What Is The Extended Due Date For Form 1041

What Is The Extended Due Date For Form 1041 - You will have 10 calendar days after the initial date on which a form 1041. Web (without regard to any extensions). Web the due date to file a form 1041 extension is the same as the actual due date of the 1041 return. Web 15th day of the 5th month following the end of the organization’s taxable year. Web individuals and families. Form 1040, 1040a, or 1040ez. The calendar year 2021 due dates for tax year 2020 tax returns is now available. If you file on a fiscal year basis (a year ending on the last day of. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. I.e., april 18, 2023, for the trusts and estates following a calendar tax year.

Expresstaxexempt | april 14, 2021. If you file on a fiscal year basis (a year ending on the last day of. The 15th day of the 4th month after the end of the tax year for the return. You will have 10 calendar days after the initial date on which a form 1041. Since april 15 falls on a saturday, and emancipation day. Web a 1041 extension must be filed no later than midnight on the normal due date of the return: Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. The calendar year 2021 due dates for tax year 2020 tax returns is now available. Web the due date to file a form 1041 extension is the same as the actual due date of the 1041 return. I.e., april 18, 2023, for the trusts and estates following a calendar tax year.

The extension request will allow a 5 1/2. Web an extension of 1041 must be filed by midnight on the regular date for filing the tax return: April 18, 2023 the due date for filing your calendar year return. Form 1040, 1040a, or 1040ez. Web december 22, 2020 mark your calendars! Web 15th day of the 5th month following the end of the organization’s taxable year. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. Expresstaxexempt | april 14, 2021.

estate tax return due date 2021 Swingeing Vlog Photographs

Web 1 best answer. Expresstaxexempt | april 14, 2021. Web december 22, 2020 mark your calendars! April 18, 2023 the due date for filing your calendar year return. Web what is the due date for irs form 1041?

Due date for filing of TDS statement extended to 10th July 2019 Due

Web december 22, 2020 mark your calendars! Web individuals and families. 15th day of the 5th month following the end of the organization’s taxable year or file for a. Web 15th day of the 5th month following the end of the organization’s taxable year. You will have 10 calendar days after the initial date on which a form 1041.

Form 1041 Extension Due Date 2019 justgoing 2020

If you file on a fiscal year basis (a year ending on the last day of. Web (without regard to any extensions). You will have 10 calendar days after the initial date on which a form 1041. Since april 15 falls on a saturday, and emancipation day. Form 1040, 1040a, or 1040ez.

Extended Due Dates for Library Items Library News

Web a 1041 extension must be filed no later than midnight on the normal due date of the return: For fiscal year estates and trusts,. The calendar year 2021 due dates for tax year 2020 tax returns is now available. Web what is the due date for irs form 1041? Whenever a regular tax filing date falls on.

Due Date Extended Archives Onlineideation

Whenever a regular tax filing date falls on. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. Web revenue secretary sanjay malhotra recently said that there have been no considerations for a deadline extension.

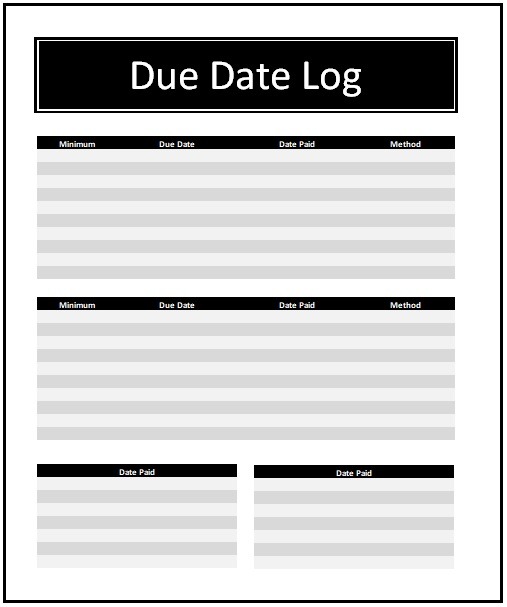

Due Date Log Templates 6+ Free Printable Word & Excel Samples

Web (without regard to any extensions). The 15th day of april, the 4th month following the conclusion for the. Web 15th day of the 5th month following the end of the organization’s taxable year. Since april 15 falls on a saturday, and emancipation day. The irs and the u.s.

SLT Adapting to New Federal Tax Returns Due Dates in New York The

Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web individuals and families. Web a trust or estate with a tax year that ends june 30 must file by.

CBDT Extended 15G & 15H Form Due Date to COVID19 Crises SAG Infotech

Web if the taxpayer requests an extended due date of more than 6 months (5 1 / 1 months for extension requests for form 1041 trust and form 1041 (other than bankruptcy estate)). Web revenue secretary sanjay malhotra recently said that there have been no considerations for a deadline extension beyond july 31, 2023. Expresstaxexempt | april 14, 2021. Web.

Due Date for furnishing FORM GSTR1 for April 2021 extended amid COVID19

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web the due date to file a form 1041 extension is the same as the actual due date of the 1041 return. For fiscal year estates and trusts,. 15th day of the 5th month following the end of the organization’s taxable year or file for a. Web individuals.

