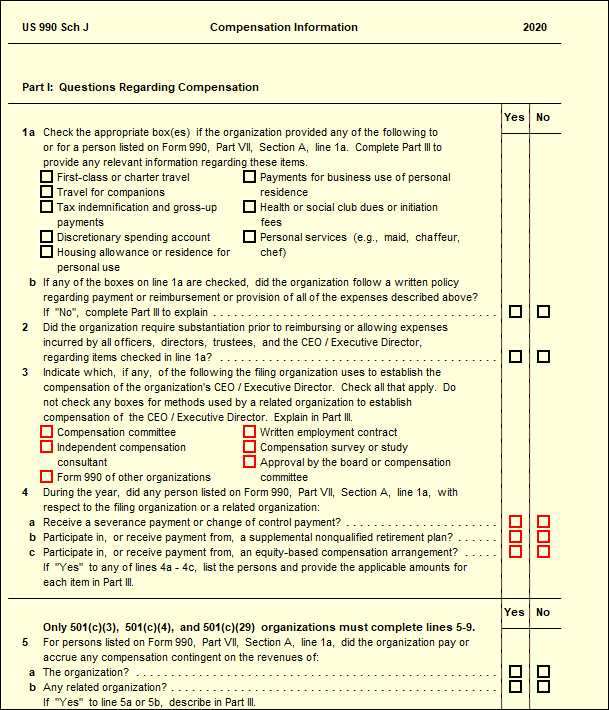

Schedule J Form 990

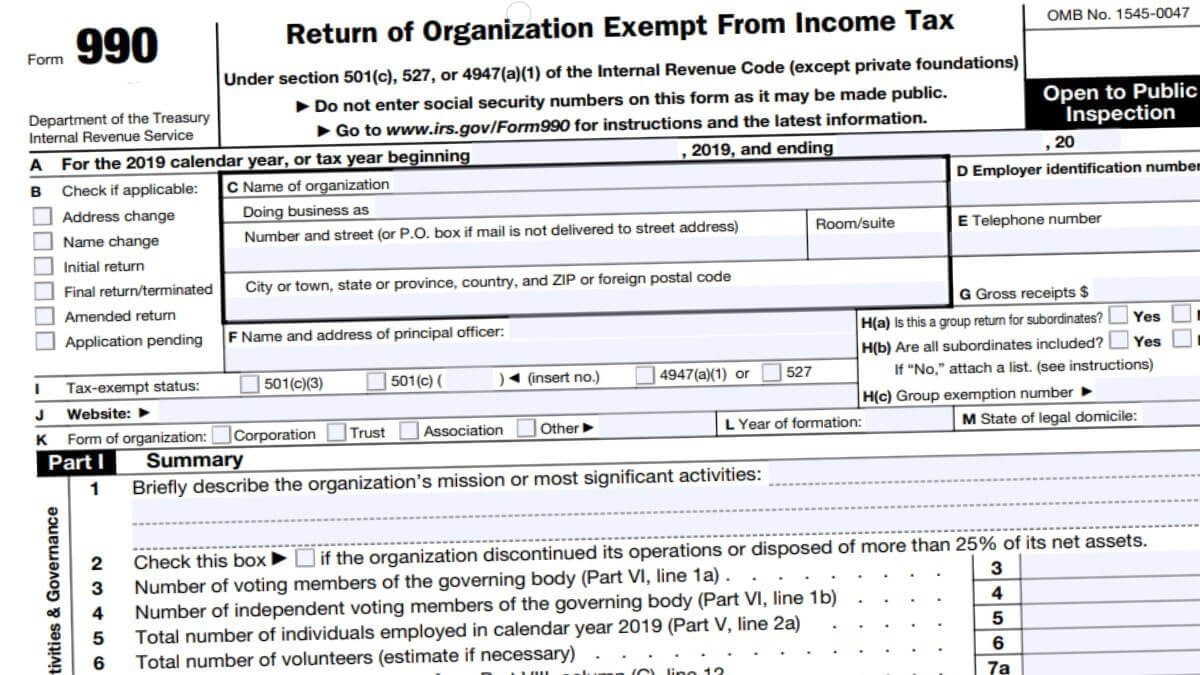

Schedule J Form 990 - Web form 990 requires an organization to report compensation paid to board members, trustees, officers, key employees, and the five highest compensated. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Read the irs instructions for 990 forms. Get ready for tax season deadlines by completing any required tax forms today. (column (b) must equal form 990, part x, col. Web consistent with the irs instructions, the following explains the compensation information reported in various columns of schedule j of the 2019 form 990: Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web purpose of schedule. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Web form 990 schedules with instructions.

Web form 990 requires an organization to report compensation paid to board members, trustees, officers, key employees, and the five highest compensated. 2 part ii officers, directors, trustees, key employees, and highest compensated employees. It provides information on the. Read the irs instructions for 990 forms. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Schedule j is used by organizations to provide a detailed summary of compensation offered to certain officers, directors,. Web what is the purpose of form 990 schedule j? Web consistent with the irs instructions, the following explains the compensation information reported in various columns of schedule j of the 2019 form 990: Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Schedule j (form 990) 2020 page 2.

It provides information on the. Read the irs instructions for 990 forms. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Complete, edit or print tax forms instantly. (column (b) must equal form 990, part x, col. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Web an organization is required to complete schedule j only if it satisfied at least one of three separate requirements: Read the irs instructions for 990 forms. Read the irs instructions for 990 forms. Use duplicate copies if additional space is.

Form 990 (Schedule J) Compensation Information Form (2015) Free Download

(column (b) must equal form 990, part x, col. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. 2 part ii officers, directors, trustees, key employees, and highest compensated employees. Web form 990 schedules with instructions. Web schedule d (form 990) 2022 schedule d.

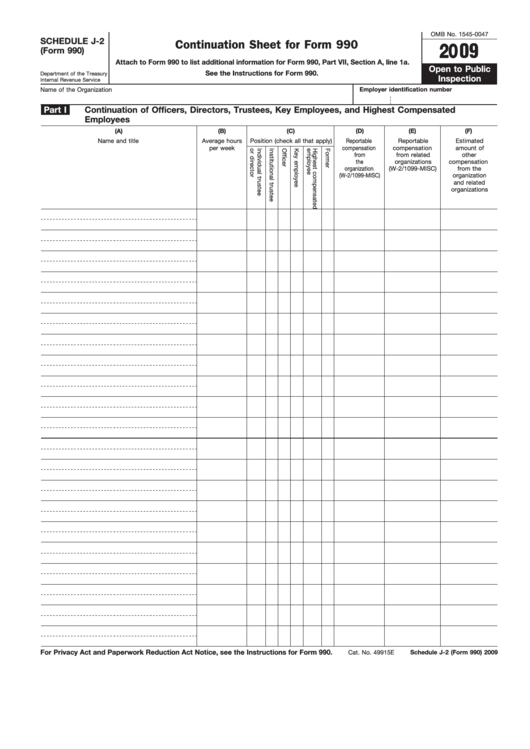

Fillable Schedule J2 (Form 990) Continuation Sheet For Form 990

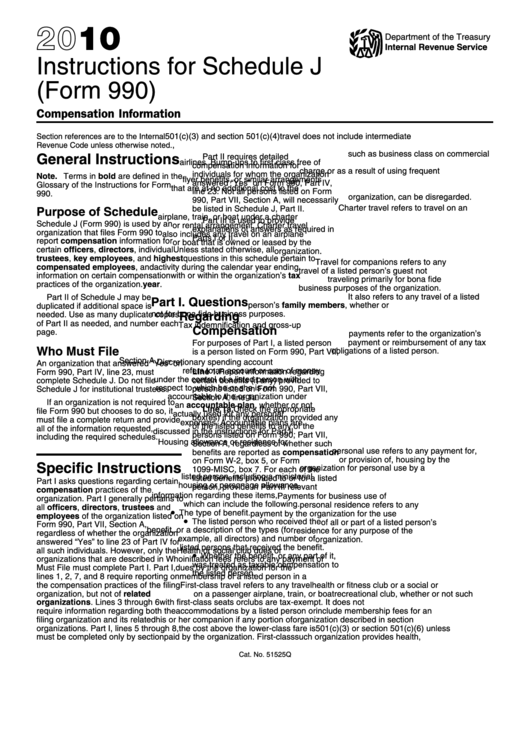

Web purpose of schedule. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Use duplicate copies if additional space is. It provides information on the. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with.

