W 4 Form Michigan

W 4 Form Michigan - Any altering of a form to change a tax year or any. Any altering of a form to change a tax year or any reported tax period outside of. This form is for income earned in tax year 2022, with tax returns due in april. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. If too little is withheld, you will generally owe tax when you file your tax return. Web instructions included on form: Web (a) other income (not from jobs). Web 2020 withholding tax forms business tax forms 2020 withholding tax forms important note tax forms are tax year specific. New hire operations center, p.o.

Instructions for completing the 8233. Complete lines 10 and 11 before. Any altering of a form to change a tax year or any reported tax period outside of. Access the wolverine access web site; New hire operations center, p.o. Sales and other dispositions of capital assets: Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Click on employee self service login. If too little is withheld, you will generally owe tax when you file your tax return. Web fluid time reporting—learn more.

If too little is withheld, you will generally owe tax when you file your tax return. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Web fluid time reporting—learn more. Web 2020 withholding tax forms business tax forms 2020 withholding tax forms important note tax forms are tax year specific. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. This form is for income earned in tax year 2022, with tax returns due in april. Access the wolverine access web site; You must complete boxes 1 thru 6, sign and date this form. Any altering of a form to change a tax year or any reported tax period outside of.

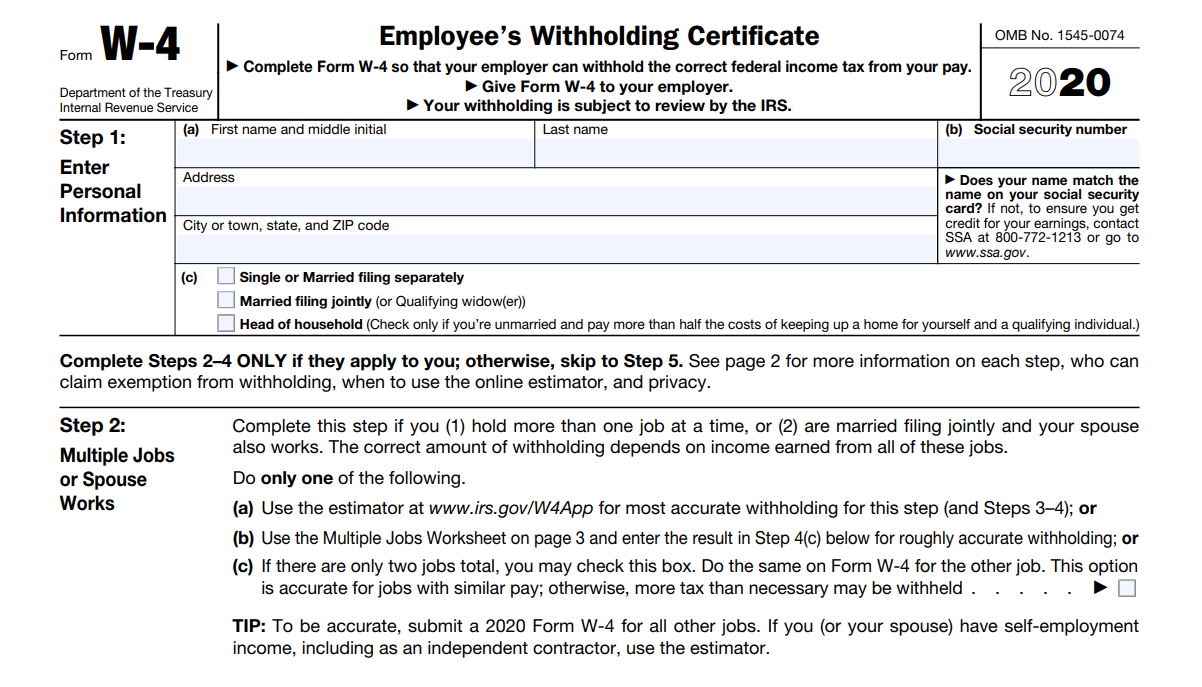

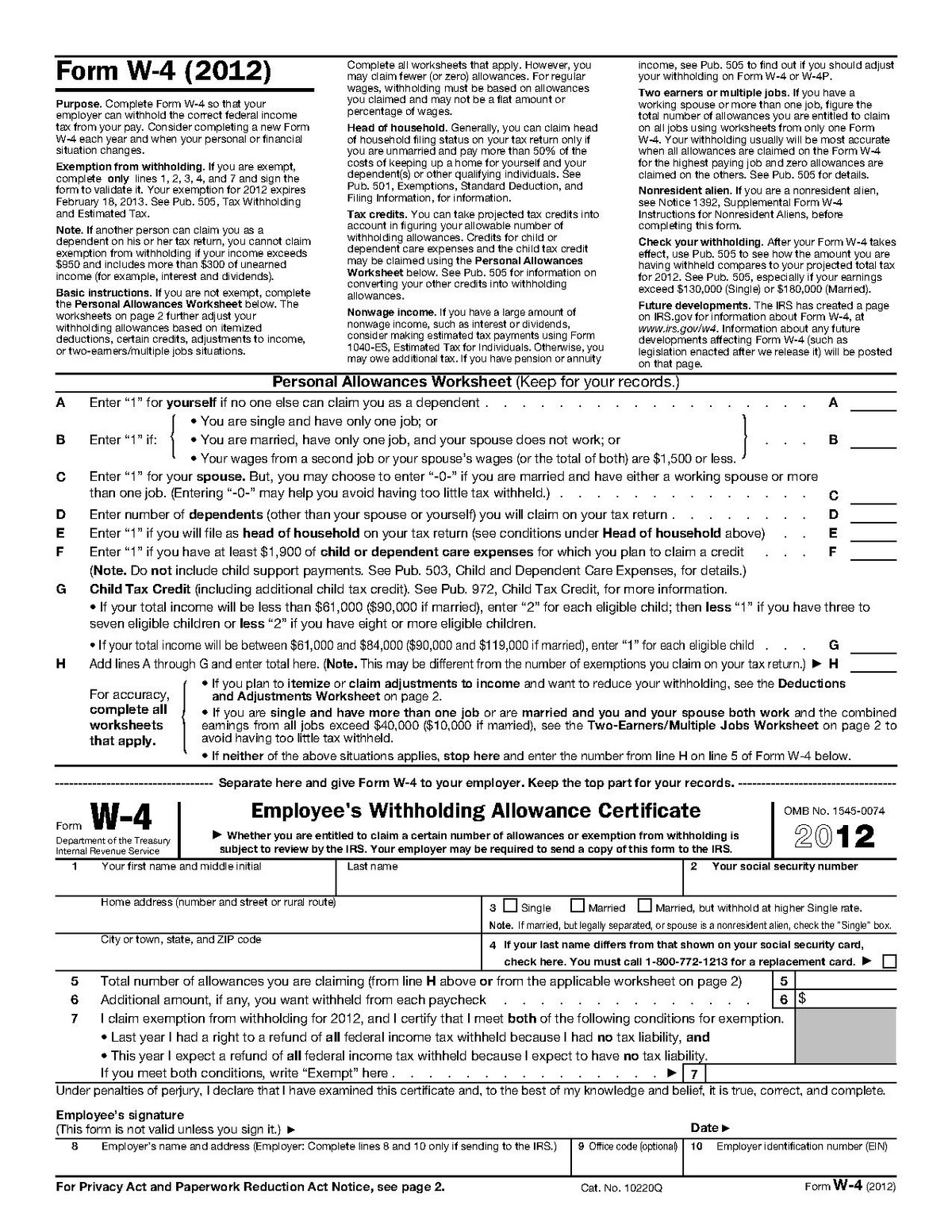

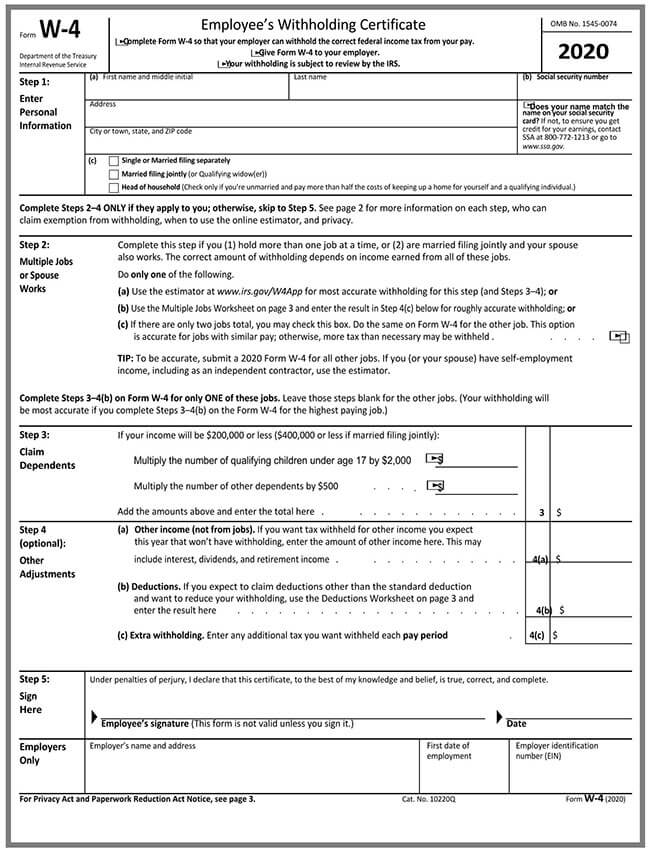

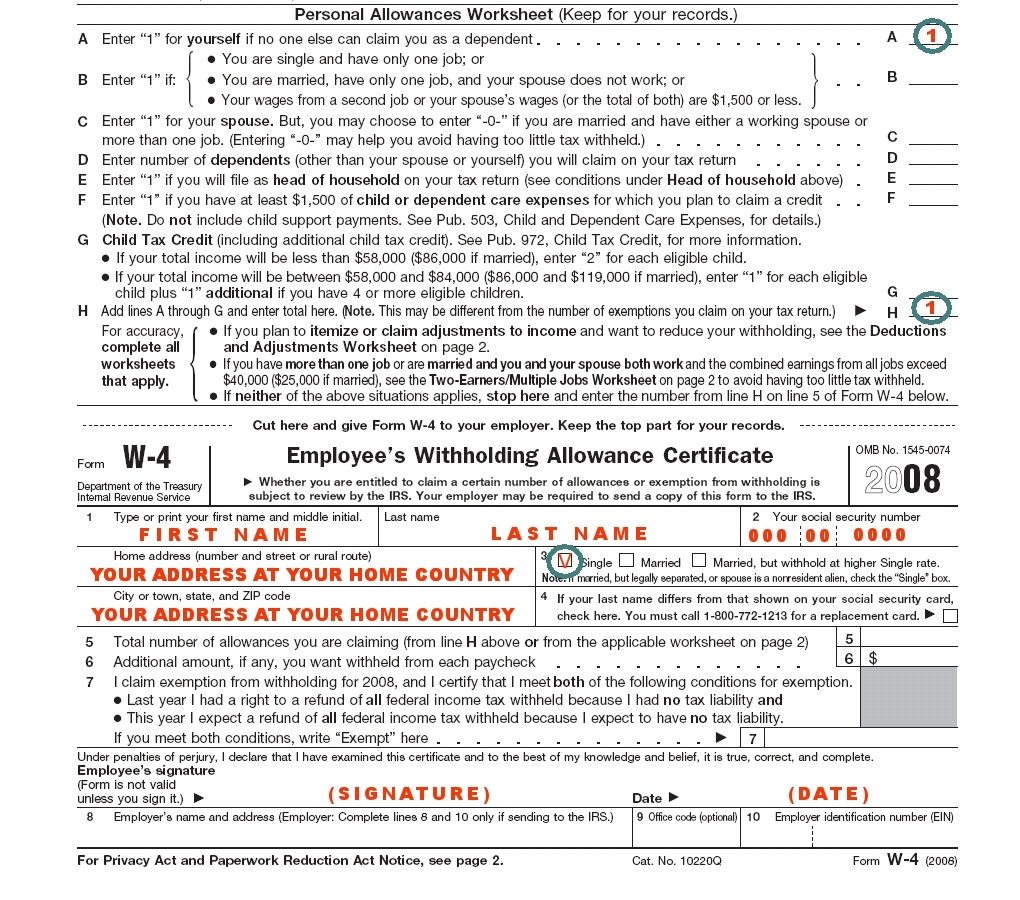

W4 Form 2020 W4 Forms TaxUni

Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. New hire operations center, p.o. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. If too little is withheld, you will generally owe tax when you file your tax return..

How To Correctly Fill Out Your W4 Form Youtube Free Printable W 4

Web (a) other income (not from jobs). Any altering of a form to change a tax year or any reported tax period outside of. Click on employee self service login. If too little is withheld, you will generally owe tax when you file your tax return. Web form with the michigan department of treasury.

How to Fill Out the W4 Form Pocket Sense

Complete lines 10 and 11 before. If you fail or refuse to submit this certificate, your employer must withhold tax from your. This form is for income earned in tax year 2022, with tax returns due in april. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Web we last updated michigan form 4.

How to Fill a W4 Form (with Guide)

This form is for income earned in tax year 2022, with tax returns due in april. Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Any altering of a form to change a tax year or any.

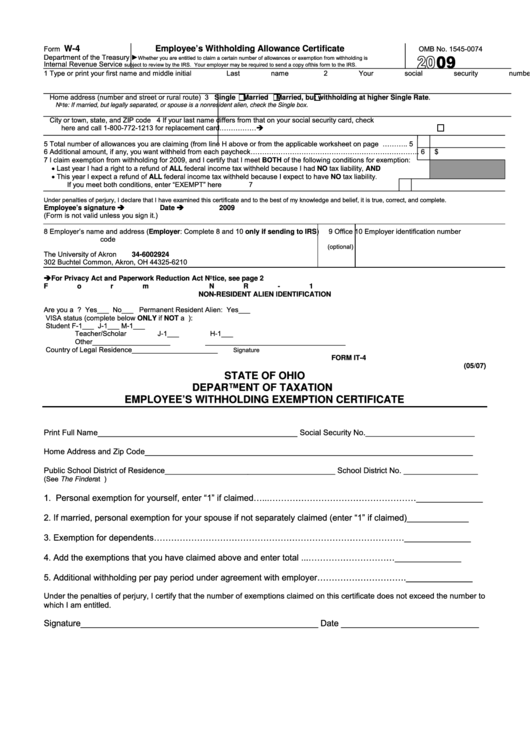

Ohio Withholding Form W 4 2022 W4 Form

This form is for income earned in tax year 2022, with tax returns due in april. Web form with the michigan department of treasury. Any altering of a form to change a tax year or any reported tax period outside of. Web (a) other income (not from jobs). Web business tax forms 2023 withholding tax forms important note tax forms.

Download Michigan Form MIW4 for Free FormTemplate

Click on employee self service login. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. This form is for income earned in tax year 2022, with tax returns due in april. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. If too little is withheld, you will.

How to Complete the W4 Tax Form The Way

Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Instructions for completing the 8233. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Web (a) other income (not from jobs). Web business tax forms 2021 withholding tax.

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Sales and other dispositions of capital assets: New hire operations center, p.o. Access the wolverine access web site; Any altering of a form to change a tax year or any.

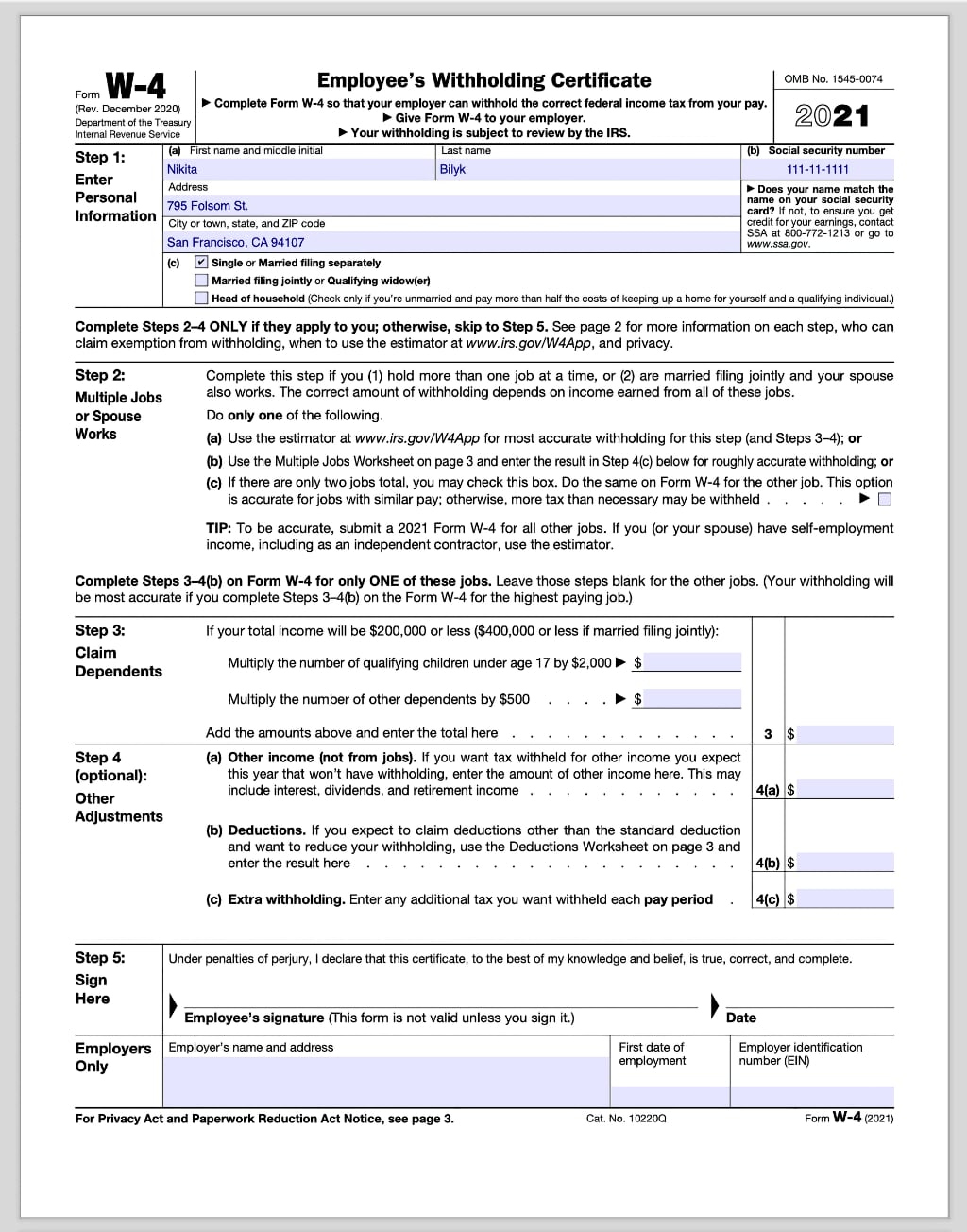

Sample W 4 Form W4 Form 2021 Printable

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Sales and other dispositions of capital assets:.

Michigan W 4 2021 2022 W4 Form

Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. Web fluid time reporting—learn more. Sales and other dispositions of capital assets: Click on employee self service login. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury.

You Must Complete Boxes 1 Thru 6, Sign And Date This Form.

Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Any altering of a form to change a tax year or any reported tax period outside of. If too little is withheld, you will generally owe tax when you file your tax return.

New Hire Operations Center, P.o.

If too little is withheld, you will generally owe tax when you file your tax return. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. If you fail or refuse to submit this certificate, your employer must withhold tax from your. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here.

Sales And Other Dispositions Of Capital Assets:

Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web (a) other income (not from jobs). Instructions for completing the 8233.

Web Form With The Michigan Department Of Treasury.

Any altering of a form to change a tax year or any. Access the wolverine access web site; Web 2020 withholding tax forms business tax forms 2020 withholding tax forms important note tax forms are tax year specific. Web fluid time reporting—learn more.