What Is Form 8919

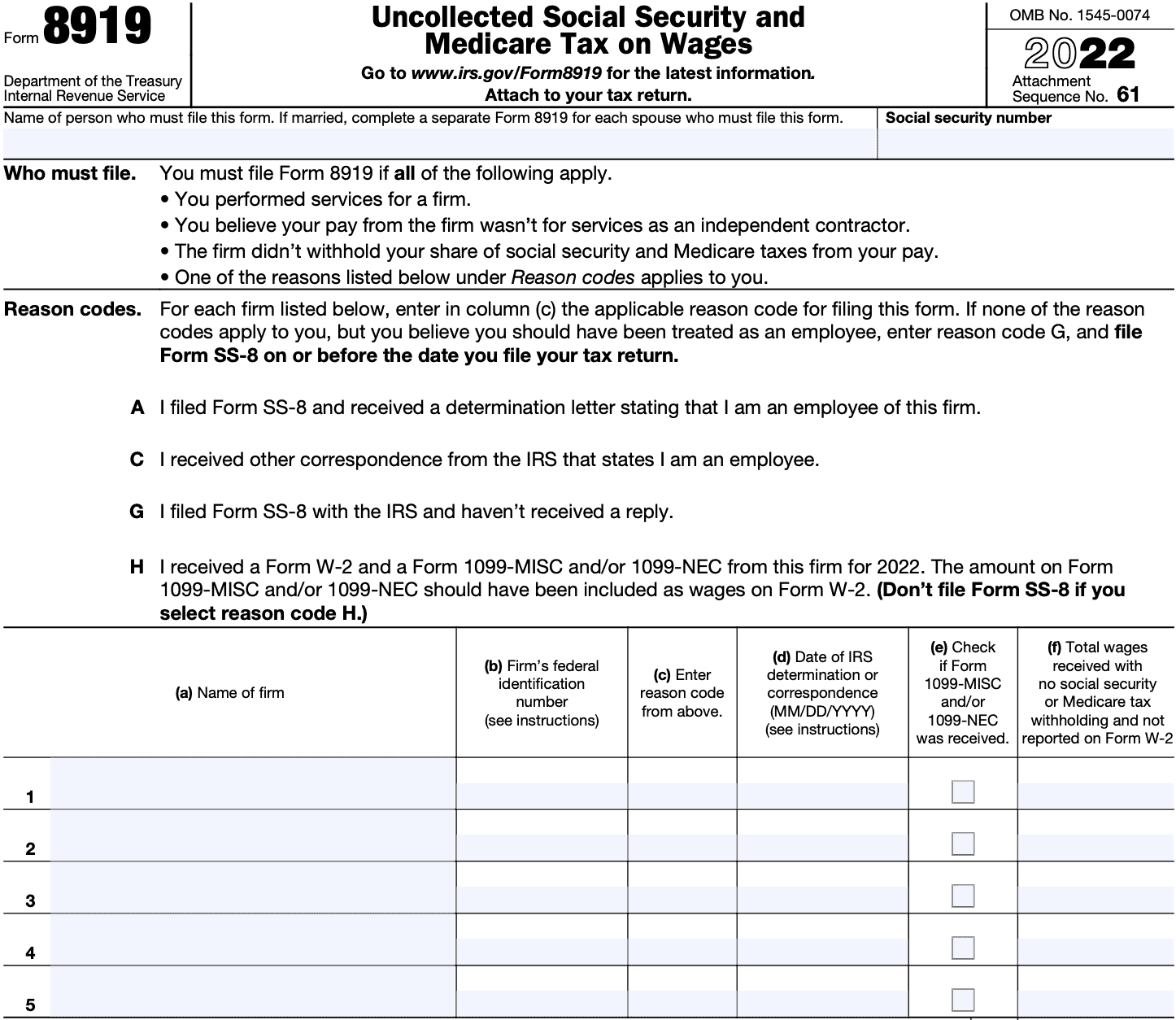

What Is Form 8919 - Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Use form 8919 to figure and.

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web name of person who must file this form. You performed services for a firm. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web what is irs form 8919? Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web why am i being asked to fill out form 8919? Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true:

Web what is irs form 8919? Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Community discussions taxes get your taxes done still need to file? Web name of person who must file this form. Our experts can get your taxes done right. Web form 8919 is a form that employees treated as independent contractors can use to report their share of uncollected social security and medicare taxes. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. The taxpayer performed services for an individual or a firm.

8919 Cobalt Glass Print Ltd.

Web why am i being asked to fill out form 8919? Our experts can get your taxes done right. Use form 8919 to figure and. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Irs form 8819, uncollected social security and medicare tax on.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Our experts can get your taxes done right. Web what is irs form 8919? Web why am i being asked to fill out form 8919? Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web name of person.

IRS Form 8919 Uncollected Social Security & Medicare Taxes

Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Our experts can get your taxes done right. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web what is irs form 8919? Web form 8919 is a solution for.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Irs form 8819, uncollected social security and.

Fill Free fillable F8919 Accessible 2019 Form 8919 PDF form

Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web why am i being asked to fill out form 8919? Use form 8919 to figure and. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form.

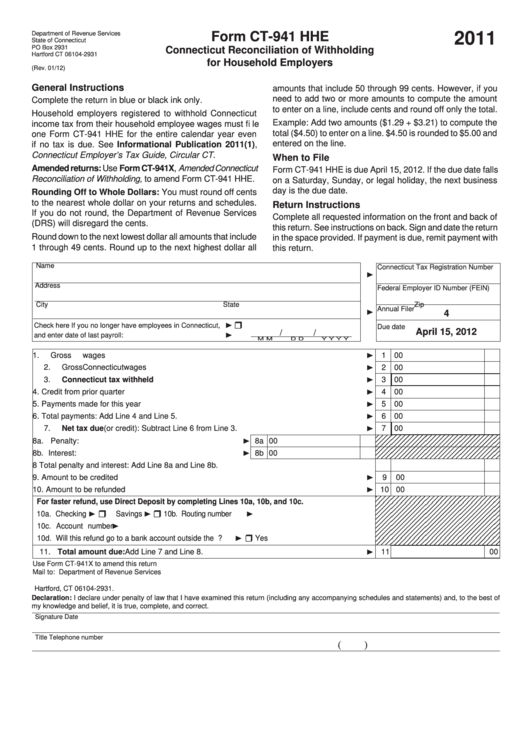

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

Use form 8919 to figure and. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Community discussions taxes get your taxes done still need to file? Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is.

1099 Form Independent Contractor Pdf / Do You Need a W2 Employee or a

Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web name of person who must file this form. You performed services for a firm. Web form 8919.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Use form 8919 to figure and. Web why.

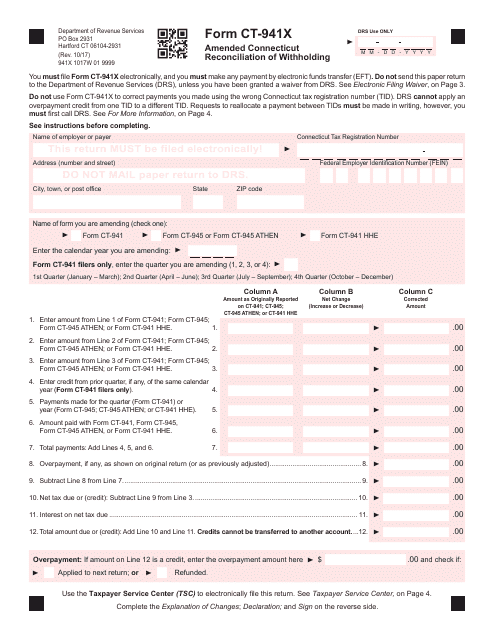

Form CT941X Download Printable PDF or Fill Online Amended Connecticut

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: You performed services for a firm. Community discussions taxes get your taxes done still need to file? Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor,.

Use Form 8919 To Figure And.

Web name of person who must file this form. You performed services for a firm. Our experts can get your taxes done right. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.

Community Discussions Taxes Get Your Taxes Done Still Need To File?

If married, complete a separate form 8919 for each spouse who must file this form. Web what is irs form 8919? Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. The taxpayer performed services for an individual or a firm.

Web Why Am I Being Asked To Fill Out Form 8919?

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Form 8919 is used to calculate and report your share of the uncollected social security and medicare taxes due on your compensation if you. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like.

Web Form 8919 Is A Form That Employees Treated As Independent Contractors Can Use To Report Their Share Of Uncollected Social Security And Medicare Taxes.

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare.