Simple Dcf Excel Template

Simple Dcf Excel Template - Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web start free trial to access template. Learn how to build a simple dcf model aligned with investment banking best practices. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Calculate the discounted cash flow (dcf) of your investments and make smart. Forecast the company's key financials and calculate the corresponding. It can be used in a variety of ways to analyze and compare investment opportunities, conduct capital. It includes an example to help you apply the.

This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Web dcf calculator is a versatile tool that goes beyond simple valuation. Web calculate your company's dcf valuation with this free and easy to use dcf calculator. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web dcf template discount factor terminal value value of asset conclusion summary text this video opens with an explanation of the objective of a discounted cash flow (“dcf”). Financial modeling crash course with detailed excel. It can be used in a variety of ways to analyze and compare investment opportunities, conduct capital. Web discounted cash flow (dcf) model template + instructions. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Download wso's free discounted cash flow (dcf) model template below!

Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Forecast the company's key financials and calculate the corresponding. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web calculate your company's dcf valuation with this free and easy to use dcf calculator. Web how to calculate net present value written by tim vipond published january 2, 2019 updated june 27, 2023 guide to the discounted cash flow dcf formula this. This template allows you to build your own discounted cash flow model with. It can be used in a variety of ways to analyze and compare investment opportunities, conduct capital. Web dcf calculator is a versatile tool that goes beyond simple valuation. Download wso's free discounted cash flow (dcf) model template below!

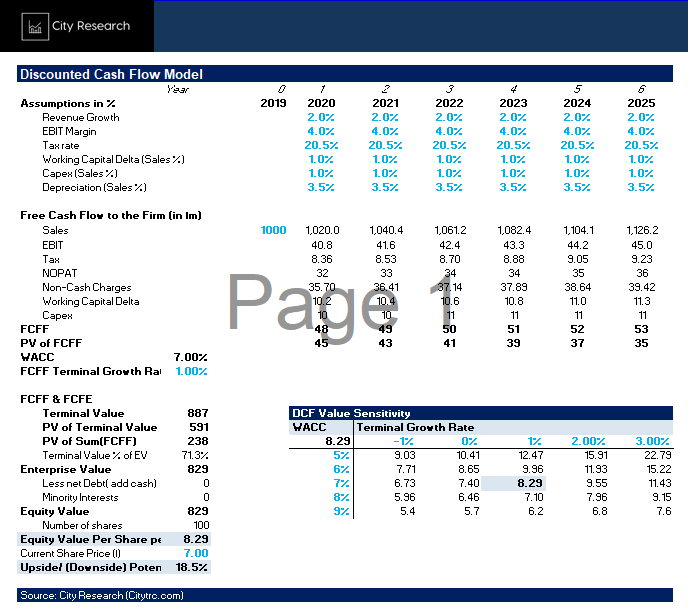

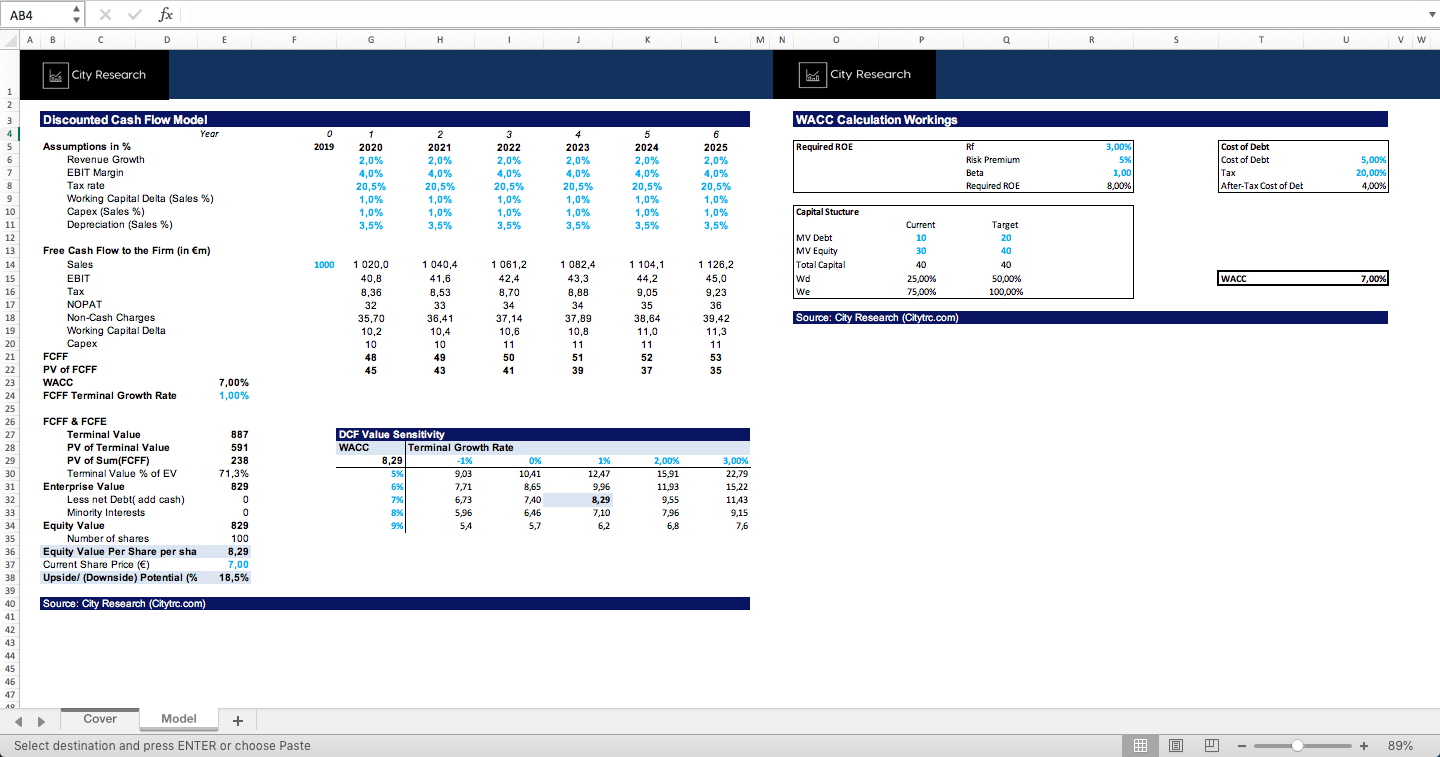

Simple Discounted Cashflow (DCF) Excel Model Template Eloquens

It includes an example to help you apply the. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web start free trial to access template. Download wso's free.

Discounted Cash Flow Dcf Model Template Instructions Eloquens

Web dcf calculator is a versatile tool that goes beyond simple valuation. Financial modeling crash course with detailed excel. Web discounted cash flow (dcf) model template + instructions. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. This discounted cash flow (dcf).

