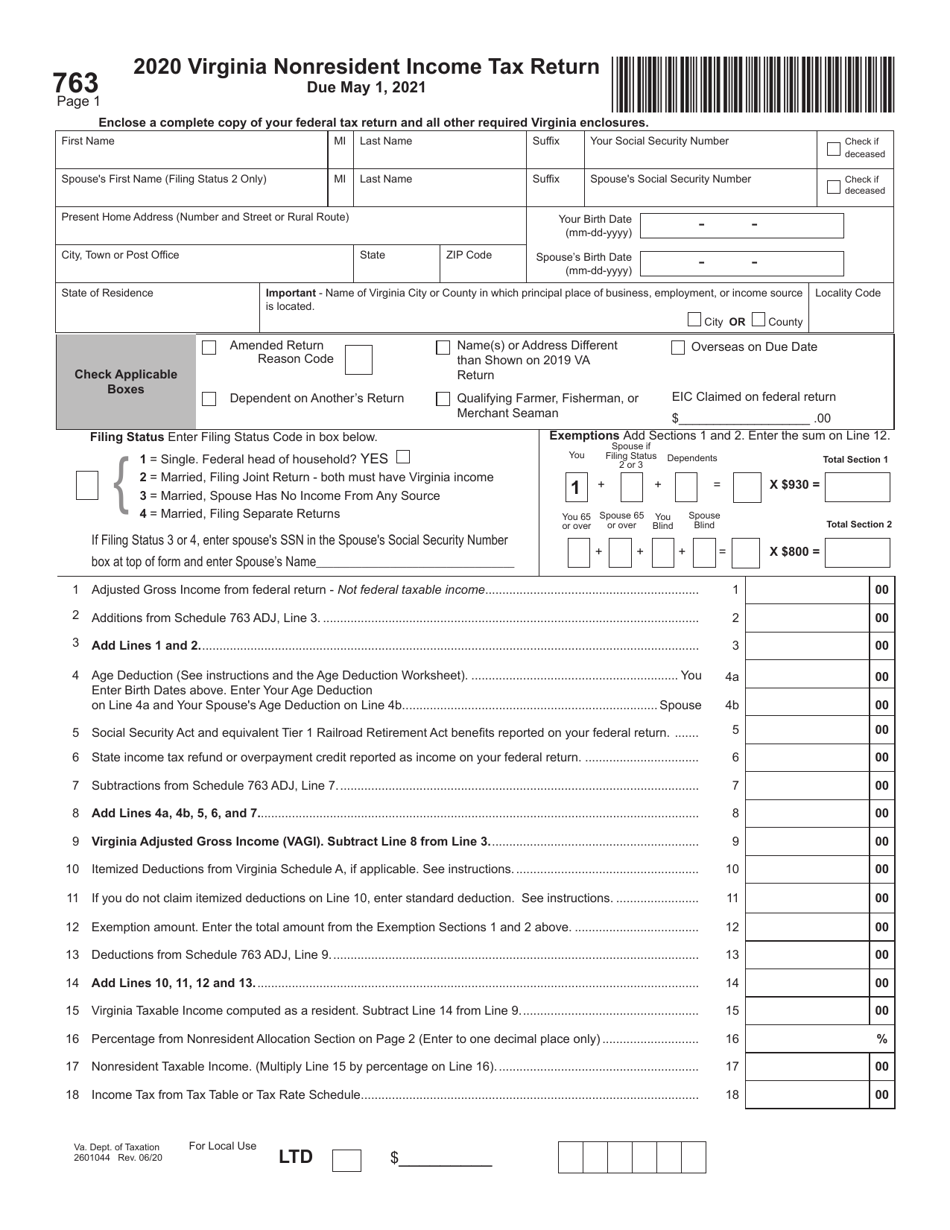

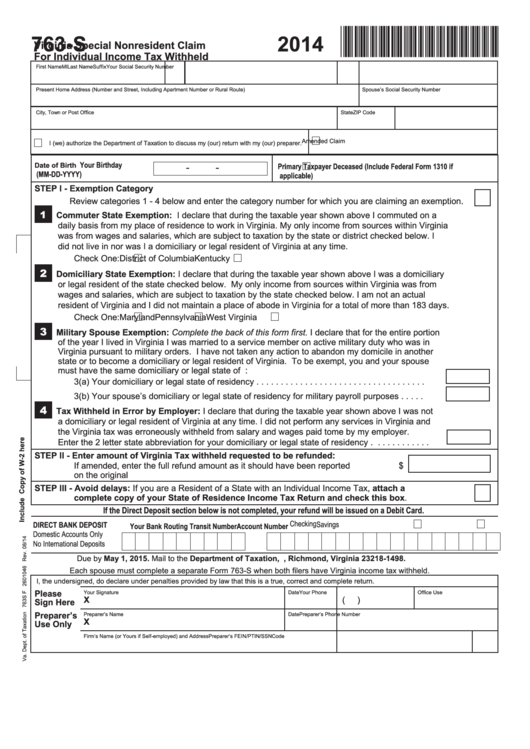

Tax Form 763

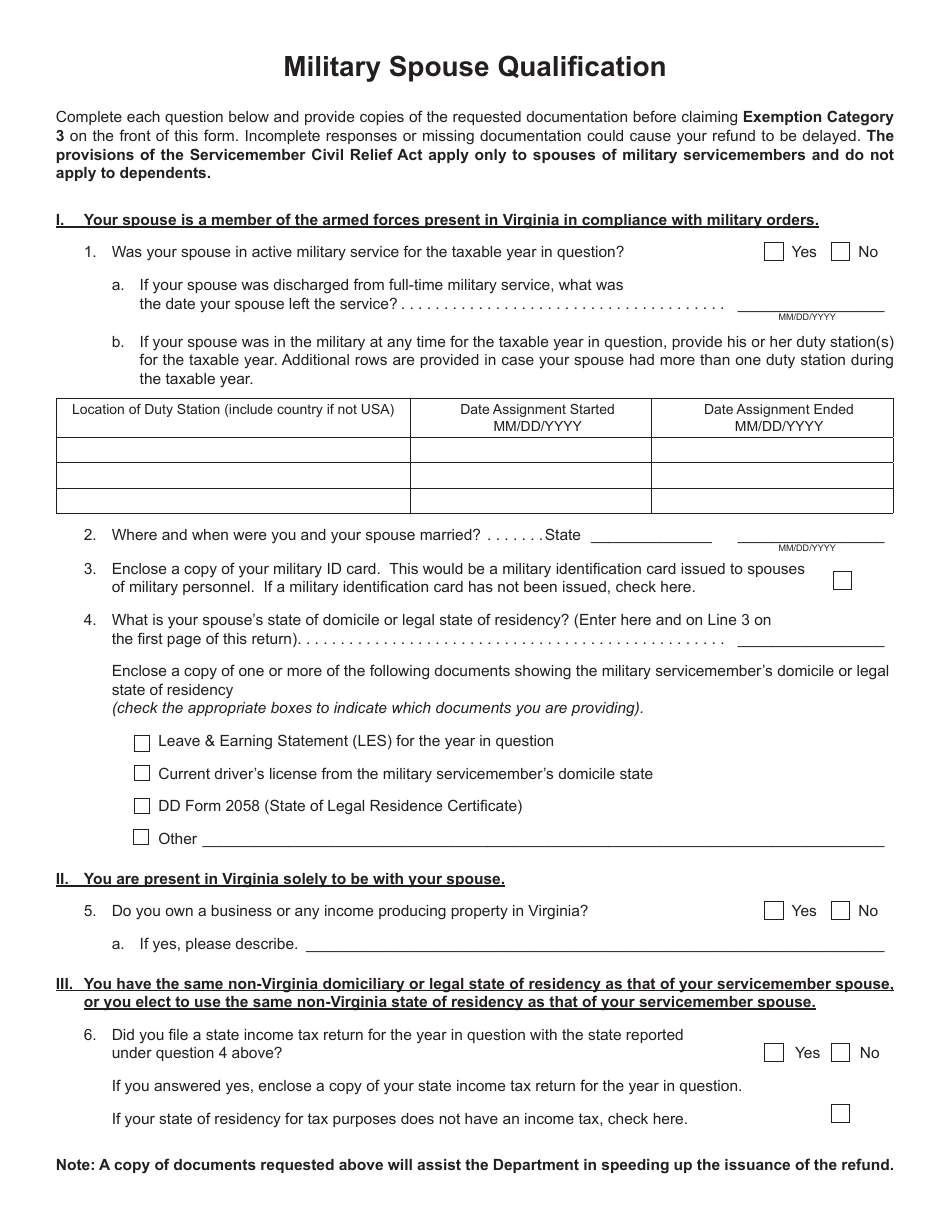

Tax Form 763 - 06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld date of birth your birthday. Taxpayers who are not able to file electronically should mail a paper tax return along. If the corporation's principal business, office, or agency is located in. 763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763 = (7 * 100) + (6 * 10) + (3 * 1) 763 = 700 + 60 + 3. Nonresidents of virginia need to file form 763 for their virginia income taxes. Refer to the form 763 instructions for other. Web find mailing addresses by state and date for filing form 2553. Web find irs addresses for private delivery of tax returns, extensions and payments. In admissible form, sufficient to require a trial of material factual issues. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld.

Web the data in your state of virginia return is populated by the data you enter for your federal return. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. Nonresidents of virginia need to file form 763 for their virginia income taxes. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. Private delivery services should not deliver returns to irs offices other than. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. Web expanded form of 763: Web find mailing addresses by state and date for filing form 2553. Web draft 2022 form 763, virginia nonresident income tax return. 763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763 = (7 * 100) + (6 * 10) + (3 * 1) 763 = 700 + 60 + 3.

In admissible form, sufficient to require a trial of material factual issues. Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022. Web the data in your state of virginia return is populated by the data you enter for your federal return. Taxpayers who are not able to file electronically should mail a paper tax return along. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. Private delivery services should not deliver returns to irs offices other than. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Web what form should i file | 763s.

Fillable Online ww2 anokacounty form 763 Fax Email Print pdfFiller

Of taxation 763s f 2601046 rev. Web if you live in another state and have rental property and/or business income from virginia, file virginia form 763, a nonresident tax return. Web what form should i file | 763s. Private delivery services should not deliver returns to irs offices other than. Filing electronically is the easiest.

Form 763 Download Fillable PDF or Fill Online Virginia Nonresident

Enclose a complete copy of. Refer to the form 763 instructions for other. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Web in that event, follow the steps outlined in the taxpayer guide to identity theft. Based on the information you.

Form TC763C Download Fillable PDF or Fill Online Cigarette Tax Surety

Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. 06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld date of birth your birthday. Stein law firm, p.c., 35 ny3d at 179; Of taxation 763s f 2601046 rev. Web we last updated the nonresident income tax instructions in march 2023,.

Form 763S Download Fillable PDF or Fill Online Virginia Special

Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022. If you moved into or out of virginia six. Filing electronically is the easiest. In admissible form, sufficient to require a trial of material factual issues. Web 2021 virginia nonresident income tax.

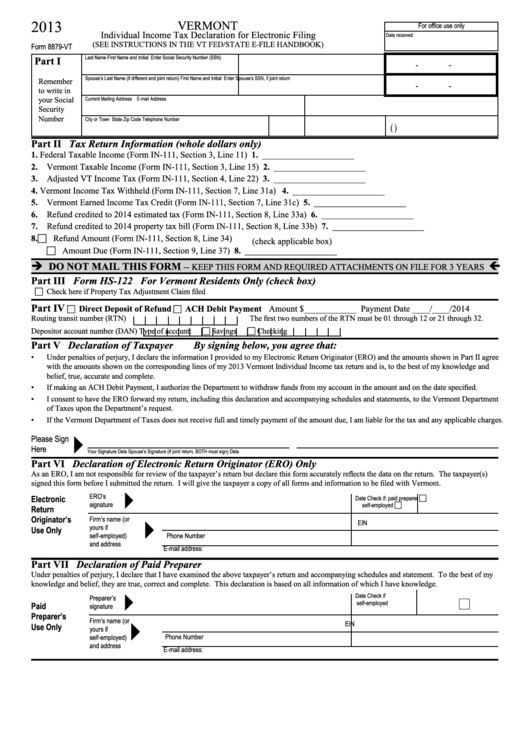

Form 8879Vt Individual Tax Declaration For Electronic Filing

Web the data in your state of virginia return is populated by the data you enter for your federal return. Web find mailing addresses by state and date for filing form 2553. If the corporation's principal business, office, or agency is located in. 763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763.

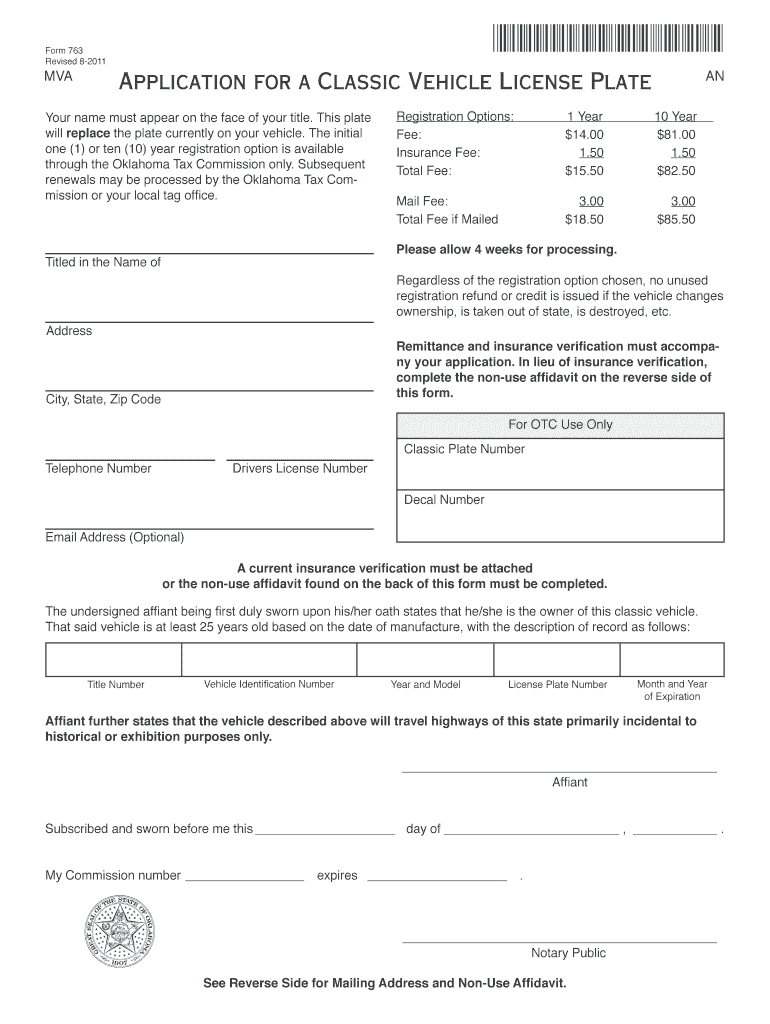

Tax Ok Gov Online Services Fill Out and Sign Printable PDF Template

Of taxation 763s f 2601046 rev. Generally, you are required to make payments. Web the data in your state of virginia return is populated by the data you enter for your federal return. Private delivery services should not deliver returns to irs offices other than. Web in that event, follow the steps outlined in the taxpayer guide to identity theft.

Fillable Form 763S Virginia Special Nonresident Claim For Individual

Enclose a complete copy of. Web draft 2022 form 763, virginia nonresident income tax return. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Web estimated income tax filing if you did not have enough income tax withheld, you may need to.

