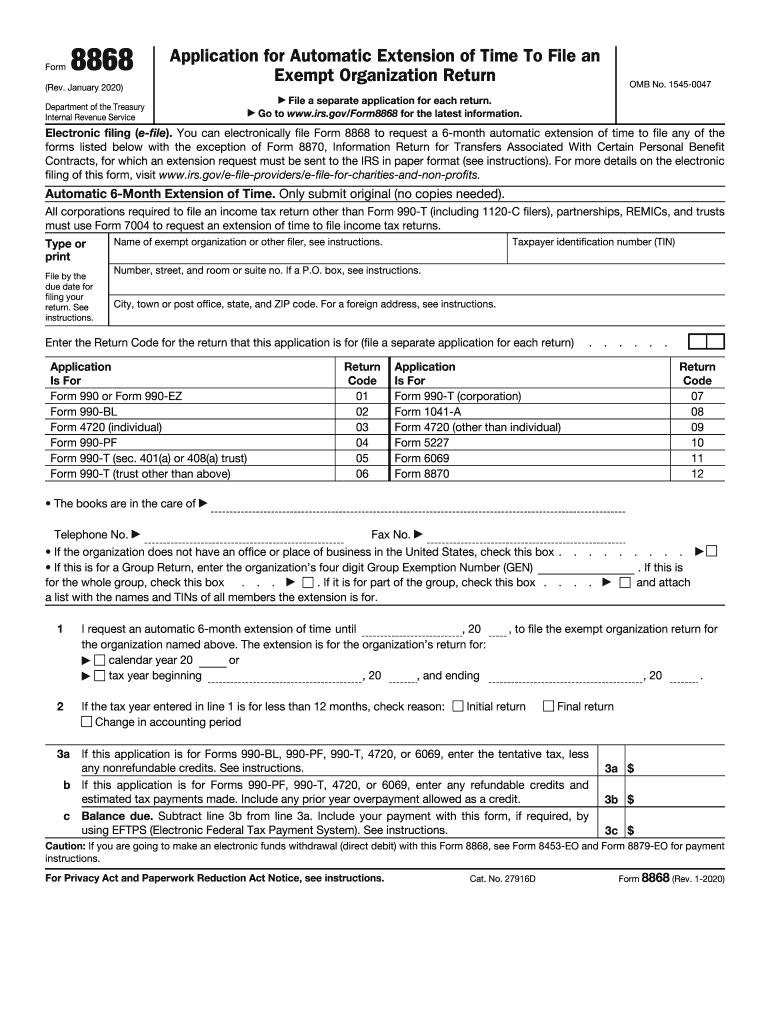

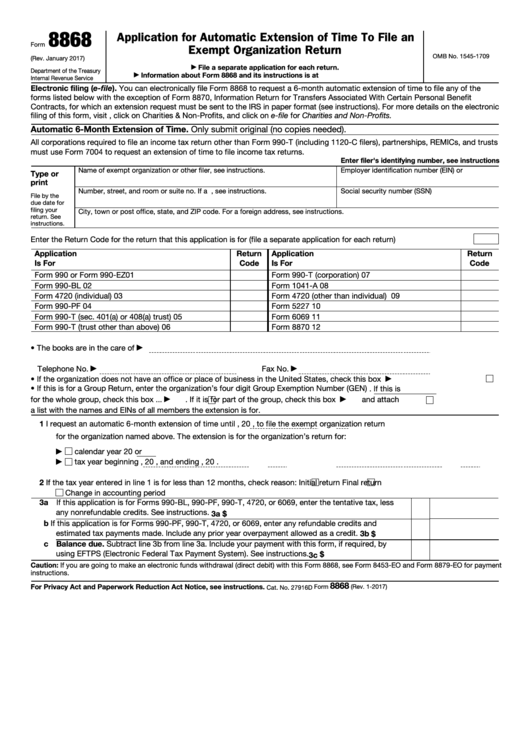

Tax Extension Form 8868

Tax Extension Form 8868 - File form 8868 for free when you pay in advance for a 990 return with our package pricing. If you want an extension for another form,. Ad sovos combines tax automation with a human touch. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. And you are not enclosing a payment use this address and you are enclosing a payment. Complete, edit or print tax forms instantly. You can electronically file form 8868 if you need a 3. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Web enter the return code based on the type of return for which you are requesting a form 8868 extension. Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically?

Minimize sales tax compliance risk with automated solutions from avalara Check your state tax extension requirements. Ad sovos combines tax automation with a human touch. The irs form 4868 is an extension form that can be used to get an. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Reach out to learn how we can help you! If you want an extension for another form,. Form 8868 is used by an exempt organization to request an. Web may 8, 2023. Enter only one return code.

If your nonprofit organization has a. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. You’ll receive an electronic acknowledgment once you complete the. Web what is irs form 8868? Form 8868 is used by an exempt organization to request an. Web may 8, 2023. And you are not enclosing a payment use this address and you are enclosing a payment. Web there are several ways to submit form 4868. *file from any device for an extension of up to 6 months. File form 8868 for free when you pay in advance for a 990 return with our package pricing.

Irs Form 8868 Fill Out and Sign Printable PDF Template signNow

Ad avalara calculates, collects, files & remits sales tax returns for your business. Web may 8, 2023. Web enter the return code based on the type of return for which you are requesting a form 8868 extension. Form 8868 is used by an exempt organization to request an. File form 8868 for free when you pay in advance for a.

How to File A LastMinute 990 Extension With Form 8868

Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Application for extension of time to file an exempt organization return. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Taxpayers can file form.

Form 8868, NonProfit Organization Tax Extension Deadline Alert!

Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Enter only one return code. Web enter the return code based on the type of return for which you are requesting a form 8868 extension. Minimize sales tax compliance risk with automated solutions from avalara Ad download or email irs 8868 & more fillable.

Tax extension form 8868

Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Ad sovos combines tax automation with a human touch. Form 8868 is the extension form obtained from the internal revenue service for an automatic extension of six months to file form 990. Web there are several ways to submit form 4868. Web may 8,.

EFile Tax Extension Form 8868 by Span Enterprises LLC

Complete, edit or print tax forms instantly. Web you can get an automatic extension of time to file your tax return by filing form 4868 electronically. Application for extension of time to file an exempt organization return. If your nonprofit organization has a. Minimize sales tax compliance risk with automated solutions from avalara

EFile Tax Extension Form 8868 by Span Enterprises LLC

Ad sovos combines tax automation with a human touch. Web there are several ways to submit form 4868. *file from any device for an extension of up to 6 months. Ad sovos combines tax automation with a human touch. If you want an extension for another form,.

Tax extension form 8868

Reach out to learn how we can help you! If your nonprofit organization has a. Web what is irs form 8868? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Application for extension of time to file an exempt organization return.

Fillable Form 8868 Application For Automatic Extension Of Time To

You can electronically file form 8868 if you need a 3. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Web what is irs form 8868? *file from any device for an extension of up to 6 months. Web what is irs form 8868?

Irs form 8868

*file from any device for an extension of up to 6 months. Web form 4868 addresses for taxpayers and tax professionals; Web may 11, 2022. Complete, edit or print tax forms instantly. File form 8868 for free when you pay in advance for a 990 return with our package pricing.

File Form 8868 Online Efile 990 Extension with the IRS

Reach out to learn how we can help you! If your nonprofit organization has a. Web may 8, 2023. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Application for extension of time to file an exempt organization return.

Web Enter The Return Code Based On The Type Of Return For Which You Are Requesting A Form 8868 Extension.

Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Complete, edit or print tax forms instantly. Ad sovos combines tax automation with a human touch. Form 8868 is used by an exempt organization to request an.

You Can Electronically File Form 8868 If You Need A 3.

If your nonprofit organization has a. *file from any device for an extension of up to 6 months. Ad avalara calculates, collects, files & remits sales tax returns for your business. File form 8868 for free when you pay in advance for a 990 return with our package pricing.

Web What Is Irs Form 8868?

Web there are several ways to submit form 4868. Ad download or email irs 8868 & more fillable forms, register and subscribe now! The irs form 4868 is an extension form that can be used to get an. Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically?

Reach Out To Learn How We Can Help You!

File form 8868 for free when you pay in advance for a 990 return with our package pricing. And you are not enclosing a payment use this address and you are enclosing a payment. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Web may 8, 2023.