Virginia Form 502 Instructions

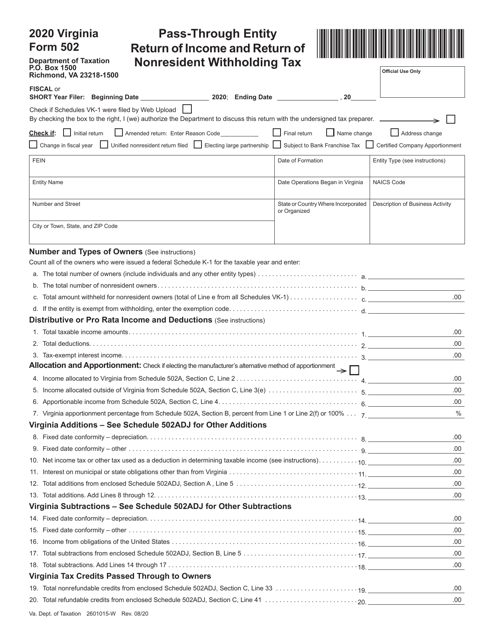

Virginia Form 502 Instructions - Virginia schedule 502adj form 502. 1546001745 at present, virginia tax does not support international ach. Web form 502ptet and all corresponding schedules must be filed electronically. No paper submissions will be accepted. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Web the entity’s virginia return of income (form 502) filed with the department of taxation. Web to the form 502 instructions for more information. (1) first, a pte should determine the allocation and. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. If form 502 is filed more than 6 months after the due date or more.

State or country where incorporated. No paper submissions will be accepted. (1) first, a pte should determine the allocation and. Payments must be made electronically by the filing. Web to the form 502 instructions for more information. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. Virginia form 502 pass through entity income tax return; Not filed contact us 502ez. No application for extension is required. 1546001745 at present, virginia tax does not support international ach.

Not filed contact us 502w. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Web the following forms and schedules are prepared for the virginia return: State or country where incorporated. (1) first, a pte should determine the allocation and. Virginia form 502 pass through entity income tax return; Web to the form 502 instructions for more information. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. No application for extension is required. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street:

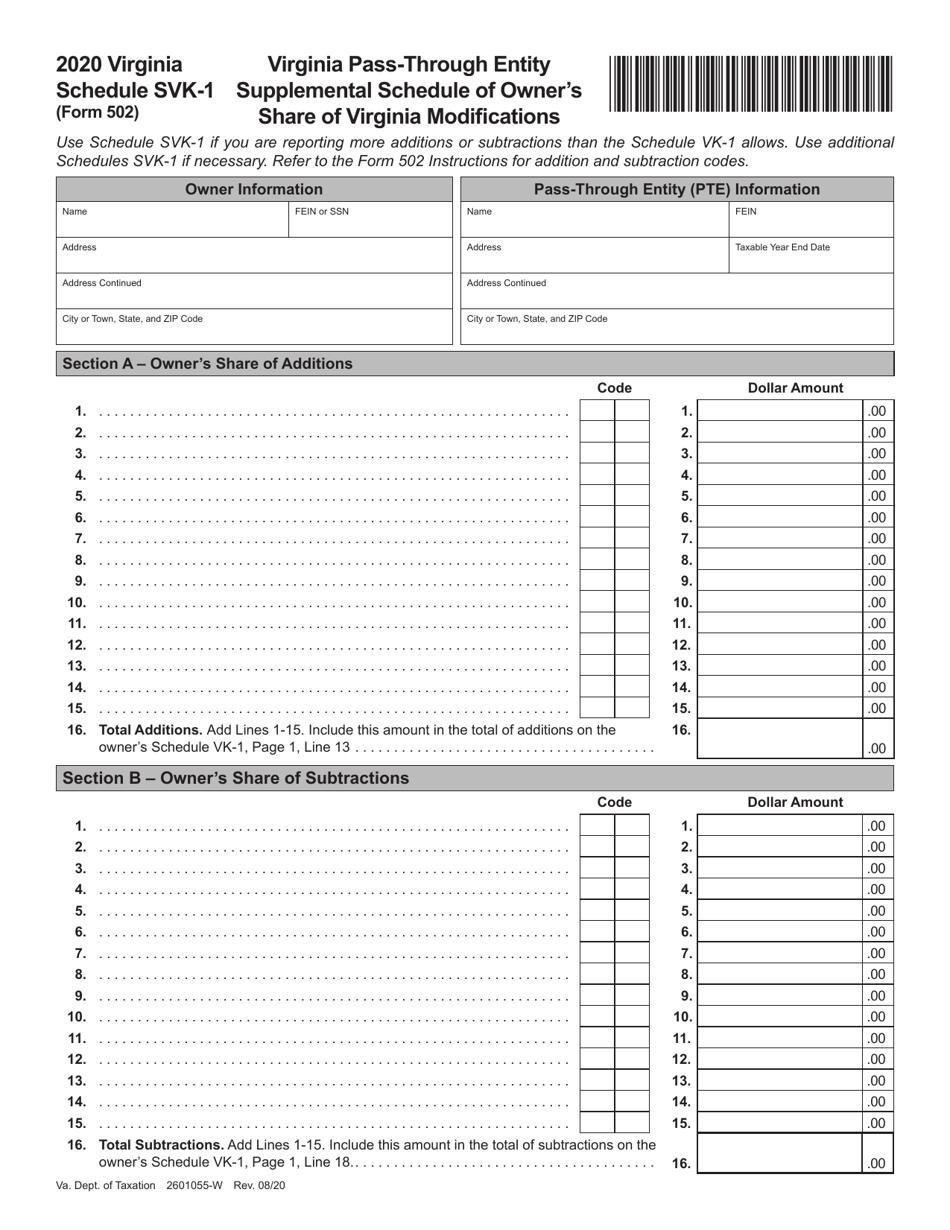

Form 502 Schedule SVK1 Download Fillable PDF or Fill Online Virginia

Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Virginia form 502 pass through entity income tax return; Virginia schedule 502adj form 502. Web the entity’s virginia return of income (form 502) filed with the department of taxation. 1546001745 at present, virginia tax does not support international ach.

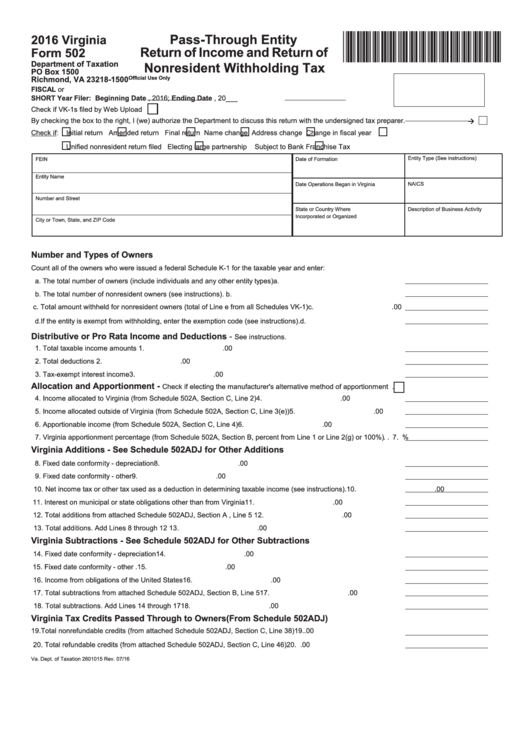

Fillable Virginia Form 502 PassThrough Entity Return Of And

Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Payments must be made electronically by the filing. Not filed contact us 502w. Beginning with the 2008 return, there are two additional lines.

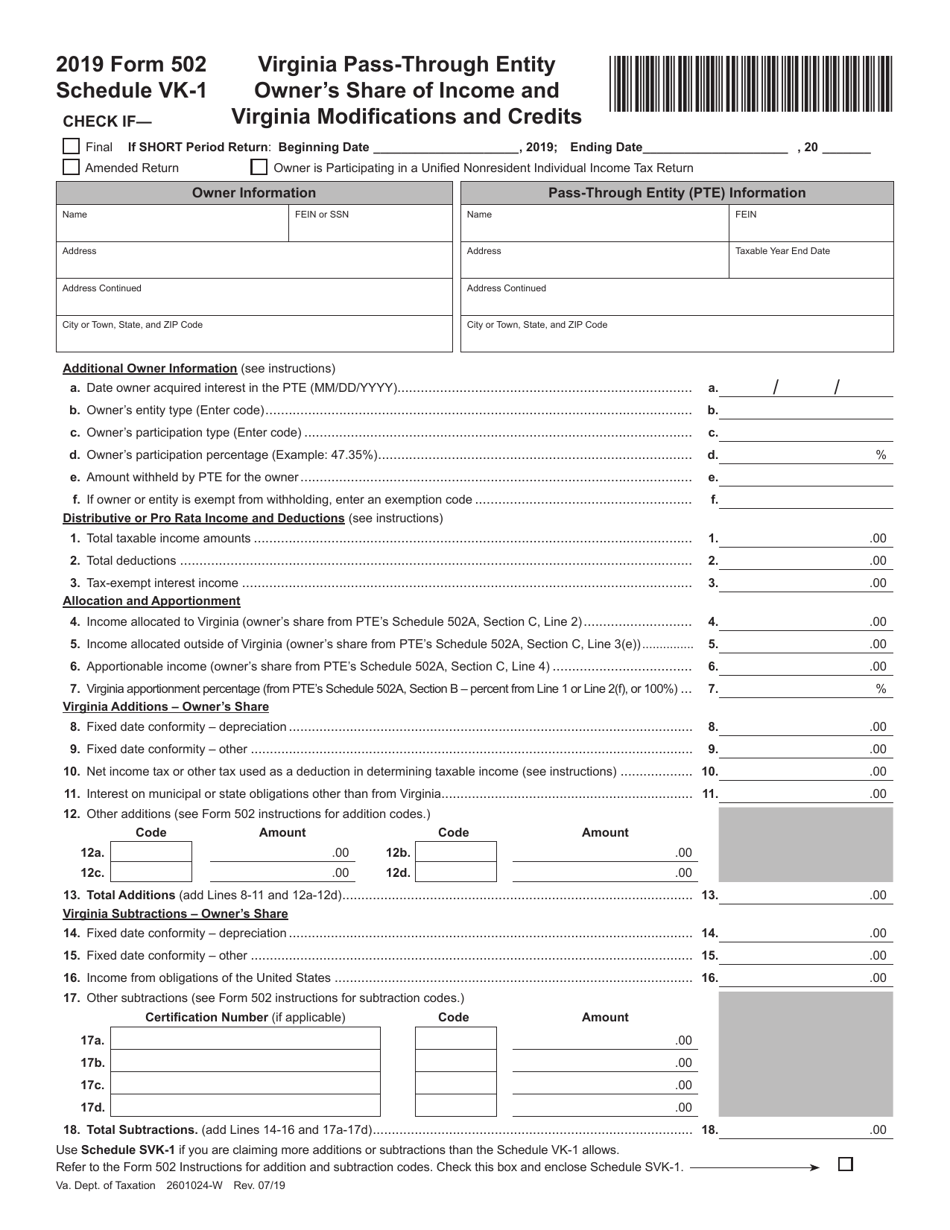

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

If form 502 is filed more than 6 months after the due date or more. Not filed contact us 502v. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Not filed contact us 502ez. 1546001745 at present, virginia tax does not support international ach.

Virginia form Cc 1680 Brilliant Au 1998 A 5 Ests for Secreted Proteins

Beginning with the 2008 return, there are two additional lines to complete under. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: State or country where incorporated. 1546001745 at present, virginia tax does not support international ach. If form 502 is filed more than 6 months after the due.

Top 11 Virginia Form 502 Templates free to download in PDF format

Web the entity’s virginia return of income (form 502) filed with the department of taxation. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. State or country where incorporated. Not filed contact us 502v. An owner of a pte may be an individual, a corporation, a partnership, or any other type.

Ckht 502 Form 2019 / CA Olympic Archery In Schools New School

Not filed contact us 502w. Web the entity’s virginia return of income (form 502) filed with the department of taxation. If form 502 is filed more than 6 months after the due date or more. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. (1) first, a pte should determine the.

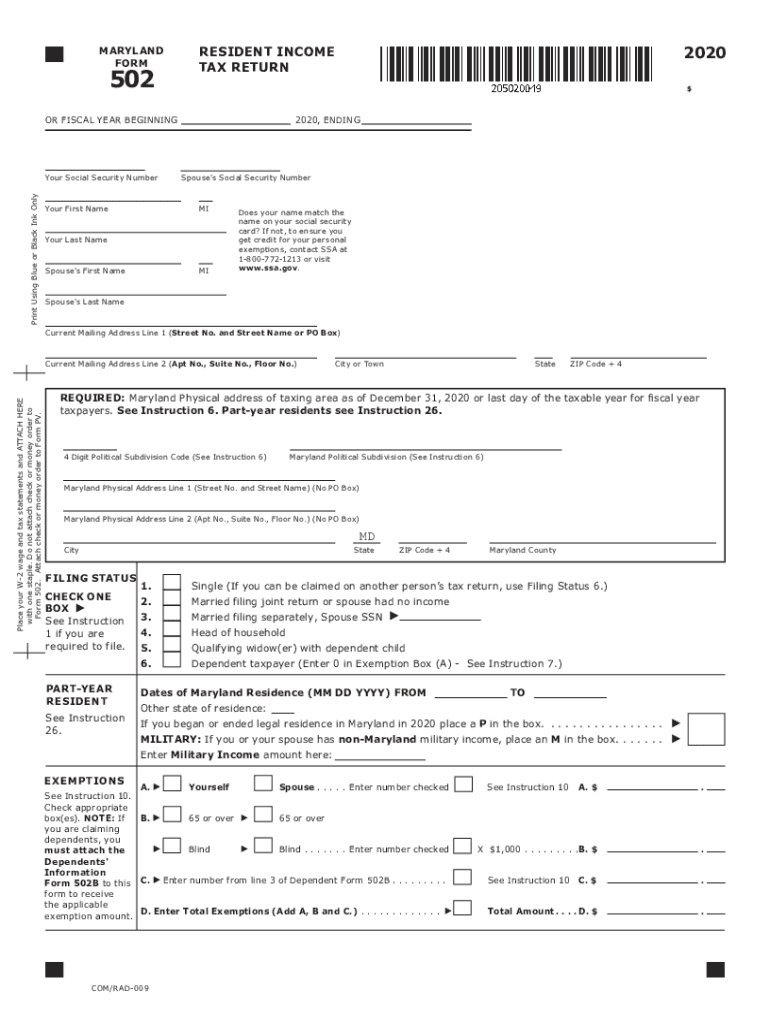

Md 502 instructions 2018 Fill out & sign online DocHub

Web to the form 502 instructions for more information. Beginning with the 2008 return, there are two additional lines to complete under. If form 502 is filed more than 6 months after the due date or more. Web the following forms and schedules are prepared for the virginia return: Virginia schedule 502adj form 502.

Virginia form Cc 1680 Awesome Probate Lawyers and Estate Lawyers In

Not filed contact us 502ez. Virginia form 502 pass through entity income tax return; Web to the form 502 instructions for more information. Beginning with the 2008 return, there are two additional lines to complete under. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount.

