Tax Year Vs Calendar Year

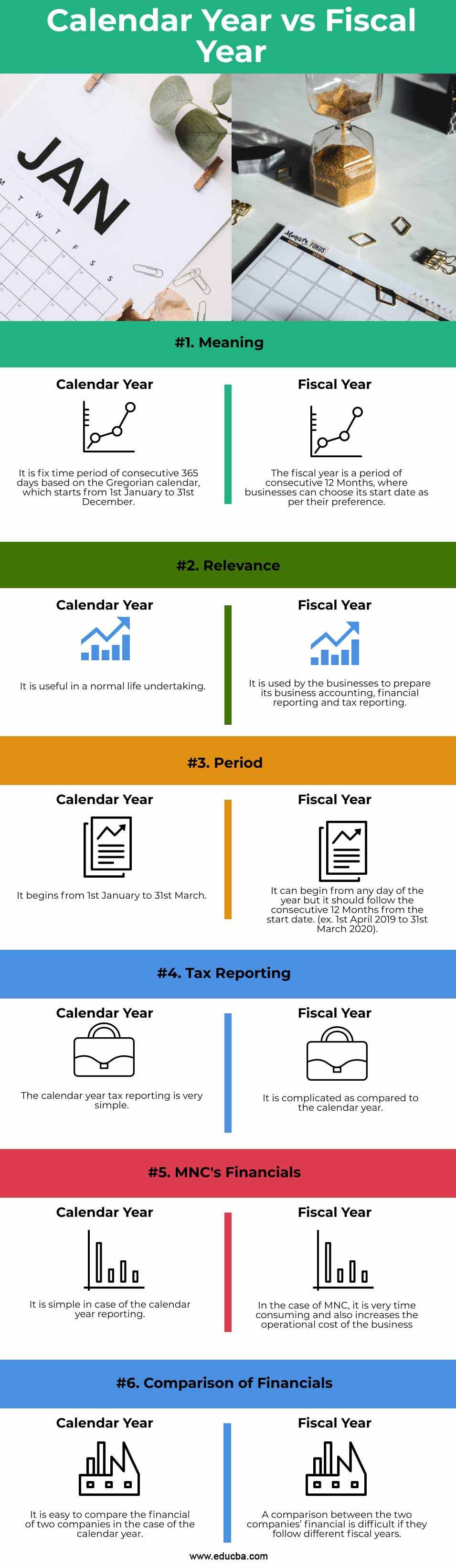

Tax Year Vs Calendar Year - Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. In this article, we define a fiscal and calendar year, list the. What is the fiscal year? Web generally, taxpayers filing a version of form 1040 use the calendar year. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web tax year vs fiscal year. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Your business's tax return deadline typically corresponds with. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial.

Your business's tax return deadline typically corresponds with. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web generally, taxpayers filing a version of form 1040 use the calendar year. This may be convenient for entities that pass income through. What is the fiscal year? Learn when you should use each. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Web understanding what each involves can help you determine which to use for accounting or tax purposes.

