What Is Tax Form 944

What Is Tax Form 944 - File form 944 only once for each calendar year. If you filed form 944 electronically, don't file a paper form 944. Employers can fill out a 944 form to inform the irs about their payroll tax responsibilities. The form helps both the employer and the irs keep track of how much income tax and federal insurance contribution act (fica) tax that employer owes to. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web form 944 for 2022: Employer’s annual federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address omb no. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and before

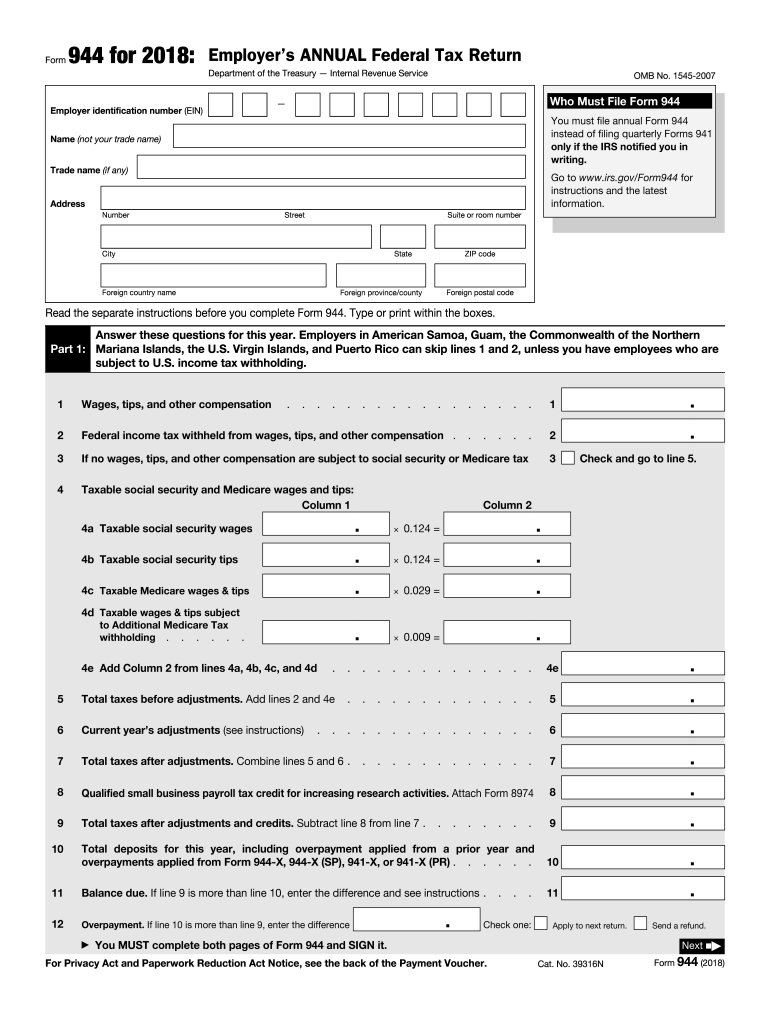

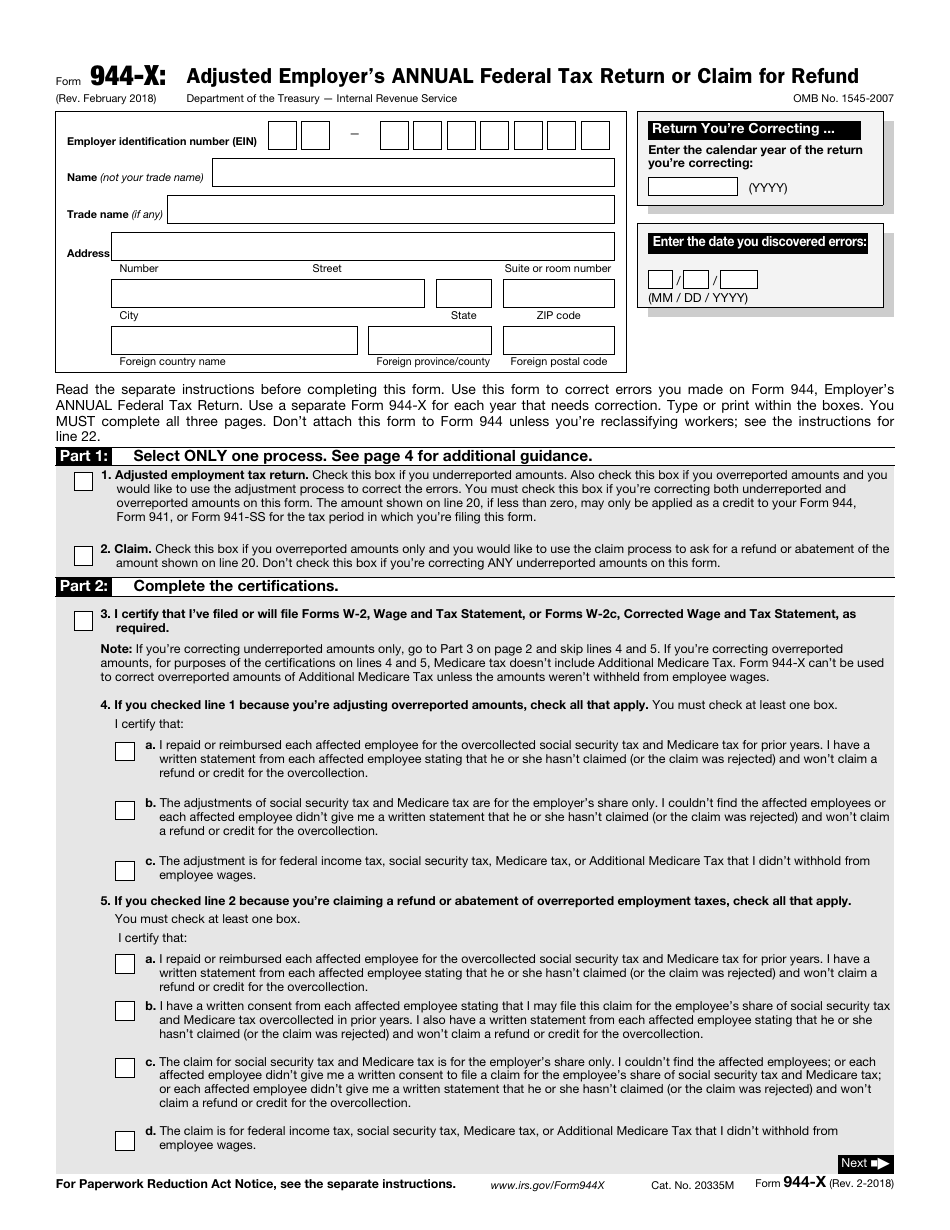

Web irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. Like form 941, it’s used to report your employer and employee social security and medicare taxes, plus employee federal income tax. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Web form 944 is a method that certain employers use to report payroll tax information to the irs. The irs notifies you by letter if you’re required to file this form instead of the 941. Web form 944 for 2021: Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Use this form to correct errors on a form 944 that you previously filed. You’ll file this form with the irs annually. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages.