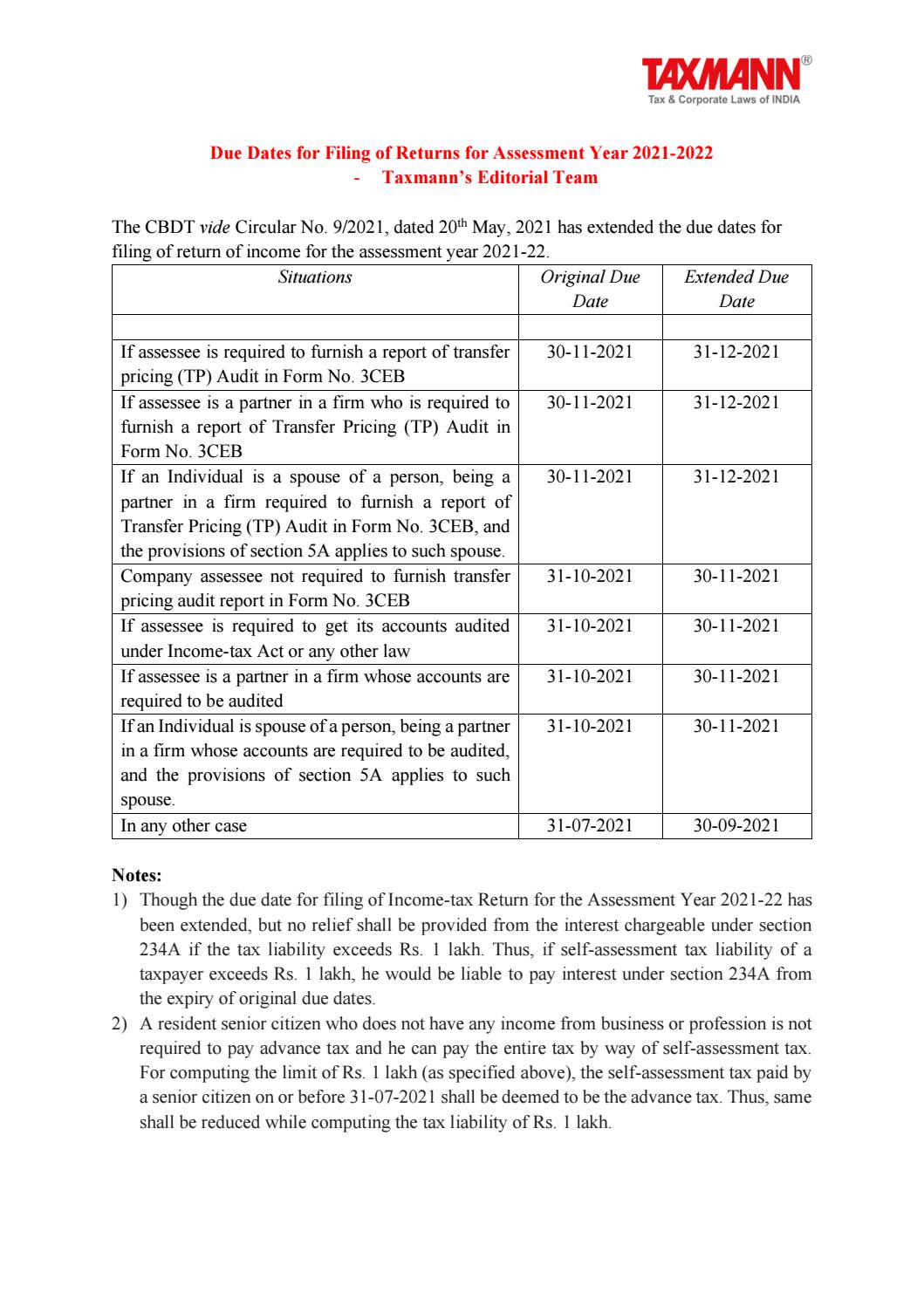

Extended Due Dates for Filing ITR for A.Y. 202122 by Taxmann Issuu

Web if the taxpayer requests an extended due date of more than 6 months (5 1 / 1 months for extension requests for form 1041 trust and form 1041 (other than bankruptcy estate)). For fiscal year estates and trusts,. If you file on a fiscal year basis (a year ending on the last day of. The original due date of.

Expresstaxexempt | April 14, 2021.

For fiscal year estates and trusts,. Web if the taxpayer requests an extended due date of more than 6 months (5 1 / 1 months for extension requests for form 1041 trust and form 1041 (other than bankruptcy estate)). The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. 15th day of the 5th month following the end of the organization’s taxable year or file for a.

Annual Personal Income Tax Filings (Form 1040) Due Tuesday, April 18, 2023.

Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. For fiscal year estates, file form 1041 by the 15th day of the 4th month. The 15th day of the 4th month after the end of the tax year for the return. The late filing penalty is 5% of the tax due for each month or.

The Calendar Year 2021 Due Dates For Tax Year 2020 Tax Returns Is Now Available.

Web 15th day of the 5th month following the end of the organization’s taxable year. Since april 15 falls on a saturday, and emancipation day. Form 1040, 1040a, or 1040ez. The 15th day of april, the 4th month following the conclusion for the.

Web (Without Regard To Any Extensions).

The extension request will allow a 5 1/2. April 18, 2023 the due date for filing your calendar year return. Web what is the due date for irs form 1041? Web individuals and families.

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)