Tn State Tax Form

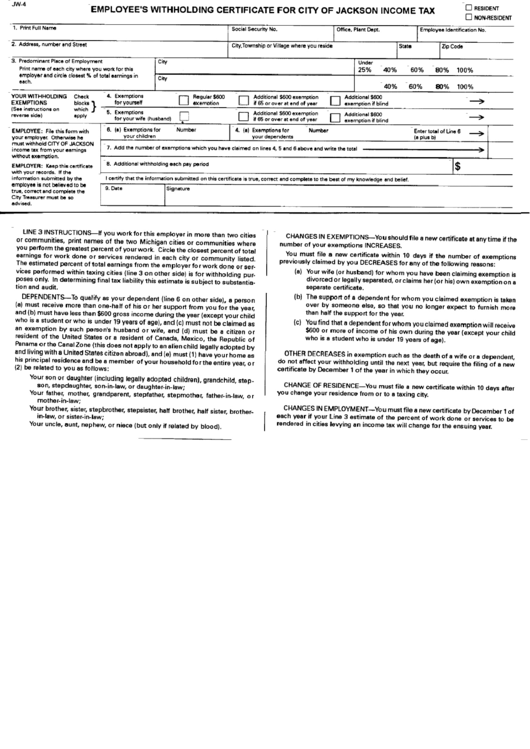

Tn State Tax Form - However, tennessee has no state income tax on earned income and therefore has no withholding requirements. Yes, a form is required for purchase card transactions. 2341 page 2 of 5 distribution: Adult performance business privilege tax alcoholic beverages taxes Please visit the file and pay section of our website for more information on this process. Web taxes the department of revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Who do i contact if i have questions? Web tdhs staff should check the “forms” section of the intranet to ensure the use of current versions. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Child care agency and agency applicant personnel record

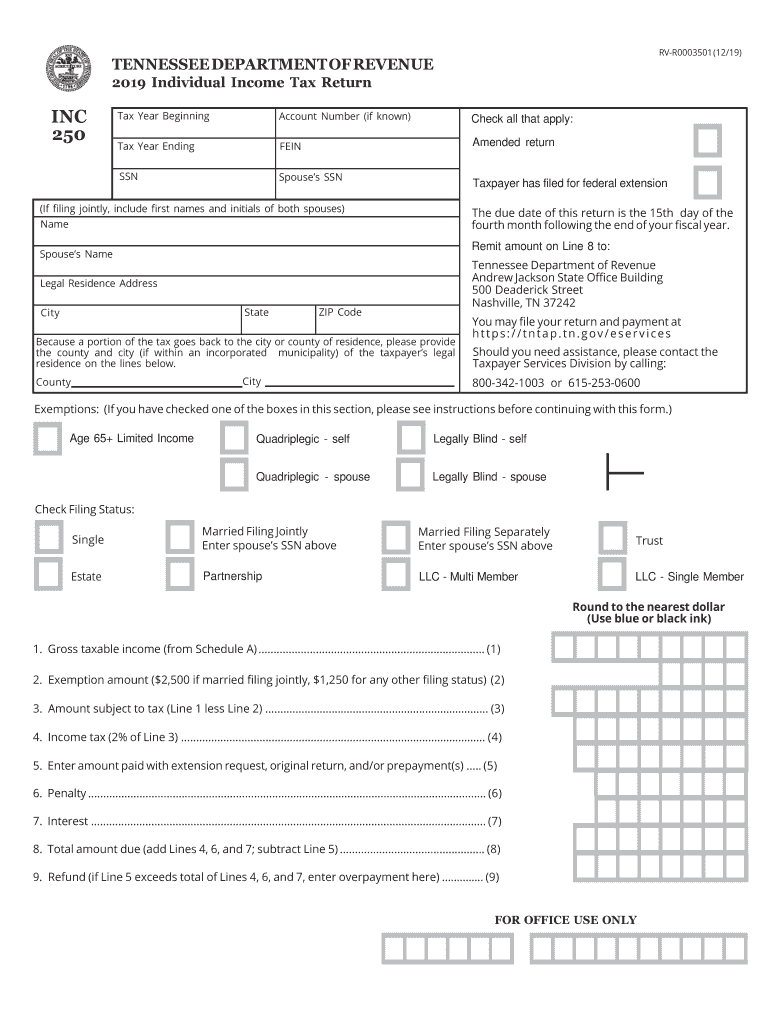

Paper forms application for registration and instructions application for registration sales and use tax exempt entities or state and federally chartered credit unions Web 60 rows state tax forms and filing options. Web taxes the department of revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Tennessee sales or use tax government certificate of exemption. However, tennessee has no state income tax on earned income and therefore has no withholding requirements. Page last reviewed or updated: This year, the irs tax filing deadline has been extended to tuesday, april 18, 2023 due to the observance of emancipation day in. Tennessee does not tax individual's earned income, so you are not required to file a tennessee tax return. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. Other exemption certificates are not updated and remain in effect unless there is a change in location requiring the certificate to be.

Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Who do i contact if i have questions? 2341 page 2 of 5 distribution: Ad register and subscribe now to work on your tn dor form inc 250 & more fillable forms. Adult performance business privilege tax alcoholic beverages taxes Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? This year, the irs tax filing deadline has been extended to tuesday, april 18, 2023 due to the observance of emancipation day in. Yes, a form is required for purchase card transactions. Child care agency and agency applicant personnel record If you have your return prepared by an approved software vendor, the payment is still required to be made electronically.

Tennessee Employee Withholding Tax Form 2023

Page last reviewed or updated: Web 60 rows state tax forms and filing options. Web county and city websites. Web taxes the department of revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Start a federal tax return.

TN RVF1301201 2014 Fill out Tax Template Online US Legal Forms

Do i need a form? Child care agency and agency applicant personnel record This year, the irs tax filing deadline has been extended to tuesday, april 18, 2023 due to the observance of emancipation day in. Who do i contact if i have questions? When that date falls on a weekend or holiday, filers get until the next business day.

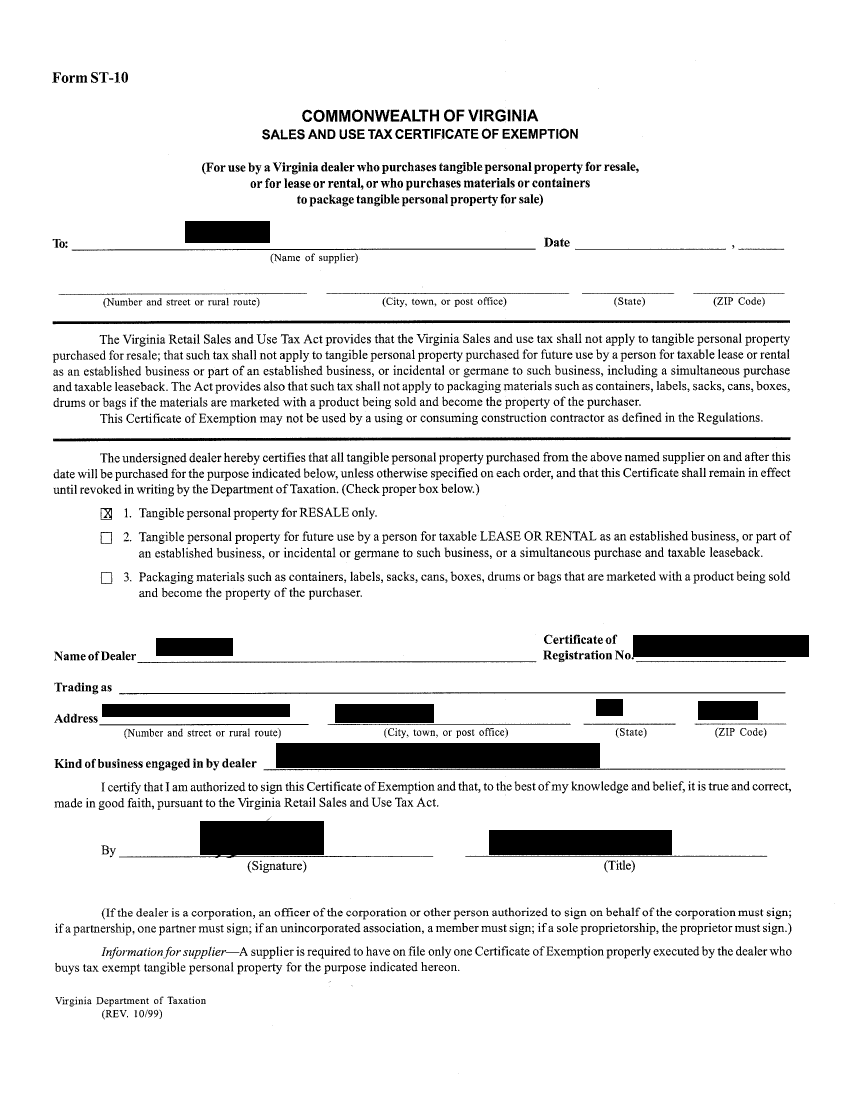

Tennessee Exemption State Fill Out and Sign Printable PDF Template

Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Do i need a form? Child care agency and agency applicant personnel record However, tennessee has no state income tax on earned income and therefore has no withholding requirements. Web county and city websites.

