T2200 Form Canada

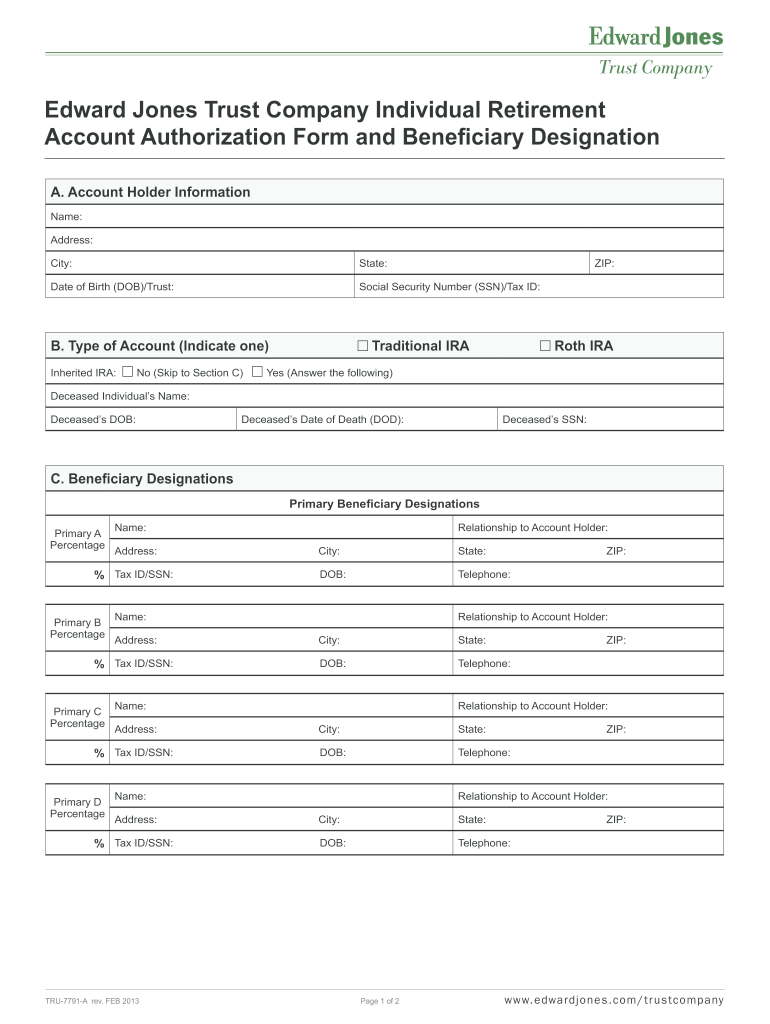

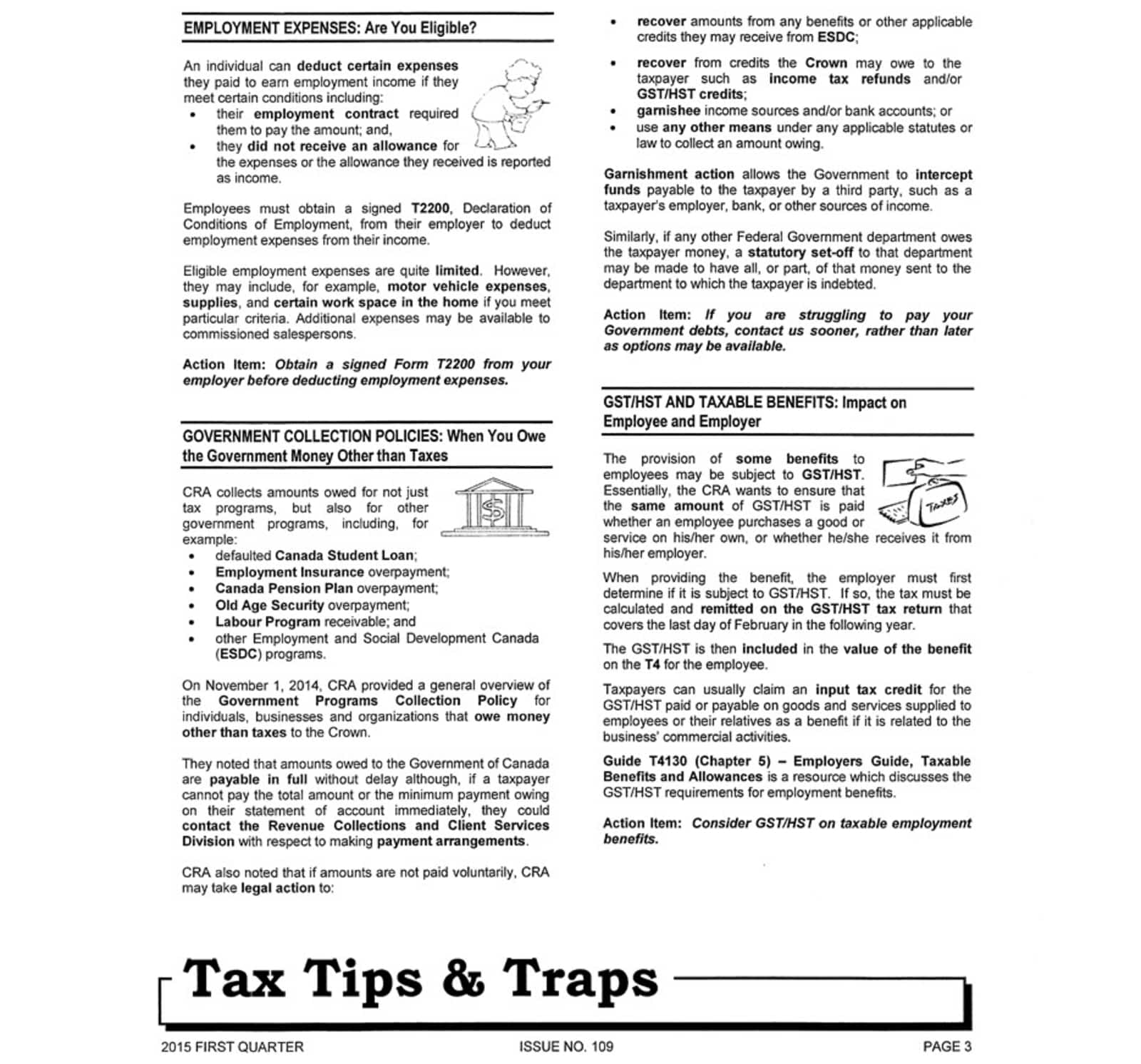

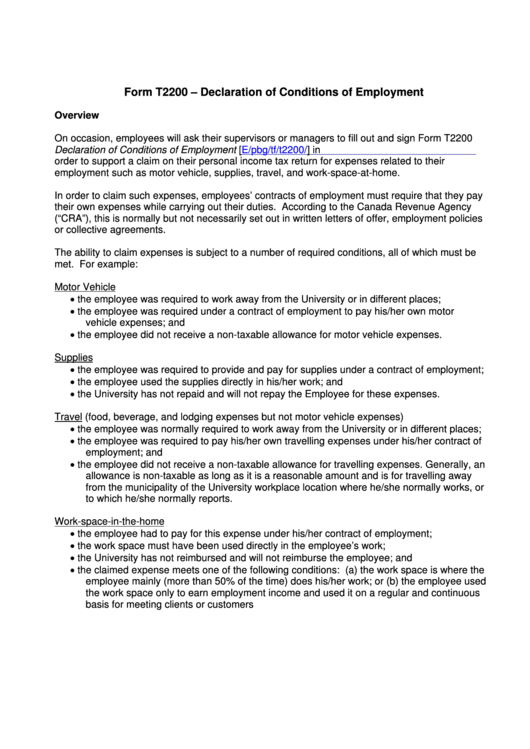

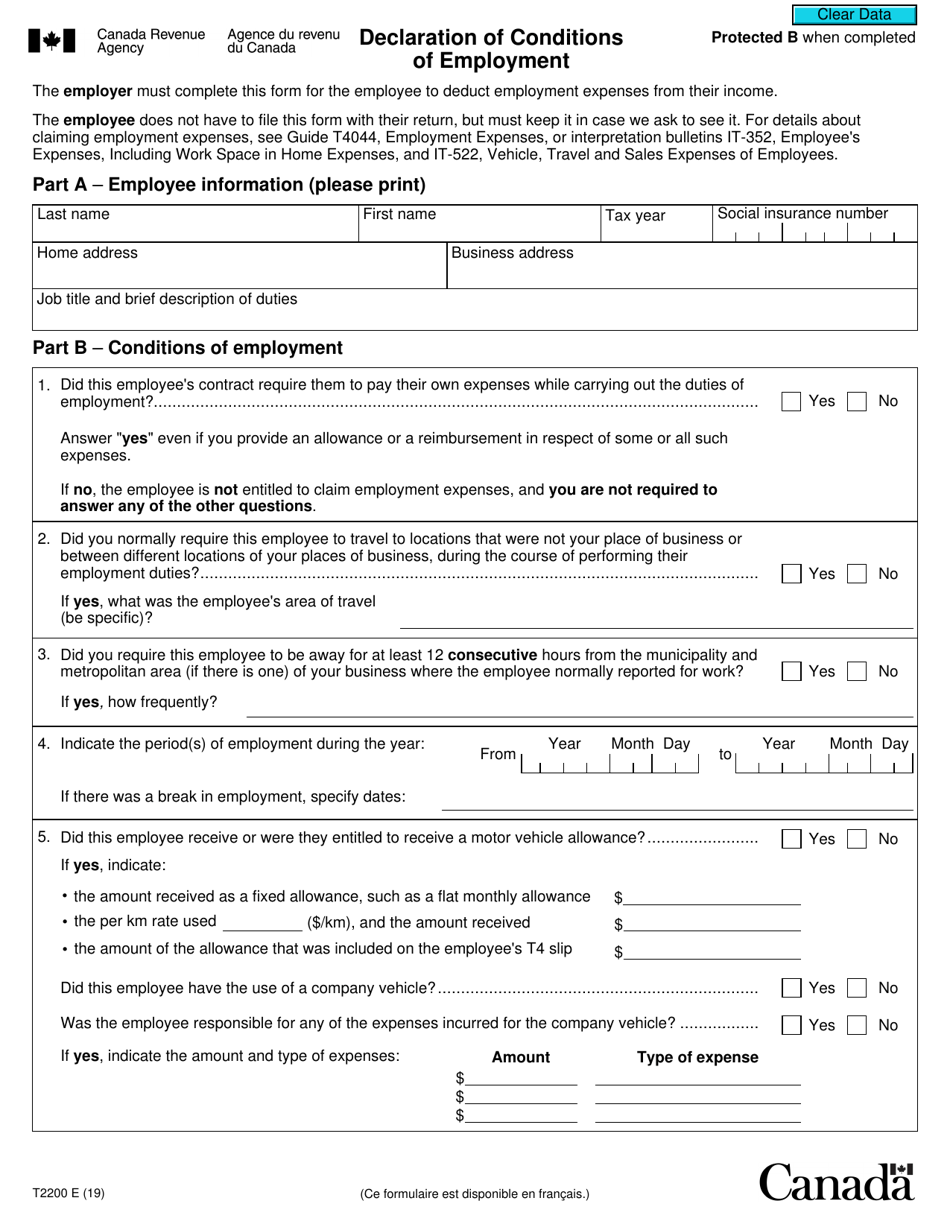

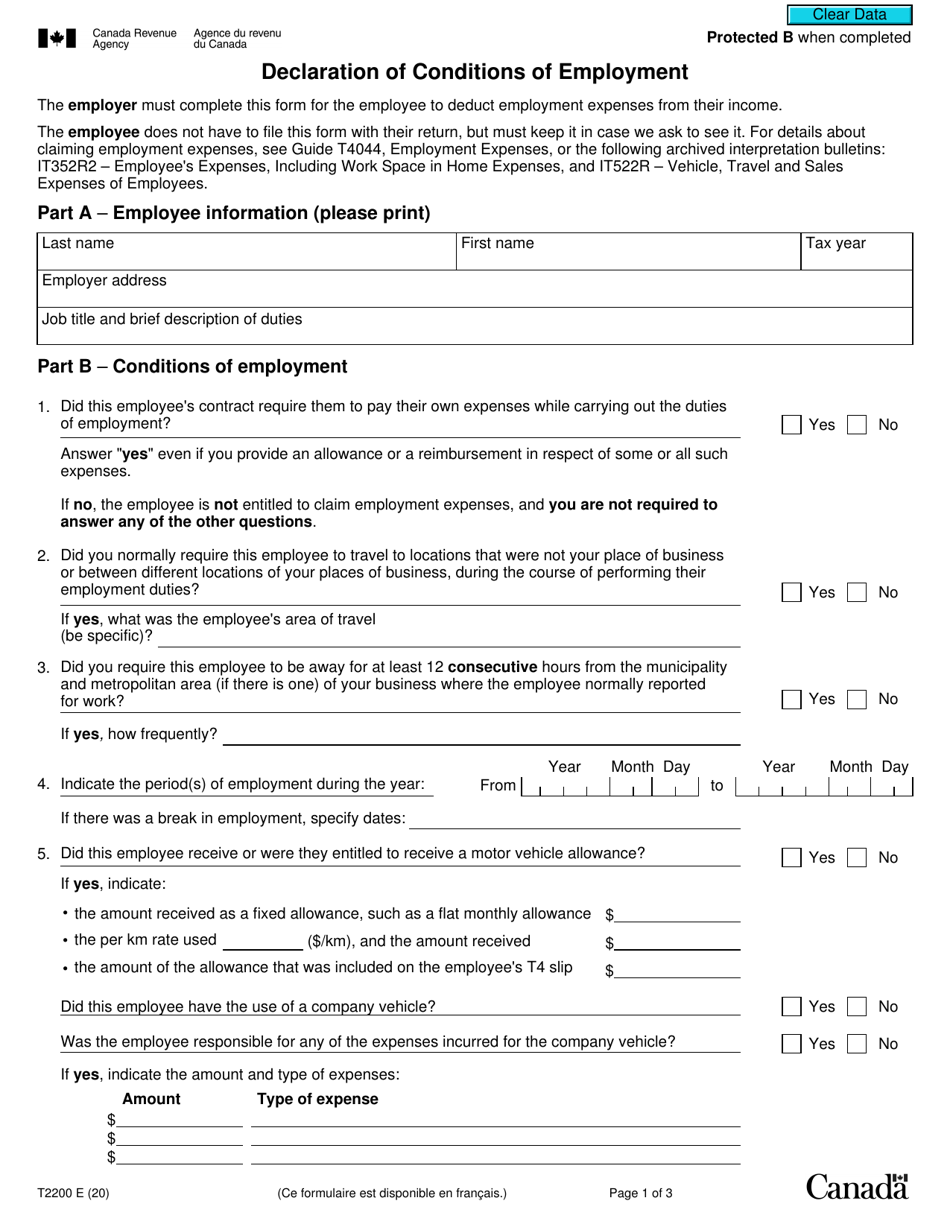

T2200 Form Canada - This is an amendment of form. Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Save money and time with pdffiller Quickbooks online can help you maximize. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,.

This is an amendment of form. Save money and time with pdffiller Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. For best results, download and open this form in adobe reader. The form t2200 actually certifies that the. Ad download or email t2200 & more fillable forms, register and subscribe now! Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. The employee received a signed form.

Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Web we would like to show you a description here but the site won’t allow us. The form t2200 actually certifies that the. Ad download or email t2200 & more fillable forms, register and subscribe now! Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. For best results, download and open this form in adobe reader. This is an amendment of form. Save money and time with pdffiller

Form T2200 Declaration Of Conditions Of Employment printable pdf download

Save money and time with pdffiller For best results, download and open this form in adobe reader. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. As.

Canada Covid19 Support Form T2200 activpayroll

The form t2200 actually certifies that the. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. For best results, download and open this form in adobe reader. Web the t2200 form, also referred to as the declaration of conditions of.

How to send multiple T2200S forms in minutes! Versatile Analytics

Ad download or email t2200 & more fillable forms, register and subscribe now! This is an amendment of form. Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web employees who use the detailed method must maintain documentation to support their home office expense claim and.

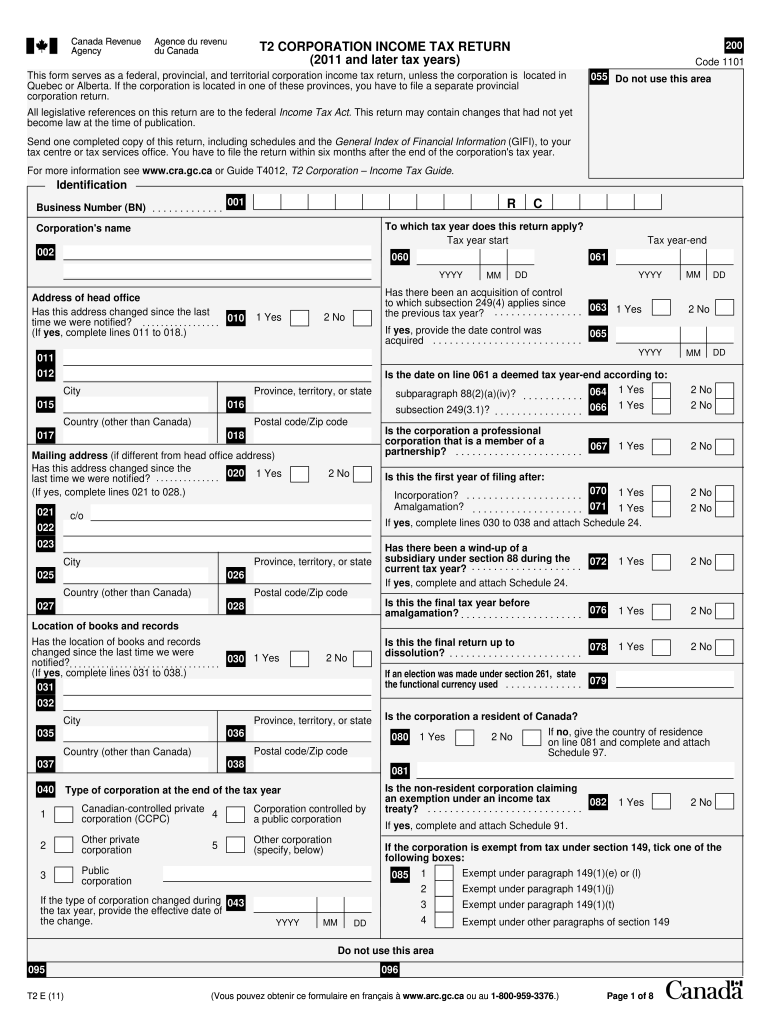

t2 2011 Fill out & sign online DocHub

The form t2200 actually certifies that the. The employee received a signed form. Web a new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days. Web form t2200 is a form provided by your employer that allows you to claim eligible.

Form T2200 Download Fillable PDF or Fill Online Declaration of

This is an amendment of form. As of now the t2200. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web on september 11, 2020, the cra.

What You Need To Know About This Year's T2200 Forms numbercrunch

The employee received a signed form. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need.

Form T2200 Download Fillable PDF or Fill Online Declaration of

Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Web a new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days. Save money and time with.

53 [pdf] YES BANK FORM DOWNLOAD PRINTABLE HD DOWNLOAD ZIP * BankForm

Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. The employee received a signed form. Quickbooks online can help.

Form Simple Ira Contribution Fill Out And Sign Printable Pdf Template 5F4

Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. This is an amendment of form. Ad download or email t2200 & more fillable forms, register and subscribe now! As of now the t2200. Save money and time with pdffiller

CRA T2200 PDF

Quickbooks online can help you maximize. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form.

As Of Now The T2200.

The employee received a signed form. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s. For best results, download and open this form in adobe reader. Quickbooks online can help you maximize.

Ad Download Or Email T2200 & More Fillable Forms, Register And Subscribe Now!

Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses.

Web The Employee Was Required To Pay At Least Some Home Office Expenses (If Reimbursement Was Received, It Did Not Cover All Expenses).

Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. Web we would like to show you a description here but the site won’t allow us. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Ad download or email t2200 & more fillable forms, register and subscribe now!

Web Form T2200 Allows Employees To Claim Expenses That They May Incur To Do Their Job, Including Running A Home Office, Mobile Phone Expenses And Car.

Web a new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days. Save money and time with pdffiller This is an amendment of form. The form t2200 actually certifies that the.

![53 [pdf] YES BANK FORM DOWNLOAD PRINTABLE HD DOWNLOAD ZIP * BankForm](https://data.formsbank.com/pdf_docs_html/136/1363/136388/page_1_thumb_big.png)