Virginia State Income Tax Form

Virginia State Income Tax Form - Virginia department of taxation, p.o. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Complete, edit or print tax forms instantly. Web virginia form 760 *va0760122888* resident income tax return. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web individual income tax filing filing electronically, and requesting direct deposit if you’re expecting a refund, is the fastest, safest, and easiest way to file your return. New reporting requirements for corporations due july 1 | virginia. Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. File by may 1, 2023 — use black ink. Your withholding is subject to review by the.

Web individual income tax filing filing electronically, and requesting direct deposit if you’re expecting a refund, is the fastest, safest, and easiest way to file your return. Be sure to verify that the form you are downloading is for the correct year. Streamlined document workflows for any industry. Web virginia state income tax forms. Get ready for tax season deadlines by completing any required tax forms today. Virginia state income tax brackets and income tax rates depend on taxable income and residency. If the amount on line 9 is less than the amount shown below for your filing. Web virginia tax individual online account application. New reporting requirements for corporations due july 1 | virginia. Virginia department of taxation, p.o.

Virginia state income tax brackets and income tax rates depend on taxable income and residency. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Find forms for your industry in minutes. Web to mail your income tax return directly to the department of taxation use:: If the amount on line 9 is less than the amount shown below for your filing. You must ¿le this form. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. Web virginia state income tax forms. Web download or print the 2022 virginia income tax instructions (virginia income tax instructional booklet) for free from the virginia department of taxation.

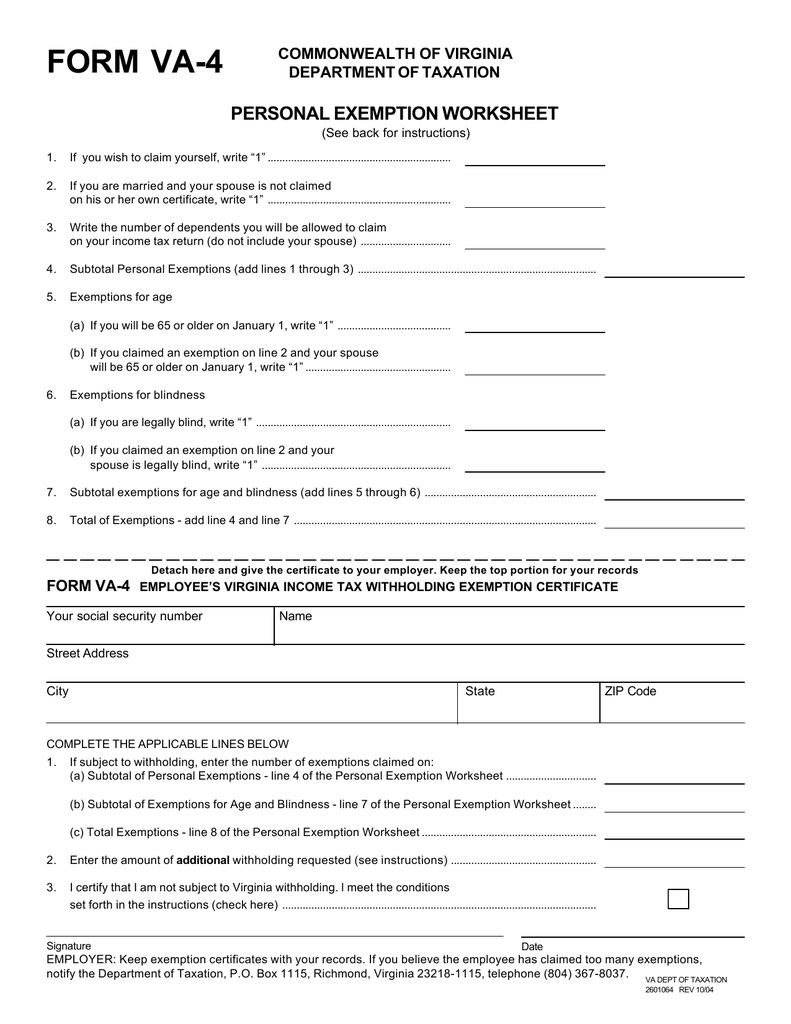

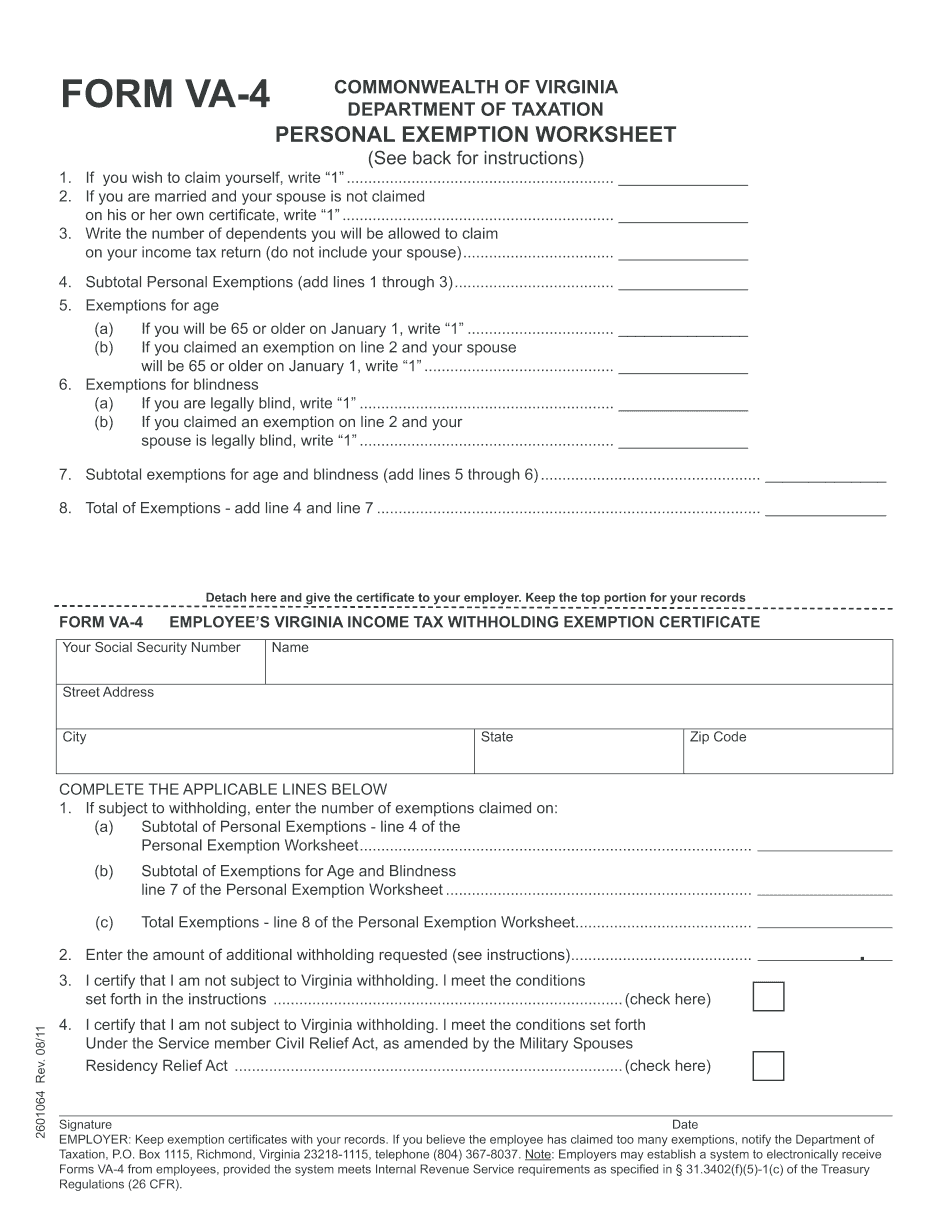

Form VA4 Employee`s Virginia Tax Withholding

Virginia state income tax forms for tax year 2022 (jan. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. New reporting requirements for corporations due july 1 | virginia. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and.

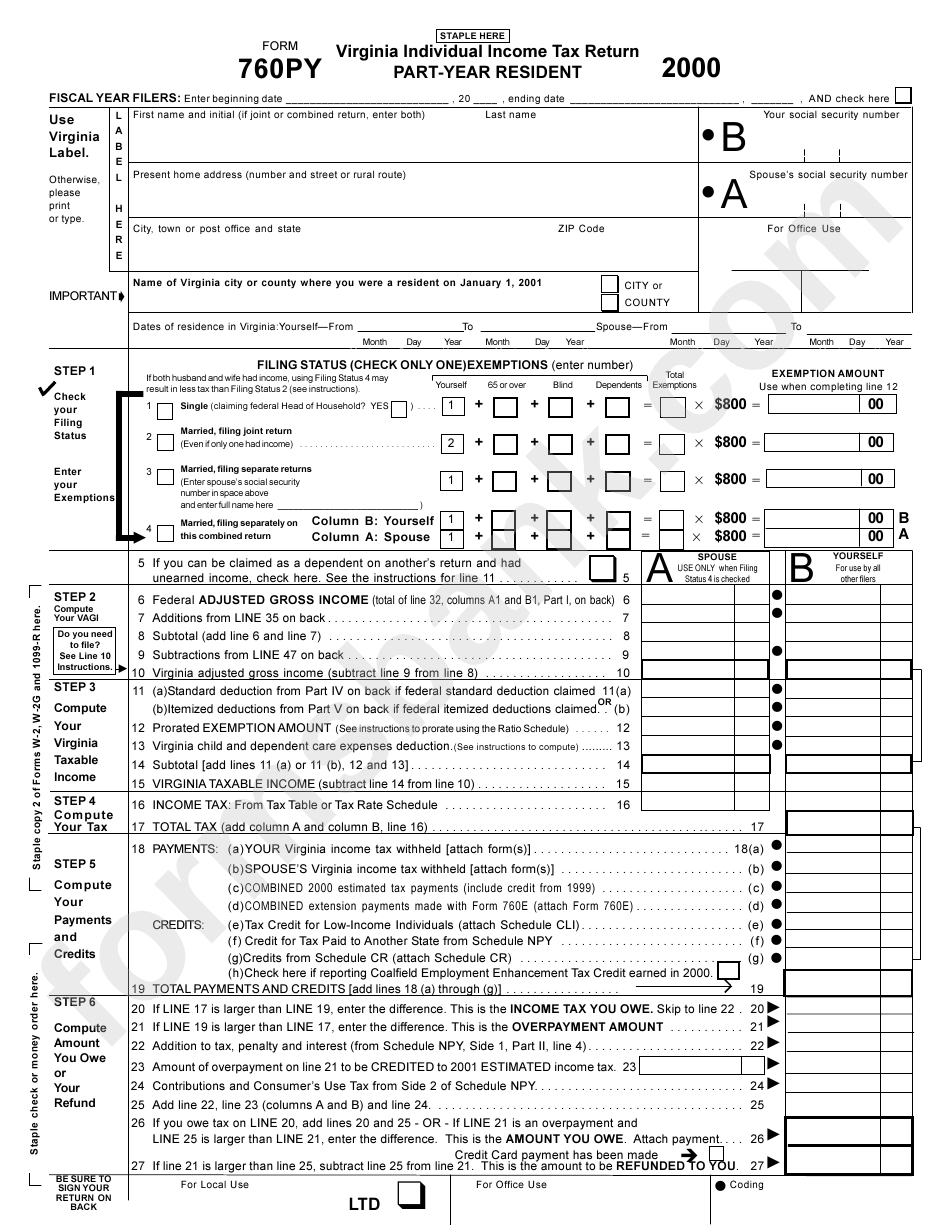

Form 760py Virginia Individual Tax Return PartYear Resident

Web to mail your income tax return directly to the department of taxation use:: Be sure to verify that the form you are downloading is for the correct year. Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. Web use this form to notify your.

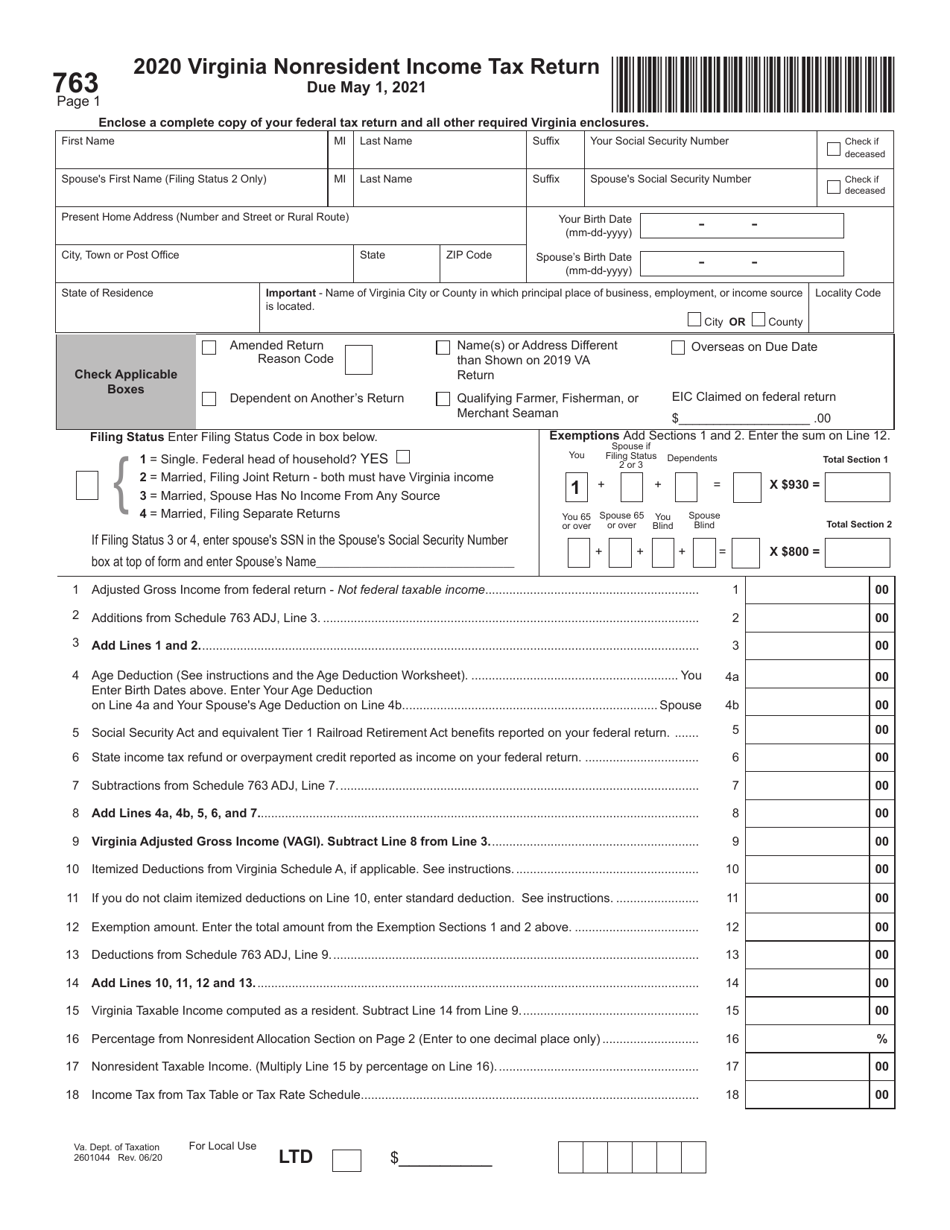

Form 763 Download Fillable PDF or Fill Online Virginia Nonresident

Find forms for your industry in minutes. Get ready for tax season deadlines by completing any required tax forms today. You must ¿le this form. Complete, edit or print tax forms instantly. Virginia state income tax brackets and income tax rates depend on taxable income and residency.

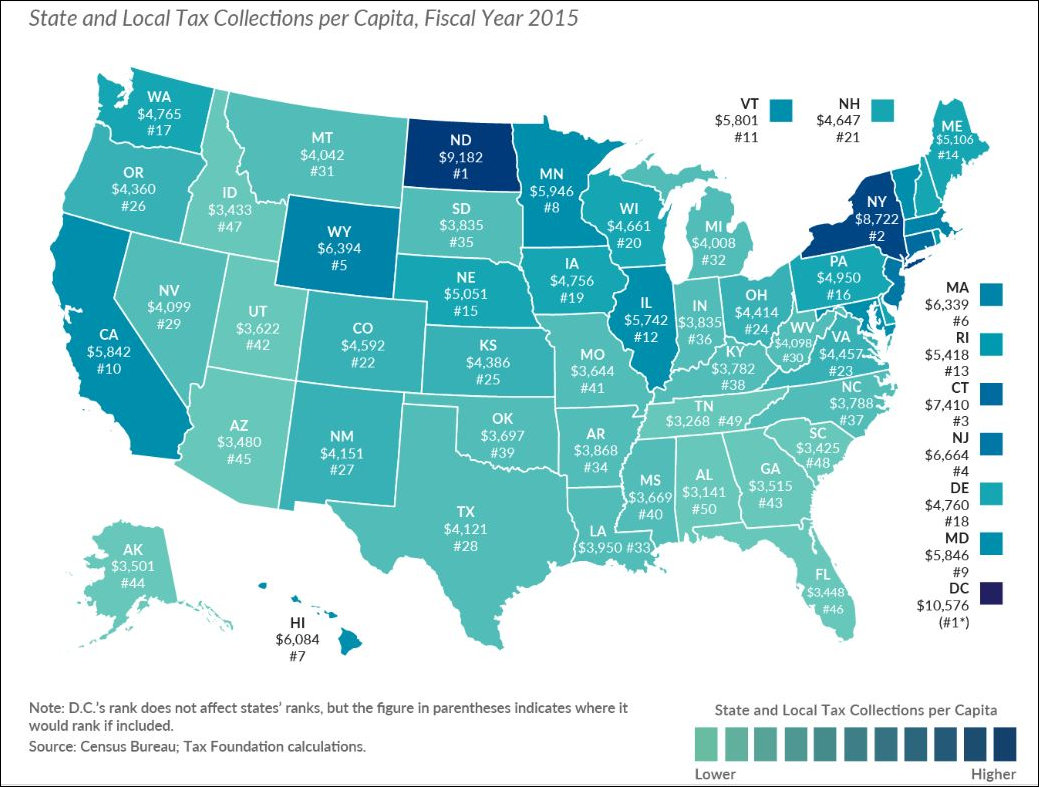

Virginia State/Local Taxes Per Capita 4,457 Bacon's Rebellion

Virginia state income tax brackets and income tax rates depend on taxable income and residency. Virginia department of taxation, p.o. Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. Virginia state income tax.

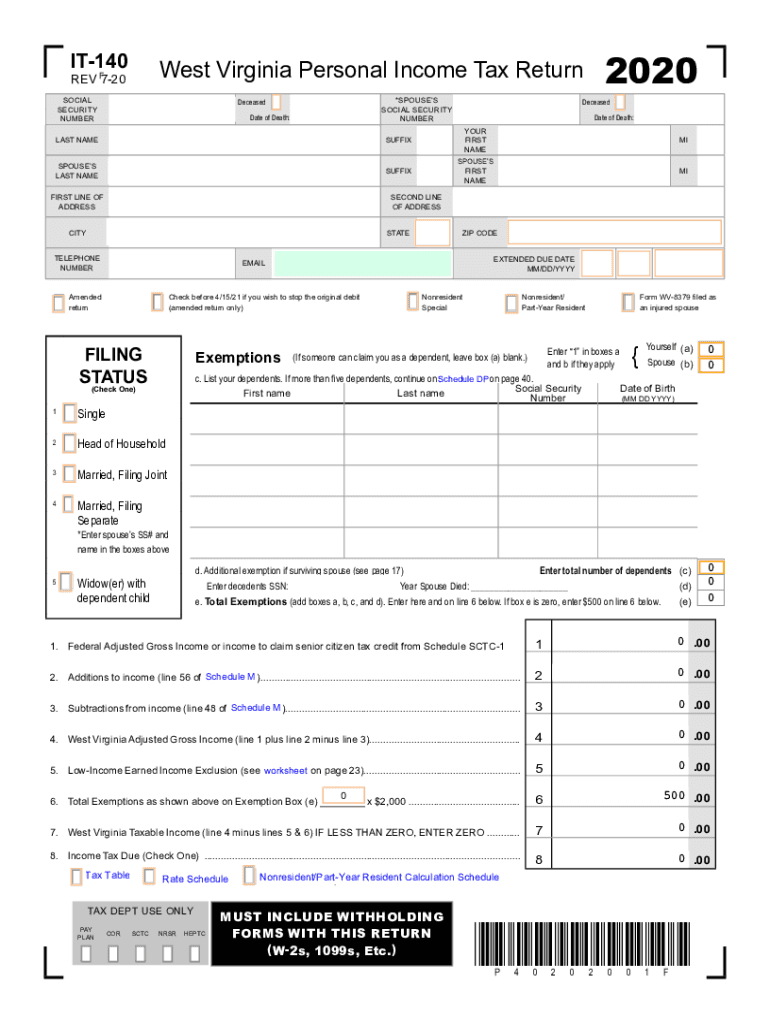

It140 Fill Out and Sign Printable PDF Template signNow

New reporting requirements for corporations due july 1 | virginia. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web use this form to notify your employer.

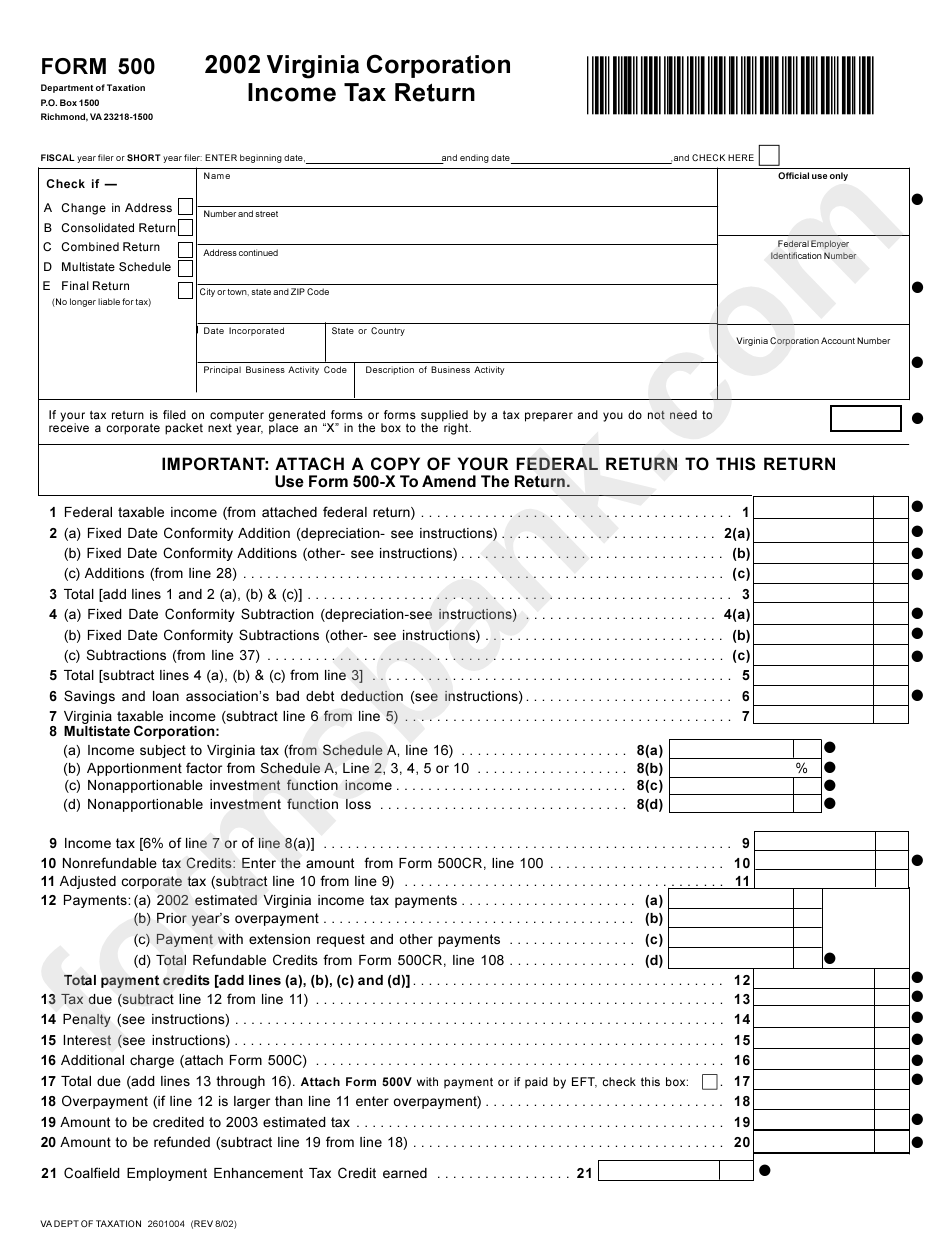

Form 500 Virginia Corporation Tax Return 2002 printable pdf

Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Virginia department of taxation, p.o. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. Get ready for tax season deadlines by completing any required tax forms today. Be sure to verify.

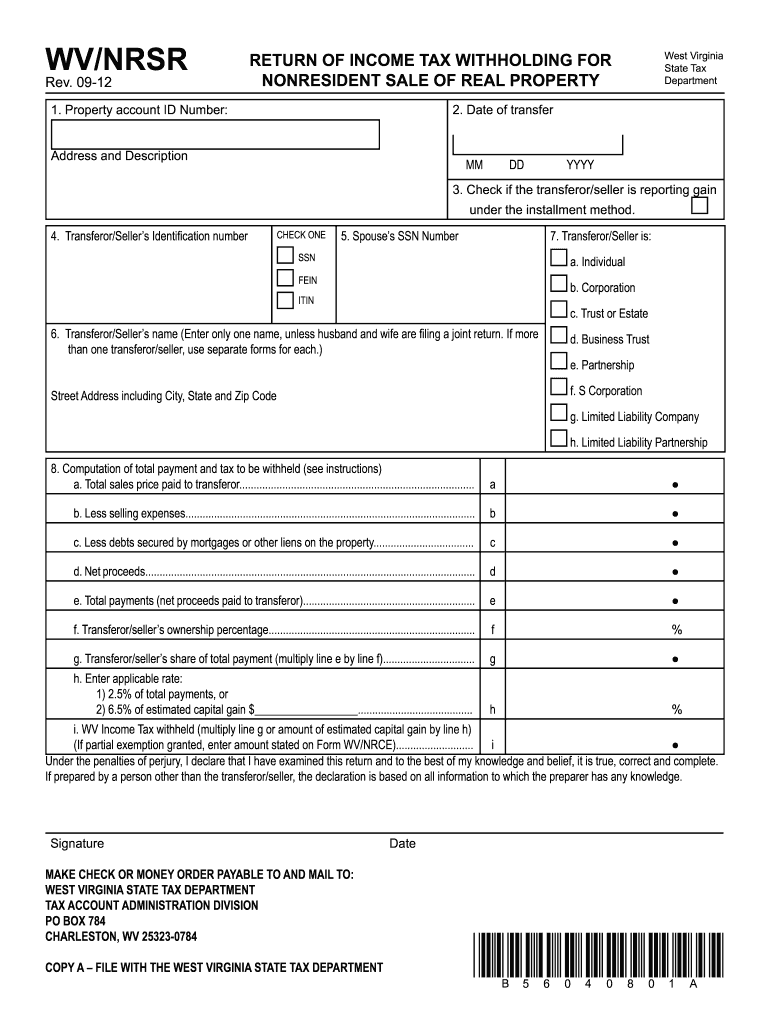

Wv Nrsr Fill Out and Sign Printable PDF Template signNow

Web virginia form 760 *va0760122888* resident income tax return. Streamlined document workflows for any industry. File by may 1, 2023 — use black ink. Find forms for your industry in minutes. Web virginia state income tax forms.

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate)

Get ready for tax season deadlines by completing any required tax forms today. Web virginia state income tax forms. Web virginia form 760 *va0760122888* resident income tax return. Web to mail your income tax return directly to the department of taxation use:: Web use this form to notify your employer whether you are subject to virginia income tax withholding and.

Form WV8453 Download Printable PDF or Fill Online Individual

Get ready for tax season deadlines by completing any required tax forms today. You must ¿le this form. Web virginia tax individual online account application. Streamlined document workflows for any industry. Web individual income tax filing filing electronically, and requesting direct deposit if you’re expecting a refund, is the fastest, safest, and easiest way to file your return.

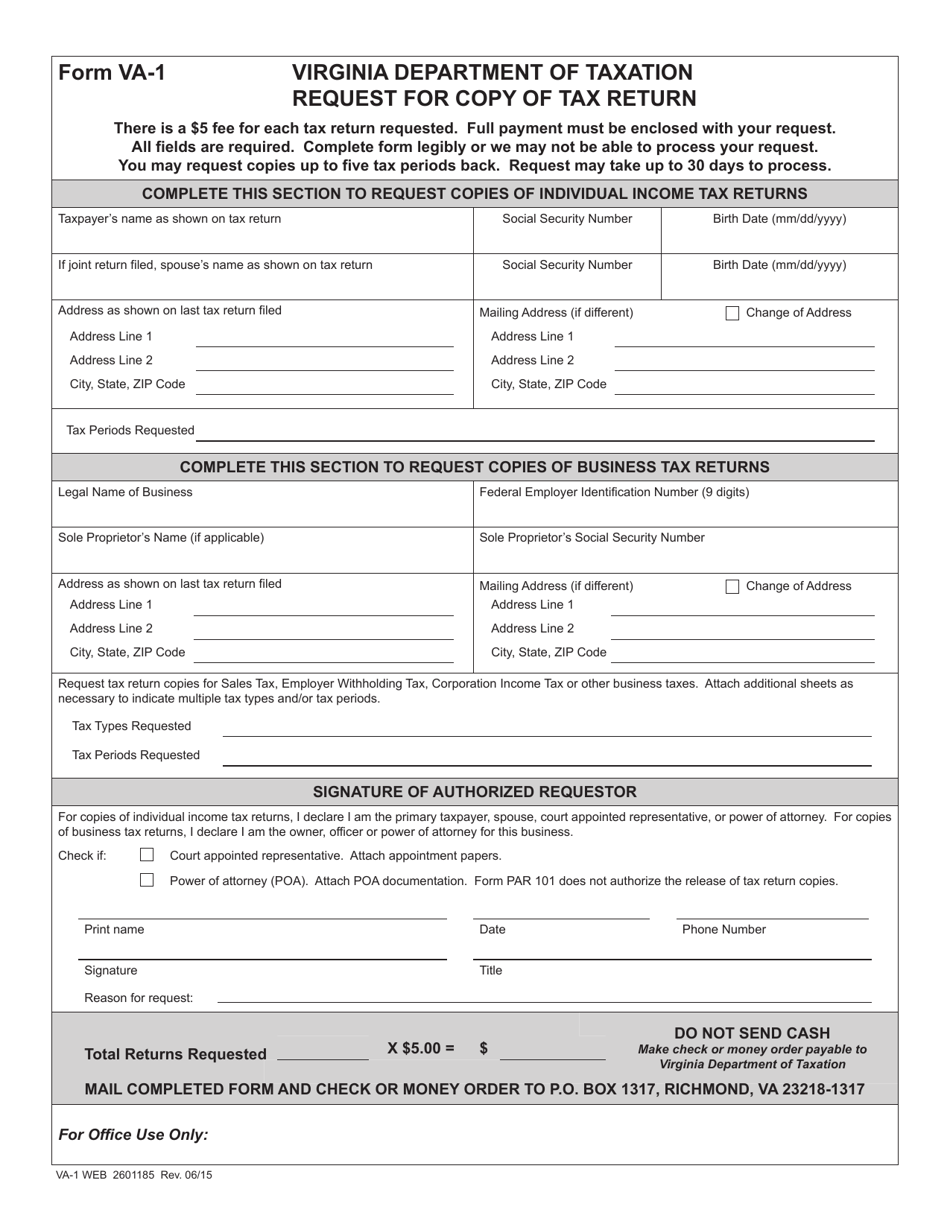

Form VA1 Download Fillable PDF or Fill Online Request for Copy of Tax

Virginia state income tax forms for tax year 2022 (jan. Be sure to verify that the form you are downloading is for the correct year. Web to mail your income tax return directly to the department of taxation use:: Complete, edit or print tax forms instantly. File by may 1, 2023 — use black ink.

Complete, Edit Or Print Tax Forms Instantly.

Virginia department of taxation, p.o. Get ready for tax season deadlines by completing any required tax forms today. Web download or print the 2022 virginia income tax instructions (virginia income tax instructional booklet) for free from the virginia department of taxation. Virginia state income tax brackets and income tax rates depend on taxable income and residency.

Streamlined Document Workflows For Any Industry.

Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. Box 1498, richmond, va 23218. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim.

Web Virginia State Income Tax Forms.

Find forms for your industry in minutes. If the amount on line 9 is less than the amount shown below for your filing. Virginia state income tax forms for tax year 2022 (jan. Web virginia form 760 *va0760122888* resident income tax return.

This Commonwealth Of Virginia System Belongs To The Department Of Taxation (Virginia Tax) And Is Intended.

Be sure to verify that the form you are downloading is for the correct year. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web individual income tax filing filing electronically, and requesting direct deposit if you’re expecting a refund, is the fastest, safest, and easiest way to file your return.