Where Do I File Form 7004 Extension

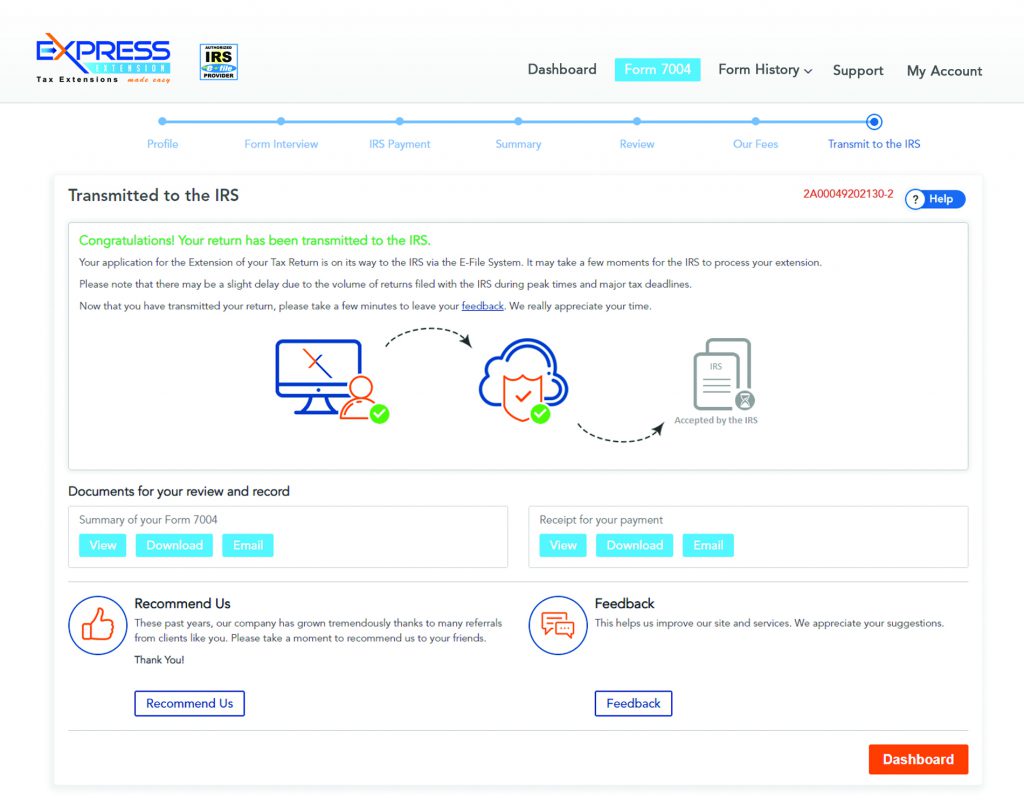

Where Do I File Form 7004 Extension - With your return open, select search and enter extend; Note if your business is in texas or another area where fema issued a disaster declaration. Ad get ready for tax season deadlines by completing any required tax forms today. It is important to remember that if you are to file the form 7004, you will need to do so on or before date. Select the tax year step 4: Complete, edit or print tax forms instantly. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web how to file a 7004 to request an extension of time.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web filing extensions electronically eliminates the need to mail form 7004. Where to file the form and do i mail it? Web what’s new address changes for filing form 7004. Enter business details step 2: Web address changes for filing form 7004. Web you can file an irs form 7004 electronically for most returns. If the tax return shows a balance due, your client can pay the balance due by mailing a check or money. Select business entity & form step 3: Enter code 25 in the box on form 7004, line 1.

Select the tax year step 4: The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Transmit your form to the irs ready to e. If the tax return shows a balance due, your client can pay the balance due by mailing a check or money. See where to file, later. Web filing extensions electronically eliminates the need to mail form 7004. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

