Schedule F Form

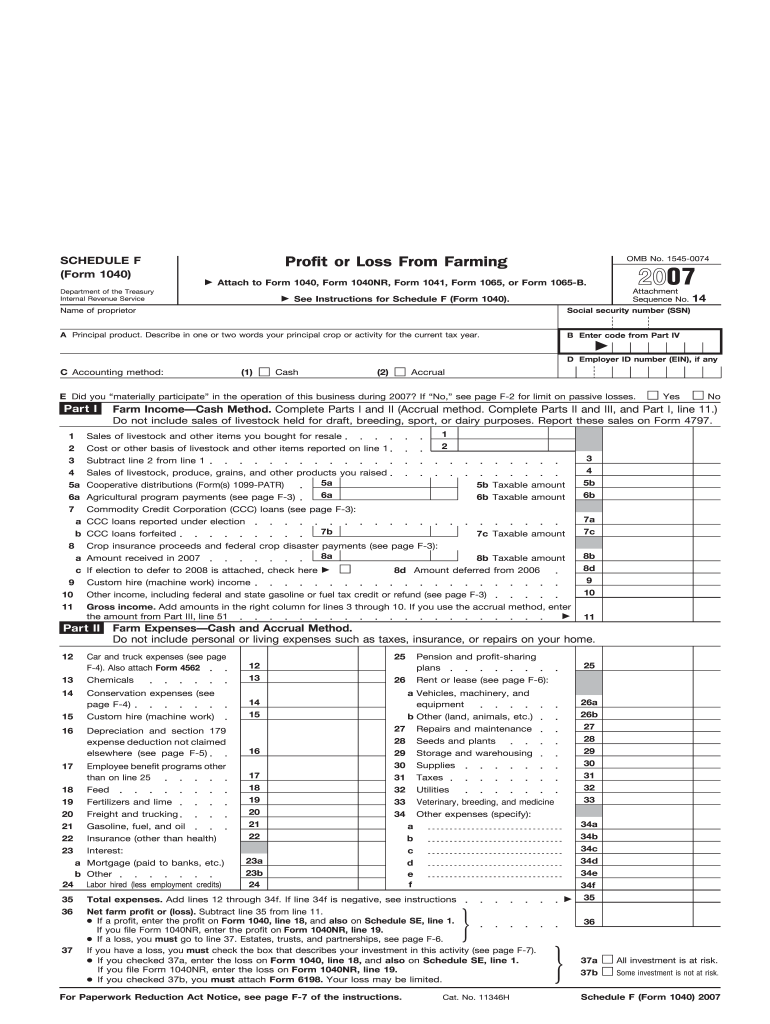

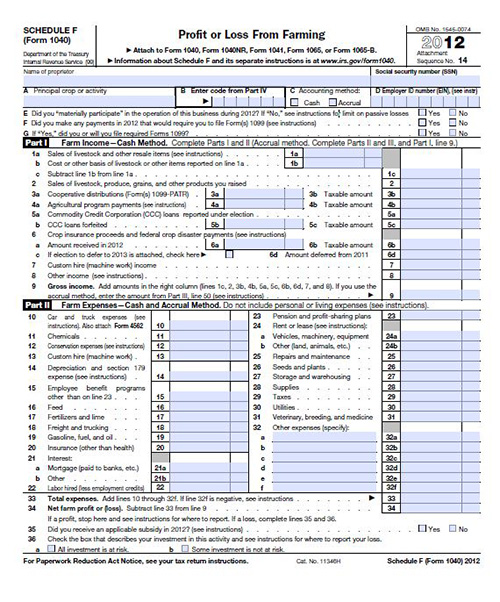

Schedule F Form - Schedule j (form 1040) income averaging for farmers and. Use schedule f (form 1040) to report farm income and expenses. Web use irs schedule f to report farm income and expenses. Assumed and ceded remsurance by company: Get ready for tax season deadlines by completing any required tax forms today. Keep track of all the latest moves in the standings here. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. F1 academy has five teams — art grand prix,. Net profits are subject to self. Web schedule f (form 1040) profit or loss from farming.

Web schedule f (form 1040) profit or loss from farming. Complete, edit or print tax forms instantly. Web use irs schedule f to report farm income and expenses. Net profits are subject to self. Web schedule c or f. Schedule f is due when personal income taxes are due, on tax day. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Web 2021 instructions for schedule fprofit or loss from farming. Ad access irs tax forms. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses.

Part 1 shows assumed premiums and. Adding in a schedule f is necessary for tax purposes if you are claiming income from your farming operation, no matter how small.this article provides a. Net profits are subject to self. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision. Schedule f is due when personal income taxes are due, on tax day. Web schedule f (form 1040) profit or loss from farming. The decedent held an interest as joint tenants with rights of. Web taxes can be complicated. Web 2021 instructions for schedule fprofit or loss from farming.

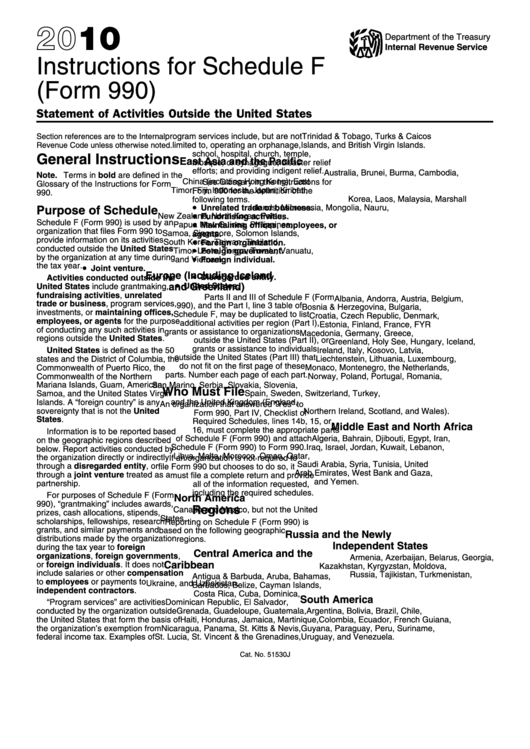

Instructions For Schedule F (Form 990) 2010 printable pdf download

Web recorded on a form 1040 schedule f: Web taxes can be complicated. Assumed and ceded remsurance by company: Web who files a schedule f? Profit or loss from farming.

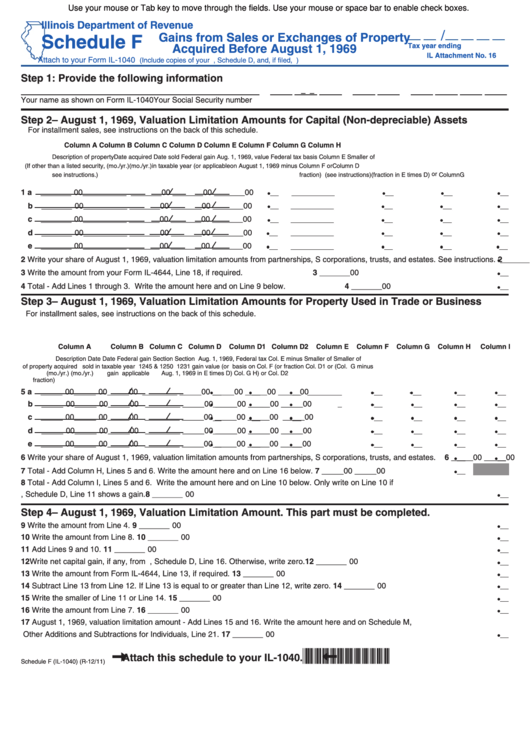

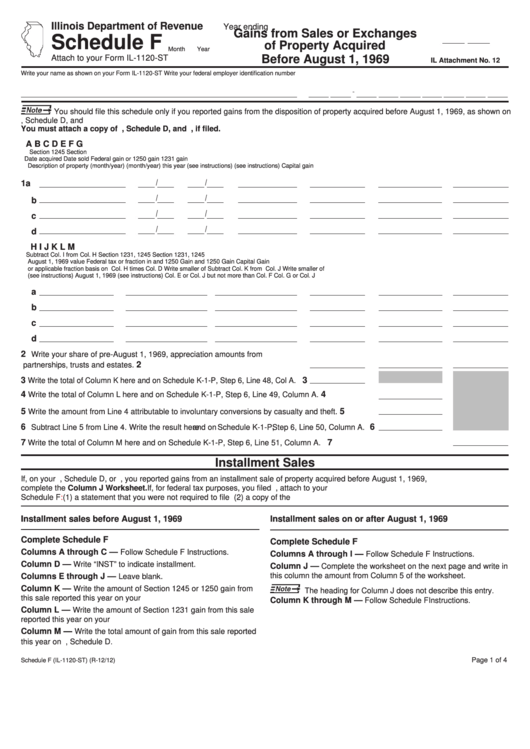

Fillable Schedule F (Form Il1040) Gains From Sales Or Exchanges Of

Net profits are subject to self. F1 academy has five teams — art grand prix,. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. For individuals, it is included with your. Web use schedule f (form 1040) to report farm income and expenses.

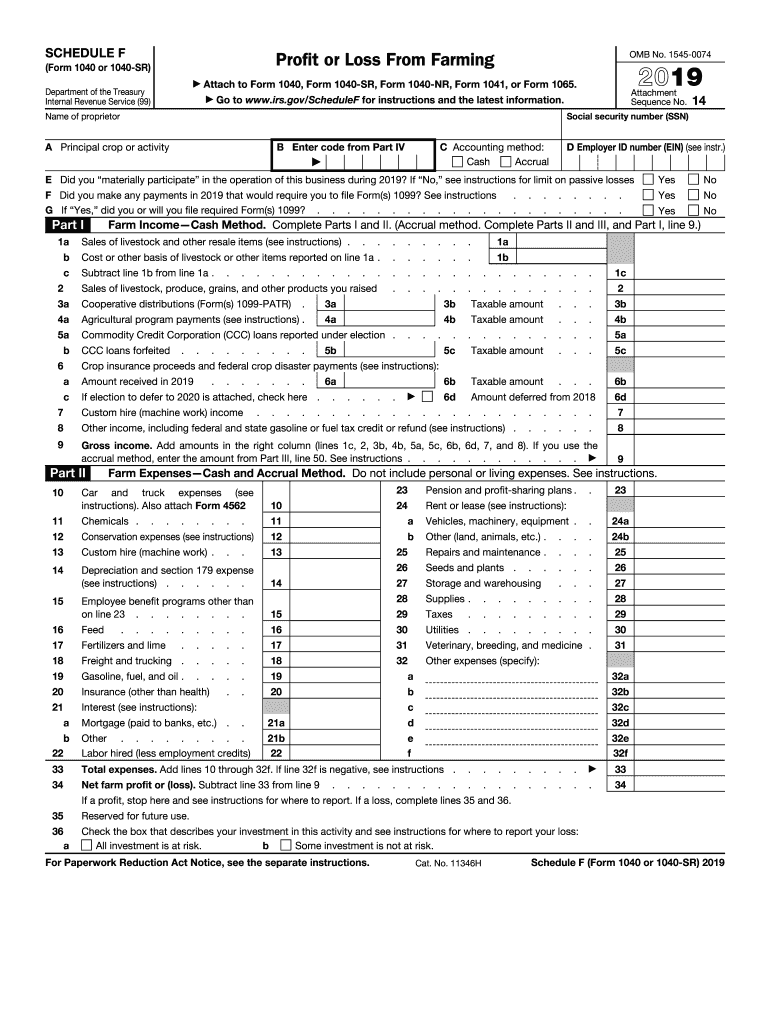

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Assumed and ceded remsurance by company: For individuals, it is included with your. Keep track of all the latest moves in the standings here. Web a schedule f appointment was a job classification in the excepted service of the united states federal civil service that existed briefly at the end of the trump administration. Web use irs schedule f to.

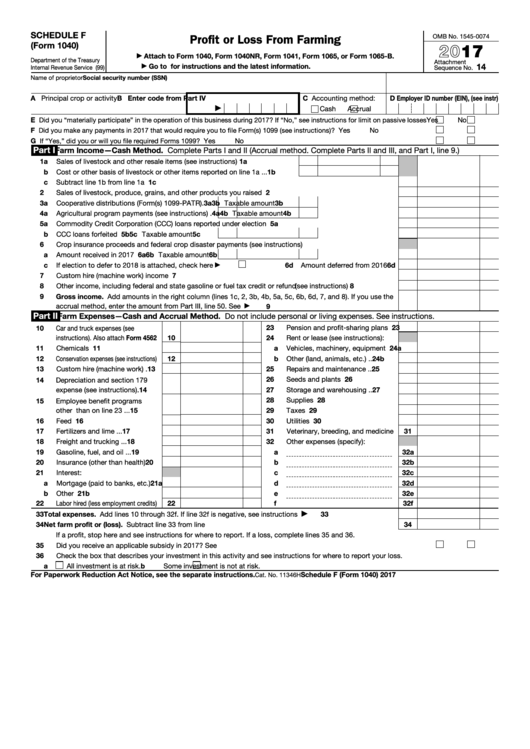

Fillable Schedule F (Form 1040) Profit Or Loss From Farming 2017

When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. Web who files a schedule f? Ad access irs tax forms. Keep track of all the latest moves in the standings here. Get ready for tax season deadlines by completing any required tax forms today.

Schedule F Attach To Your Form Il1120St Gains From Sales Or

Web who files a schedule f? Keep track of all the latest moves in the standings here. Profit or loss from farming. Get ready for tax season deadlines by completing any required tax forms today. Schedule j (form 1040) income averaging for farmers and.

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Get ready for tax season deadlines by completing any required tax forms today. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision. Assumed and ceded remsurance by company:.

Form 1040 (Schedule F) Profit or Loss From Farming (2014) Free Download

Part 1 shows assumed premiums and. Ad access irs tax forms. Assumed and ceded remsurance by company: Web recorded on a form 1040 schedule f: Web 2021 instructions for schedule fprofit or loss from farming.

Register Now for Farm Tax NC State Extension

Argentina, italy, south africa, sweden: Your farming activity may subject you to state and. Web 2021 instructions for schedule fprofit or loss from farming. Web recorded on a form 1040 schedule f: Keep track of all the latest moves in the standings here.

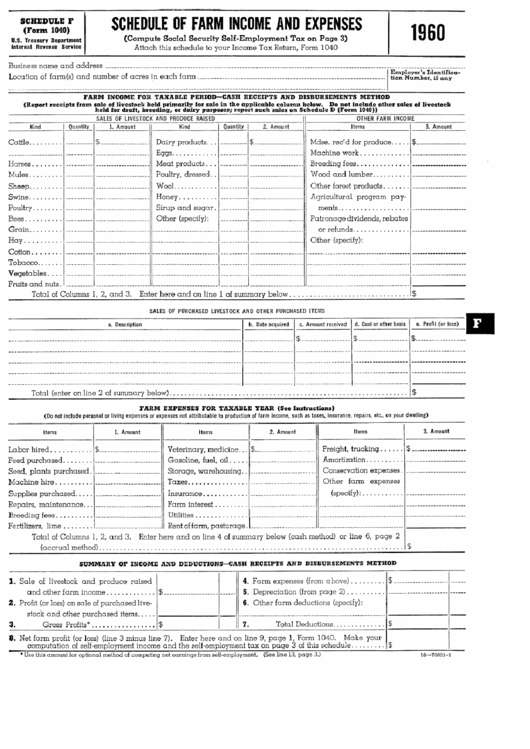

Schedule F (Form 1040) Schedule Of Farm And Expenses 1960

Schedule f is due when personal income taxes are due, on tax day. Web who files a schedule f? Use schedule f (form 1040) to report farm income and expenses. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Web 2022 instructions for schedule fprofit or loss from farming.

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

Schedule j (form 1040) income averaging for farmers and. Profit or loss from farming. Web 2021 instructions for schedule fprofit or loss from farming. Web recorded on a form 1040 schedule f: Use schedule f (form 1040) to report farm income and expenses.

Web Taxes Can Be Complicated.

F1 academy has five teams — art grand prix,. Web use irs schedule f to report farm income and expenses. Web use schedule f (form 1040) to report farm income and expenses. Schedule j (form 1040) income averaging for farmers and.

Web A Schedule F Appointment Was A Job Classification In The Excepted Service Of The United States Federal Civil Service That Existed Briefly At The End Of The Trump Administration.

Part 1 shows assumed premiums and. Web who files a schedule f? Ad access irs tax forms. Web the women's world cup is underway and australia faces a tough battle to make it out of group b.

Web Recorded On A Form 1040 Schedule F:

Schedule f is due when personal income taxes are due, on tax day. The decedent held an interest as joint tenants with rights of. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision.

Web Structure Of Schedule F Schedule F Serves Three Primary Purposes:

Profit or loss from farming. Schedule h (form 1040) household employment taxes. Adding in a schedule f is necessary for tax purposes if you are claiming income from your farming operation, no matter how small.this article provides a. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses.