Where Do I Send Form 3911

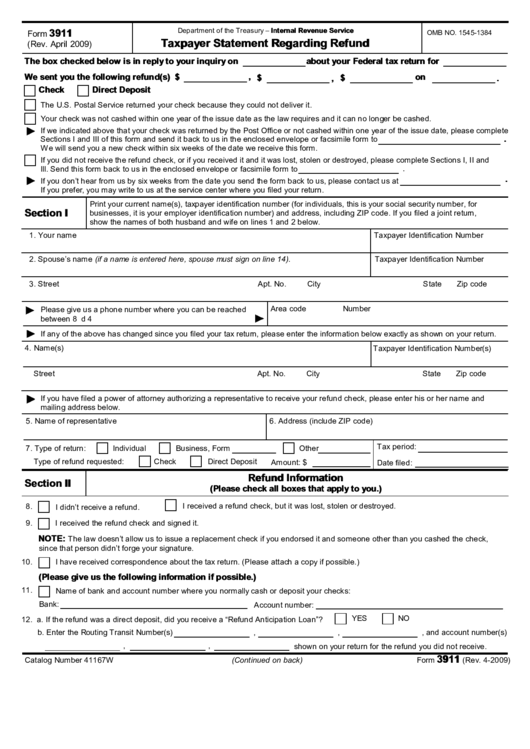

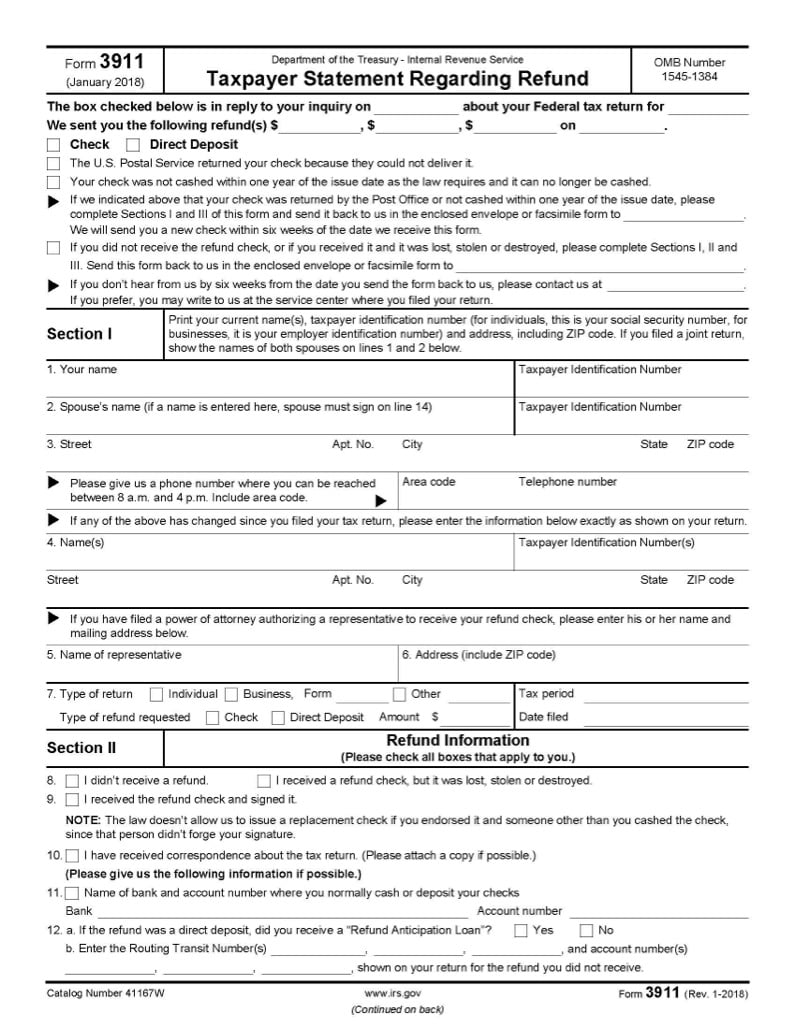

Where Do I Send Form 3911 - Web you should only file form 3911 if a substantial amount of time has passed since you filed your tax return or your economic impact payment was considered sent to. Web mail or fax irs form 3911, if you live in: Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Mail or fax the form. Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. Do not send this form to this office. Andover internal revenue service, 310 lowell st., andover,. Maine, maryland, massachusetts, new hampshire, vermont. Andover refund inquiry unit 310 lowell st mail stop. Complete, edit or print tax forms instantly.

