Texas Agricultural Tax Exempt Form

Texas Agricultural Tax Exempt Form - Web texas agriculture matters newsletter; (2) producing crops for human food, animal feed, or planting seed or for the production of. Complete, edit or print tax forms instantly. Understand that i will be liable for payment of all state and local sales or use taxes which may become due for failure to. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Select the document you want to sign and click upload. Web how many acres do you need for a special ag valuation? Application for section 18 emergency exemption: Web agricultural use includes, but is not limited to, the following activities:

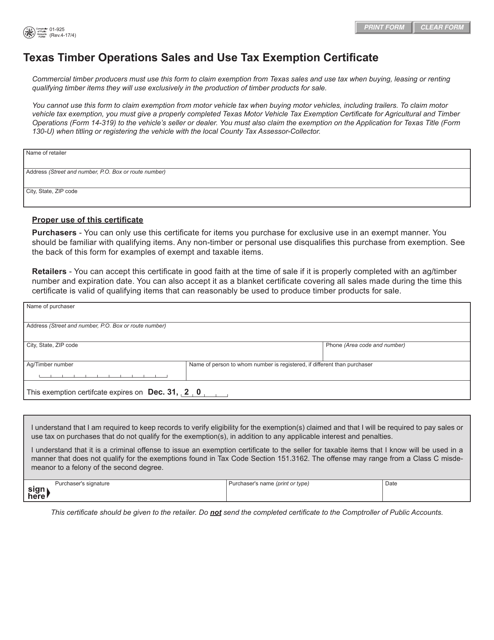

Web how many acres do you need for a special ag valuation? Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. You are also required to. Complete, edit or print tax forms instantly. Texas agricultural and timber exemption registration. Texas agriculture matters tv show; (2) producing crops for human food, animal feed, or planting seed or for the production of. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Web motor vehicle related forms. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be.

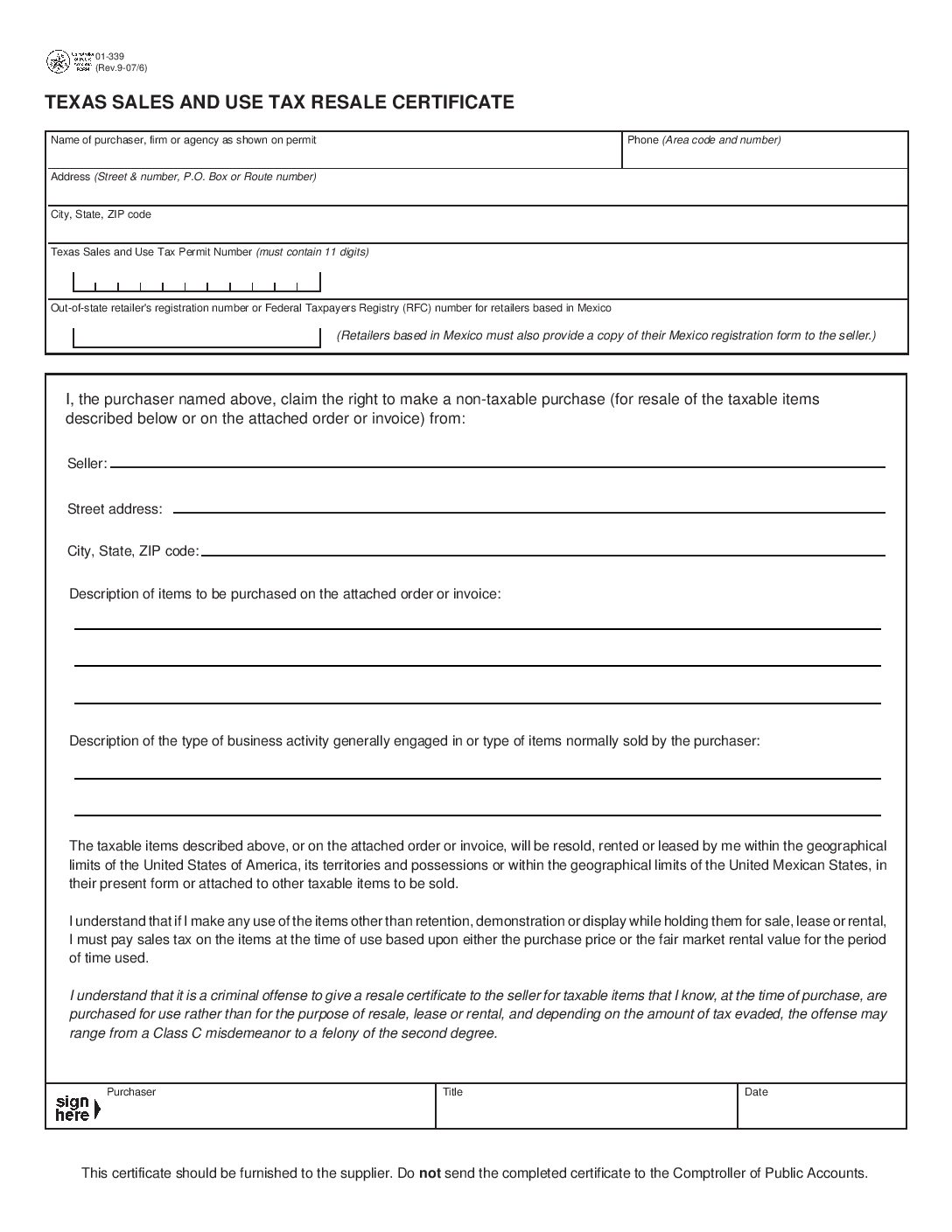

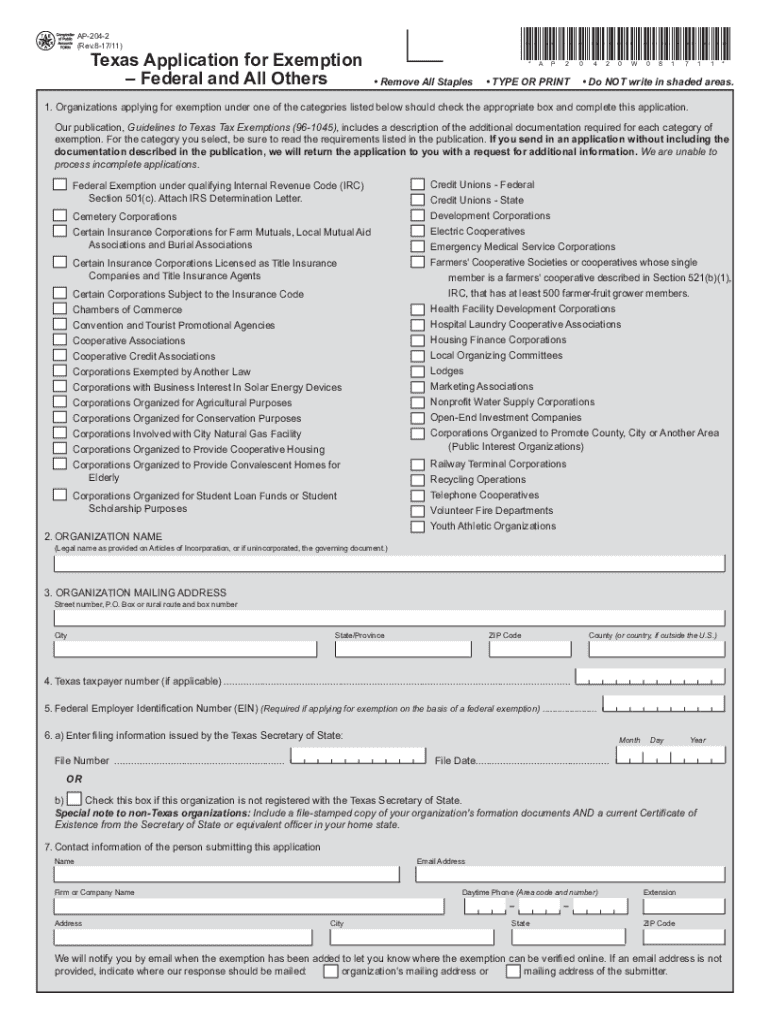

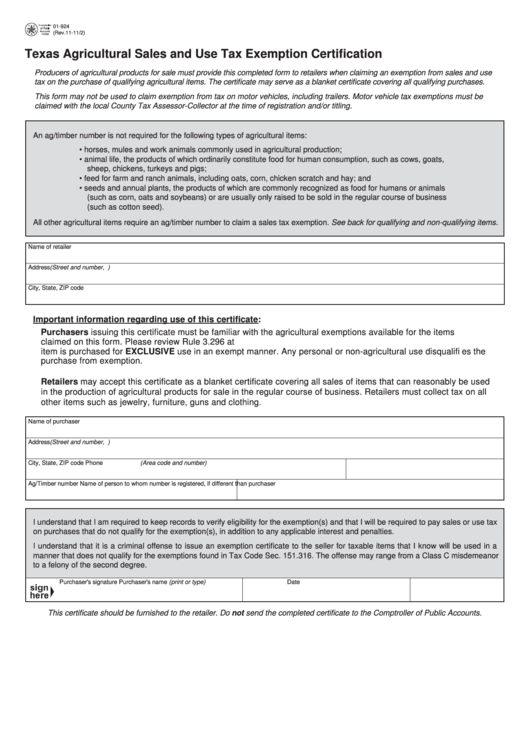

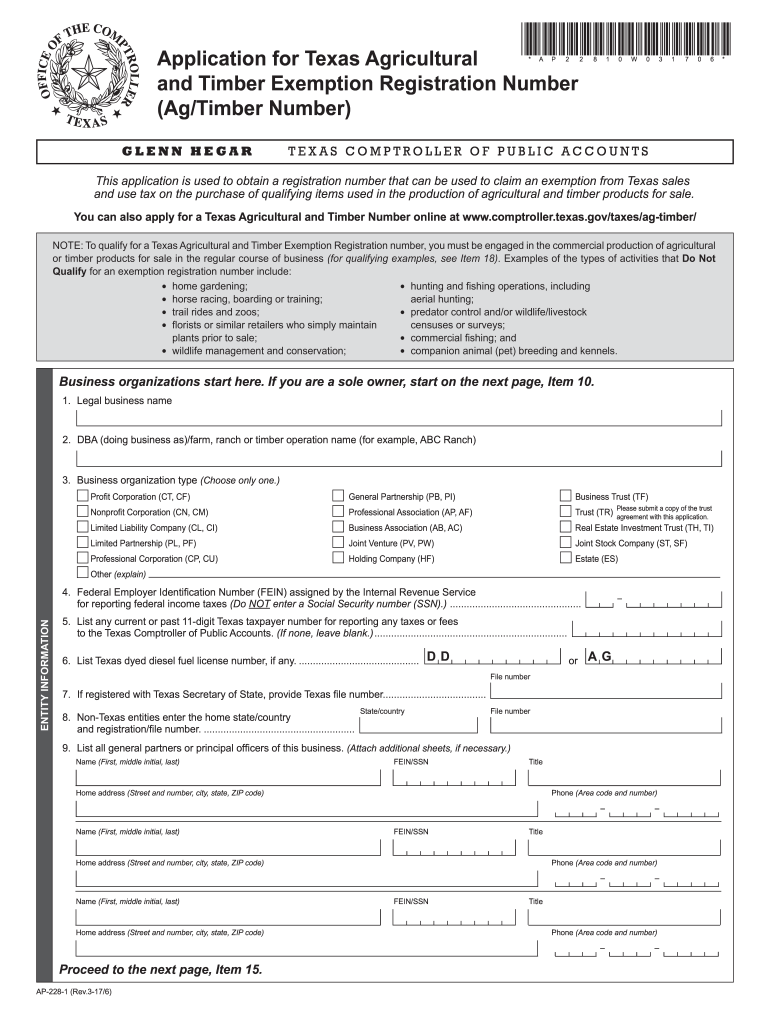

Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web purchaser claims this exemption for the following reason: Web producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. (2) producing crops for human food, animal feed, or planting seed or for the production of. Web texas agriculture matters newsletter; Form download (alternative format) instructions download. Complete, edit or print tax forms instantly. Select the document you want to sign and click upload.

Forms Texas Crushed Stone Co.

Application for section 18 emergency exemption. Web agricultural use includes, but is not limited to, the following activities: Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. (2) producing crops for human food, animal feed, or.

Homestead Exemption Texas Form 2019 Splendora Tx Fill Out and Sign

(2) producing crops for human food, animal feed, or planting seed or for the production of. Form download (alternative format) instructions download. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Web this application is used to obtain a registration number that.

Fillable 01924 Texas Agricultural Sales And Use Tax Exemption

Application for section 18 emergency exemption. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Texas.

