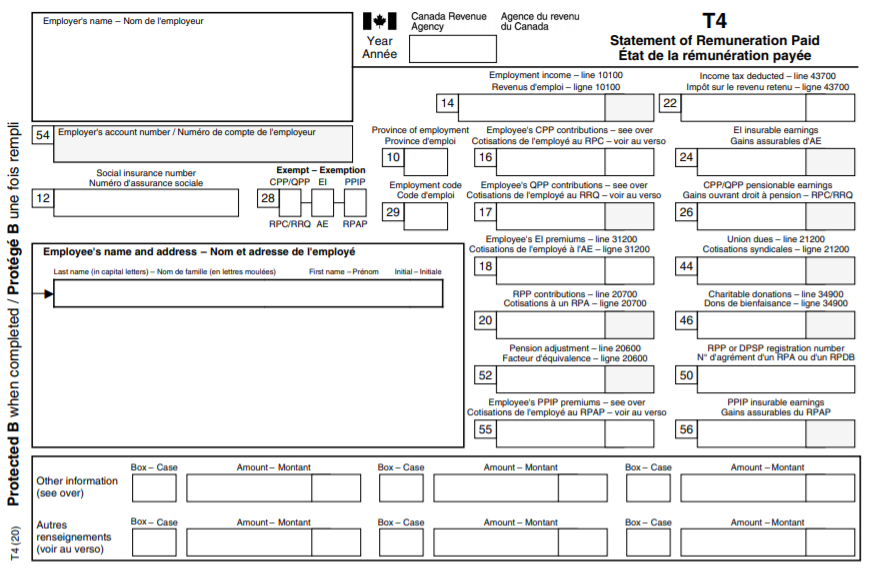

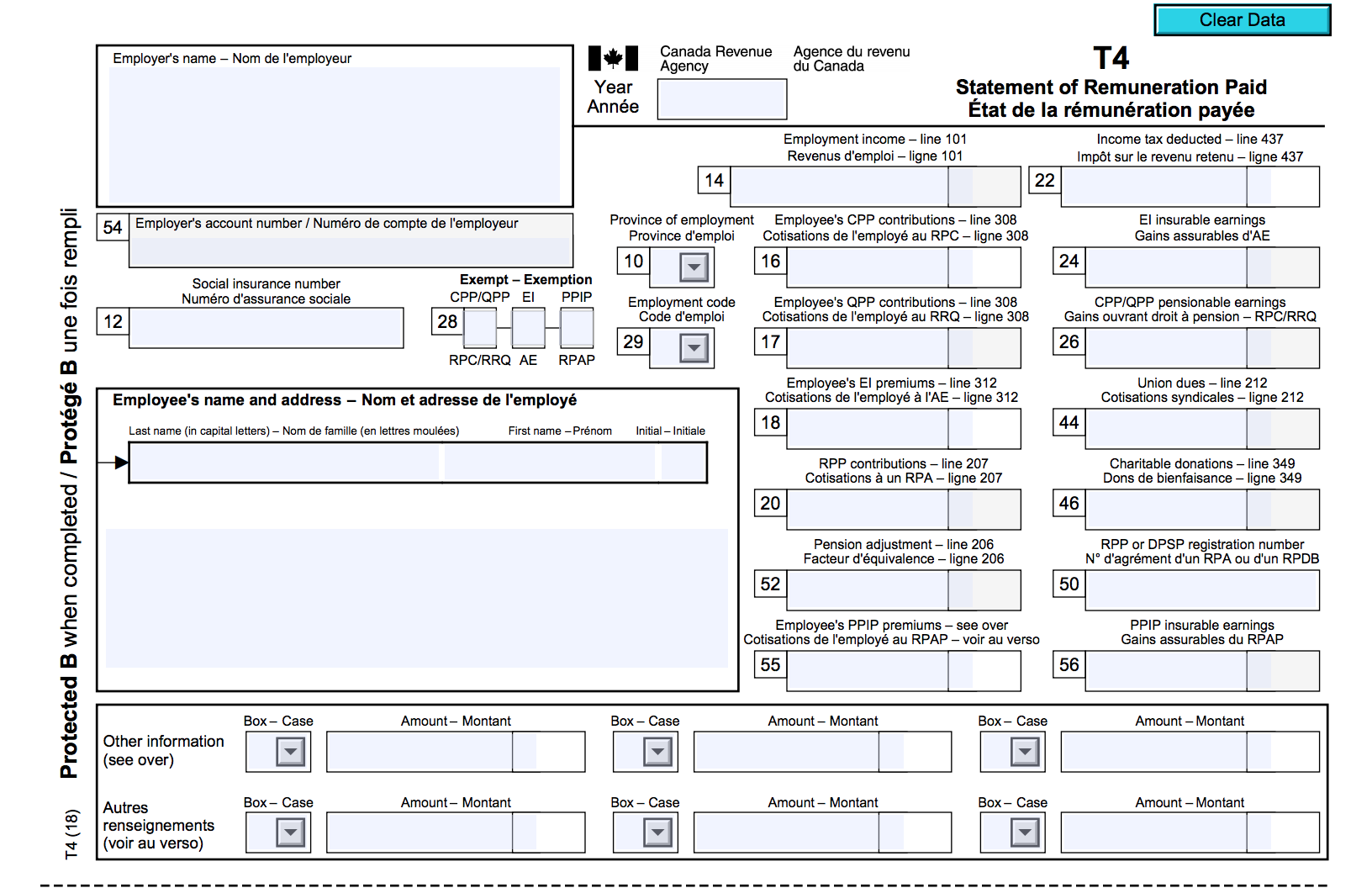

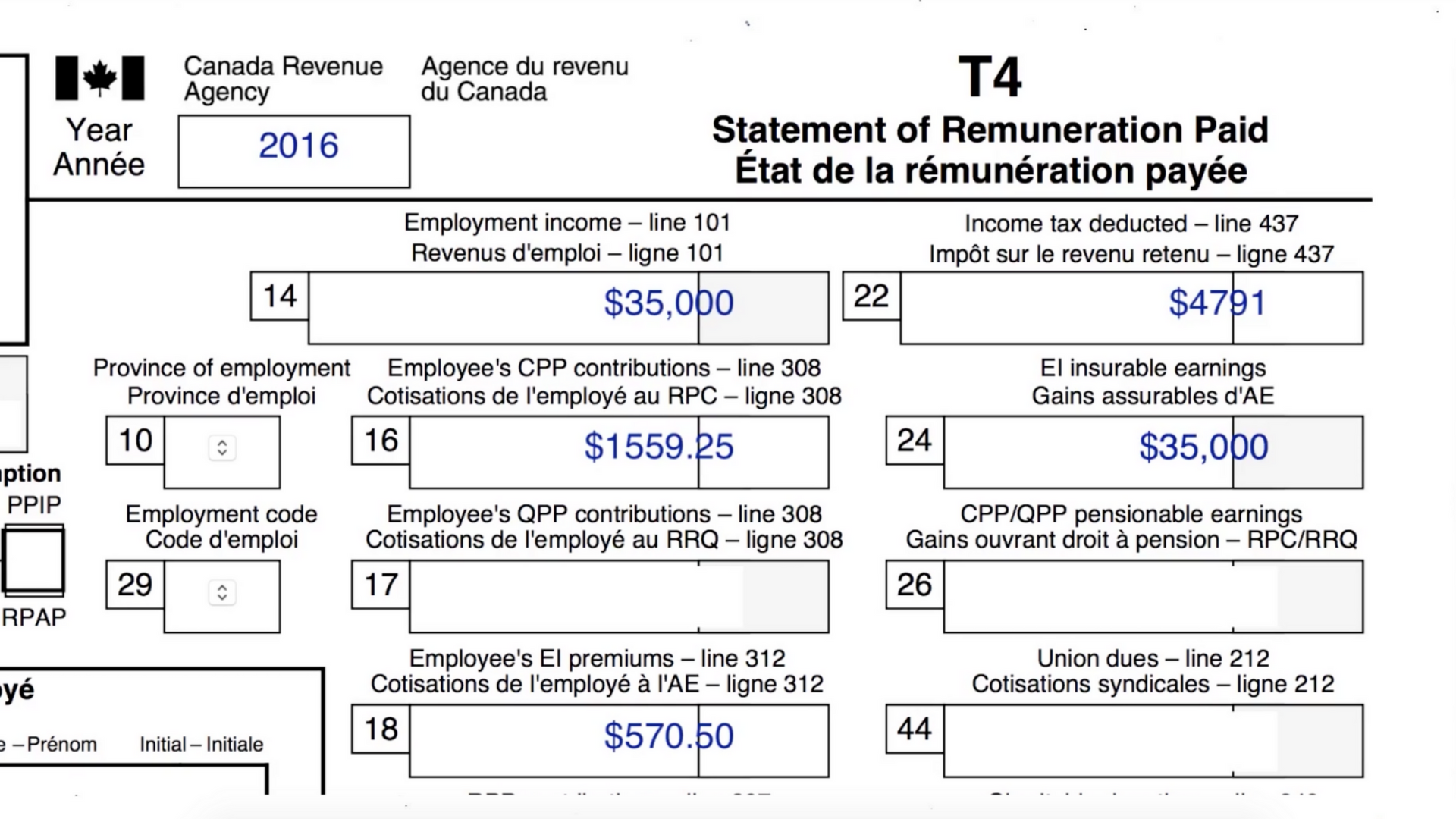

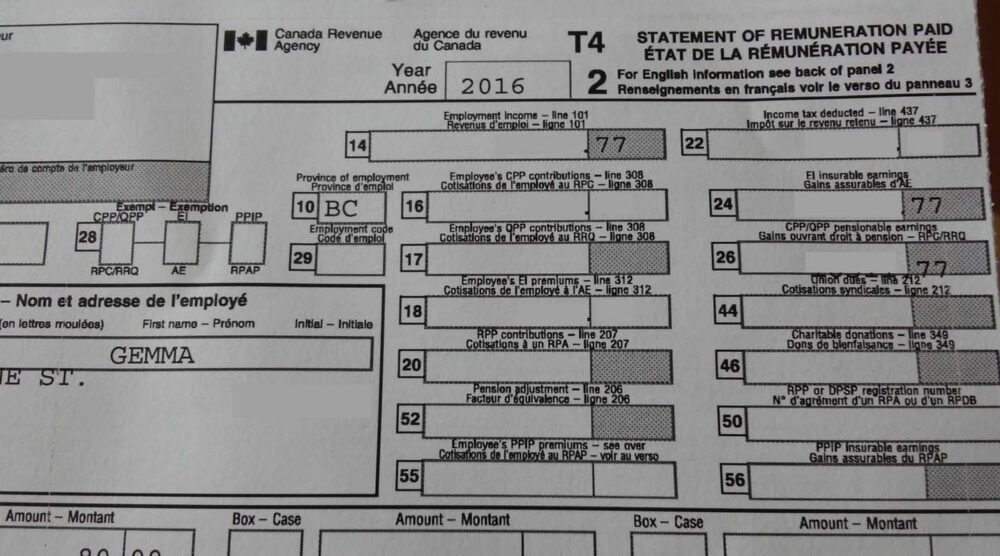

T4 Canada Tax Form

T4 Canada Tax Form - An amended return cannot contain an original slip. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Employers have until the end of february each year to issue their employees’ t4. These include income tax, employment insurance,. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Ad our international tax services can be customized to fit your specific business needs. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. You should receive most of. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are prepared by your employer, payer, administrator or financial institution. We have decades of experience with holistic international tax strategies and planning.

We have decades of experience with holistic international tax strategies and planning. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web what's the difference? Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Edit, sign and save canada t4 form. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Ad our international tax services can be customized to fit your specific business needs.

An amended return cannot contain an original slip. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Web when an employer gives you a t4 slip, they also send a copy of it to the cra. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Turbotax canada march 25, 2022 | 3 min read updated for tax year 2021 contents 3 minute. Written by hannah logan edited by beth buczynski. Employers have until the end of february each year to issue their employees’ t4.