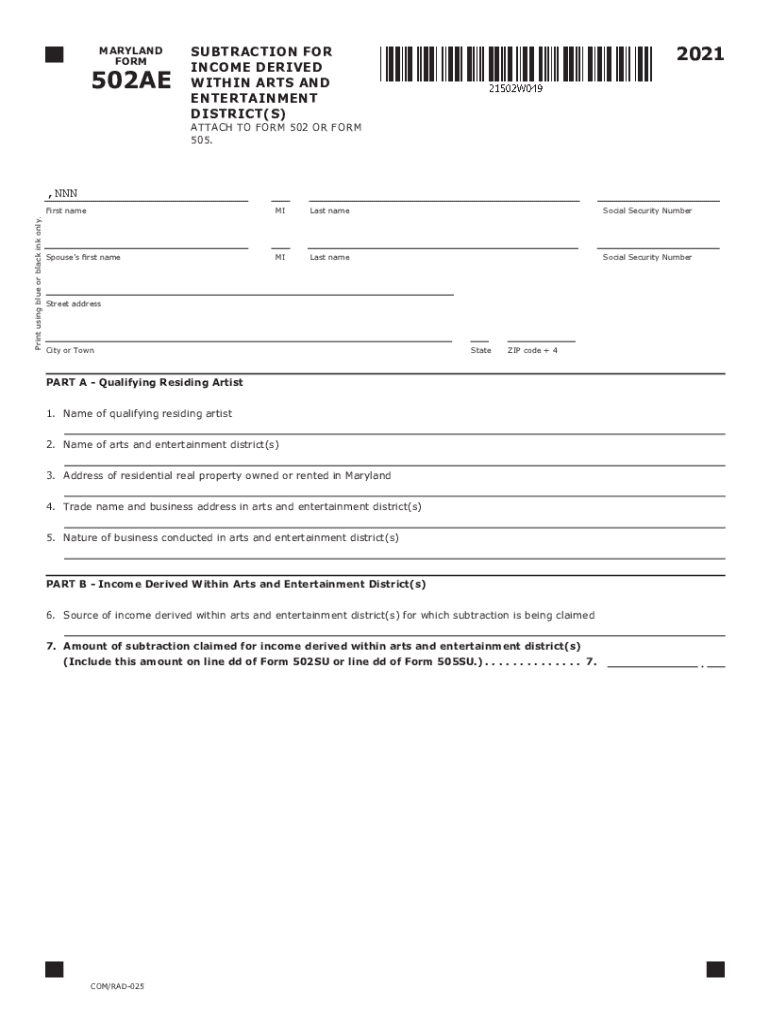

2021 Form MD 502AE Fill Online, Printable, Fillable, Blank pdfFiller

If form 502 is filed more than 6 months after the due date or more. Payments must be made electronically by the filing. State or country where incorporated. Web form 502ptet and all corresponding schedules must be filed electronically. Web to the form 502 instructions for more information.

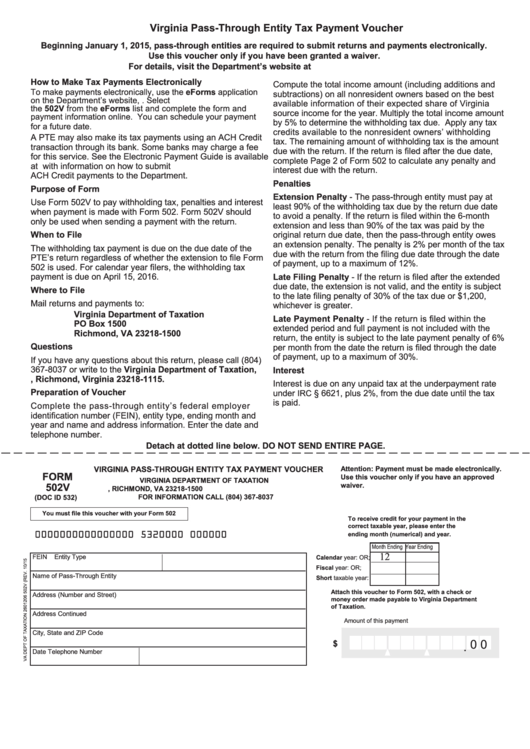

Form 502 Download Fillable PDF or Fill Online PassThrough Entity

Virginia schedule 502adj form 502. (1) first, a pte should determine the allocation and. Web the following forms and schedules are prepared for the virginia return: Beginning with the 2008 return, there are two additional lines to complete under. If form 502 is filed more than 6 months after the due date or more.

Web Form 502Ptet And All Corresponding Schedules Must Be Filed Electronically.

Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Not filed contact us 502v. Virginia form 502 pass through entity income tax return; Not filed contact us 502w.

Virginia Schedule 502Adj Form 502.

Not filed contact us 502ez. 1546001745 at present, virginia tax does not support international ach. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: Web include a copy of your federal return with form 502.

Web The Following Forms And Schedules Are Prepared For The Virginia Return:

State or country where incorporated. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Payments must be made electronically by the filing. An owner of a pte may be an individual, a corporation, a partnership, or any other type.

1546001745 At Present, Virginia Tax Does Not Support International Ach.

No paper submissions will be accepted. If form 502 is filed more than 6 months after the due date or more. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. No application for extension is required.