How To File Your Extension Form 7004? Blog ExpressExtension

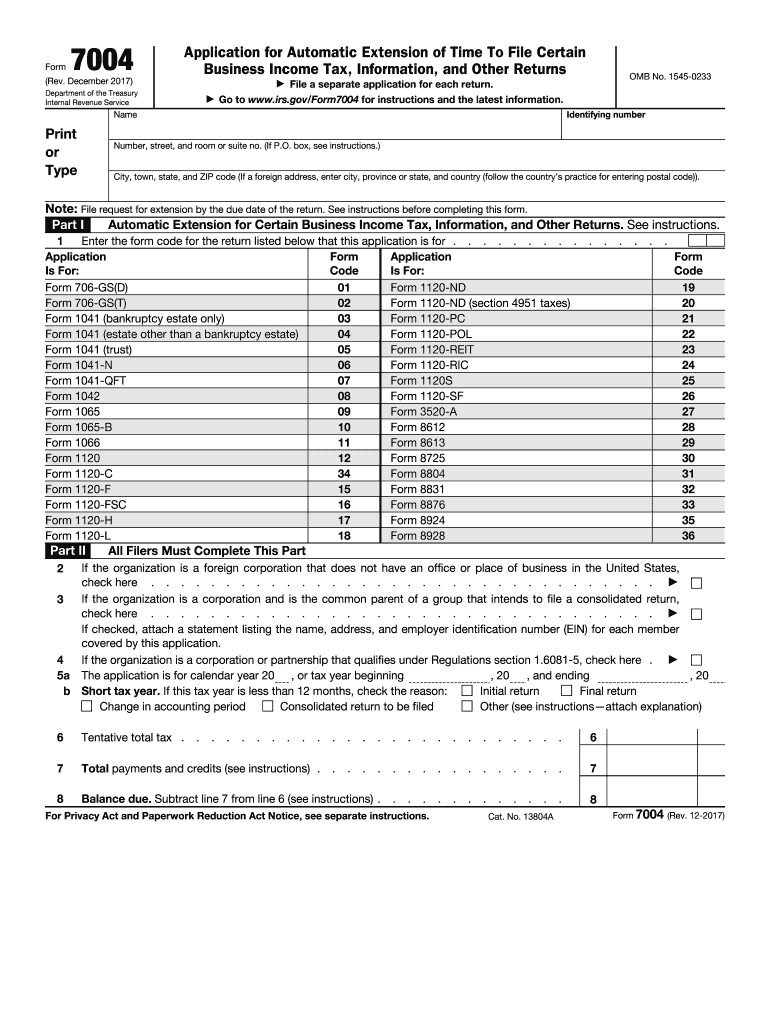

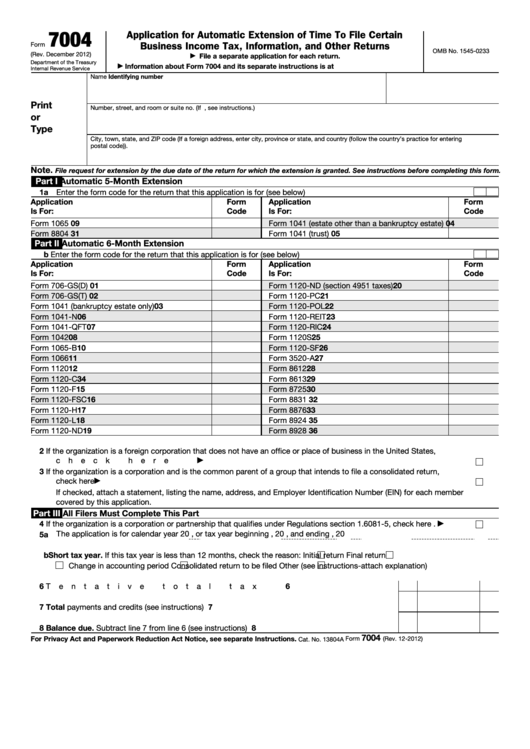

Web follow these steps to print a 7004 in turbotax business: Web certain individuals and businesses must file irs form 7004 to request an extension for their federal income tax return. Complete, edit or print tax forms instantly. Where to file the form and do i mail it? It is important to remember that if you are to file the.

Last Minute Tips To Help You File Your Form 7004 Blog

Enter tax payment details step 5: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad download or email irs 7004 & more fillable forms, register and subscribe now! The address for filing form 7004 has changed for some entities. According to the irs 7004 form instructions, this document is.

How to Fill Out Tax Form 7004 Tax forms, Irs tax forms,

Web certain individuals and businesses must file irs form 7004 to request an extension for their federal income tax return. Web you can ask for an extension of time to file this form by filing form 8868. Enter code 25 in the box on form 7004, line 1. Web address changes for filing form 7004. Select business entity & form.

How To File Your Extension Form 7004? Blog ExpressExtension

The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web certain individuals and businesses must file irs form 7004 to request an extension for their federal income tax return. See where to file, later. Ad get ready for tax season deadlines by completing any required tax forms today. See the.

Free Fillable Irs Form 7004 Printable Forms Free Online

Complete, edit or print tax forms instantly. Web filing extensions electronically eliminates the need to mail form 7004. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Enter tax payment details step 5: Web irs form 7004 tax extension:

File Form 7004 Online 2023 Business Tax Extension Form

Complete, edit or print tax forms instantly. Select extension of time to. Select business entity & form step 3: Depending on which form the company is requesting the extension for, the documents. Transmit your form to the irs ready to e.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web address changes for filing form 7004. Web address changes for filing form 7004: Web 1 min read you can extend filing form 1120s when you file form 7004. According to the irs 7004 form instructions, this document is. Enter business details step 2:

How To File Your Extension Form 7004? Blog ExpressExtension

Select business entity & form step 3: Web you can ask for an extension of time to file this form by filing form 8868. See where to file, later. Ad get ready for tax season deadlines by completing any required tax forms today. Note if your business is in texas or another area where fema issued a disaster declaration.

When is Tax Extension Form 7004 Due? Tax Extension Online

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Web in this guide, we cover it all, including: The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. If the tax return shows a balance.

Fillable Form 7004 Application For Automatic Extension Of Time To

It is important to remember that if you are to file the form 7004, you will need to do so on or before date. • you seek a missouri extension. Web how to file a 7004 to request an extension of time. Depending on which form the company is requesting the extension for, the documents. Web in this guide, we.

With Your Return Open, Select Search And Enter Extend;

Web you can file an irs form 7004 electronically for most returns. Note if your business is in texas or another area where fema issued a disaster declaration. Web address changes for filing form 7004. Depending on which form the company is requesting the extension for, the documents.

Web How To File A 7004 To Request An Extension Of Time.

Select business entity & form step 3: What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Enter business details step 2:

See The Form 7004 Instructions For A List Of The Exceptions.

Select extension of time to. Web filing extensions electronically eliminates the need to mail form 7004. The address for filing form 7004 has changed for some entities. Web address changes for filing form 7004:

Web There Are Several Ways To Submit Form 4868.

According to the irs 7004 form instructions, this document is. Where to file the form and do i mail it? It is important to remember that if you are to file the form 7004, you will need to do so on or before date. Web what’s new address changes for filing form 7004.