When Is Form 2290 Due For 2023

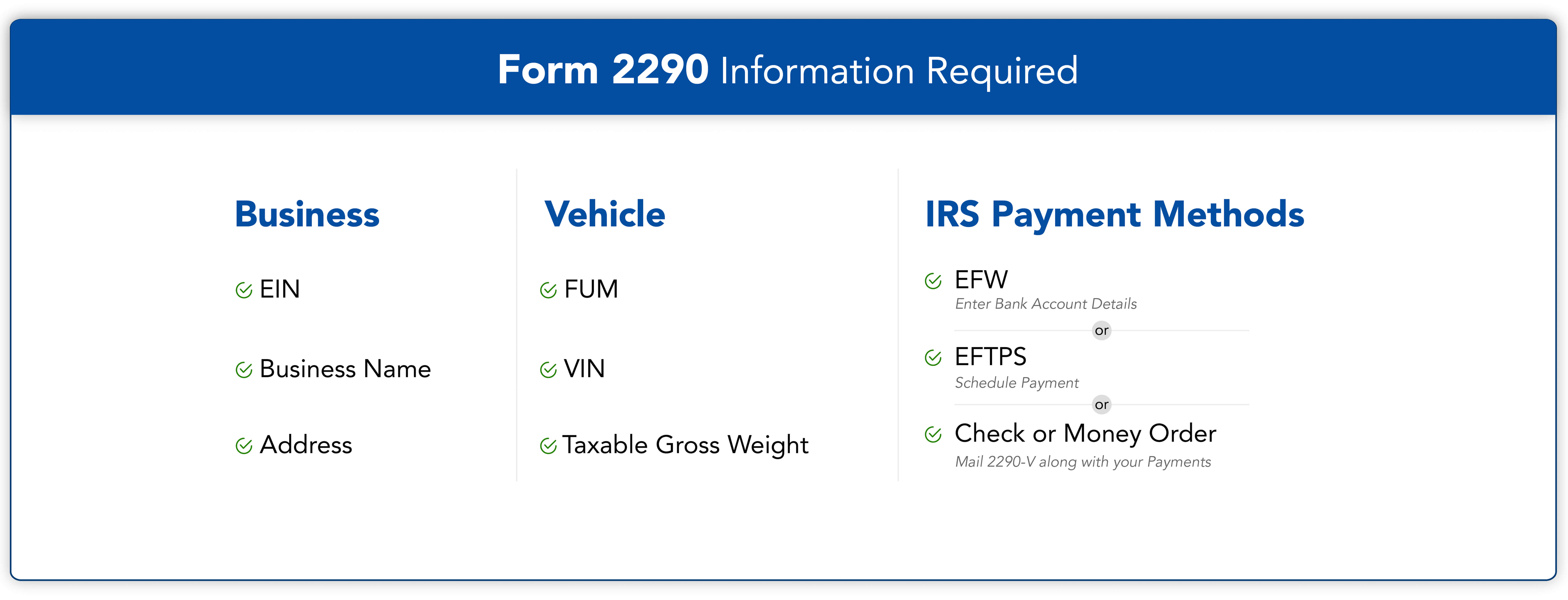

When Is Form 2290 Due For 2023 - Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Form 2290 is due on the last day of the month following the vehicle's first use month. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024. This revision if you need to file a return for a tax period that began on or before june 30, 2023. If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Web form 2290 due dates and extended due dates for tax year 2023 Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. The current period begins july 1, 2023, and ends june 30, 2024.

If you fail to file by this date, you may be subject to penalties and interest on any taxes owed. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. Form 2290 due dates for vehicles first used on public. Web form 2290 due dates and extended due dates for tax year 2023 If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. To obtain a prior revision of form 2290 and its separate instructions, visit. The current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024.

Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. What is the irs form 2290 due date? Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Form 2290 is due on the last day of the month following the vehicle's first use month. The current period begins july 1, 2023, and ends june 30, 2024. To obtain a prior revision of form 2290 and its separate instructions, visit. If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Web form 2290 due dates and extended due dates for tax year 2023

IRS Form 2290 Due Date For 20222023 Tax Period

To obtain a prior revision of form 2290 and its separate instructions, visit. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Tax computation for privately purchased used vehicles Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june.

