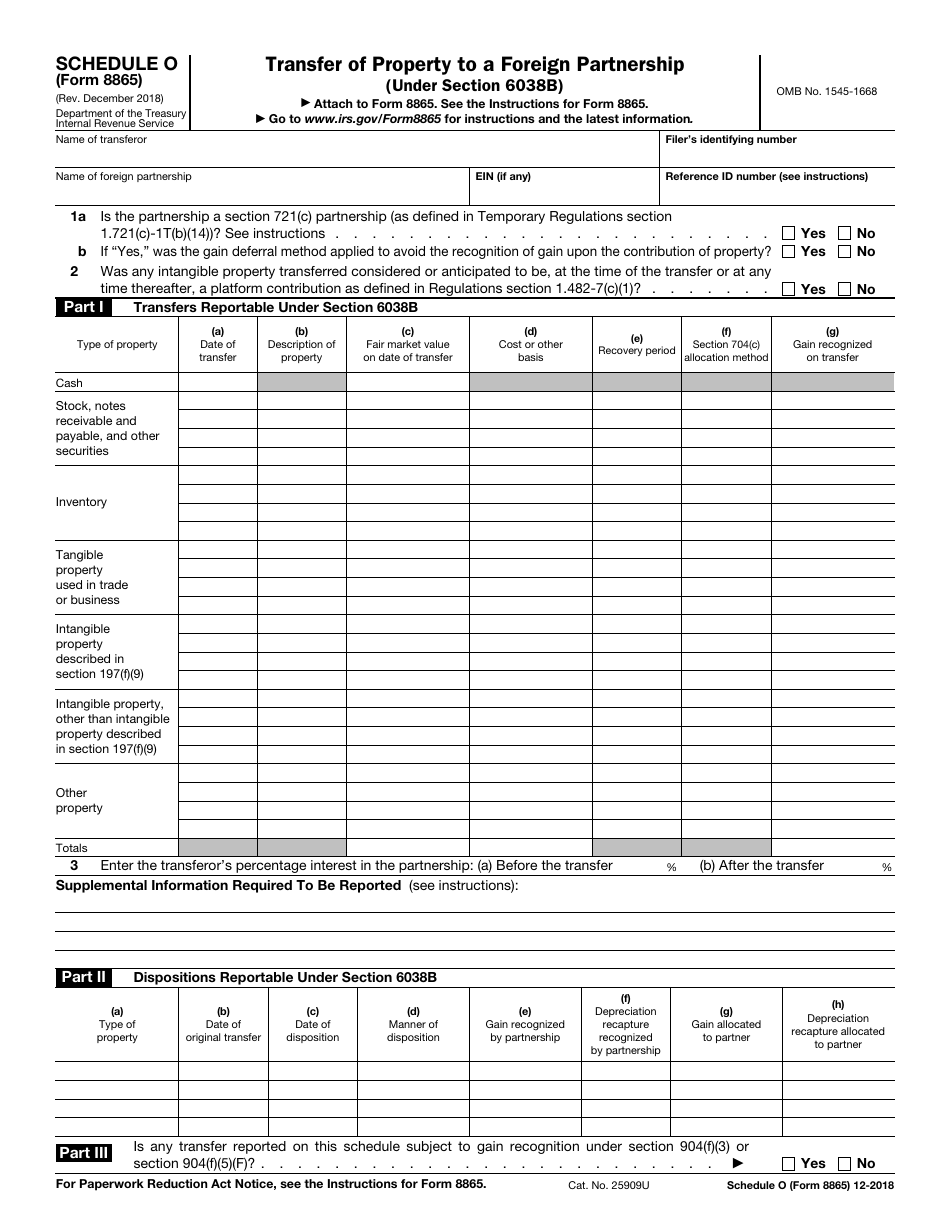

Schedule O Form 8865

Schedule O Form 8865 - Web schedule o (form 8865) (rev. Web additional form and statement requirements. December 2021) department of the treasury internal revenue service statement of application of the gain deferral method under section. (direct partners only) schedule o (form 8865)—transfer of property to a foreign partnership. Part ii dispositions reportable under section 6038b. Web schedule g (form 8865) (rev. Transfer of property to a foreign. Web schedule o (form 8865) (rev. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. The form cannot be electronically filed separately.

Web form 8865, schedule o, is a tax form used by certain u.s. Web schedule o, part i: Upload, modify or create forms. Web form 8865, return of u.s. Web schedule o transfer of property to a foreign partnership (form 8865) omb no. Entering code csh will only fill out schedule o, part i, columns a, c, and g. Individuals and organizations to make elections under section 965 of the internal revenue code (irc). You must have a separate ultratax. October 2021) transfer of property to a foreign partnership schedule o (form 8865) (under section 6038b) (rev. In addition to the reporting requirements above, the following statements and forms must also be filed to satisfy the requirements for the.

In addition to the reporting requirements above, the following statements and forms must also be filed to satisfy the requirements for the. Upload, modify or create forms. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. October 2021) department of the treasury internal revenue service. Transfer of property to a foreign. Web schedule o transfer of property to a foreign partnership (form 8865) omb no. October 2021) transfer of property to a foreign partnership schedule o (form 8865) (under section 6038b) (rev. But what is form 8865—and. Web schedule o (form 8865) (rev. December 2021) department of the treasury internal revenue service statement of application of the gain deferral method under section.

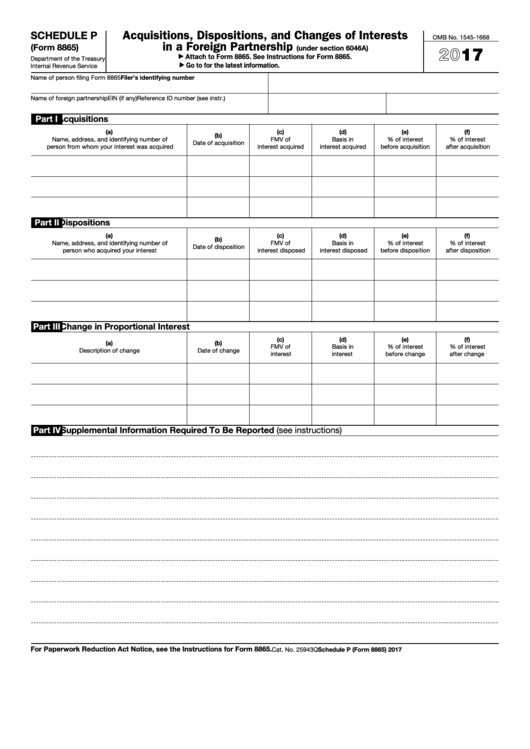

Fillable Schedule P (Form 8865) Acquisitions, Dispositions, And

Web additional form and statement requirements. Web schedule o (form 8865) department of the treasury internal revenue service transfer of property to a foreign partnership (under section 6038b) attach to form 8865. Upload, modify or create forms. Web schedule o transfer of property to a foreign partnership (form 8865) omb no. 25909u schedule o (form 8865) 2013

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

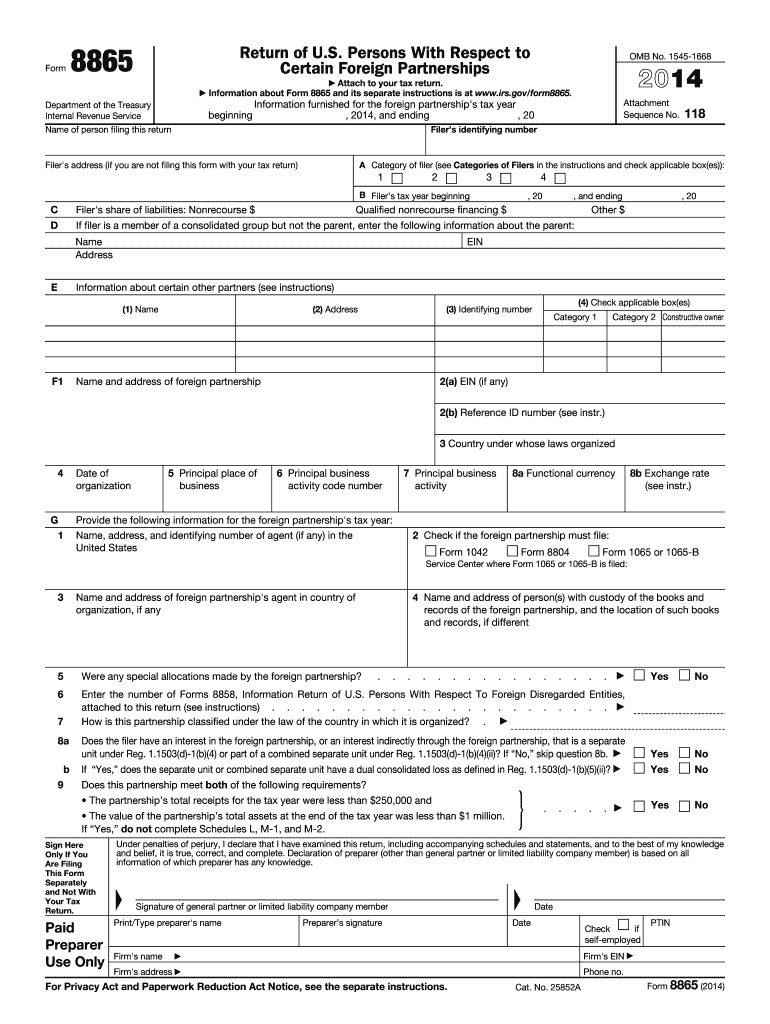

Persons with respect to certain foreign partnerships worksheet. Form 8865, version of form. The form cannot be electronically filed separately. You must have a separate ultratax. Persons with respect to certain foreign partnerships ;

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

December 2021) department of the treasury internal revenue service statement of application of the gain deferral method under section. Persons with respect to certain foreign partnerships worksheet. October 2021) transfer of property to a foreign partnership schedule o (form 8865) (under section 6038b) (rev. Transfer of property to a foreign. Part ii dispositions reportable under section 6038b.