Electronic Filing for Software Developers VA1346

Enclose a complete copy of. Stein law firm, p.c., 35 ny3d at 179; Private delivery services should not deliver returns to irs offices other than. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. 2022 virginia nonresident income tax return.

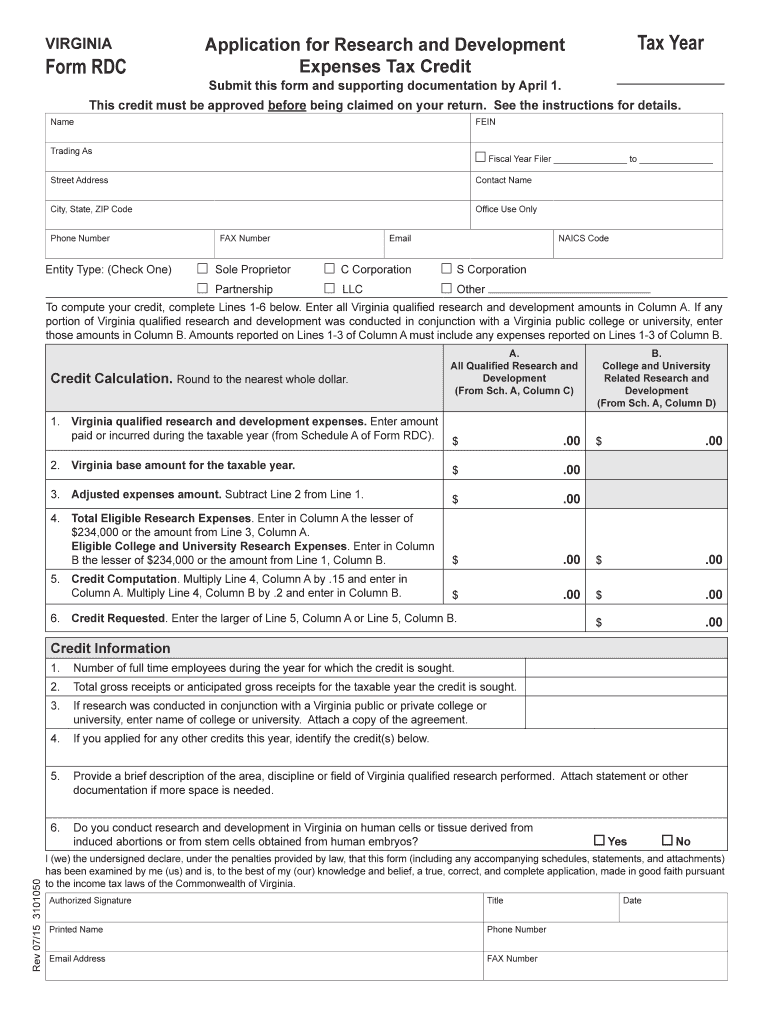

VA Form RDC 2015 Fill out Tax Template Online US Legal Forms

Generally, you are required to make payments. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. Enclose a complete copy of. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld..

In Admissible Form, Sufficient To Require A Trial Of Material Factual Issues.

Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022. Filing electronically is the easiest. Web expanded form of 763: Web if you live in another state and have rental property and/or business income from virginia, file virginia form 763, a nonresident tax return.

Web The Data In Your State Of Virginia Return Is Populated By The Data You Enter For Your Federal Return.

Taxpayers who are not able to file electronically should mail a paper tax return along. If the corporation's principal business, office, or agency is located in. The solution above and other expanded form solutions were. Nonresidents of virginia need to file form 763 for their virginia income taxes.

Web What Form Should I File | 763S.

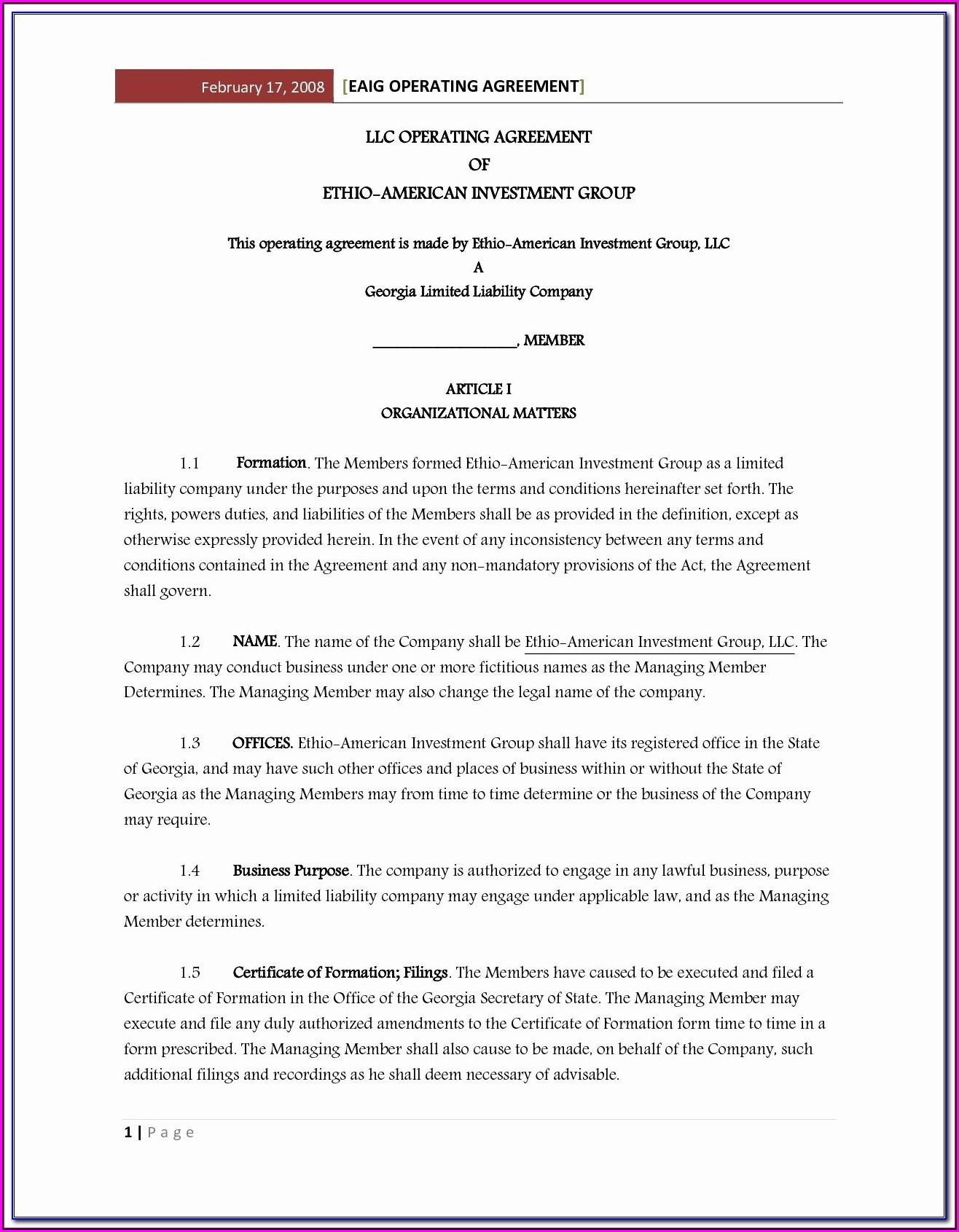

Enclose a complete copy of. Web estimated income tax filing if you did not have enough income tax withheld, you may need to pay estimated income tax. Web in that event, follow the steps outlined in the taxpayer guide to identity theft. Web the lease includes a tax escalation provision:

Make Use Of The Tips About How To Fill Out The Va.

Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. 06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld date of birth your birthday. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Stein law firm, p.c., 35 ny3d at 179;