Irs 8962 form 2018 Brilliant 50 Beautiful Printable 2290 form Wallpaper

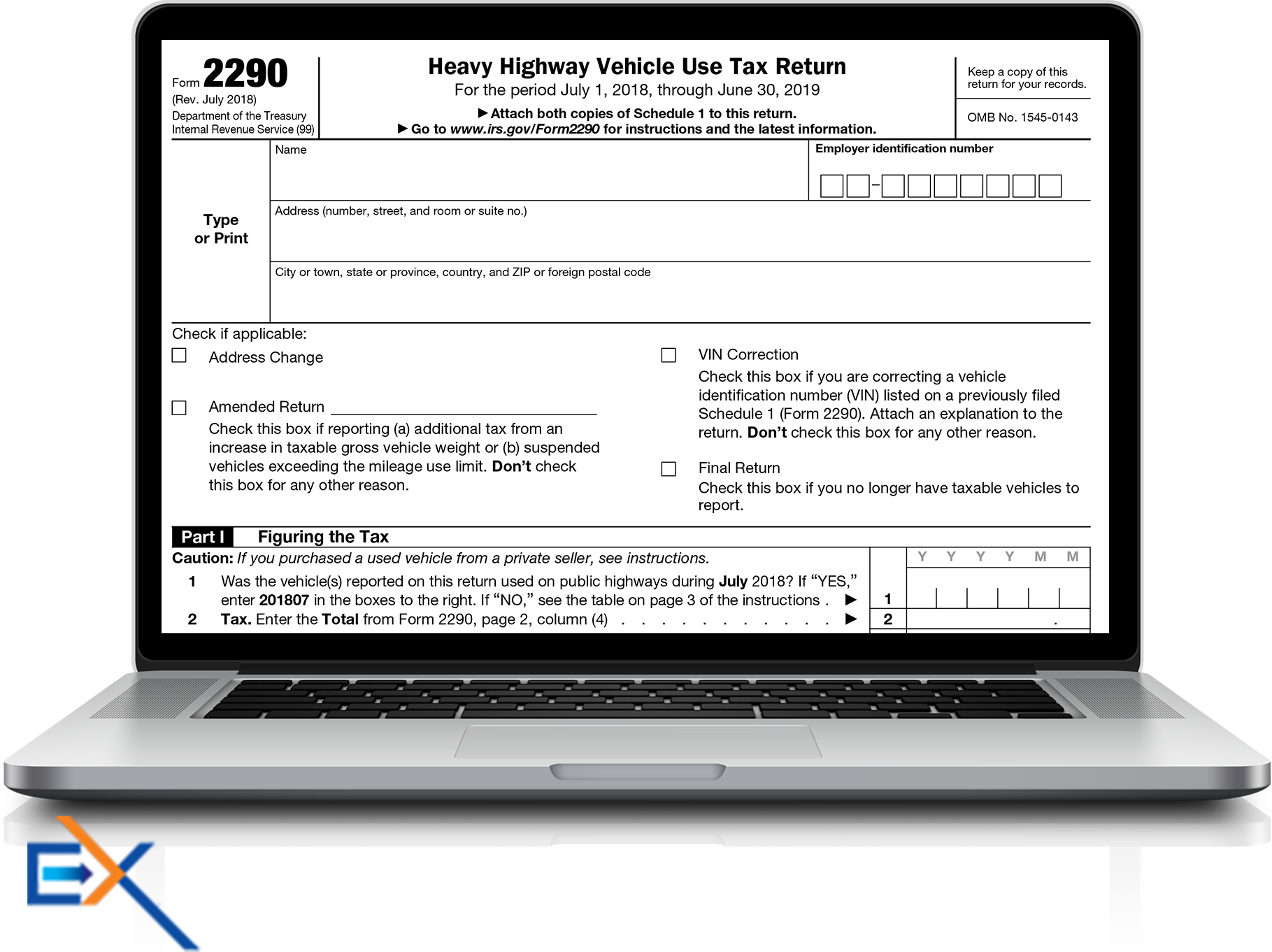

Web form 2290 due dates and extended due dates for tax year 2023 Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Form 2290 due dates for vehicles first used on public. Web this july 2023 revision is for the tax period beginning on july 1, 2023,.

PreFile 2290 Form Online for 20222023 Tax Year & Pay HVUT Later

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Form.

Irs Form 2290 Printable Form Resume Examples

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Web this july 2023 revision is for.

20232024 Form 2290 Generator Fill, Create & Download 2290

The current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024. If you fail to file by.

File IRS 2290 Form Online for 20222023 Tax Period

The current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Web form 2290.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Form 2290 is due on the last day of the month following the vehicle's first use month. Form 2290 due dates for vehicles first.

IRS Form 2290 Due Date For 20232024 Tax Period

To obtain a prior revision of form 2290 and its separate instructions, visit. Web form 2290 due dates and extended due dates for tax year 2023 What is the irs form 2290 due date? Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. The current period begins july 1, 2023, and ends june.

IRS Form 2290 Instructions for 20222023

If the due date falls on a saturday, sunday or any federal holidays, you should file form 2290. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Form 2290 must be filed by the last day of the month following the month of first use (as shown in.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

If you are still using the same truck as last year, august 31 will be the due date for each tax period. If the due date falls on a saturday, sunday or any federal holidays, you should file form 2290. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024. Form.

Web This July 2023 Revision Is For The Tax Period Beginning On July 1, 2023, And Ending On June 30, 2024.

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Web form 2290 due dates and extended due dates for tax year 2023 It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024.

The Current Period Begins July 1, 2023, And Ends June 30, 2024.

To obtain a prior revision of form 2290 and its separate instructions, visit. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Form 2290 Due Dates For Vehicles First Used On Public.

If the due date falls on a saturday, sunday or any federal holidays, you should file form 2290. If you fail to file by this date, you may be subject to penalties and interest on any taxes owed. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31.

Web Information About Form 2290, Heavy Highway Vehicle Use Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. If you are still using the same truck as last year, august 31 will be the due date for each tax period. Form 2290 is due on the last day of the month following the vehicle's first use month. Tax computation for privately purchased used vehicles