What Is A 990 T Tax Form

What Is A 990 T Tax Form - Web a 990t is the form ira holders must use to report their retirement account assets. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. In a nutshell, the form gives the irs an overview of the. An organization must pay estimated tax if. It serves as an annual. Tax payers use the form 990t for the following purposes: A quick & easy breakdown. Ad access irs tax forms. Complete, edit or print tax forms instantly.

Web a 990t is the form ira holders must use to report their retirement account assets. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. In a nutshell, the form gives the irs an overview of the. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. A quick & easy breakdown. It serves as an annual. Tax payers use the form 990t for the following purposes: Supports current & prior year filings.

Tax payers use the form 990t for the following purposes: In a nutshell, the form gives the irs an overview of the. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Supports current & prior year filings. A quick & easy breakdown. It serves as an annual. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Complete, edit or print tax forms instantly. An organization must pay estimated tax if. Ad access irs tax forms.

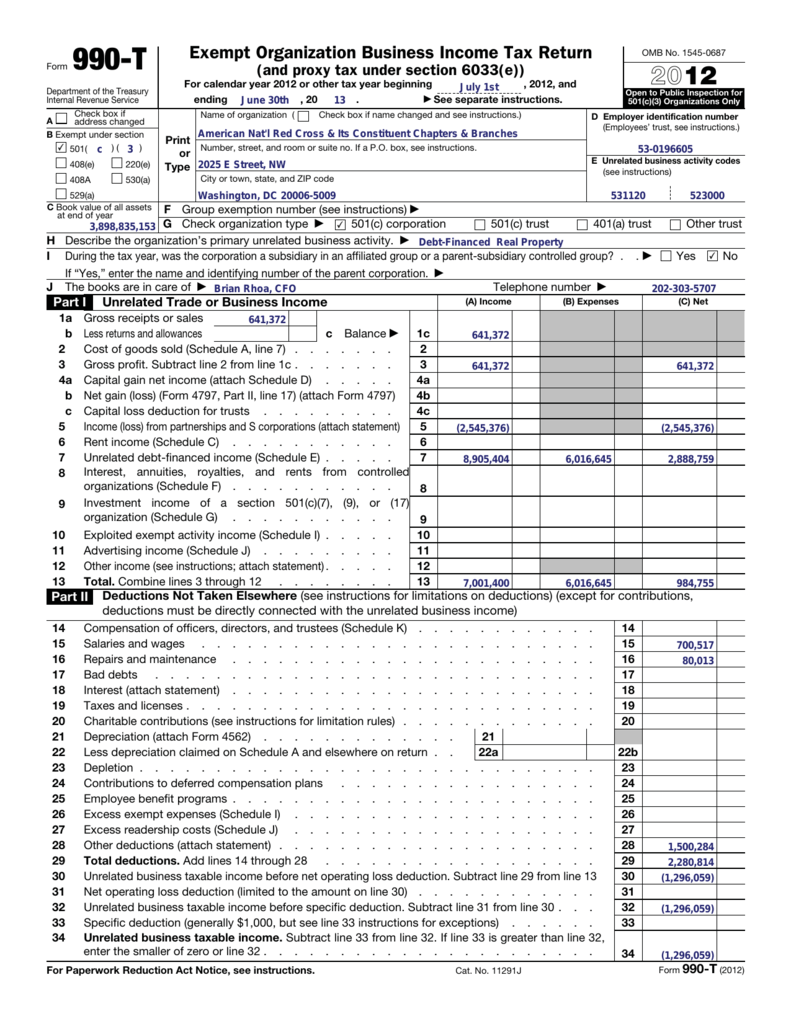

Form 990T, Unrelated Trade or Business

An organization must pay estimated tax if. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Supports current & prior year filings. In a nutshell, the form gives the irs an overview of the. Complete, edit or print tax forms instantly.

It’s Time to File your Form 990 for Tax Year 2020! Blog TaxBandits

Complete, edit or print tax forms instantly. Ad access irs tax forms. It serves as an annual. Web a 990t is the form ira holders must use to report their retirement account assets. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

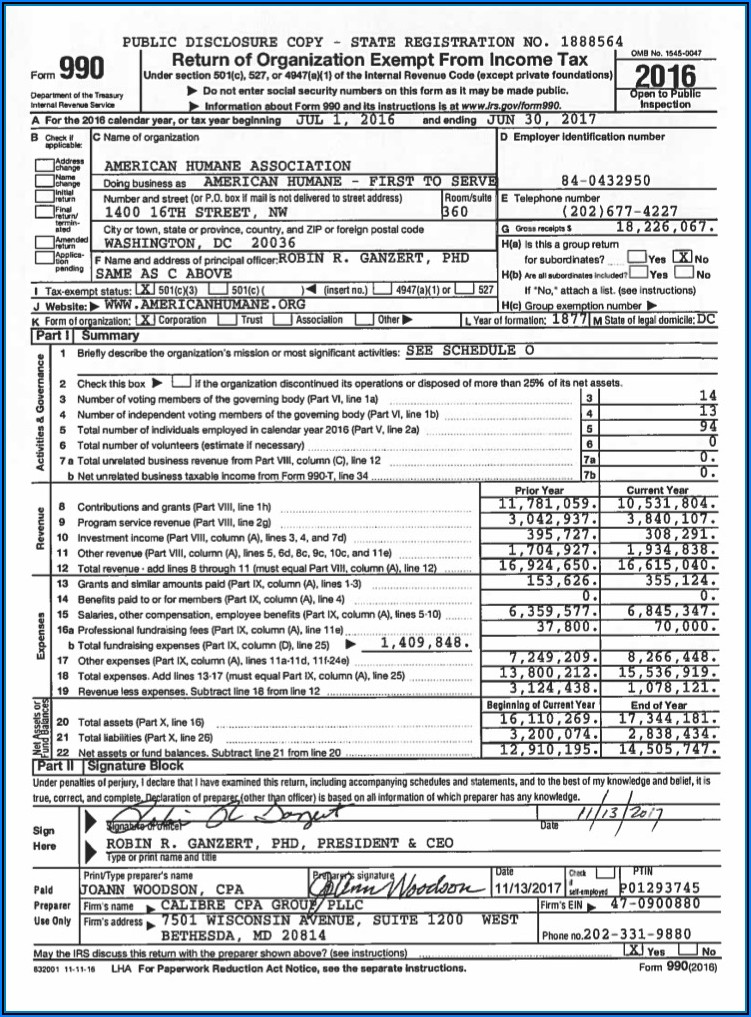

Form 990 IRS NonProfit Tax Returns & Tax Form 990 Community Tax

It serves as an annual. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Tax payers use the.

Fillable Form 990T Draft Exempt Organization Business Tax

Supports current & prior year filings. Ad access irs tax forms. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Tax payers use the form 990t for the following purposes: A quick & easy breakdown.

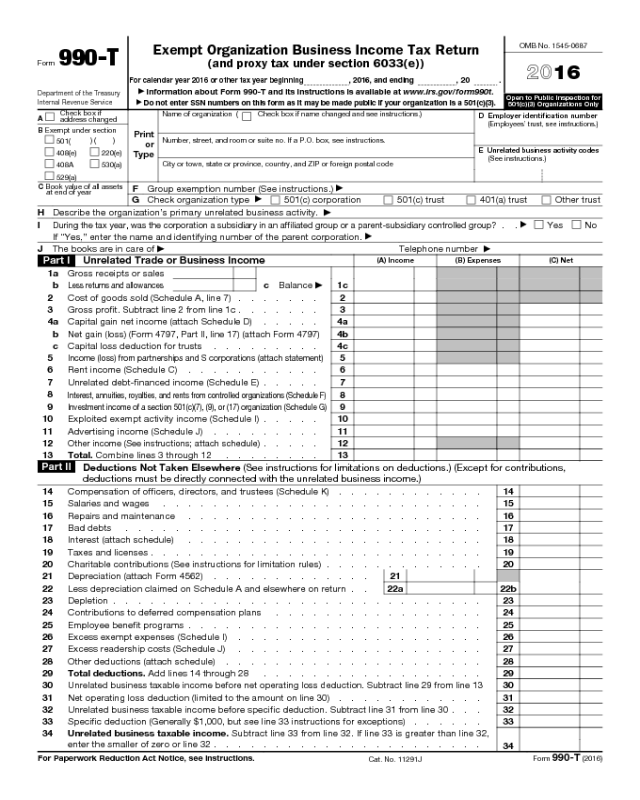

Form 990T Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web a 990t is the form ira holders must use to report their retirement account assets. Ad access irs tax forms. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. An organization must pay.

Form 990T Exempt Organization Business Tax Return Form (2014

In a nutshell, the form gives the irs an overview of the. A quick & easy breakdown. Complete, edit or print tax forms instantly. Supports current & prior year filings. It serves as an annual.

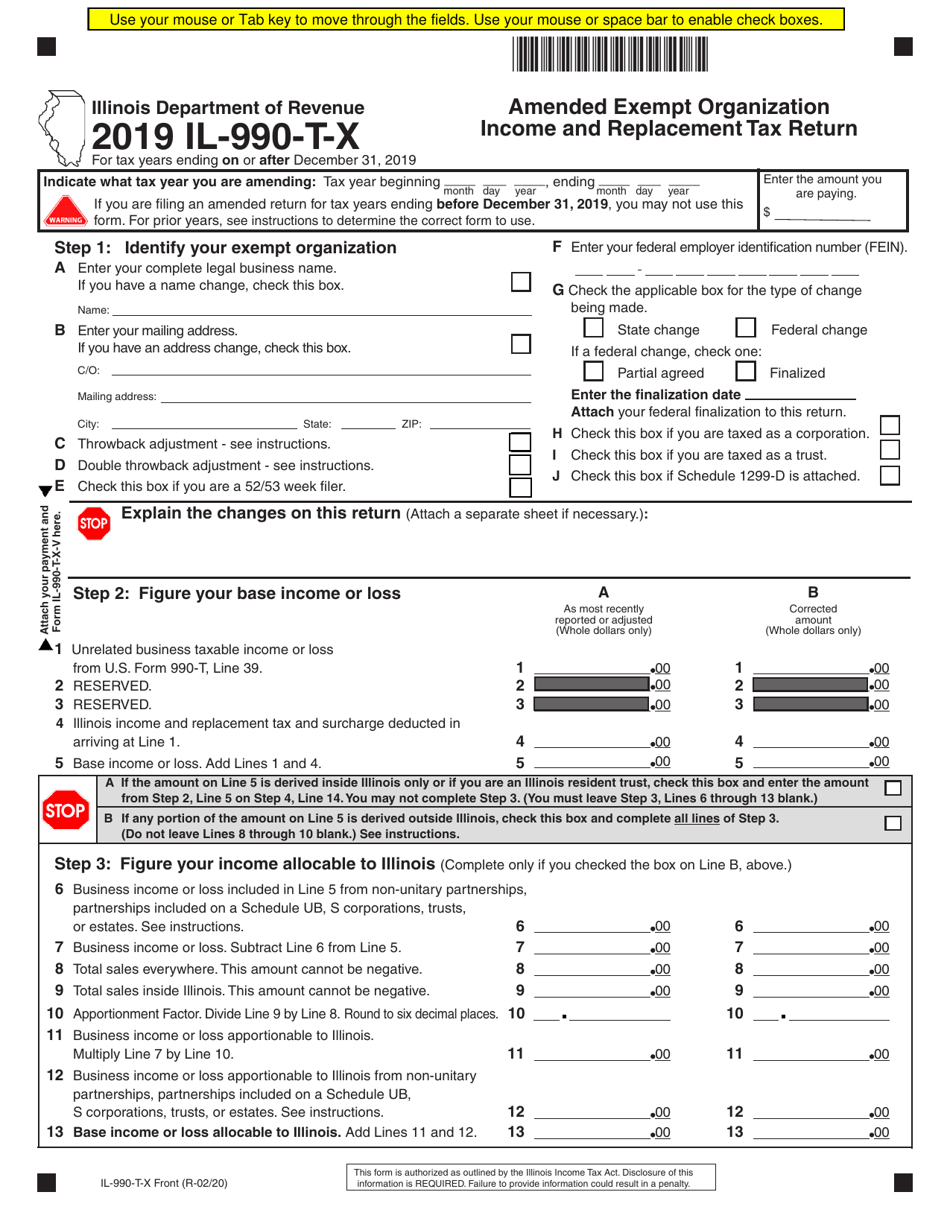

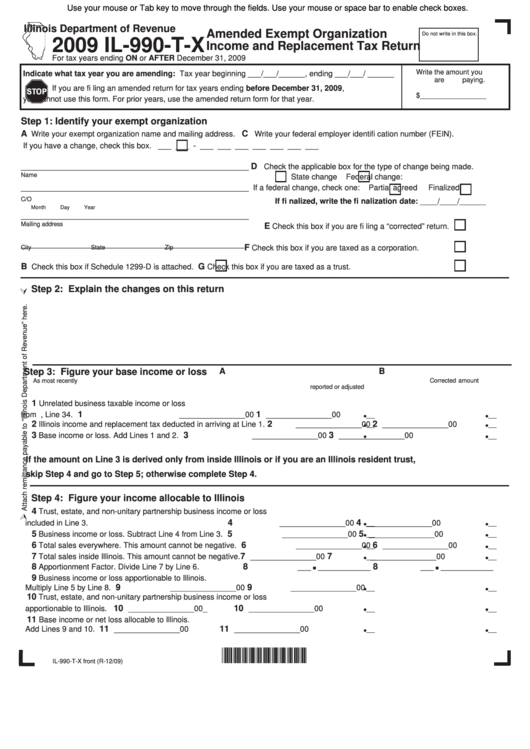

Form IL990TX Download Fillable PDF or Fill Online Amended Exempt

Supports current & prior year filings. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. A quick & easy breakdown. Web a 990t is the form ira holders must use to report their retirement account assets. An organization must pay estimated.

What Is A 990 Tax Form For Nonprofits Form Resume Examples E4Y43g79lB

Supports current & prior year filings. It serves as an annual. Tax payers use the form 990t for the following purposes: Ad access irs tax forms. An organization must pay estimated tax if.

Fillable Form Il990TX Amended Exempt Organization And

Ad access irs tax forms. Tax payers use the form 990t for the following purposes: It serves as an annual. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form.

Form 990T Exempt Organization Business Tax Return Form (2014

Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Ad access irs tax forms. It serves as an annual. Web a 990t is the form ira holders must use to report their retirement account assets. An organization must pay estimated tax.

Web A 990T Is The Form Ira Holders Must Use To Report Their Retirement Account Assets.

It serves as an annual. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Supports current & prior year filings. In a nutshell, the form gives the irs an overview of the.

Tax Payers Use The Form 990T For The Following Purposes:

Web file charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. An organization must pay estimated tax if. Complete, edit or print tax forms instantly. Ad access irs tax forms.