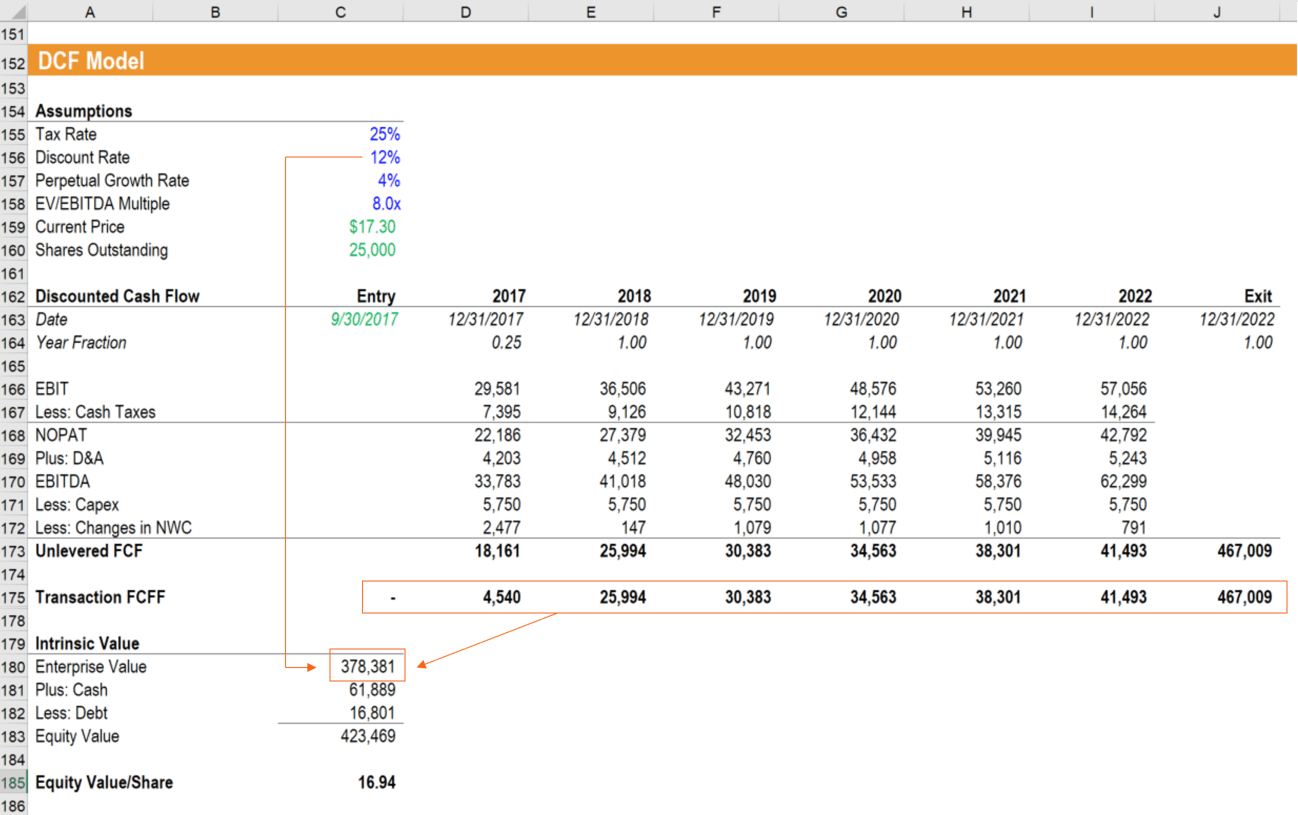

DCF Model Training 6 Steps to Building a DCF Model in Excel 네이버 블로그

Financial modeling crash course with detailed excel. The dcf formula allows you to determine the. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Forecast the company's key financials and calculate the corresponding. Input the valuation date, discount rate, perpetual growth rate, and tax rate.

DCF, Discounted Cash Flow Valuation in Excel Video YouTube

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. This template allows you to build your own discounted cash flow model with. Calculate the discounted cash flow (dcf) of your investments and make smart. This discounted cash flow (dcf) model, is a.

Simple Discounted Cashflow (DCF) Excel Model Template Eloquens

Download wso's free discounted cash flow (dcf) model template below! Forecast the company's key financials and calculate the corresponding. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web calculate your company's dcf valuation with this free and easy to use dcf calculator. Financial modeling crash course with.

Single Sheet DCF (Discounted Cash Flow) Excel Template FinWiser

Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. The dcf formula allows you to determine the. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web calculate your company's dcf.

DCF Model Full Guide, Excel Templates, and Video Tutorial

Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web start free trial to access template. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web calculate your company's dcf valuation with this free and easy to.

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

Web dcf calculator is a versatile tool that goes beyond simple valuation. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Web the discounted cash flow (dcf) is a valuation method.

Basic Accounting Excel Formulas Spreadsheet Templates for Busines basic

Web calculate your company's dcf valuation with this free and easy to use dcf calculator. Web how to calculate net present value written by tim vipond published january 2, 2019 updated june 27, 2023 guide to the discounted cash flow dcf formula this. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on.

DCF Model Excel Template Free Download from CFI Marketplace

Web start free trial to access template. Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Download wso's free discounted cash flow (dcf) model template below! Discounted cash flow (dcf) is a method used to estimate the value of an investment based on.

Forecast The Company's Key Financials And Calculate The Corresponding.

Calculate the discounted cash flow (dcf) of your investments and make smart. Learn how to build a simple dcf model aligned with investment banking best practices. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Financial modeling crash course with detailed excel.

Web Dcf Calculator Is A Versatile Tool That Goes Beyond Simple Valuation.

Web calculate your company's dcf valuation with this free and easy to use dcf calculator. This template allows you to build your own discounted cash flow model with. This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow.

Download Wso's Free Discounted Cash Flow (Dcf) Model Template Below!

It includes an example to help you apply the. Web discounted cash flow (dcf) model template + instructions. Input the valuation date, discount rate, perpetual growth rate, and tax rate. The dcf formula allows you to determine the.

Web The Discounted Cash Flow (Dcf) Is A Valuation Method That Estimates Today’s Value Of The Future Cash Flows Taking Into Account The Time Value Of Money.

It can be used in a variety of ways to analyze and compare investment opportunities, conduct capital. Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Web start free trial to access template. Web how to calculate net present value written by tim vipond published january 2, 2019 updated june 27, 2023 guide to the discounted cash flow dcf formula this.