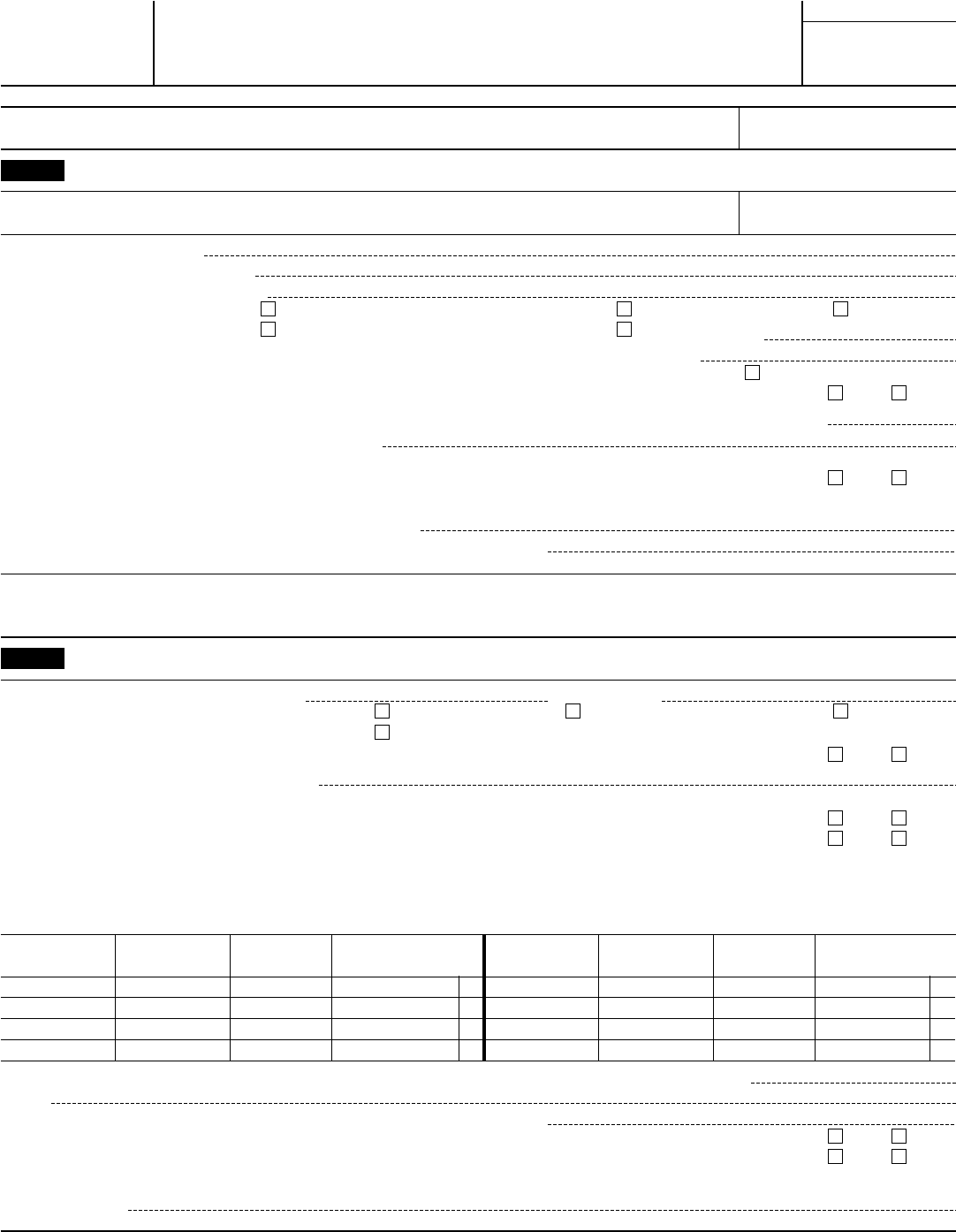

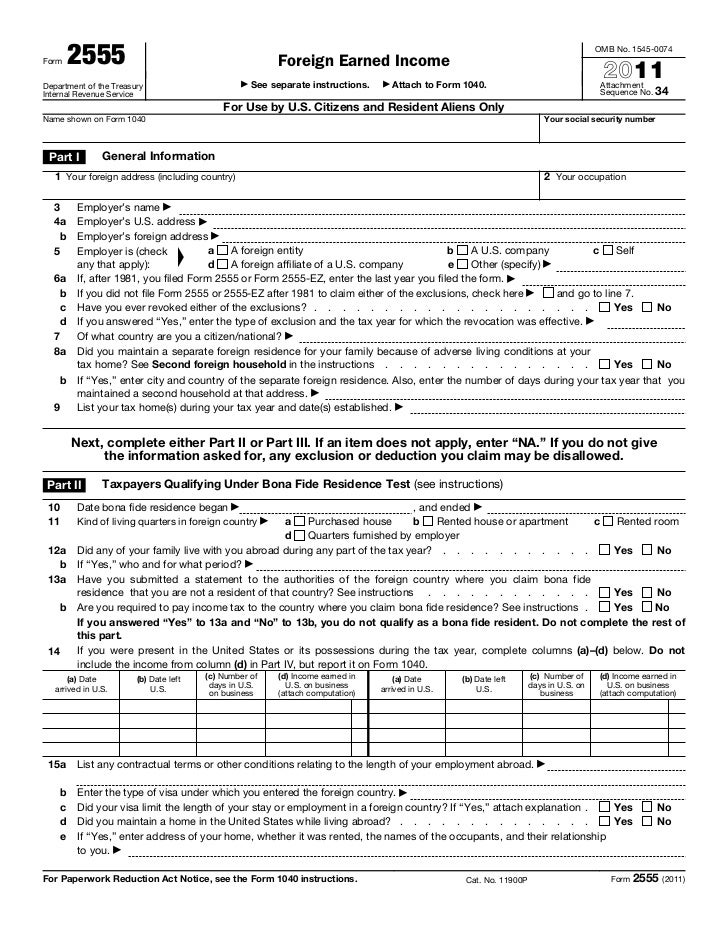

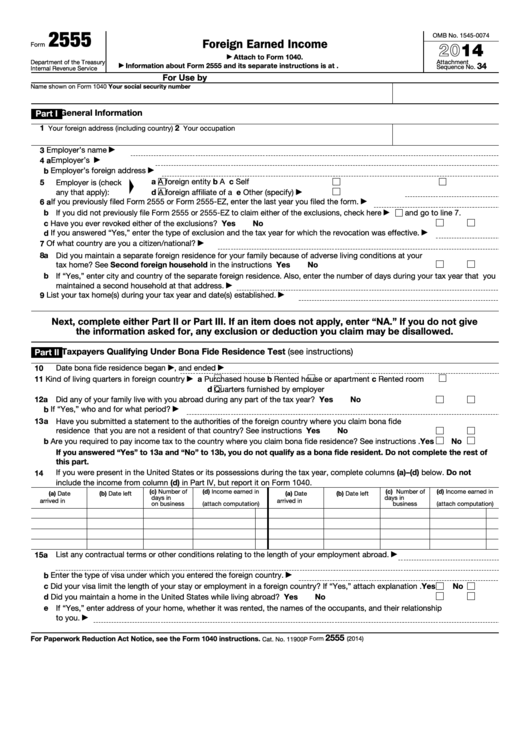

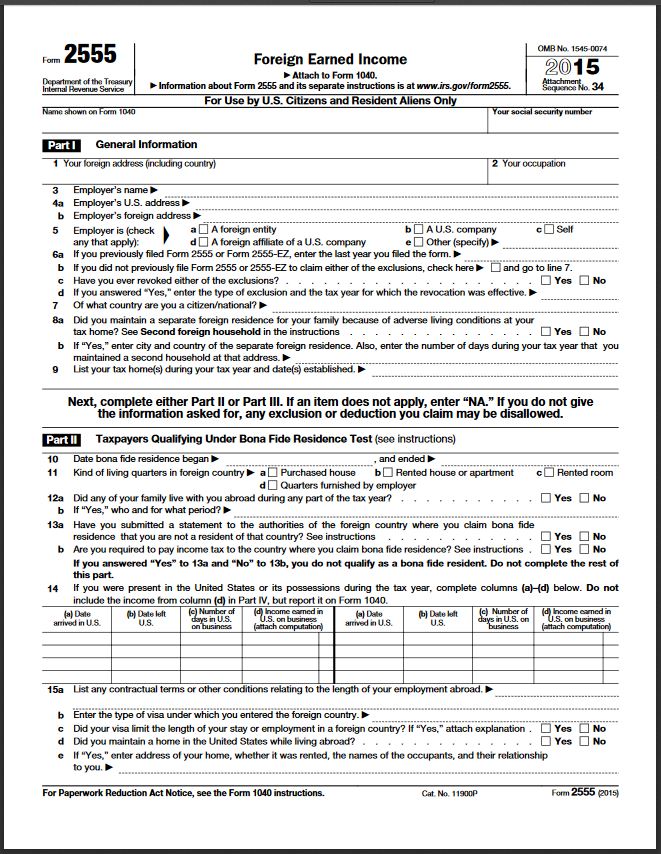

Tax Form 2555

Tax Form 2555 - If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. 34 for use by u.s. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Learn the basics of form 2555 and claiming the foreign earned income exclusion here. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Go to www.irs.gov/form2555 for instructions and the latest information. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned income exclusion as well as their housing exclusion or deduction. Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. Web what is form 2555 used for? Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax.

Web what is form 2555 used for? February 26, 2021 share on social what is irs form 2555? Learn the basics of form 2555 and claiming the foreign earned income exclusion here. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. 34 for use by u.s. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned income exclusion as well as their housing exclusion or deduction. Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income.

Go to www.irs.gov/form2555 for instructions and the latest information. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. If you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Learn the basics of form 2555 and claiming the foreign earned income exclusion here. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. Web what is form 2555 used for? Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year.

Form 2555, Foreign Earned Exclusion YouTube

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned income exclusion as well as their housing exclusion or deduction. Learn the basics of form 2555 and claiming the foreign earned income exclusion here. Form 2555 is the form.

Breanna Tax Form 2555 Ez 2019

34 for use by u.s. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Learn the basics of form 2555 and claiming the foreign earned income exclusion here. February 26, 2021 share on social what is irs form 2555? You cannot exclude or deduct more than the.

2 FREE DOWNLOAD U.S. TAX FORM 2555 PDF DOC AND VIDEO TUTORIAL * Tax Form

Web what is form 2555 used for? Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned income exclusion as well as their housing exclusion or deduction. If you qualify, you can use form 2555 to figure your foreign.

US Tax Abroad Expatriate Form 2555

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. Web if you are working and/or living abroad and meet certain requirements, you may be.

2 FREE DOWNLOAD U.S. TAX FORM 2555 PDF DOC AND VIDEO TUTORIAL * Tax Form

Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Form 2555 is used by united states citizens who live and earn.

Breanna Tax Form 2555 Ez Foreign Earned

Web what is form 2555 used for? Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income.

Fillable Form 2555 Foreign Earned 2014 printable pdf download

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You cannot exclude or deduct more than the amount of your foreign earned income for the year. 34.

Filing Taxes While Working Abroad — Ambassador Year in China

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. 34 for use by u.s. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Web what is form 2555 used for? Learn the basics of form 2555 and claiming the foreign.

Foreign Earned Exclusion Form 2555 Verni Tax Law

If you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions.

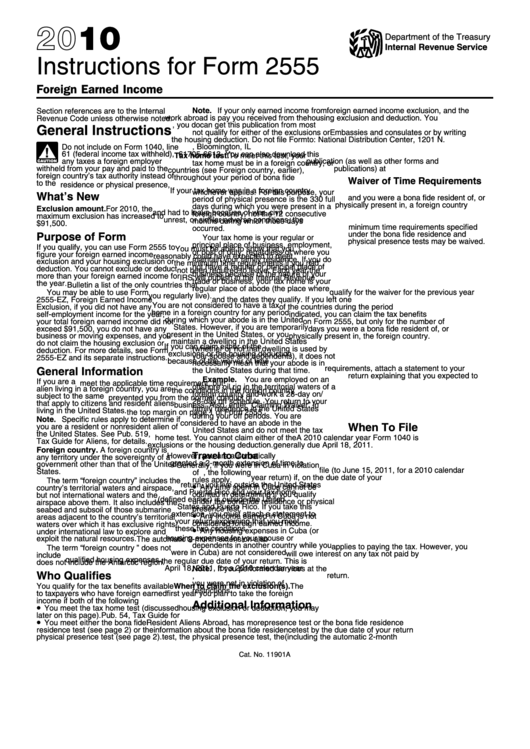

Instructions For Form 2555 Foreign Earned Internal Revenue

Learn the basics of form 2555 and claiming the foreign earned income exclusion here. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. If you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country..

Web The Feie (Form 2555) Can Be Used To Exclude “Foreign Earned Income” From Being Subject To Us Tax.

Web what is form 2555 used for? Go to www.irs.gov/form2555 for instructions and the latest information. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned income exclusion as well as their housing exclusion or deduction.

34 For Use By U.s.

Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Learn the basics of form 2555 and claiming the foreign earned income exclusion here. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file.

You Cannot Exclude Or Deduct More Than The Amount Of Your Foreign Earned Income For The Year.

If you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. February 26, 2021 share on social what is irs form 2555?

If You Qualify, You Can Use Form 2555 To Figure Your Foreign Earned Income Exclusion And Your Housing Exclusion Or Deduction.

Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income.