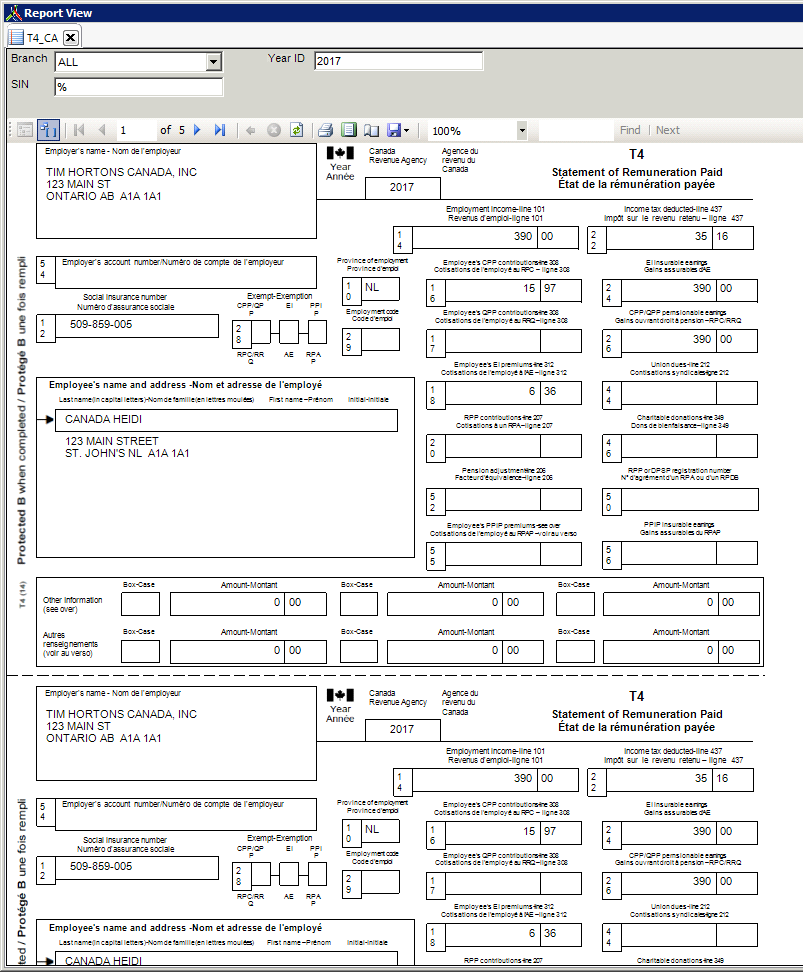

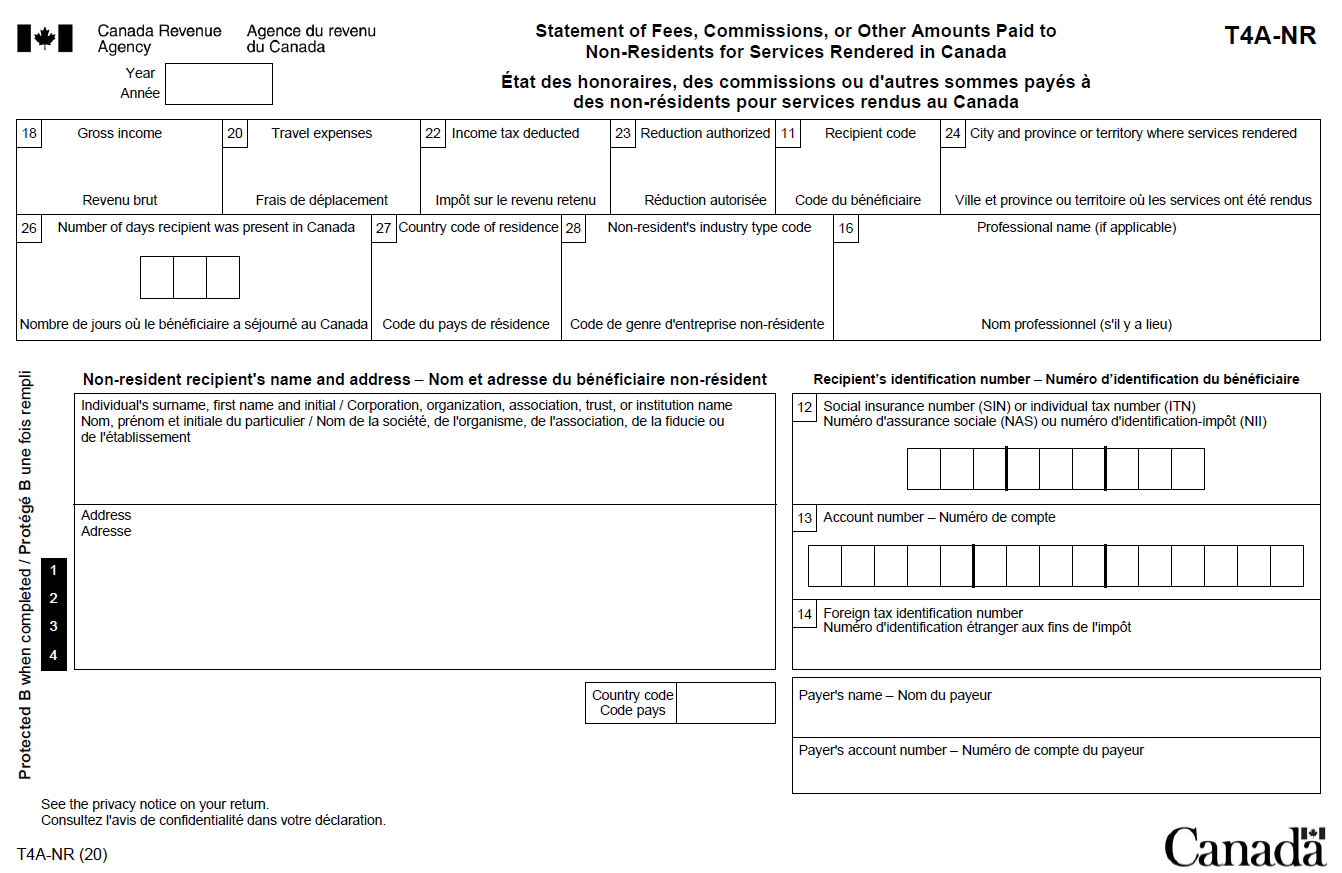

ProWeb Entering Canadian Form T4 & T4ANR Support

Web t4 and t4a are two necessary tax forms that detail employment income. Web what's the difference? Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank. You should receive most of.

The Canadian Employer's Guide to the T4 Bench Accounting

Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. We have decades of experience with holistic international tax strategies and planning. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank. You should receive most of. Statement of remuneration paid for.

Standard Canadian Report T4_CA Avionte Classic

Web what's the difference? Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Edit, sign.

What is a T4 slip? Canada.ca

Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. We have decades of experience with holistic international tax strategies and planning. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Written by hannah logan edited by.

Revenue Canada T4A Fillable designcentersas

An amended return cannot contain an original slip. We have decades of experience with holistic international tax strategies and planning. Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Web when an employer gives you a t4 slip, they also send.

Desktop Entering Canadian Form T4 & T4ANR Support

These include income tax, employment insurance,. Ad our international tax services can be customized to fit your specific business needs. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. You should receive most of. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips.

How to Prepare a T4 Slip in 12 Easy Steps Madan CPA

We have decades of experience with holistic international tax strategies and planning. These include income tax, employment insurance,. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Ad our international tax services can be customized to fit your specific business needs. You should receive most.

FAQs Tslip turnaround for autofill my return

Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions. Web when an employer gives you a t4 slip, they also send a copy of it to.

How to File a Tax Return on a Working Holiday in Canada 2021

Ad download or email canada t4 form & more fillable forms, register and subscribe now! Web t4 and t4a are two necessary tax forms that detail employment income. Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Statement of remuneration paid for detailed information on the.

the SUPER BASIC story of Canadian Tax From Rags to Reasonable

Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Ad download or email canada t4 form & more fillable forms, register and subscribe now! Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips slips are.

Edit, Sign And Save Canada T4 Form.

Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding box number below. Written by hannah logan edited by beth buczynski. Web every employee in canada who earns $500 or more in employment income within a calendar year (january 1 to december 31) must receive a t4 from every. Web when an employer gives you a t4 slip, they also send a copy of it to the cra.

Web Get Your T4, T5, T3, T2202, Rc62, Rc210 Or Rrsp Slips Slips Are Prepared By Your Employer, Payer, Administrator Or Financial Institution.

Ad download or email canada t4 form & more fillable forms, register and subscribe now! Web what's the difference? Where the t4 form directly deals with income earned through employment and deductions made by the employer, the t4a form, on the other. Web boxes 16 and 26 are completed with the appropriate amounts and boxes 18 and 24 are left blank.

We Have Decades Of Experience With Holistic International Tax Strategies And Planning.

Ad our international tax services can be customized to fit your specific business needs. Web t4 and t4a are two necessary tax forms that detail employment income. These include income tax, employment insurance,. Turbotax canada march 25, 2022 | 3 min read updated for tax year 2021 contents 3 minute.

You Should Receive Most Of.

Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. An amended return cannot contain an original slip. Employers have until the end of february each year to issue their employees’ t4. Web a t4 slip is a tax document that summarizes your annual employment earnings as well as any deductions.