What 1099 Form Do I Use For Rent Payments

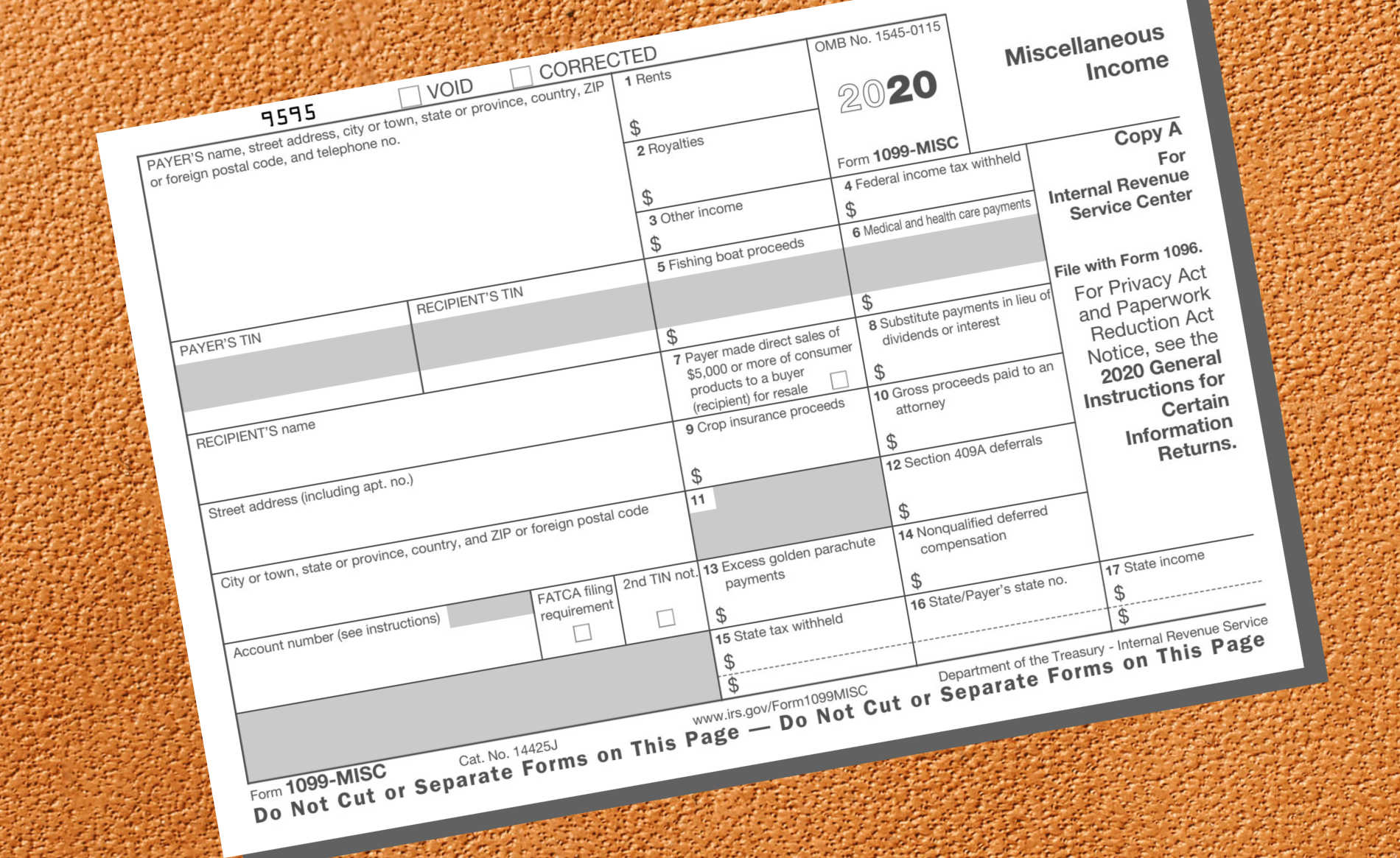

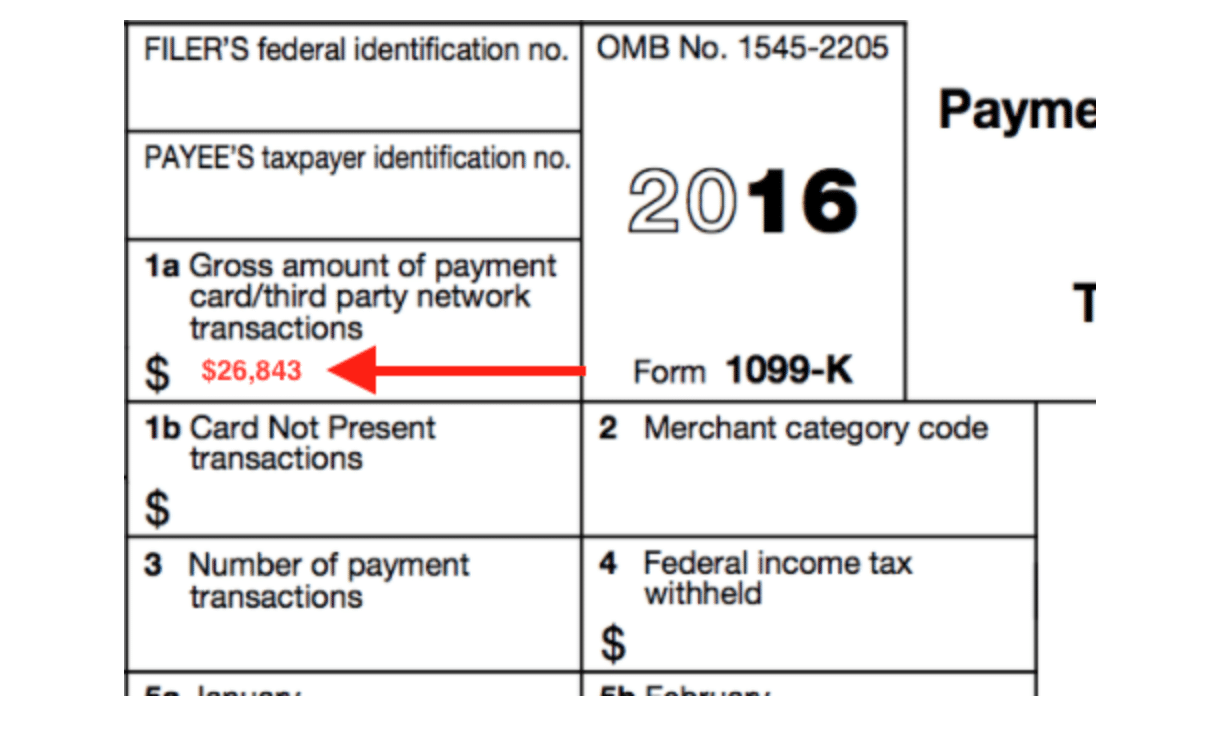

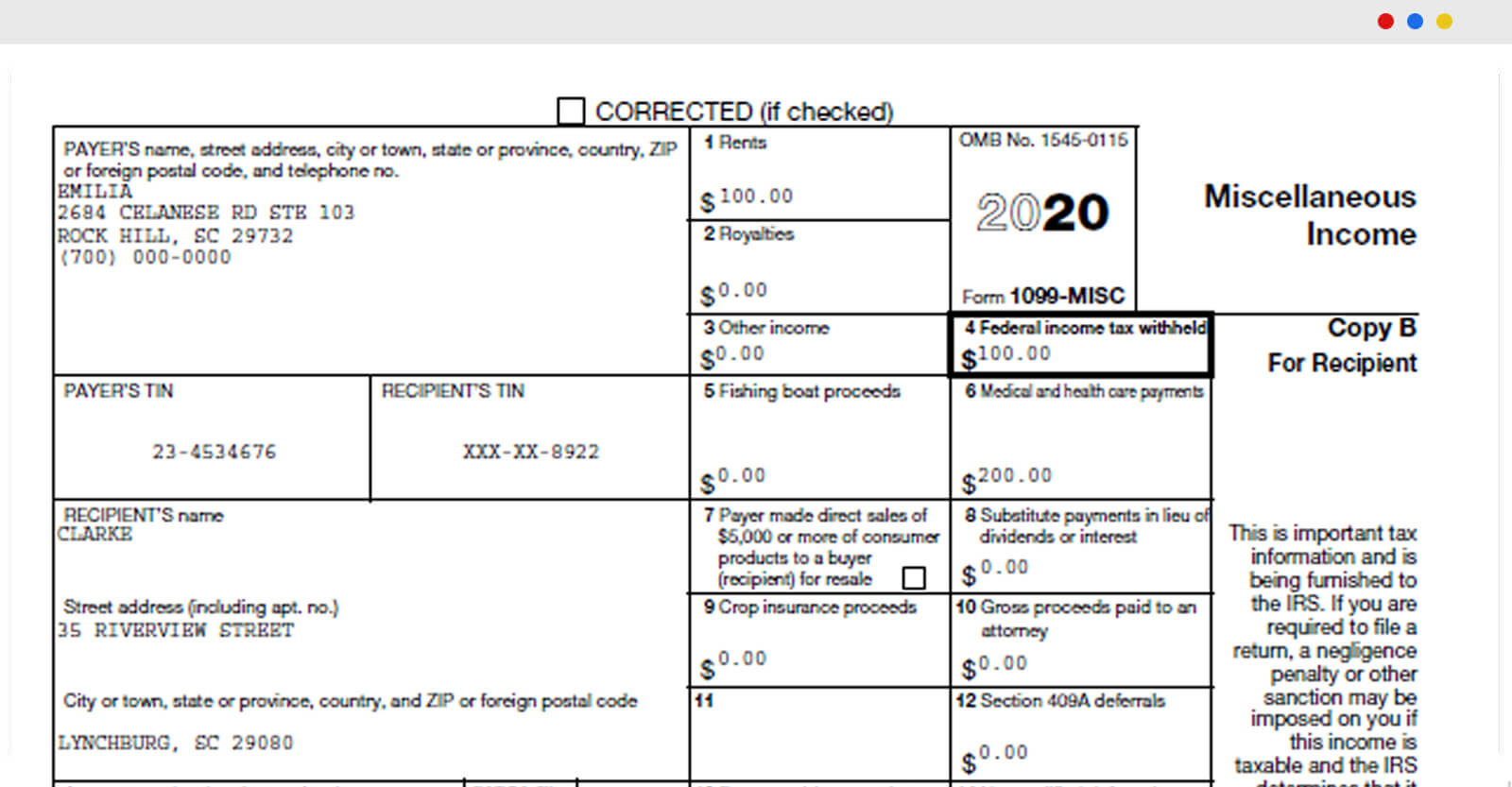

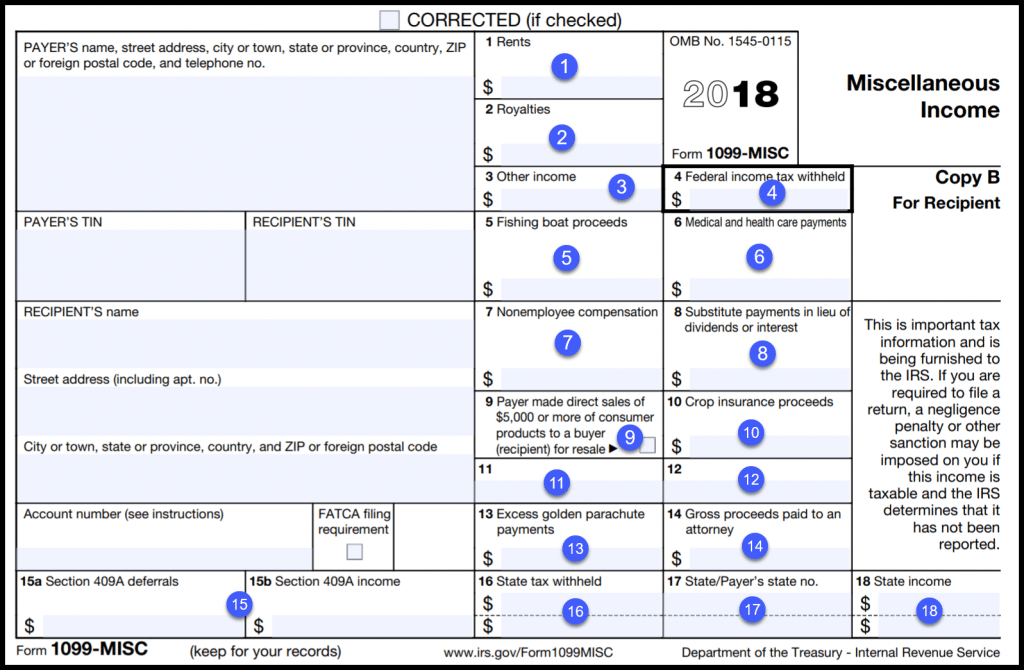

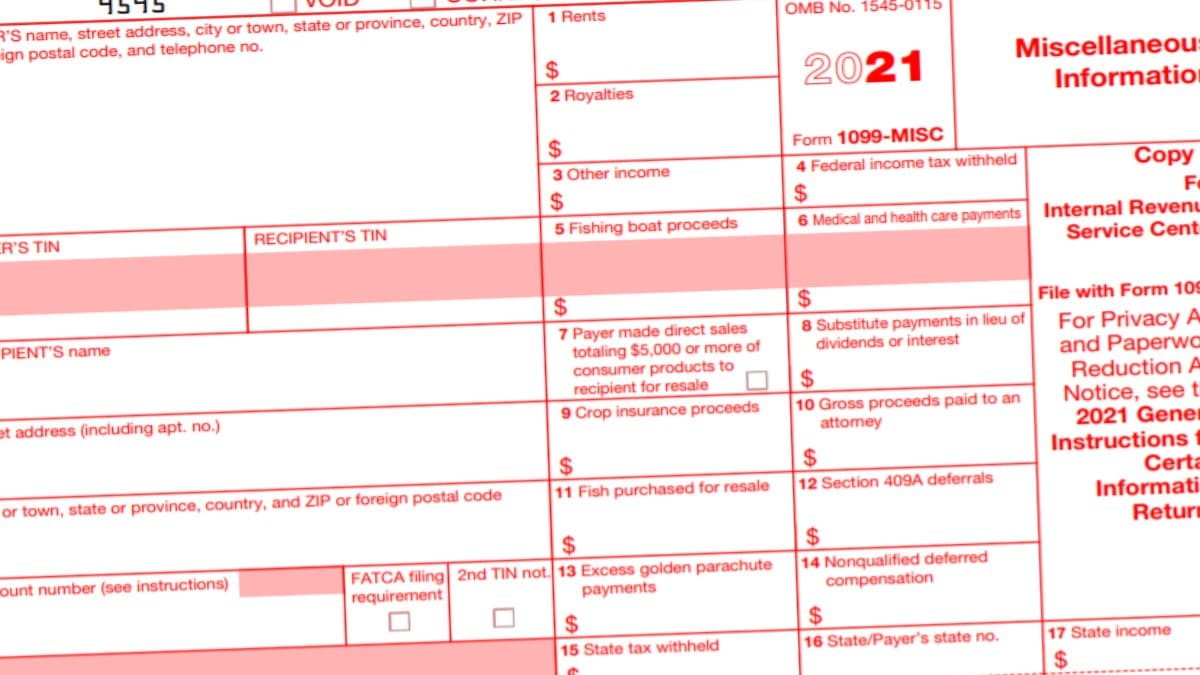

What 1099 Form Do I Use For Rent Payments - “ if you accepted credit card or debit card. Web current tax law defines receiving rental income as conducting the trade or business of renting out property, subject to form 1099 reporting requirements. Takes 5 minutes or less to complete. Ad discover a wide selection of 1099 tax forms at staples®. Web issuing a 1099 misc for rent payments is not mandatory but assures accountability for irs purposes. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. In this case you can enter your rental. Web if you use venmo to collect rent, they will be required to notify the irs about the rental income you receive. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. This exception is only if the property is known as a corporate entity.

Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Reporting rental income on your tax return. Web current tax law defines receiving rental income as conducting the trade or business of renting out property, subject to form 1099 reporting requirements. Web there are around 20 different types of 1099s but for landlords the ones you’ll need to use most often are: Takes 5 minutes or less to complete. Web there are 20 different variations of the 1099 form, but a few are important for landlords to be familiar with: This exception is only if the property is known as a corporate entity. Ad discover a wide selection of 1099 tax forms at staples®. “ if you accepted credit card or debit card. Web reporting payments to independent contractors.

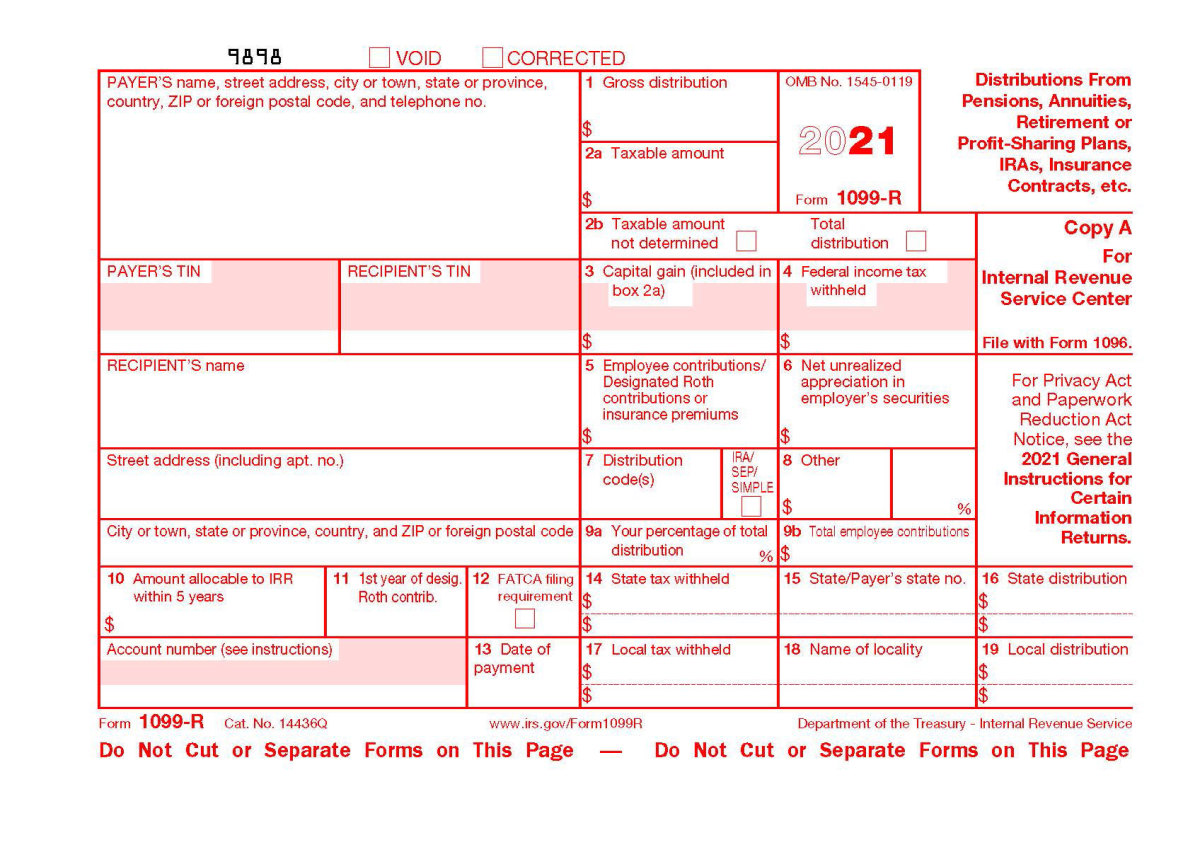

Web current tax law defines receiving rental income as conducting the trade or business of renting out property, subject to form 1099 reporting requirements. Web there are around 20 different types of 1099s but for landlords the ones you’ll need to use most often are: Ad discover a wide selection of 1099 tax forms at staples®. “ if you accepted credit card or debit card. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Simply answer a few question to instantly download, print & share your form. Web if you use venmo to collect rent, they will be required to notify the irs about the rental income you receive. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. There are three types of 1099 rental income related forms. Attorney fees paid to a.

Which 1099 Form Do I Use for Rent

Takes 5 minutes or less to complete. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Simply answer a few question to instantly download, print & share your form. Web there are 20 different variations of the 1099 form, but a few are important for landlords to.

1099 MISC Form 2022 1099 Forms TaxUni

Web there are 20 different variations of the 1099 form, but a few are important for landlords to be familiar with: Simply answer a few question to instantly download, print & share your form. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web there are 20 different variations of the 1099 form, but a few are important for landlords to be familiar with: Reporting rental income on your tax return. Simply answer a few question to instantly download, print & share your form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Box.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Web there are around 20 different types of 1099s but for landlords the ones you’ll need to use most often are: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. “ if you accepted credit card or debit card. There are.

Airbnb 1099 Forms Everything You Need to Know Shared Economy Tax

Ad discover a wide selection of 1099 tax forms at staples®. Takes 5 minutes or less to complete. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. We’ll outline them by situation: Box 1 will not be used for reporting under section 6050r, regarding cash payments for.

Florida 1099 Form Online Universal Network

Simply answer a few question to instantly download, print & share your form. We’ll outline them by situation: Web 1099 for rental income. Attorney fees paid to a. In turn, if you pay rents for the rental of your office.

Efile Form 1099 MISC Online How to File 1099 MISC for 2020

Takes 5 minutes or less to complete. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad discover a wide selection of 1099 tax forms at staples®. Web issuing a 1099 misc for rent payments is not mandatory but assures accountability for irs purposes. Web if the rental property owner is.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Reporting rental income on your tax return. Ad discover a wide selection of 1099.

IRS Form 1099 Reporting for Small Business Owners

Web there are around 20 different types of 1099s but for landlords the ones you’ll need to use most often are: Web if the rental property owner is a corporation, you do not need to file a 1099 form. We’ll outline them by situation: Web issuing a 1099 misc for rent payments is not mandatory but assures accountability for irs.

J. Hunter Company Businesses use form 1099NEC to report contractor

This exception is only if the property is known as a corporate entity. Takes 5 minutes or less to complete. Simply answer a few question to instantly download, print & share your form. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Web 1099 for rental income.

Box 1 Will Not Be Used For Reporting Under Section 6050R, Regarding Cash Payments For The Purchase Of Fish For Resale Purposes.

Staples provides custom solutions to help organizations achieve their goals. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Web if you use venmo to collect rent, they will be required to notify the irs about the rental income you receive. Web reporting payments to independent contractors.

Web There Are Around 20 Different Types Of 1099S But For Landlords The Ones You’ll Need To Use Most Often Are:

Web current tax law defines receiving rental income as conducting the trade or business of renting out property, subject to form 1099 reporting requirements. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. “ if you accepted credit card or debit card. We’ll outline them by situation:

Web There Are 20 Different Variations Of The 1099 Form, But A Few Are Important For Landlords To Be Familiar With:

Web issuing a 1099 misc for rent payments is not mandatory but assures accountability for irs purposes. Simply answer a few question to instantly download, print & share your form. Web if the rental property owner is a corporation, you do not need to file a 1099 form. Web 1099 for rental income.

In Turn, If You Pay Rents For The Rental Of Your Office.

There are three types of 1099 rental income related forms. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. This exception is only if the property is known as a corporate entity.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)