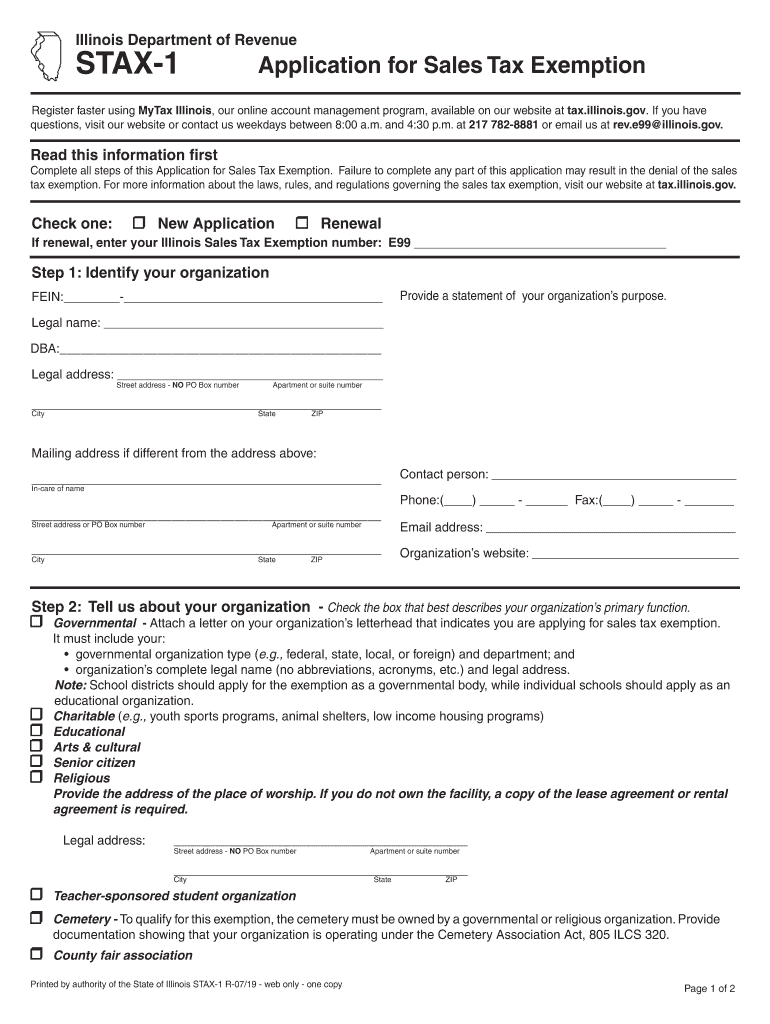

IL STAX1 2019 Fill out Tax Template Online US Legal Forms

Applicants must provide a current permit card issued by the texas comptroller’s office with a. Web purchaser claims this exemption for the following reason: Web “ag exemption” o common term used to explain the central appraisal district’s (cad) appraised value of the land o is not an exemption is a special use appraisal based on the. Web producers of agricultural.

Agricultural and Timber Exemptions and Texas Taxes Timber, Growing

Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Texas agriculture matters tv show; Web how many acres do you need for a special ag valuation? Web this application is used to obtain a registration number that can be used to claim.

20172020 Form TX AP2281 Fill Online, Printable, Fillable, Blank

Texas agriculture matters tv show; Web producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying. Complete, edit or print tax forms instantly. Select the document you want to sign and click upload. Web purchaser claims this exemption for the following reason:

How To Get A Sales Tax Exemption Certificate In Texas Gallery Wallpaper

Web motor vehicle related forms. Application for section 18 emergency exemption. Web purchaser claims this exemption for the following reason: Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Web this application is used to obtain a registration number that can be used to claim an exemption from texas.

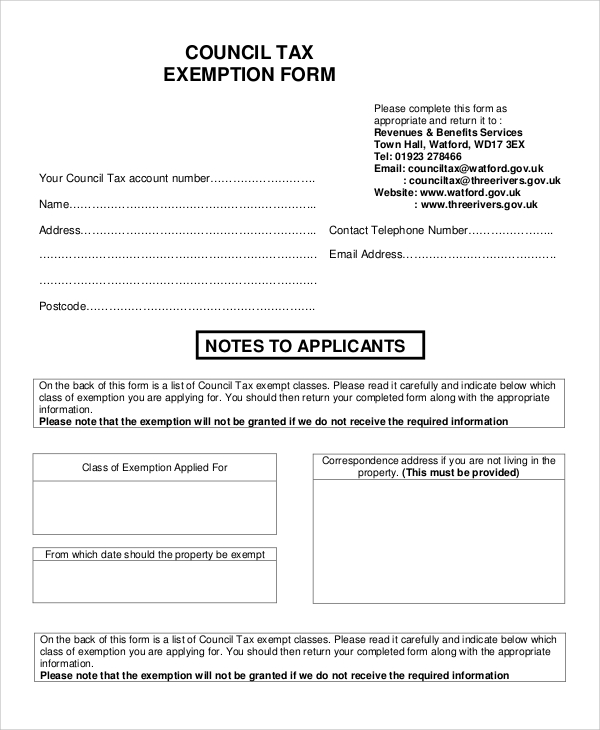

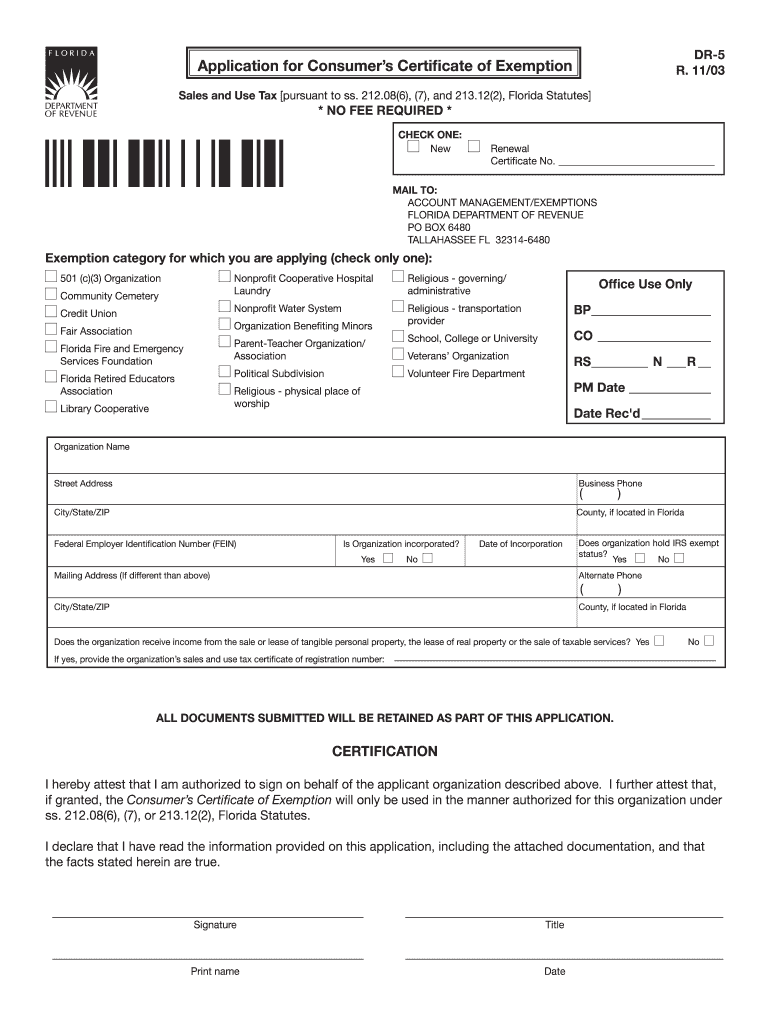

FREE 10+ Sample Tax Exemption Forms in PDF

You are also required to. Web purchaser claims this exemption for the following reason: Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Applicants must provide a current permit card issued by the texas comptroller’s office.

Agriculture Tax Exempt Form Florida

Application for section 18 emergency exemption. Web purchaser claims this exemption for the following reason: Web texas agriculture matters newsletter; Texas agriculture matters tv show; Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

You are also required to. Web texas agriculture matters newsletter; Web to get the tax exemptions on agricultural items, you must first apply for an ag/timber registration number from the texas comptroller. Web producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying..

Web Motor Vehicle Related Forms.

Web how many acres do you need for a special ag valuation? Web purchaser claims this exemption for the following reason: Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web texas agriculture matters newsletter;

Application For Section 18 Emergency Exemption:

(2) producing crops for human food, animal feed, or planting seed or for the production of. Form download (alternative format) instructions download. Web “ag exemption” o common term used to explain the central appraisal district’s (cad) appraised value of the land o is not an exemption is a special use appraisal based on the. Applicants must provide a current permit card issued by the texas comptroller’s office with a.

Understand That I Will Be Liable For Payment Of All State And Local Sales Or Use Taxes Which May Become Due For Failure To.

Appraisal districts can answer questions about property values, exemptions, agricultural appraisal, and. Complete, edit or print tax forms instantly. Application for section 18 emergency exemption. Complete, edit or print tax forms instantly.

Web This Application Is Used To Obtain A Registration Number That Can Be Used To Claim An Exemption From Texas Sales And Use Tax On The Purchase Of Qualifying Items Used In The.

Texas agricultural and timber exemption registration. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. You are also required to. Texas agriculture matters tv show;