990 schedule j Fill Online, Printable, Fillable Blank form990

Web schedule j (form 990) 2022. Web purpose of schedule. Web form 990 requires an organization to report compensation paid to board members, trustees, officers, key employees, and the five highest compensated. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Read the irs instructions for 990 forms.

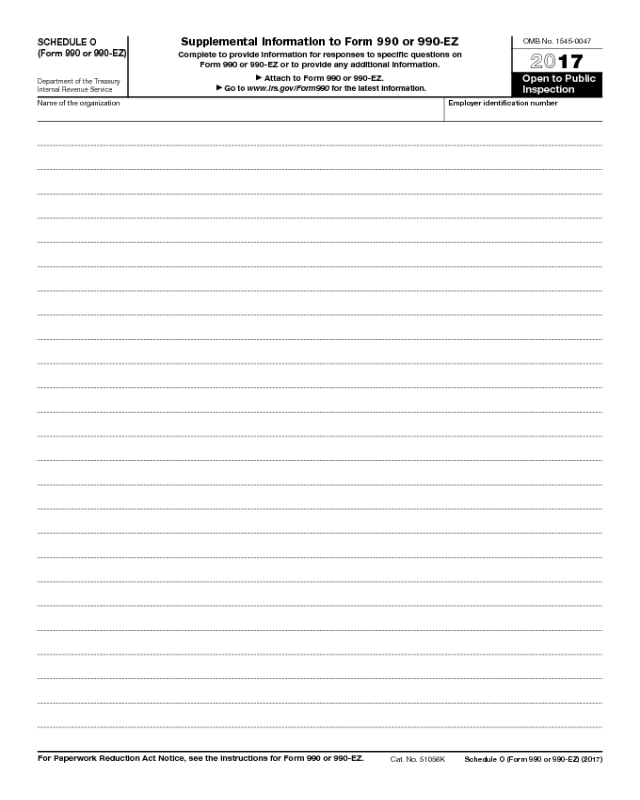

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

2 part ii officers, directors, trustees, key employees, and highest compensated employees. Get ready for tax season deadlines by completing any required tax forms today. Web form 990 requires an organization to report compensation paid to board members, trustees, officers, key employees, and the five highest compensated. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total..

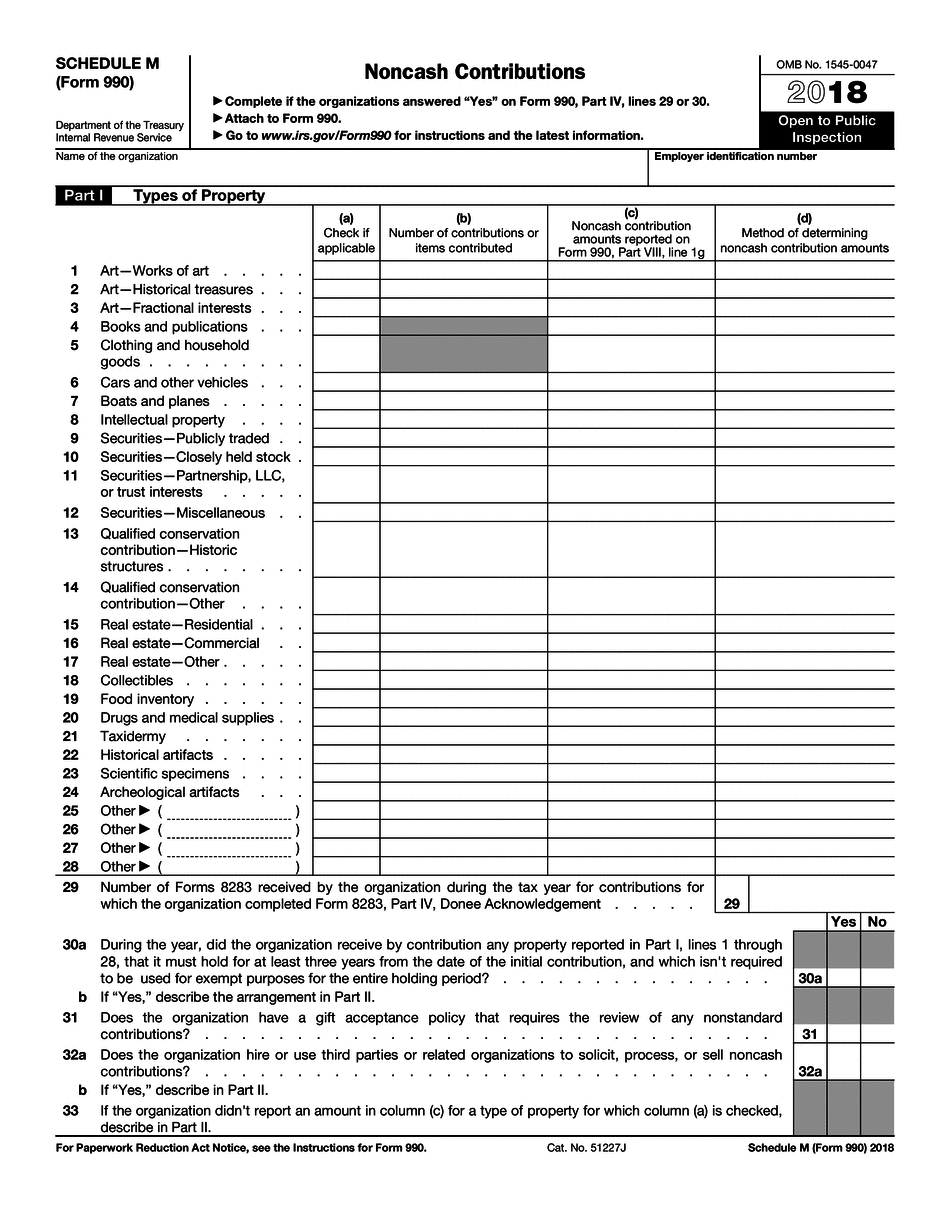

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

Web form 990 schedules with instructions. Use duplicate copies if additional space is. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web an organization is required to complete schedule j only if it satisfied at least one of three separate requirements: The following.

Schedule J (990) Compensation Information UltimateTax Solution Center

Read the irs instructions for 990 forms. Use duplicate copies if additional space is. Use duplicate copies if additional space is. Web what is the purpose of form 990 schedule j? Web purpose of schedule.

Form 990 Schedule J Instructions

Read the irs instructions for 990 forms. Use duplicate copies if additional space is. Web what is the purpose of form 990 schedule j? It provides information on the. Get ready for tax season deadlines by completing any required tax forms today.

Form 990 Instructions For Schedule J printable pdf download

Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Read the irs instructions for 990 forms. Read the irs instructions for 990 forms. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Complete, edit or print tax forms instantly.

IRS Form 990 (Schedule J) 2018 2019 Fill out and Edit Online PDF

Use duplicate copies if additional space is. Web schedule j (form 990) 2019. Web consistent with the irs instructions, the following explains the compensation information reported in various columns of schedule j of the 2019 form 990: Web schedule j (form 990) 2022. Web purpose of schedule.

990 Form 2021

It is required to list any former officer, director, trustee, key. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Read the irs instructions for 990 forms. (column (b) must equal form 990, part x, col. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web what is the purpose of form 990 schedule j? It provides information on the. Use duplicate copies if additional space is. 2 part ii officers, directors, trustees, key employees, and highest compensated employees.

Web An Organization Is Required To Complete Schedule J Only If It Satisfied At Least One Of Three Separate Requirements:

Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web purpose of schedule. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Get ready for tax season deadlines by completing any required tax forms today.

Web Schedule J (Form 990) 2022.

Web consistent with the irs instructions, the following explains the compensation information reported in various columns of schedule j of the 2019 form 990: Schedule j (form 990) 2020 page 2. (column (b) must equal form 990, part x, col. Read the irs instructions for 990 forms.

2 Part Ii Officers, Directors, Trustees, Key Employees, And Highest Compensated Employees.

Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Web form 990 schedules with instructions. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: