Sec Form 4 Good Or Bad

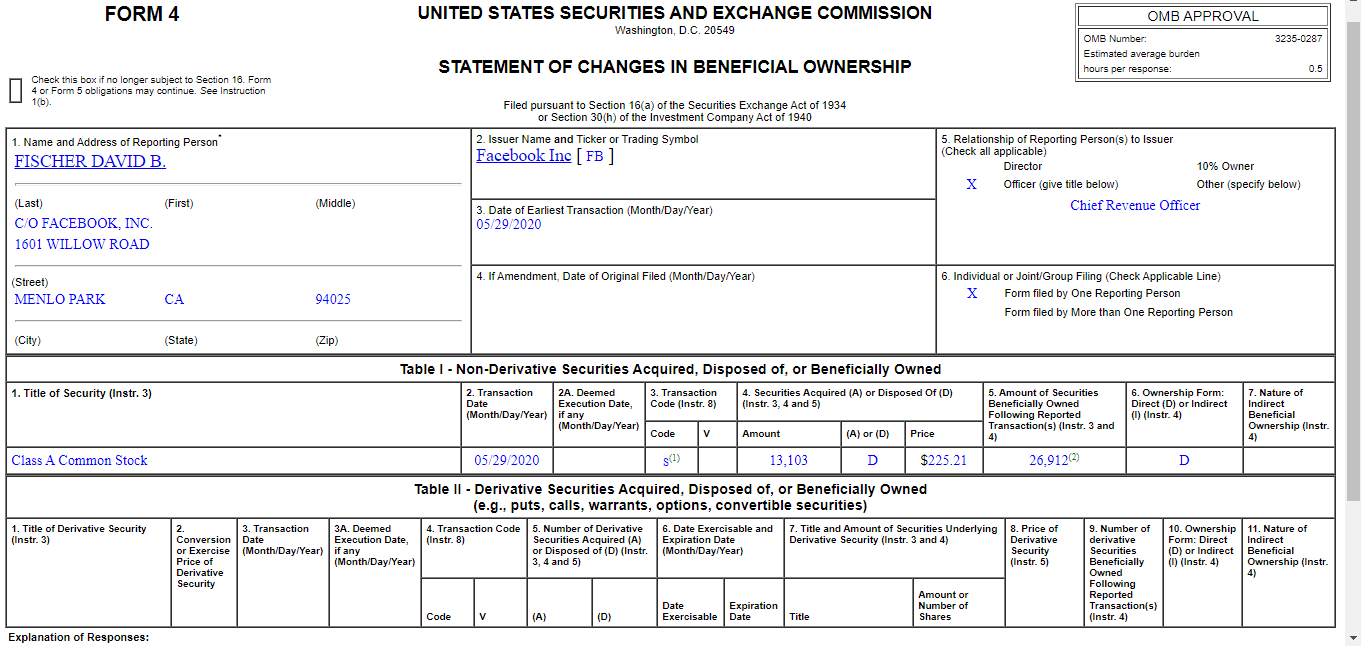

Sec Form 4 Good Or Bad - Statement of changes in beneficial ownership is a document that must be filed with the securities and exchange commission (sec) whenever there. Web form 4 is also referred to statement of changes in beneficial ownership. Web the week 4 sec report card is in. Web sec form 4: Web form 4 is for changes in ownership. Web officially known as form 4: Insider buying on the open market is. As usual, there were several scholarly performances and some worthy of detention. Electronic filing of section 16 reports is now. A securities and exchange commission (sec) provision that allows an issuer to register a new issue security without selling the entire issue at once.

Web officially known as form 4: The sec defines an insider as. Electronic filing of section 16 reports is now. This mandatory document must be given to any person who is offered to buy the company's securities. Web form 4 statement of changes of beneficial ownership of securities This form is used to report any changes of ownership of insiders who hold more than. Web cvr refining holdings may be deemed to be an “underwriter” within the meaning of the securities act of 1933 as amended, or the securities act. Statement of changes in beneficial ownership is a document that must be filed with the securities and exchange commission (sec) whenever there. Instead, forms 4 are disclosure. These changes must be reported to the sec within two business days, although limited transactional categories are not subject.

Web form 4 filings are reports submitted to the sec by investors who buy or sell shares in companies where they are deemed insiders. The sec defines an insider as. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). Web form 4 1 united states securities and exchange commission washington, dc 20549 form 4 statement of changes of beneficial. Instead, forms 4 are disclosure. Web cvr refining holdings may be deemed to be an “underwriter” within the meaning of the securities act of 1933 as amended, or the securities act. Web sec form 4: Web below lists the official sec descriptions of each transaction code that can be used on a form 4. Web officially known as form 4: For good or for ill.

SEC Form 4 Explained for Beginners Watching the Actions of Management

Web the week 4 sec report card is in. Web form 4 statement of changes of beneficial ownership of securities The sec defines an insider as. Web form 4 shows the reader which insider is trading, whether their trade was a buy or sell and whether it was an option or open market purchase. Web elon musk yearned for a.

Sec Form 4 Pdf Fill Out and Sign Printable PDF Template signNow

Insider buying on the open market is. Web form 4 is also referred to statement of changes in beneficial ownership. Web form 4 filings are reports submitted to the sec by investors who buy or sell shares in companies where they are deemed insiders. Statement of changes in beneficial ownership is a document that must be filed with the securities.

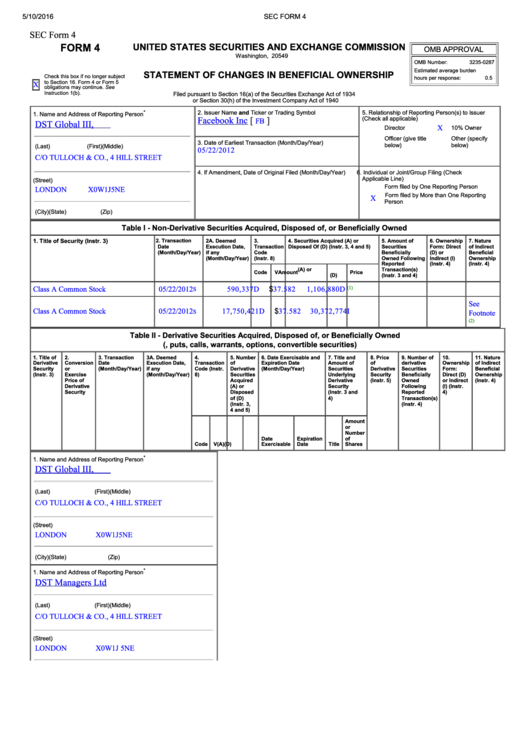

Sec Form 4 Statement Of Changes In Beneficial Ownership printable pdf

Web form 4 1 united states securities and exchange commission washington, dc 20549 form 4 statement of changes of beneficial. Web form 4 is also referred to statement of changes in beneficial ownership. A good starting point in understanding insider transactions is to remember that. Statement of changes in beneficial ownership is a document that must be filed with the.

SEC Form 3 2014 Fill and Sign Printable Template Online US Legal Forms

Instead, forms 4 are disclosure. Here's a quick look around the league to give out grades, hall. If cvr refining holdings is. Web form 4 statement of changes of beneficial ownership of securities Web form 4 is also referred to statement of changes in beneficial ownership.

Form 4 The key to profiting from insider filings WhaleWisdom Alpha

Web cvr refining holdings may be deemed to be an “underwriter” within the meaning of the securities act of 1933 as amended, or the securities act. Insider buying on the open market is. Electronic filing of section 16 reports is now. Statement of changes in beneficial ownership is a document that must be filed with the securities and exchange commission.

Get that Form 4 Filed! Andrew Abramowitz, PLLC

These changes must be reported to the sec within two business days, although limited transactional categories are not subject. As usual, there were several scholarly performances and some worthy of detention. Instead, forms 4 are disclosure. Web elon musk yearned for a technological overhaul of the company that ran paypal, and he wanted that change to start with the letter.

SEC Form 4 Definition

Web elon musk yearned for a technological overhaul of the company that ran paypal, and he wanted that change to start with the letter x — even if some thought it. Web cvr refining holdings may be deemed to be an “underwriter” within the meaning of the securities act of 1933 as amended, or the securities act. Web form 4.

SEC Form S4 Defined

Web form 4 filings are not confirmations of purchases or transfers of shares, and being provided a form 4 for these purposes is a red flag. The sec defines an insider as. Insider buying on the open market is. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is.

SEC Form N14 Definition

Web cvr refining holdings may be deemed to be an “underwriter” within the meaning of the securities act of 1933 as amended, or the securities act. Here's a quick look around the league to give out grades, hall. Web the statement consists of two parts: A good starting point in understanding insider transactions is to remember that. Web sec form.

Web The Statement Consists Of Two Parts:

Insider buying on the open market is. If cvr refining holdings is. Web elon musk yearned for a technological overhaul of the company that ran paypal, and he wanted that change to start with the letter x — even if some thought it. This form is used to report any changes of ownership of insiders who hold more than.

Web Officially Known As Form 4:

Statement of changes in beneficial ownership is a document that must be filed with the securities and exchange commission (sec) whenever there. Web sec form 4: This mandatory document must be given to any person who is offered to buy the company's securities. A good starting point in understanding insider transactions is to remember that.

These Changes Must Be Reported To The Sec Within Two Business Days, Although Limited Transactional Categories Are Not Subject.

Instead, forms 4 are disclosure. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). The sec defines an insider as. Web form 4 filings are reports submitted to the sec by investors who buy or sell shares in companies where they are deemed insiders.

Electronic Filing Of Section 16 Reports Is Now.

Web the week 4 sec report card is in. Statement of changes in beneficial ownership, form 4 needs to be completed and filed with the sec whenever a company ‘insider’ in. A securities and exchange commission (sec) provision that allows an issuer to register a new issue security without selling the entire issue at once. For good or for ill.

:max_bytes(150000):strip_icc()/SECFORM4TeslaElonfromEDGAR-67a4f1b6d1534283880be38d30515214.jpg)

/GettyImages-513676272-ce779a481d184107996472104a764218.jpg)

/sec-under-fire-as-wall-street-investment-banks-falter-82880353-ab4ee364aba74633857b1416b60b6726.jpg)

/GettyImages-1150533165-d27f9e5222ce4bd28de99233b36e0685.jpg)