Tax Exempt Form Nj

Tax Exempt Form Nj - The seller’s name and address are not required for the exemption certificate to be considered fully completed. Use tax (prior year form for purchases made on or after jan. Web exemption certificate for student textbooks: Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: Web corporation business tax. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. 31, 2017) sales and use tax: Web division’s request for substantiation of the claimed exemption to either: State of new jersey, division of taxation, p. Use tax (for purchases on or after january 1, 2018) sales and use tax:

If you were a member of a domestic partnership that was registered in new jersey on the last. Web corporation business tax. Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: Web division’s request for substantiation of the claimed exemption to either: Use tax (for purchases on or after january 1, 2018) sales and use tax: List of printable new jersey sales tax exemption certificates. Web • new jersey taxpayer identification number; Use tax (prior year form for purchases made. • signature, if using a paper exemption certificate (including fax). If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption.

Web the following uez businesses have qualified for the sales and use tax exemption available for purchases of natural gas, electricity, and the transportation and transmission of both commodities, for use at the urban enterprise zone location. State of new jersey, division of taxation, p. The seller’s name and address are not required for the exemption certificate to be considered fully completed. If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. (a) was statutorily available on the date of the transaction, and You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. Web • new jersey taxpayer identification number; Use tax (prior year form for purchases made. • signature, if using a paper exemption certificate (including fax). If you were a member of a domestic partnership that was registered in new jersey on the last.

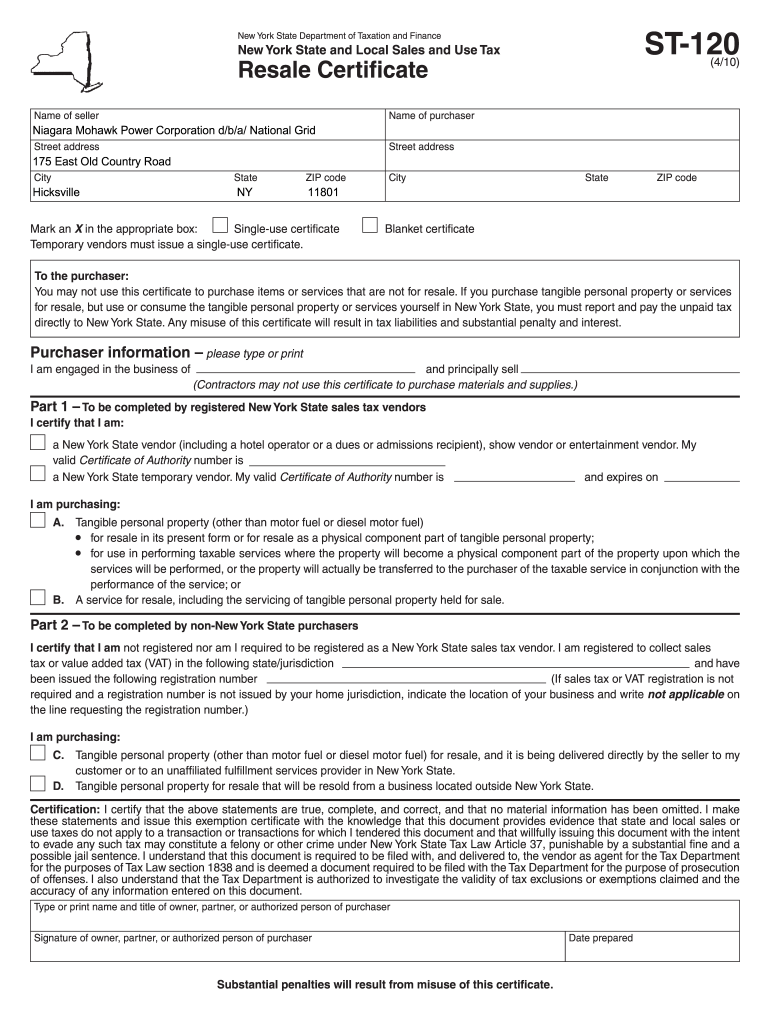

Tax Exempt Form Ny Fill and Sign Printable Template Online US Legal

If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. Use tax (for purchases on or after january 1, 2018) sales and use tax: Use tax (prior year form for purchases made on or after jan. Web division’s request for substantiation of the claimed exemption to either: Obtain.

Tax Exempt Form 2022 IRS Forms

Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. Web the following uez businesses have qualified for the sales and.

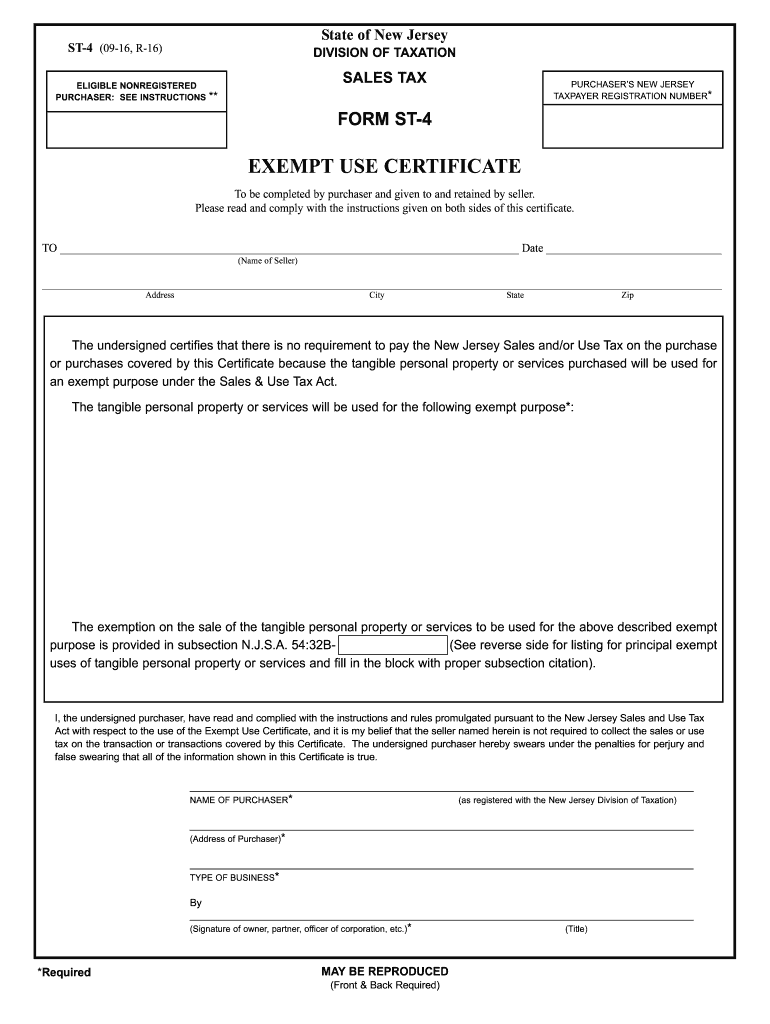

20162020 Form NJ ST4 Fill Online, Printable, Fillable, Blank PDFfiller

The seller’s name and address are not required for the exemption certificate to be considered fully completed. (a) was statutorily available on the date of the transaction, and If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. Use tax (prior year form for purchases made on or.

Nj Tax Exempt Form St 5 Fill Online, Printable, Fillable, Blank

If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. If you were a member of a domestic partnership that was registered in new jersey on the last. Use tax (for purchases on or after january 1, 2018) sales and use tax: Web exemption certificate for student textbooks:.

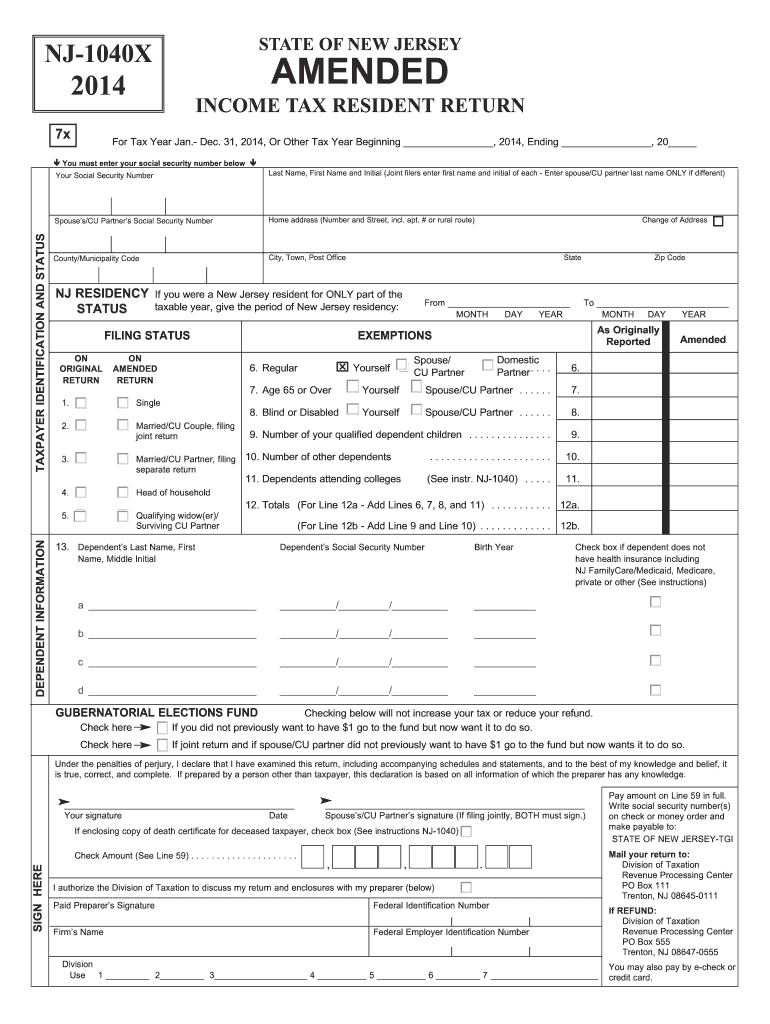

Nj State Tax Form Fill Out and Sign Printable PDF Template signNow

Web • new jersey taxpayer identification number; Web exemption certificate for student textbooks: Web corporation business tax. (a) was statutorily available on the date of the transaction, and Use tax (for purchases on or after january 1, 2018) sales and use tax:

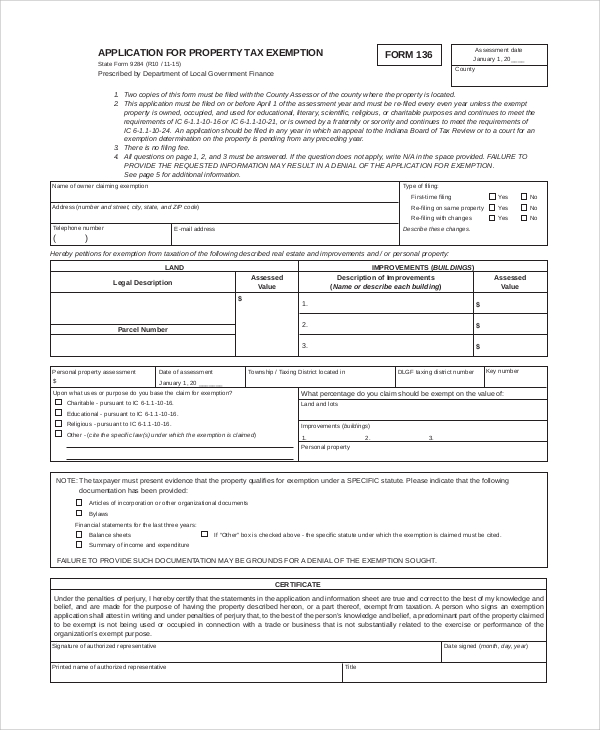

FREE 10+ Sample Tax Exemption Forms in PDF

If you were a member of a domestic partnership that was registered in new jersey on the last. Use tax (prior year form for purchases made. Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: State of new jersey, division.

Tax Exemption Form Fill Online, Printable, Fillable, Blank pdfFiller

Use tax (prior year form for purchases made. Web • new jersey taxpayer identification number; • signature, if using a paper exemption certificate (including fax). State of new jersey, division of taxation, p. If you were a member of a domestic partnership that was registered in new jersey on the last.

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

Web the following uez businesses have qualified for the sales and use tax exemption available for purchases of natural gas, electricity, and the transportation and transmission of both commodities, for use at the urban enterprise zone location. Web division’s request for substantiation of the claimed exemption to either: List of printable new jersey sales tax exemption certificates. Web corporation business.

Fillable Form RegIe Application For Exempt Organization Certificate

Web • new jersey taxpayer identification number; If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. Web the following uez businesses have qualified for the sales and use tax exemption available for purchases of natural gas, electricity, and the transportation and transmission of both commodities, for use.

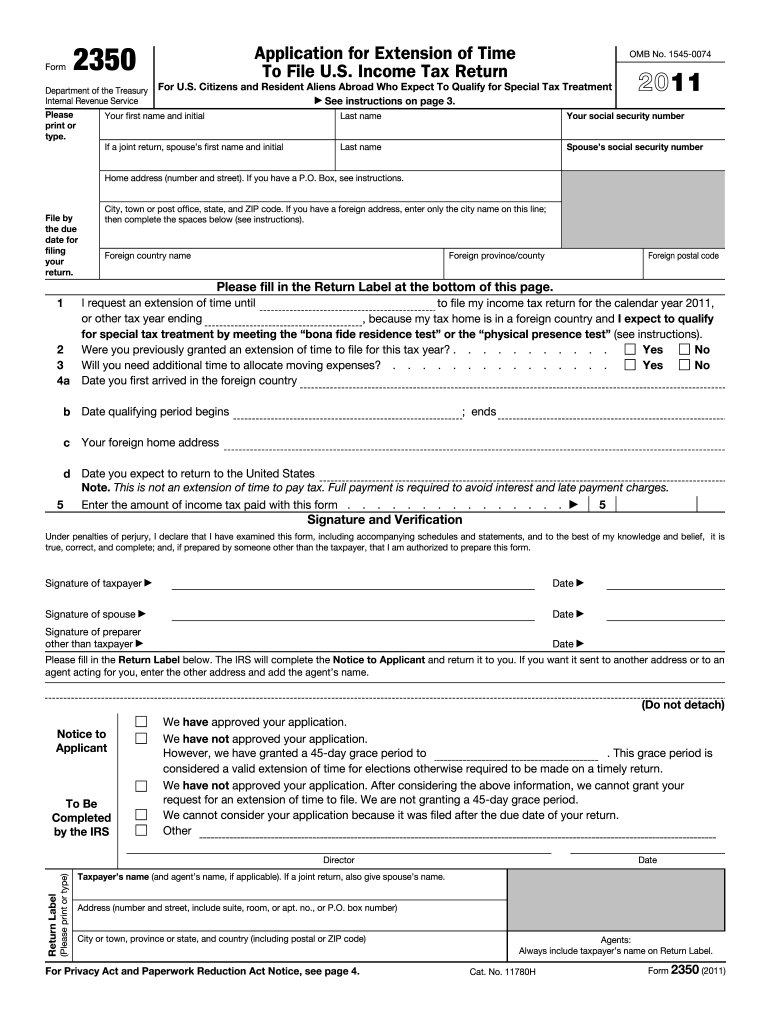

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: 31, 2017) sales and use tax: Web division’s request for substantiation of the claimed exemption to either: The seller’s name and address are not required for the exemption certificate to be.

Use Tax (Prior Year Form For Purchases Made On Or After Jan.

Use tax (prior year form for purchases made. Web corporation business tax. State of new jersey, division of taxation, p. Web exemption certificate for student textbooks:

You Can Claim A $1,000 Regular Exemption, Even If Someone Else Claims You As A Dependent On Their Tax Return.

• signature, if using a paper exemption certificate (including fax). The seller’s name and address are not required for the exemption certificate to be considered fully completed. (a) was statutorily available on the date of the transaction, and Use tax (for purchases on or after january 1, 2018) sales and use tax:

Web The Following Uez Businesses Have Qualified For The Sales And Use Tax Exemption Available For Purchases Of Natural Gas, Electricity, And The Transportation And Transmission Of Both Commodities, For Use At The Urban Enterprise Zone Location.

Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that: If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption. Web division’s request for substantiation of the claimed exemption to either: Web • new jersey taxpayer identification number;

If You Were A Member Of A Domestic Partnership That Was Registered In New Jersey On The Last.

List of printable new jersey sales tax exemption certificates. 31, 2017) sales and use tax: