What Is Total Tax Liability On Form 4868

What Is Total Tax Liability On Form 4868 - Web here are three ways to estimate your taxes for form 4868. Web enter the total amount that you plan to pay with your extension. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. Your total liability would also include any balances. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Your tax liability minus your tax payments would be the total balance due on your return. 1 min read to estimate your taxes due/balance owed, you can do either of these: Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Citizen or resident files this form to request an. Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability.

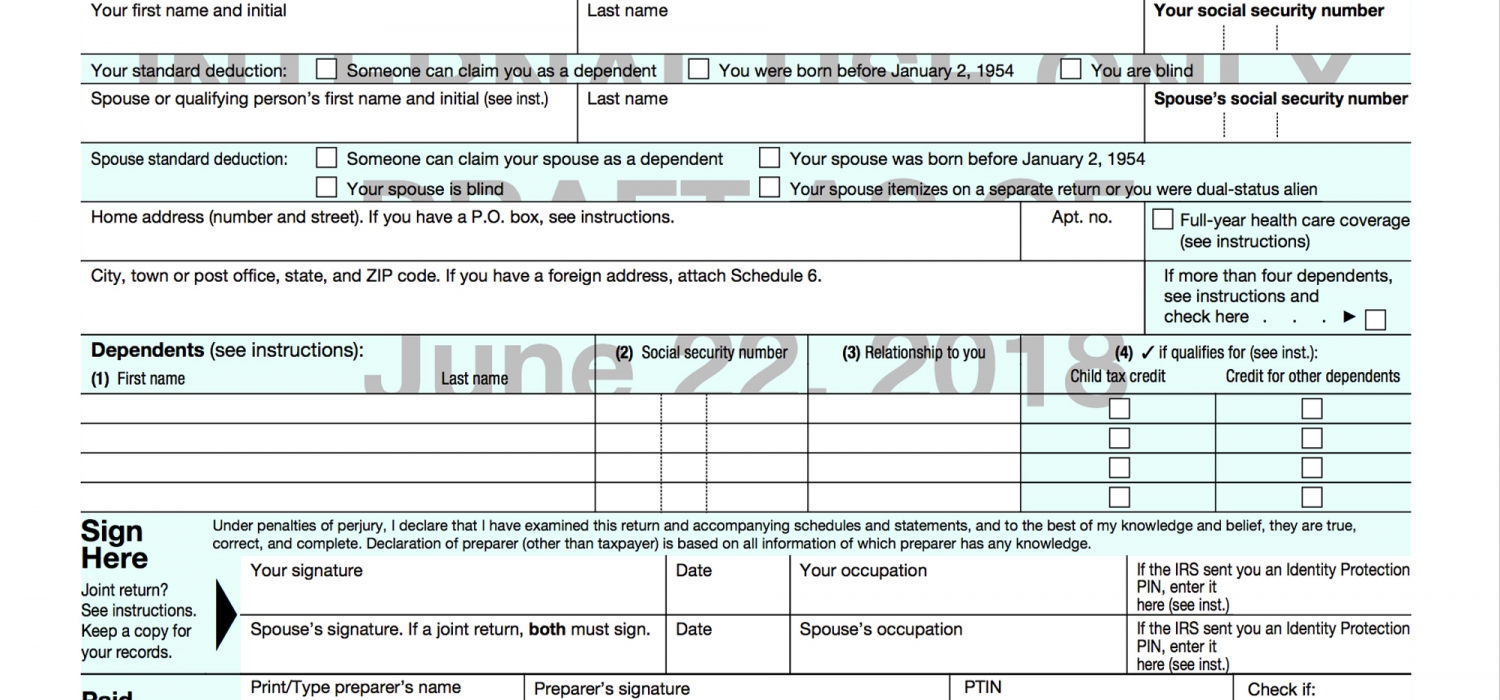

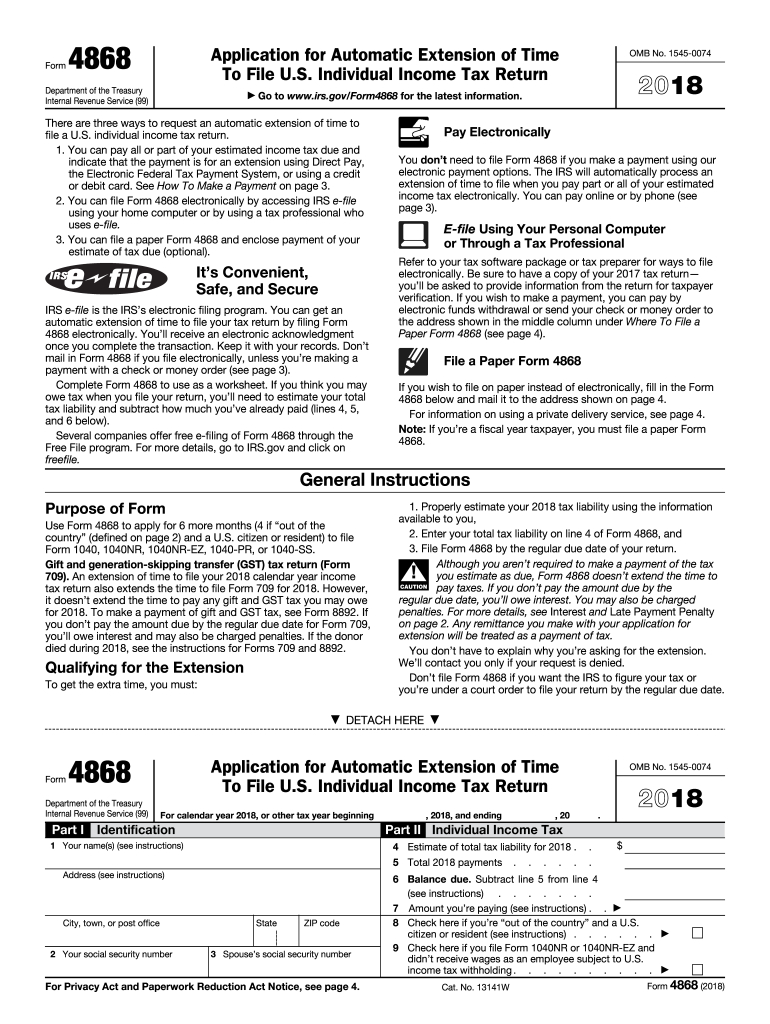

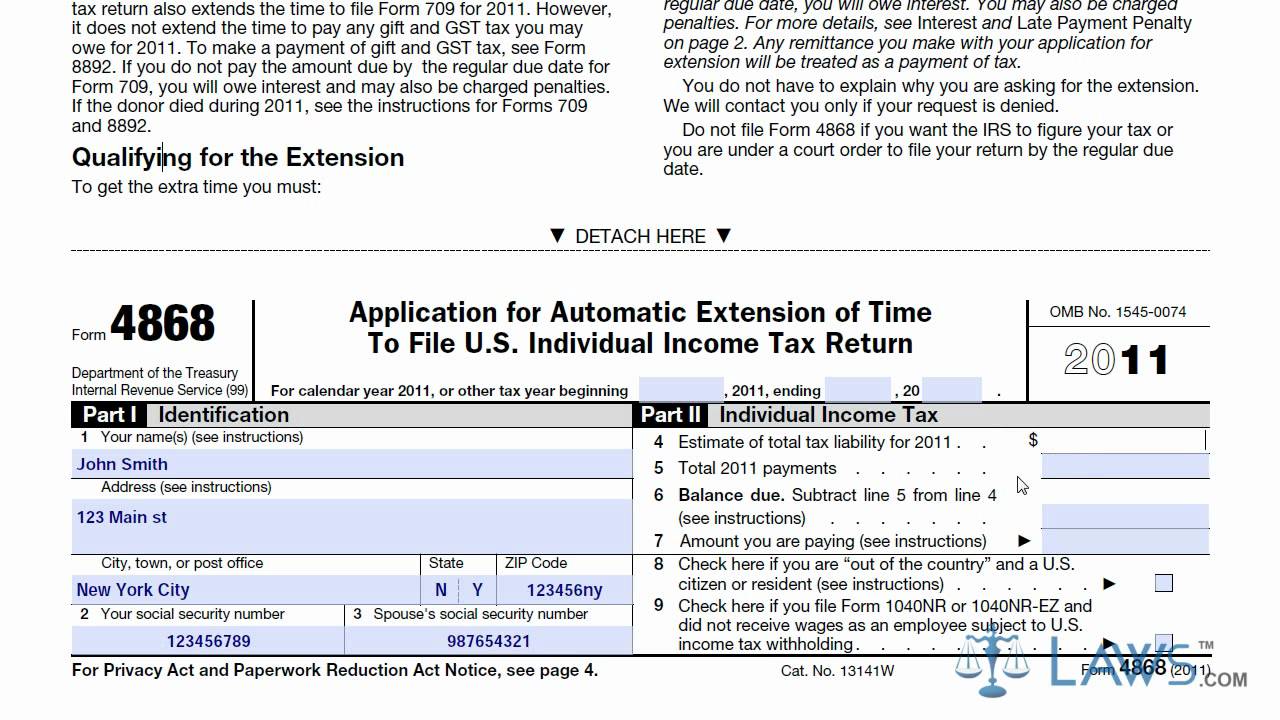

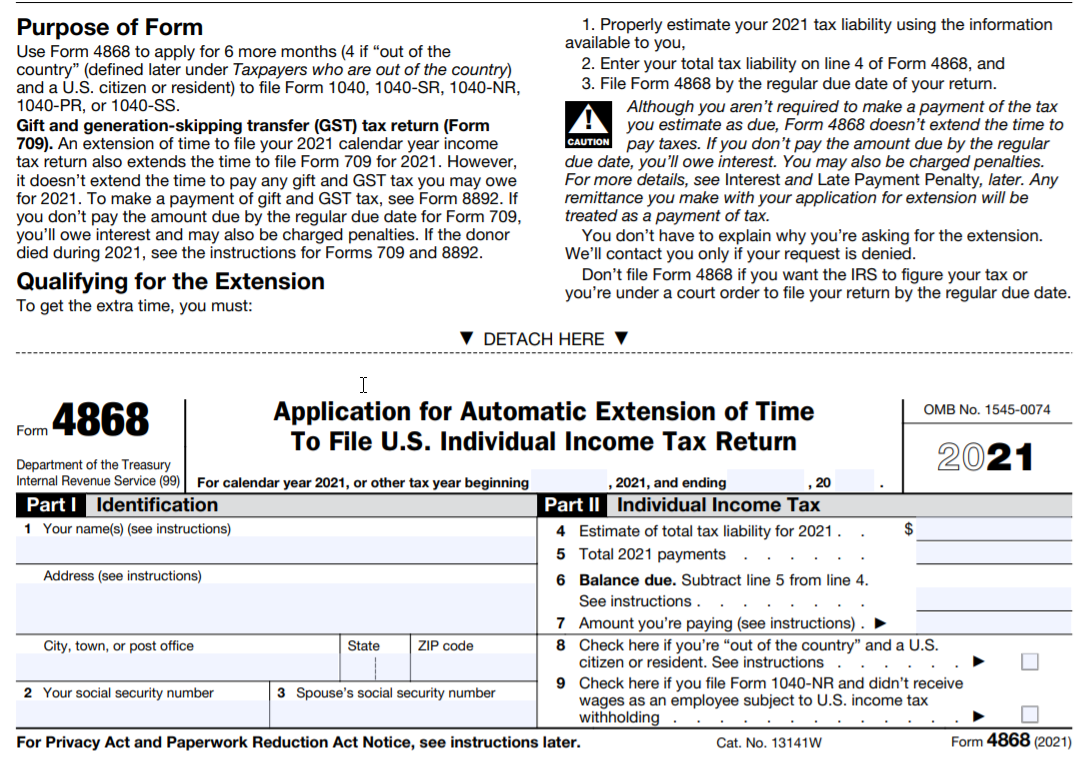

Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). Individual income tax return,” is a form that taxpayers can file with the irs if. Web in case you need more time to file your 1040 tax return, you can use form 4868, application for automatic extension of time to file u.s. Web here are three ways to estimate your taxes for form 4868. 1 min read to estimate your taxes due/balance owed, you can do either of these: Use the estimated tax worksheet in the instructions for. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information: Web enter the total amount that you plan to pay with your extension. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. In general, when people refer to this term they’re.

Web the estimate of your total tax liability (the amount that your preliminary calculations indicate you must pay for the year) the total of any payments you've already. Individual income tax return,” is a form that taxpayers can file with the irs if. Below, find an example of the latest available form 4868. Web solved•by turbotax•1276•updated 1 month ago. 1 min read to estimate your taxes due/balance owed, you can do either of these: Web here are three ways to estimate your taxes for form 4868. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information: If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Web how do i estimate extension tax liability?

IRS Form 4868 Online File 2020 IRS 4868

Web solved•by turbotax•1276•updated 1 month ago. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Web how do i estimate extension tax liability? This.

FREE 11+ Sample General Liability Forms in PDF MS Word Excel

Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. 1 min read to estimate your.

E File Tax Form 4868 Online Universal Network

Web in case you need more time to file your 1040 tax return, you can use form 4868, application for automatic extension of time to file u.s. Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6.

It’s About Your Total Tax Liability, Not Your Refund Tax Policy Center

Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. Below, find an example of the latest available form 4868. Web the definition of tax liability is the amount of money or debt, an individual or entity owes in taxes to the government..

Know about IRS tax extension Form 4868 TaxEz

Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web enter the total amount that you plan to pay with your extension. Web solved•by turbotax•1276•updated 1 month ago. Web how do i estimate extension tax liability? Web if you think you may owe tax when you file your.

Tax Withholding Brackets 2020

Web solved•by turbotax•1276•updated 1 month ago. Below, find an example of the latest available form 4868. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Web if you think you may owe tax when you file your return, you’ll need to estimate.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Citizen or resident files this form to request an. In general, when people refer to this term they’re. Below, find an example of the latest available form 4868. Web the definition of tax liability is the amount of money or debt, an individual or entity owes in taxes to the government. Web enter the total amount that you plan to.

Learn How to Fill the Form 4868 Application for Extension of Time To

Web here are three ways to estimate your taxes for form 4868. Your tax liability minus your tax payments would be the total balance due on your return. Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web the definition of tax liability is the amount of money.

How to File a Tax Extension? ZenLedger

Web here are three ways to estimate your taxes for form 4868. Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web the estimate of your total tax liability (the amount that your preliminary calculations indicate you must pay for the year) the total of any payments you've.

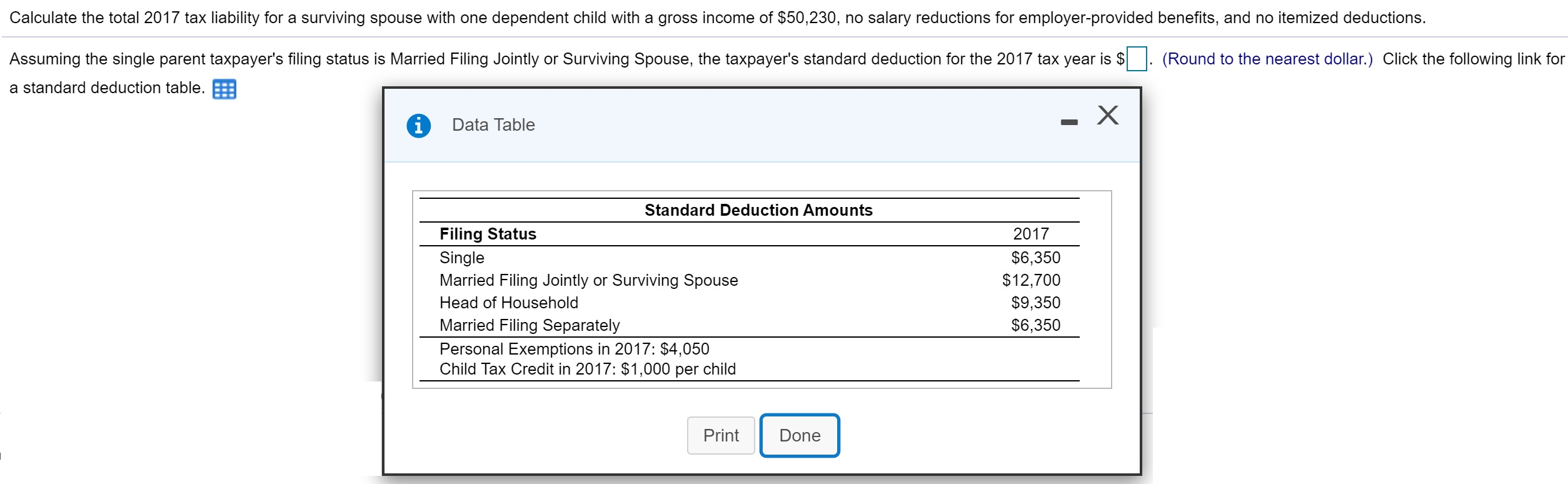

Solved Calculate the total 2017 tax liability for a

Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information: Web solved•by turbotax•1276•updated 1 month ago. 1 min read to estimate your taxes due/balance owed, you can do either of these: Web the form will ask you to estimate how much you think you'll owe and to.

Estimate Your Overall Tax Liability.

If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Web enter the total amount that you plan to pay with your extension. Web here are three ways to estimate your taxes for form 4868. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information:

1 Min Read To Estimate Your Taxes Due/Balance Owed, You Can Do Either Of These:

Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Web how do i estimate extension tax liability? Web solved•by turbotax•1276•updated 1 month ago. Web the definition of tax liability is the amount of money or debt, an individual or entity owes in taxes to the government.

Use The Estimated Tax Worksheet In The Instructions For.

Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. Individual income tax return,” is a form that taxpayers can file with the irs if. This amount will be shown on your tax form.

Web Form 4868, Also Known As An “Application For Automatic Extension Of Time To File U.s.

Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). Citizen or resident files this form to request an. Your total liability would also include any balances. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and.