What Is A Schedule K-3 Form Used For

What Is A Schedule K-3 Form Used For - It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Detailed information is provided in specific instructions. Partnership’s employer identification number (ein) b. You must include this information on your tax or information returns, if. Partnership’s name, address, city, state, and zip code. The percentage of ownership determines the amount. Web if the notification occurs before the partnership or s corporation files its return, the conditions for the filing relief are not met and the partnership or s corporation must. Detailed information is provided in specific instructions. You must include this information on your tax or information. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business.

Detailed information is provided in specific instructions. Partnership’s name, address, city, state, and zip code. The percentage of ownership determines the amount. You must include this information on your tax or information returns, if. You must include this information on your tax or information. Web if the notification occurs before the partnership or s corporation files its return, the conditions for the filing relief are not met and the partnership or s corporation must. Partnership’s employer identification number (ein) b. Detailed information is provided in specific instructions. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business.

Web if the notification occurs before the partnership or s corporation files its return, the conditions for the filing relief are not met and the partnership or s corporation must. You must include this information on your tax or information. Partnership’s name, address, city, state, and zip code. Detailed information is provided in specific instructions. Partnership’s employer identification number (ein) b. You must include this information on your tax or information returns, if. Detailed information is provided in specific instructions. The percentage of ownership determines the amount. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. International tax information to their partners, including.

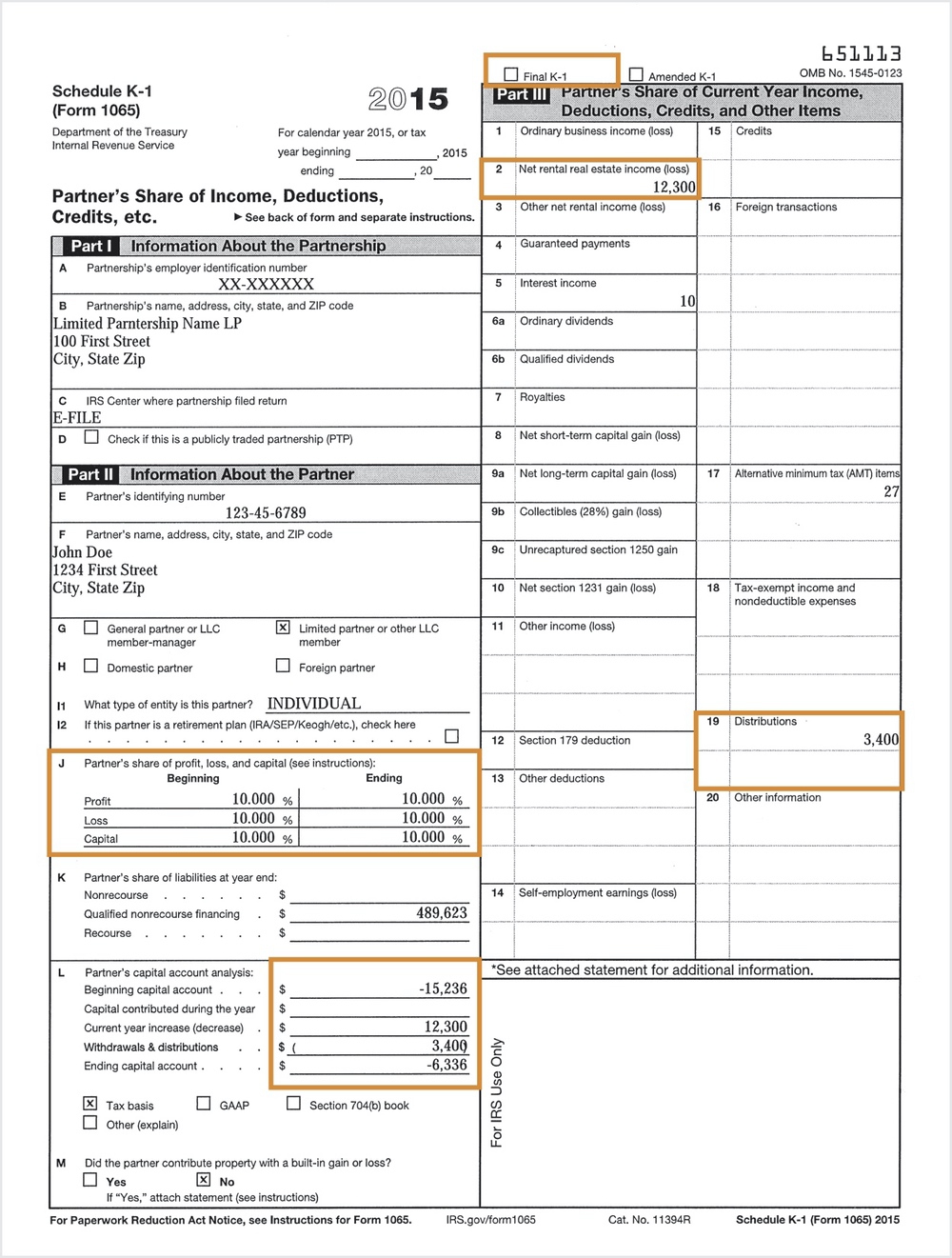

Energy Transfer Partners K 1 2019 Image Transfer and Photos

You must include this information on your tax or information returns, if. Detailed information is provided in specific instructions. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. You must include this information on your tax or information. International tax information to their partners, including.

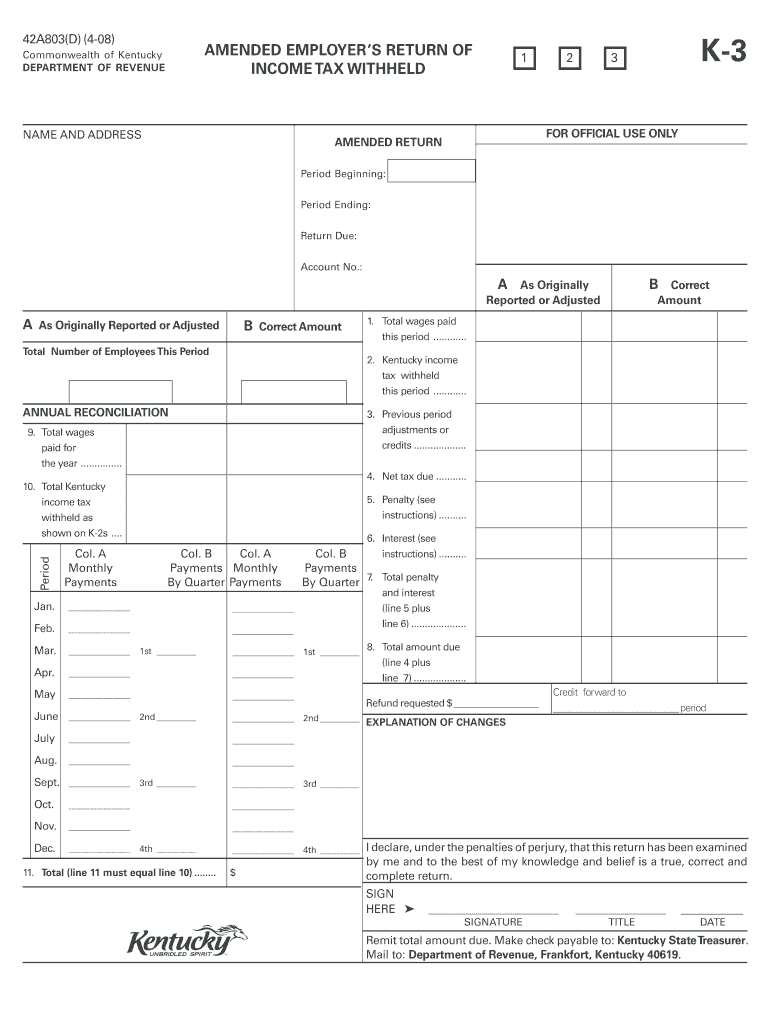

Revenue Ky Gov Form K 3 Fill Out and Sign Printable PDF Template

Detailed information is provided in specific instructions. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. Web if the notification occurs before the partnership or s corporation files its return, the conditions for the filing relief are.

Schedule K1 / 1065 Tax Form Guide LP Equity

The percentage of ownership determines the amount. Partnership’s name, address, city, state, and zip code. You must include this information on your tax or information. You must include this information on your tax or information returns, if. It’s generally used to report a partner’s or shareholder’s portion of the items reported on.

How Do I Fill Out A Schedule K 1 Armando Friend's Template

The percentage of ownership determines the amount. International tax information to their partners, including. You must include this information on your tax or information. You must include this information on your tax or information returns, if. Partnership’s name, address, city, state, and zip code.

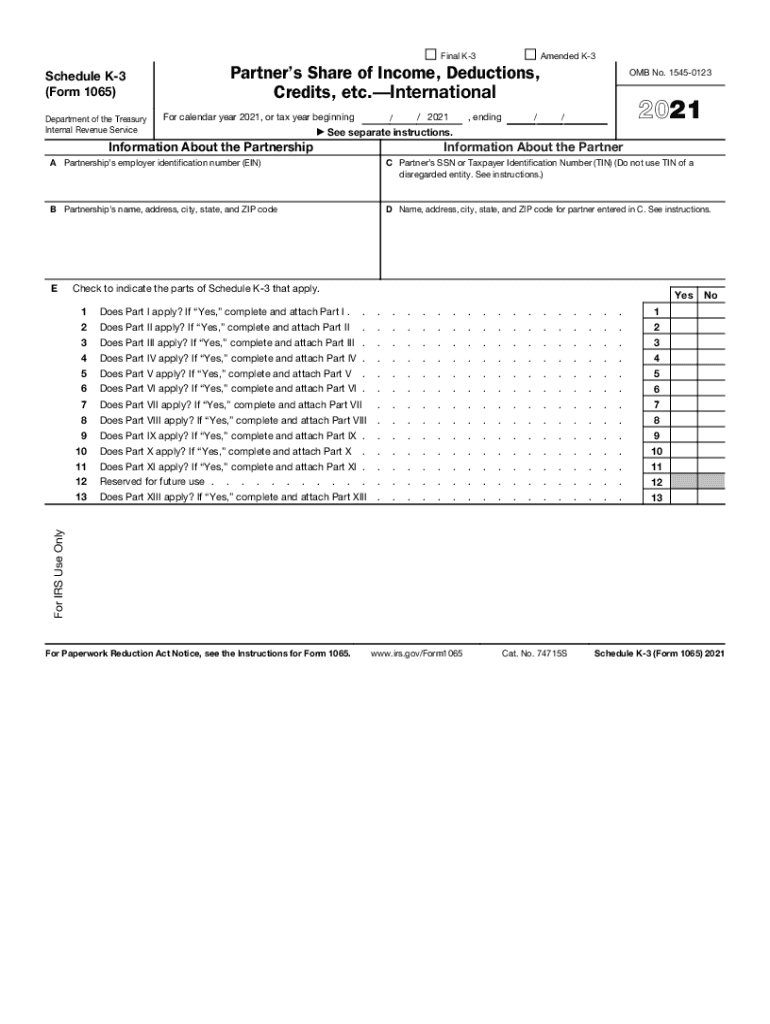

Schedule K 3 Fill Online, Printable, Fillable, Blank pdfFiller

It’s generally used to report a partner’s or shareholder’s portion of the items reported on. International tax information to their partners, including. Detailed information is provided in specific instructions. Partnership’s name, address, city, state, and zip code. Detailed information is provided in specific instructions.

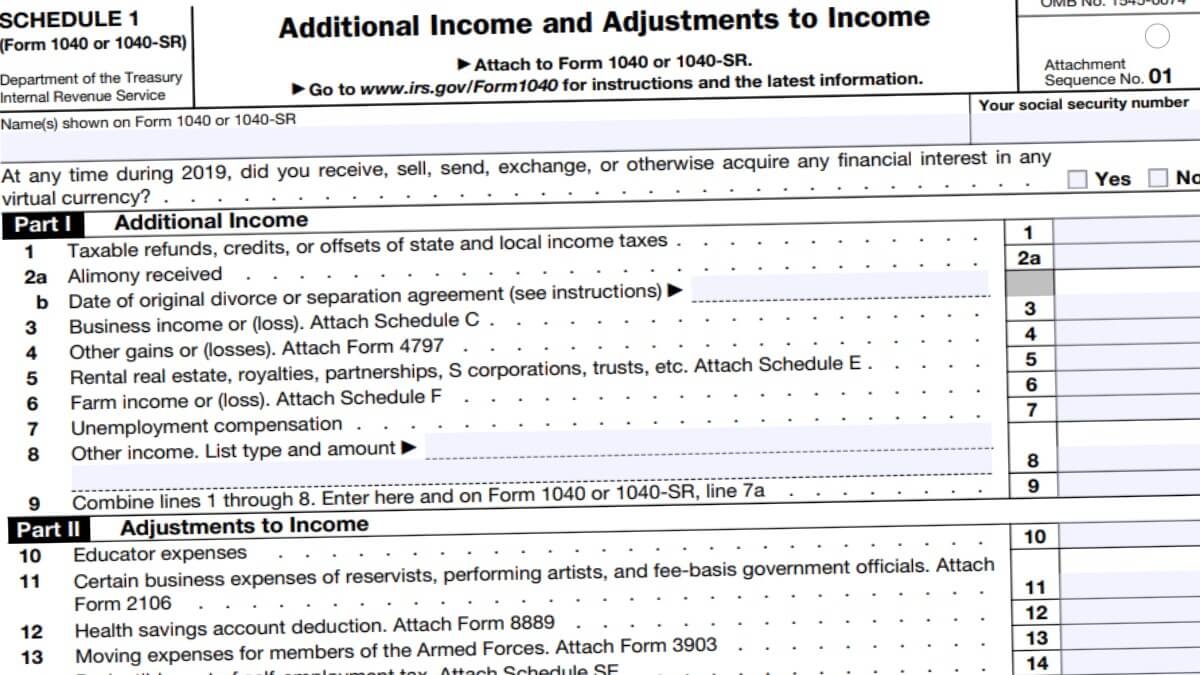

1040 Schedule 1 2021

Partnership’s name, address, city, state, and zip code. International tax information to their partners, including. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. Detailed information is provided in specific instructions. The percentage of ownership determines the amount.

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. Detailed information is provided in specific instructions. International tax information to their partners, including. The percentage of ownership determines the amount. Partnership’s name, address, city, state, and zip code.

schedule k1 instructions 1120s Fill Online, Printable, Fillable

Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. Detailed information is provided in specific instructions. The percentage of ownership determines the amount. Partnership’s employer identification number (ein) b. You must include this information on your tax or information.

Schedule k1 repayment of loans from shareholders COOKING WITH THE PROS

You must include this information on your tax or information returns, if. You must include this information on your tax or information. Web if the notification occurs before the partnership or s corporation files its return, the conditions for the filing relief are not met and the partnership or s corporation must. The percentage of ownership determines the amount. Partnership’s.

Return to School 2021 / Grades K 3 DVOA Sample Schedules

Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business. Detailed information is provided in specific instructions. The percentage of ownership determines the amount. Partnership’s name, address, city, state, and zip code. You must include this information on your tax or information.

Web If The Notification Occurs Before The Partnership Or S Corporation Files Its Return, The Conditions For The Filing Relief Are Not Met And The Partnership Or S Corporation Must.

Detailed information is provided in specific instructions. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. You must include this information on your tax or information. Web with schedule k, businesses must track each partner’s or stakeholder’s ownership or stake in the business.

International Tax Information To Their Partners, Including.

Partnership’s name, address, city, state, and zip code. The percentage of ownership determines the amount. Partnership’s employer identification number (ein) b. You must include this information on your tax or information returns, if.

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)