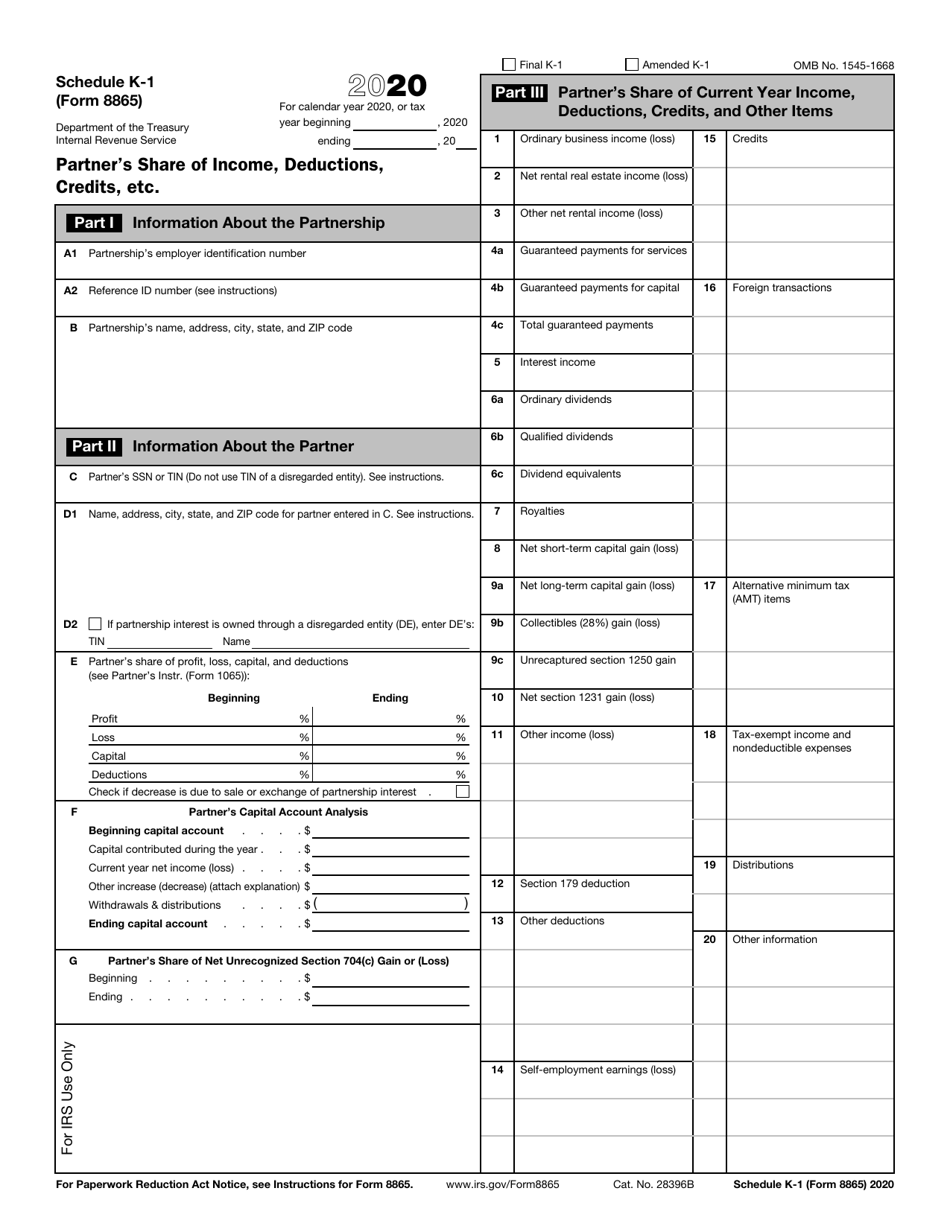

IRS Form 8865 Schedule K1 Download Fillable PDF or Fill Online Partner

Web schedule o (form 8865) department of the treasury internal revenue service transfer of property to a foreign partnership (under section 6038b) attach to form 8865. You must have a separate ultratax. Web part i transfers reportable under section 6038b supplemental information required to be reported (see instructions): Persons with respect to certain foreign partnerships worksheet. 25909u schedule o (form.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Persons with respect to certain foreign partnerships ; Transfer of property to a foreign. Web schedule o transfer of property to a foreign partnership (form 8865) omb no. October 2021) transfer of property to a foreign partnership schedule o (form 8865) (under section 6038b) (rev. The form cannot be electronically filed separately.

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

Web form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040). Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. (direct partners only) schedule o (form 8865)—transfer of property to a foreign partnership. Transfer of property.

8865 Form Fill Out and Sign Printable PDF Template signNow

Transfer of property to a foreign partnership (under section. You must have a separate ultratax. Web schedule g (form 8865) (rev. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. Web part i transfers reportable under section 6038b supplemental information required to be reported (see instructions):