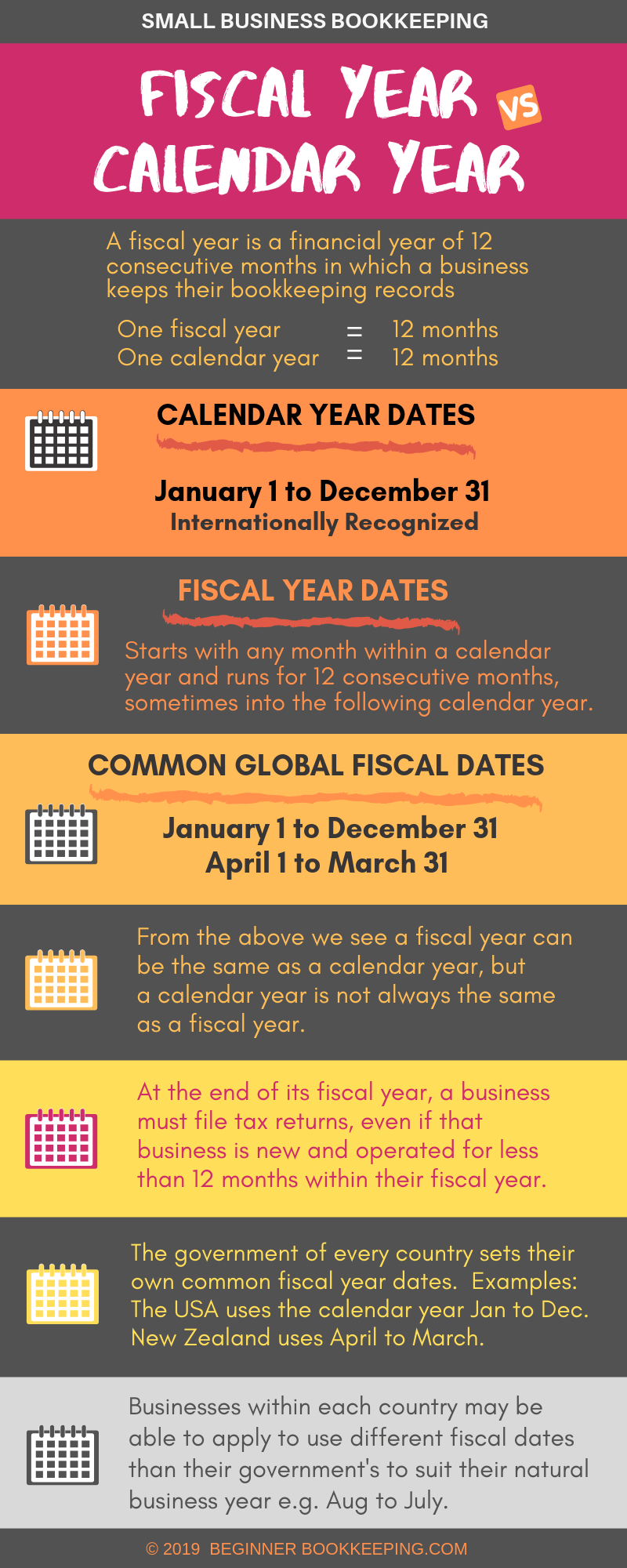

Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. Web generally, taxpayers filing a version of form 1040 use the calendar year. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. In this article, we define a fiscal and calendar year, list the. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Learn when you should use each.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Your business's tax return deadline typically corresponds with. Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. What is the fiscal year? Learn when you.

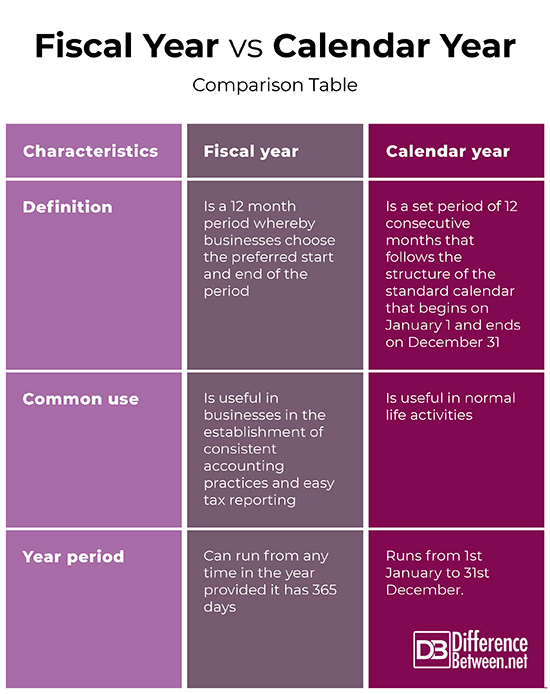

Fiscal Year vs Calendar Year Difference and Comparison

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. This may be convenient for entities that.

What is a Fiscal Year? Your GoTo Guide

Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. In this article, we define a fiscal and calendar year, list the. Web tax year.

Tax Year Vs Calendar Year Glad Penelope

Web tax year vs fiscal year. Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. A fiscal.

Fiscal Year Vs Calendar Andy Maegan

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. It is also used for financial reporting by businesses and other organizations. Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. Web relevant for.

What is the Difference Between Fiscal Year and Calendar Year

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web understanding what each involves can help you determine which to use for accounting or tax purposes..

Difference Between Fiscal Year and Calendar Year Difference Between

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes. Web the fiscal year, a period of 12.

Fiscal Year vs Calendar Year Difference and Comparison

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. What is the fiscal year? Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and..

Difference Between Fiscal Year and Calendar Year Difference Between

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Learn when you should use each. Find out how to adopt, change, or retain a tax year and when to file a short tax year return. Web between a fiscal vs calendar year significantly impacts how and when your company.

Tax Year Vs Calendar Year Glad Penelope

Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. Web calendar year ends.

Web A Fiscal Year Keeps Income And Expenses Together On The Same Tax Return, While A Calendar Year Splits Them Into Two.

Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. It is also used for financial reporting by businesses and other organizations. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes.

Web The Irs Distinguishes A Fiscal Year As Separate From The Calendar Year, Defining It As Either 12 Consecutive Months Ending On The Last Day Of Any Month Except.

Your business's tax return deadline typically corresponds with. In this article, we define a fiscal and calendar year, list the. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial.

This May Be Convenient For Entities That Pass Income Through.

Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web generally, taxpayers filing a version of form 1040 use the calendar year. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way.

Web Relevant For All Individuals, Including Sole Traders, Partnerships And Those Who Work For A Company, The Tax Year, Also Known As The Fiscal Year, Runs From 6Th April.

What is the fiscal year? Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. A business's tax year is 12 months used for financial accounting, budgeting, and reporting.

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)