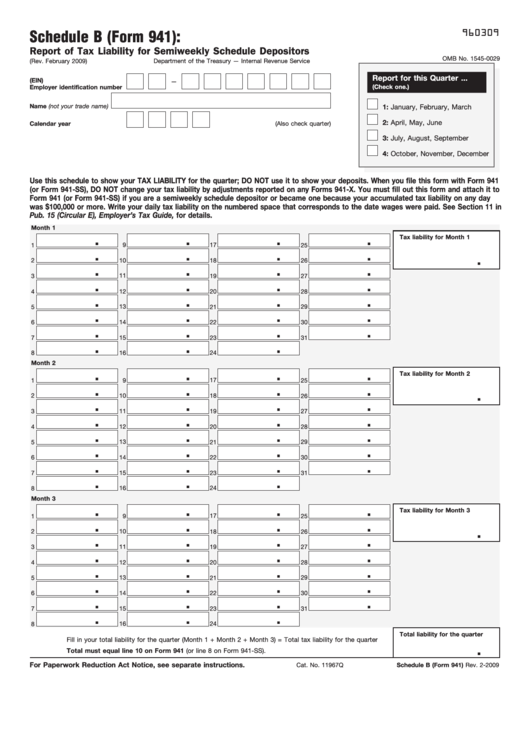

Schedule B 941 Form 2023 - The 2023 form 941, employer’s quarterly federal tax return, and its instructions. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. The instructions for schedule b, report of tax liability for semiweekly schedule depositors. It discusses what is new for this version as well as the requirements for completing each form line by line. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code

Schedule r, allocation schedule for aggregate form 941 filers, and its instructions. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. The instructions for schedule b, report of tax liability for semiweekly schedule depositors. Don't use it to show your deposits. It discusses what is new for this version as well as the requirements for completing each form line by line. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. It includes the filing requirements and tips on reconciling and balancing the two forms.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The instructions for schedule b, report of tax liability for semiweekly schedule depositors. It includes the filing requirements and tips on reconciling and balancing the two forms. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Don't use it to show your deposits. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; It discusses what is new for this version as well as the requirements for completing each form line by line. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023.

941 Form 2023

It discusses what is new for this version as well as the requirements for completing each form line by line. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code.

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

The 2023 form 941, employer’s quarterly federal tax return, and its instructions. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; It discusses what is new for this version as well as the requirements for completing each form line by line. Web this webinar covers the irs form 941 and its accompanying.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code It includes the filing requirements and tips on reconciling and balancing the.

Printable 941 Tax Form Printable Form 2021

Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. It includes the filing requirements and tips.

2023 Form 941 Generator Create Fillable Form 941 Online

It includes the filing requirements and tips on reconciling and balancing the two forms. It discusses what is new for this version as well as the requirements for completing each form line by line. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to.

941 form 2021 schedule b Fill Online, Printable, Fillable Blank

Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name.

Form 941 Printable & Fillable Per Diem Rates 2021

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Schedule r, allocation schedule for aggregate form 941 filers, and its instructions..

IRS Form 941 Schedule B 2023

July 22, 2023 5:00 a.m. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Don't use it to show your deposits. It discusses what is new for this version as well as.

Form 941 Employers Quarterly Federal Tax Return, Schedule B (Form 941

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. If you haven't received a payment. Completes schedule b (form 941) by reducing the amount.

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

This is the final week the social security administration is sending out payments for july. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county.

This Is The Final Week The Social Security Administration Is Sending Out Payments For July.

Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code If you haven't received a payment. Don't use it to show your deposits.

It Includes The Filing Requirements And Tips On Reconciling And Balancing The Two Forms.

The 2023 form 941, employer’s quarterly federal tax return, and its instructions. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Schedule r, allocation schedule for aggregate form 941 filers, and its instructions.

Form 941 Is Used By Employers Who Withhold Income Taxes From Wages Or Who Must Pay Social Security Or Medicare Tax.

July 22, 2023 5:00 a.m. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. The instructions for schedule b, report of tax liability for semiweekly schedule depositors.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) — Name (Not Your Trade Name) Trade Name (If Any) Address Number Street Suite Or Room Number City State Zip Code Foreign Country Name Foreign Province/County.

Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; It discusses what is new for this version as well as the requirements for completing each form line by line.