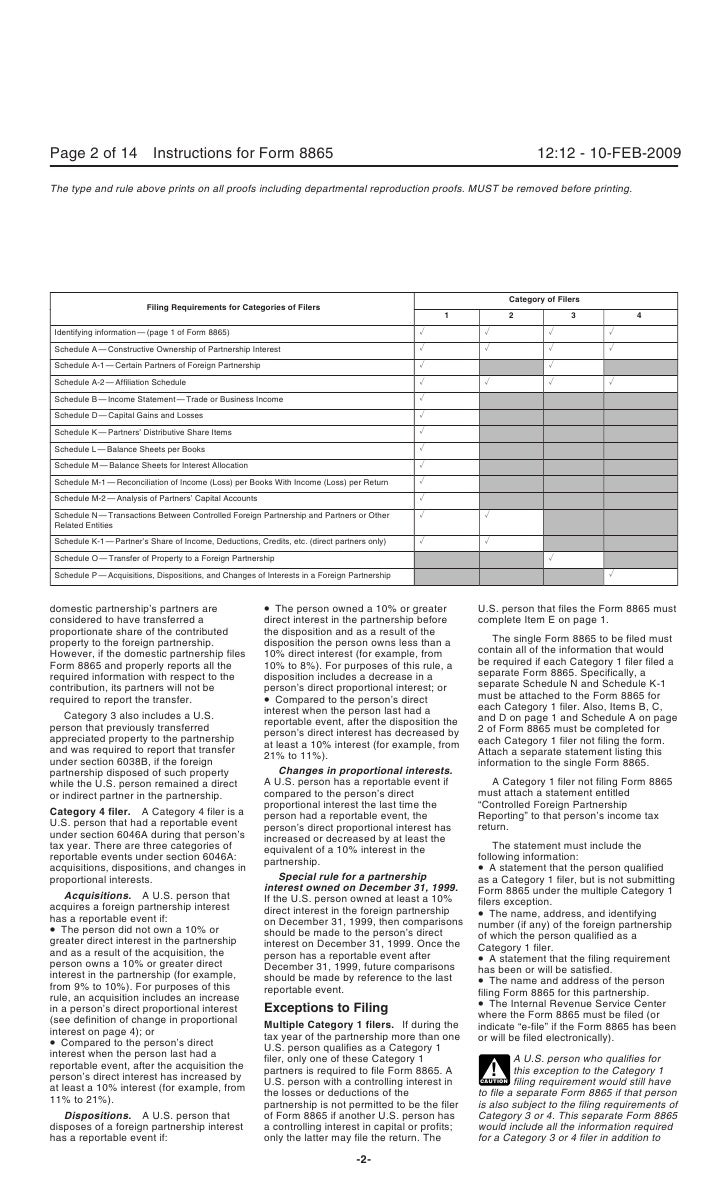

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

December 2021) department of the treasury internal revenue service statement of application of the gain deferral method under section. Persons with respect to certain foreign partnerships ; Web schedule o (form 8865) department of the treasury internal revenue service transfer of property to a foreign partnership (under section 6038b) attach to form 8865. Web schedule o, part i: Upload, modify.

Form 8865 (Schedule K1) Partner's Share of Deductions and

Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. Complete, edit or print tax forms instantly. October 2021) transfer of property to a foreign partnership schedule o (form 8865) (under section 6038b) (rev. Web form 8865 is used to report the activities of a controlled foreign partnership and must be filed.

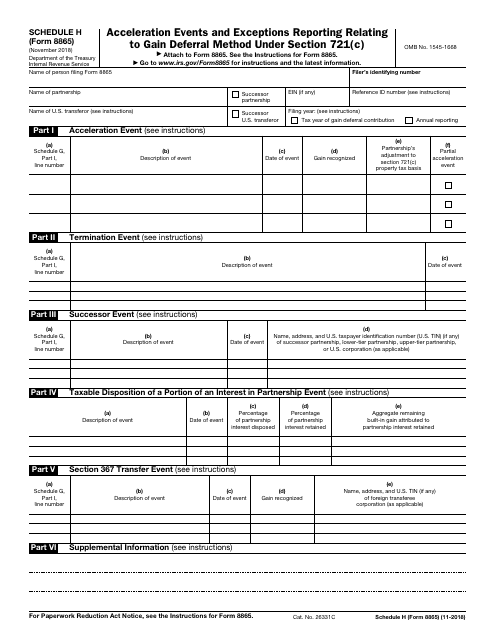

IRS Form 8865 Schedule H Download Fillable PDF or Fill Online

Web schedule o (form 8865) department of the treasury internal revenue service transfer of property to a foreign partnership (under section 6038b) attach to form 8865. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. Form 8865, version of form. Try it for free now! Web form 8865 is used to.

Web Schedule O, Part I:

December 2021) department of the treasury internal revenue service statement of application of the gain deferral method under section. Web additional form and statement requirements. Web part i transfers reportable under section 6038b supplemental information required to be reported (see instructions): You must have a separate ultratax.

Web Schedule O (Form 8865) (Rev.

Web form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040). 25909u schedule o (form 8865) 2013 In addition to the reporting requirements above, the following statements and forms must also be filed to satisfy the requirements for the. Upload, modify or create forms.

Persons With Respect To Certain Foreign Partnerships Worksheet.

Part ii dispositions reportable under section 6038b. Complete, edit or print tax forms instantly. Web schedule g (form 8865) (rev. Form 8865, version of form.

Web Schedule O Transfer Of Property To A Foreign Partnership (Form 8865) Omb No.

Try it for free now! Schedule o (form 8865) (rev. Transfer of property to a foreign partnership (under section. (direct partners only) schedule o (form 8865)—transfer of property to a foreign partnership.