Hecht Group 3 Ways To Pay Your Commercial Property Taxes In Nashville

Child care agency and agency applicant personnel record Web 60 rows state tax forms and filing options. Tennessee does not tax individual's earned income, so you are not required to file a tennessee tax return. 2341 page 2 of 5 distribution: Web the tennessee government exemption certificate paper form that is fully completed and signed may be used by the.

Hall Tax Tn Taxes Tax Information Network

Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates of exemption to all current exemption holders. Child care agency and agency applicant personnel record 2341 page 2 of 5 distribution: Web 60 rows state tax forms and filing options. Who do i contact if i have questions?

2019 Form TN DoR INC 250 Fill Online, Printable, Fillable, Blank

This year, the irs tax filing deadline has been extended to tuesday, april 18, 2023 due to the observance of emancipation day in. However, tennessee has no state income tax on earned income and therefore has no withholding requirements. Tennessee sales or use tax government certificate of exemption. Start a federal tax return. Starting with tax year 2021 tennessee will.

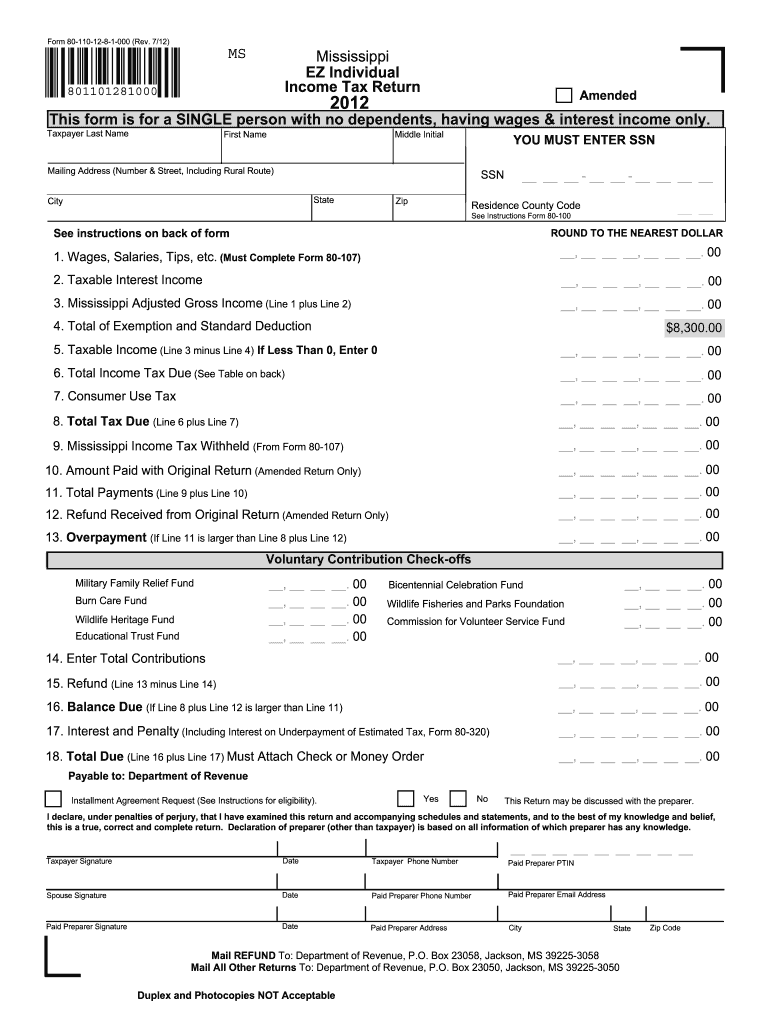

Ms State Tax Form 2022 W4 Form

Please visit the file and pay section of our website for more information on this process. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web taxes the department of revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those.

Virginia Tax Exemption Form

Web county and city websites. If you have your return prepared by an approved software vendor, the payment is still required to be made electronically. Per state law, many taxes are now required to be filed electronically. Do i need a form? Web taxpayers can find forms needed to file tax returns with the department of revenue here.

TN RVF1315201 2014 Fill out Tax Template Online US Legal Forms

Paper forms application for registration and instructions application for registration sales and use tax exempt entities or state and federally chartered credit unions See all 24 articles informal conferences Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates of exemption to all current exemption holders. Other exemption certificates are not updated and remain in effect unless.

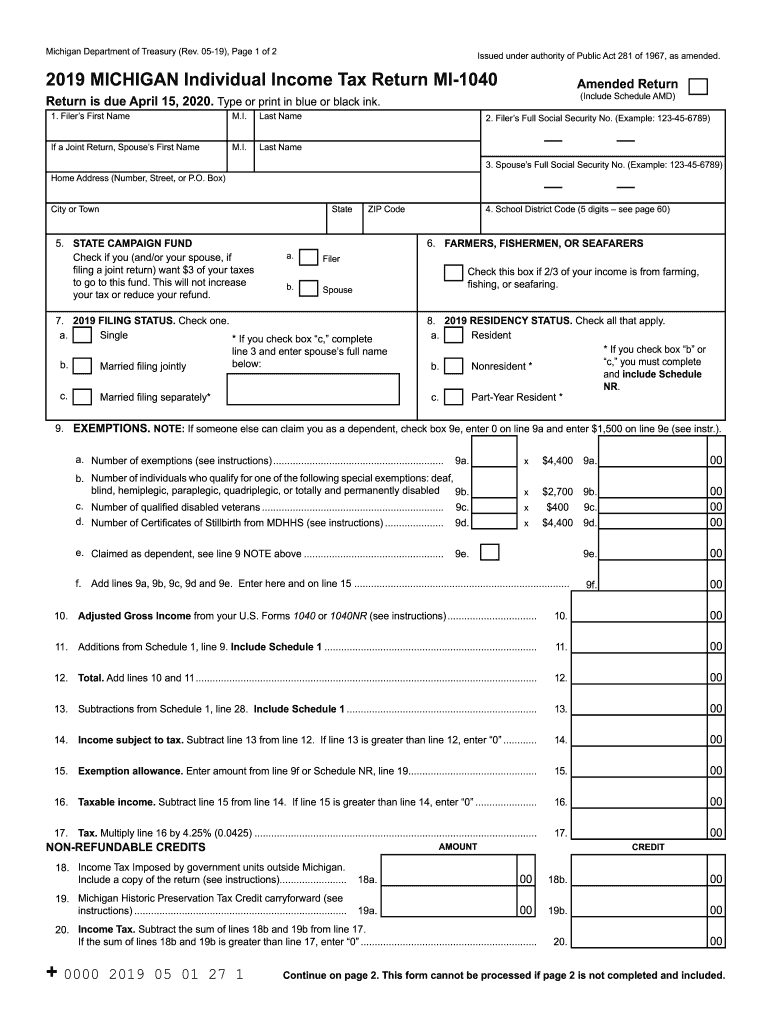

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

Web the tennessee government exemption certificate paper form that is fully completed and signed may be used by the federal government and its agencies, the state of tennessee and its agencies, or a county or municipality of the state of tennessee and their agencies to claim the government sales and use tax exemption for sales made. Complete, edit or print.

Other Exemption Certificates Are Not Updated And Remain In Effect Unless There Is A Change In Location Requiring The Certificate To Be.

Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Please visit the file and pay section of our website for more information on this process. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt?

Do I Need A Form?

Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. When that date falls on a weekend or holiday, filers get until the next business day to submit their state returns. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural certificates of exemption to all current exemption holders. Page last reviewed or updated:

2341 Page 2 Of 5 Distribution:

Forms may not be altered without prior approval. Web tdhs staff should check the “forms” section of the intranet to ensure the use of current versions. Web county and city websites. Tennessee sales or use tax government certificate of exemption.

Start A Federal Tax Return.

Tennessee does not tax individual's earned income, so you are not required to file a tennessee tax return. Web 60 rows state tax forms and filing options. Paper forms application for registration and instructions application for registration sales and use tax exempt entities or state and federally chartered credit unions Generally, hardship exceptions will include taxpayers.