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. Use this form to correct errors on a form 944 that you previously filed. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and before If you filed form 944 electronically, don't file a paper form 944. Web irs form 944 is the employer's annual federal tax return. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Web form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Employer’s annual federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address omb no. Web form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. The form helps both the employer and the irs keep track of how much income tax and federal insurance contribution act (fica) tax that employer owes to.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

File form 944 only once for each calendar year. Web irs form 944 is the employer's annual federal tax return. Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter..

Form 944SS Employer's Annual Federal Tax Return Form (2011) Free

Web for 2022, file form 944 by january 31, 2023. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web form 944.

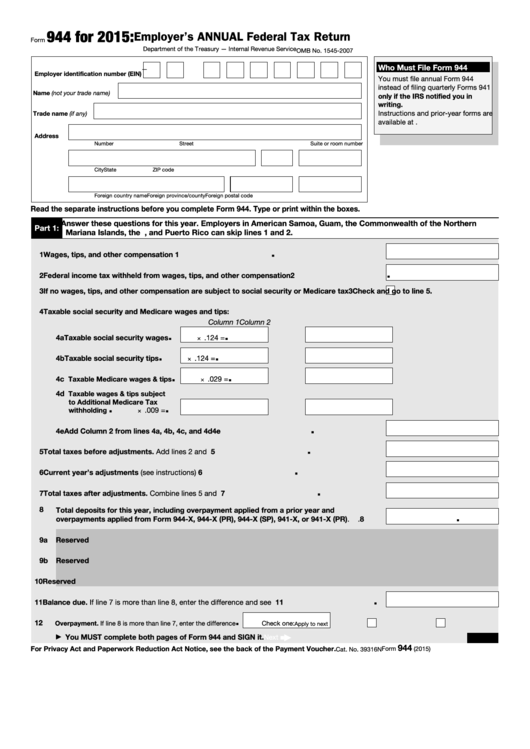

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability..

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Employer’s annual federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address omb no. The irs notifies you by letter if you’re required to file this form instead of the 941. Small business owners also use irs form 944 to calculate and report their.

Form 944 Internal Revenue Code Simplified

Who needs to file form 944? You’ll file this form with the irs annually. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. What's new social security and medicare tax for 2022. This form is designed specifically for very small businesses with a tax liability of $1,000 or less.

Form 944 Fill Out and Sign Printable PDF Template signNow

Web generally, employers are required to file forms 941 quarterly. Web form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Like form 941, it’s used to report your employer and employee social security and medicare taxes, plus employee federal income tax. Web form 944 is designed so the smallest employers (those whose annual.

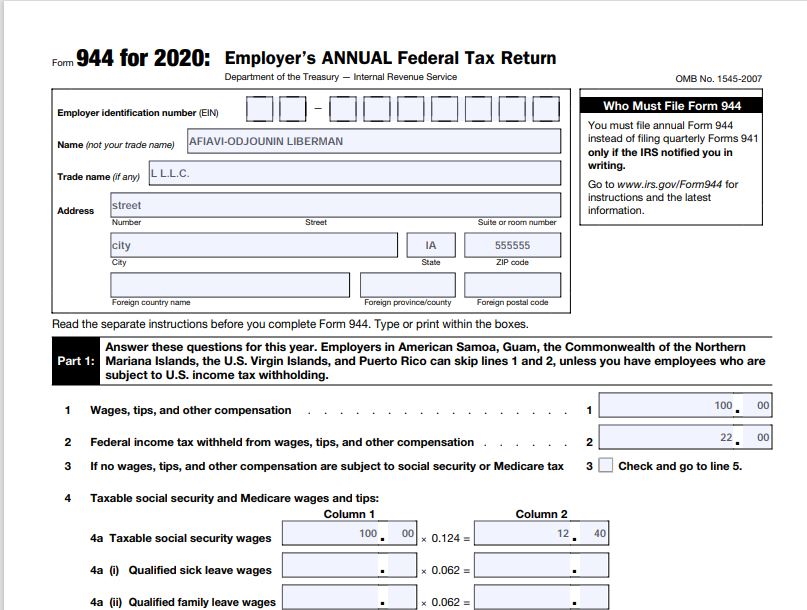

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Web form 944 for 2021: Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s paychecks. You’ll file this form with the irs annually. Web form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. Web about.

IRS Form 944x Download Fillable PDF or Fill Online Adjusted Employer's

Web form 944 for 2022: Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you may be eligible to update your filing requirement to form 941,. Web irs form 944 becomes the mechanism to pay these taxes, taking the place of.

Form 944 [Definition, Instructions, & FAQs]

Employer’s annual federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address omb no. Employers can fill out a 944 form to inform the irs about their payroll tax responsibilities. Like form 941, it’s used to report your employer and employee social security and.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

The form helps both the employer and the irs keep track of how much income tax and federal insurance contribution act (fica) tax that employer owes to. Web for 2022, file form 944 by january 31, 2023. File form 944 only once for each calendar year. Web generally, employers are required to file forms 941 quarterly. Employers who use form.

These Responsibilities Include Reporting Their Employees’ Wages And The Amount Of Payroll Taxes Withheld From Their Paychecks, Including:

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. Who qualifies for form 944 if you would like to file form 941 instead of 944, you will need to call the irs or send a written letter. See the instructions for form 944 for more information. The irs notifies you by letter if you’re required to file this form instead of the 941.

Web Form 944 Is Designed So The Smallest Employers (Those Whose Annual Liability For Social Security, Medicare, And Withheld Federal Income Taxes Is $1,000 Or Less) Will File And Pay These Taxes Only Once A Year Instead Of Every Quarter.

Web irs form 944 is the employer's annual federal tax return. This form is designed specifically for very small businesses with a tax liability of $1,000 or less. Form 944 is to report the payroll taxes annually rather than quarterly (for which form 941 is used). Web irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941.

Web Forms 941 And 944 Are The Two Forms That Employers Use To Report Employee Wage And Payroll Tax Information To The Irs.

Web for 2022, file form 944 by january 31, 2023. What's new social security and medicare tax for 2022. What is the difference between form 941 and 944? Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes.

Form 944 Is Designed So The Smallest Employers (Those Whose Annual Liability For Social Security, Medicare, And Withheld Federal Income Taxes Is $1,000 Or Less) Will File And Pay These Taxes Only Once A Year Instead Of Every Quarter.

Web form 944 for 2022: If you filed form 944 electronically, don't file a paper form 944. Web simply put, form 944 is a document the irs requires some employers to file annually. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941.

![Form 944 [Definition, Instructions, & FAQs]](https://www.thesmbguide.com/images/form-944-1024x512-20191024.png)