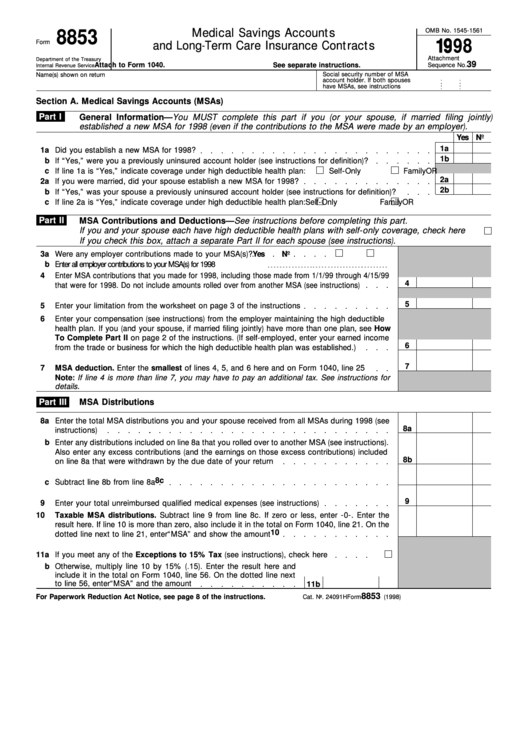

What Is Form 8853

What Is Form 8853 - Ad download or email irs 8853 & more fillable forms, register and subscribe now! Web the medical savings account deduction ( form 8853) is used by taxpayers to: Web health savings accounts (hsas) before you begin: Web under item f, check the box that corresponds with the s corporation's selected tax year. Web form 1040, u.s. Try it for free now! Report archer msa contributions (including employer contributions. Web use form 8853 to: Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Part i hsa contributions and.

Ad download or email irs 8853 & more fillable forms, register and subscribe now! Figure your archer msa deduction. Form 8853 p1 share my file with agent. Web use form 8853 to: Figure your archer msa deduction. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Web health savings accounts (hsas) before you begin: Web to claim an exclusion for accelerated death benefits made on a per diem or other periodic basis, you must file form 8853 with your return. Form 8853 is a tax form used to report distributions from certain designated roth accounts and to calculate the taxable portion of those distributions. Get ready for tax season deadlines by completing any required tax forms today.

It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web under item f, check the box that corresponds with the s corporation's selected tax year. Report archer msa contributions (including employer contributions. Ad download or email irs 8853 & more fillable forms, register and subscribe now! Web compensation (see instructions) from the employer maintaining the high deductible health plan. Web use form 8853 to: Try it for free now! Send tax file to agent. Figure your archer msa deduction. Part i hsa contributions and.

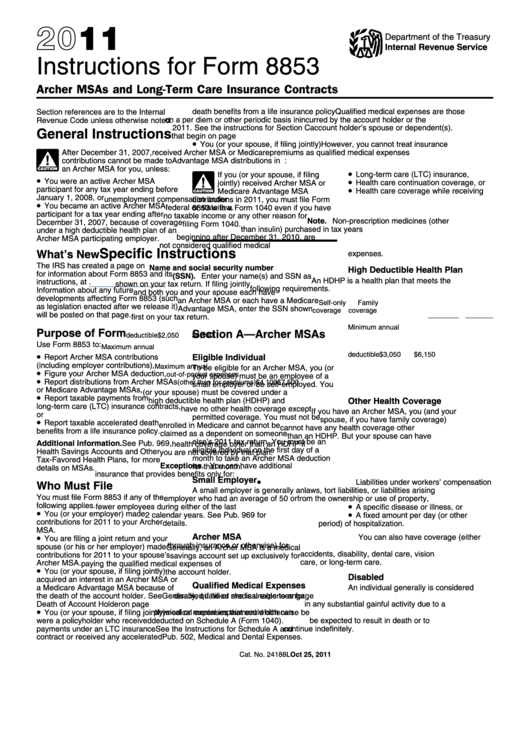

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Web compensation (see instructions) from the employer maintaining the high deductible health plan. You must file form 8853 if any of the following applies. Report archer msa contributions (including employer contributions) figure your archer msa. If box 2 or 4 is checked, provide the additional information about the. Web use form 8853 to:

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Web form 2553 is an irs form. Report archer msa contributions (including employer contributions) figure your archer msa. If box 2 or 4 is checked, provide the additional information about the. Report archer msa contributions (including employer contributions. Web health savings accounts (hsas) before you begin:

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Report archer msa contributions (including employer contributions. Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Form 8853 is the tax form. Try it for free now! Send tax file to agent.

Online IRS Form 8853 2018 2019 Fillable and Editable PDF Template

Form 8853 p1 share my file with agent. Report archer msa contributions (including employer contributions. Web to claim an exclusion for accelerated death benefits made on a per diem or other periodic basis, you must file form 8853 with your return. If using mac send tax file to turbotax agent did the information on this page answer. Report archer msa.

Form 8889 Health Savings Accounts (HSAs) (2014) Free Download

It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. If using mac send tax file to turbotax agent did the information on this page answer. If the corporation's principal business, office, or agency is located in. You must file form 8853 if any of the following applies. Ad download or email.

Instructions For Form 8853 2009 printable pdf download

Form 8853 p1 share my file with agent. Web use form 8853 to: Report archer msa contributions (including employer contributions. Form 8853 is the tax form. Web what is form 8853?

Fillable Form 8853 Medical Savings Accounts And LongTerm Care

Upload, modify or create forms. Similar to a health savings account, an archer medical savings account. Web form 2553 is an irs form. Send tax file to agent. Get ready for tax season deadlines by completing any required tax forms today.

Instructions For Form 8853 2011 printable pdf download

Send tax file to agent. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web form 8853 is the tax form used for reporting msa account withdrawals. Web the medical savings account deduction ( form 8853) is used by taxpayers to: If the corporation's principal business, office, or agency is located.

Form 8853 Archer MSAs and LongTerm Care Insurance Contracts (2014

Form 8853 is a tax form used to report distributions from certain designated roth accounts and to calculate the taxable portion of those distributions. Upload, modify or create forms. Web form 2553 is an irs form. Ad download or email irs 8853 & more fillable forms, register and subscribe now! Web what is form 8853?

Figure Your Archer Msa Deduction.

Figure your archer msa deduction. Web what is the form used for? Form 8853 p1 share my file with agent. Try it for free now!

Similar To A Health Savings Account, An Archer Medical Savings Account.

Upload, modify or create forms. Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Web form 8853 is the tax form used for reporting msa account withdrawals. Web form 2553 is an irs form.

You Must File Form 8853 If Any Of The Following Applies.

If the corporation's principal business, office, or agency is located in. If using mac send tax file to turbotax agent did the information on this page answer. Report archer msa contributions (including employer contributions) figure your archer msa. You don't have to file form 8853 to.

Web What Is Form 8853?

Web health savings accounts (hsas) before you begin: Web find mailing addresses by state and date for filing form 2553. Send tax file to agent. Report archer msa contributions (including employer contributions.