Maine, maryland, massachusetts, new hampshire, vermont; Maine, maryland, massachusetts, new hampshire, vermont. Complete, edit or print tax forms instantly. Web purpose (1) this transmits revised irm 21.4.2, refund inquiries, refund trace and limited payability. Web where you file a paper tax return/mail form 3911 depends on where you live. Instead, please use the envelope provided or mail the form to the. Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. Web mail or fax irs form 3911, if you live in: Complete, edit or print tax forms instantly. Be sure to complete sections i, ii, and iii.

If you're trying to obtain a. Mail or fax the form. Do not send this form to this office. Be sure to complete sections i, ii, and iii. Complete, edit or print tax forms instantly. Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. Maine, maryland, massachusetts, new hampshire, vermont; Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include. We will send you a new check within six weeks of the date we receive this. Web where you file a paper tax return/mail form 3911 depends on where you live.

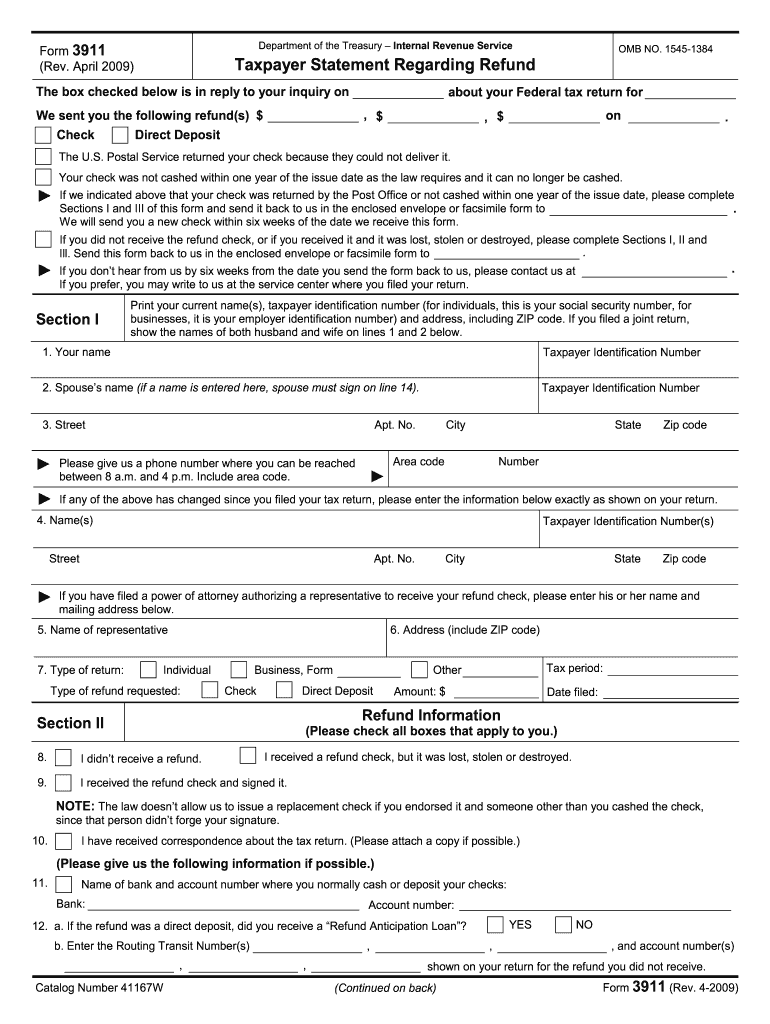

Irs Form 3911 Printable Printable World Holiday

Complete, edit or print tax forms instantly. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process. Web completing the form 3911. Maine, maryland, massachusetts, new hampshire, vermont. We will send you a new check within six weeks of the date we receive this.

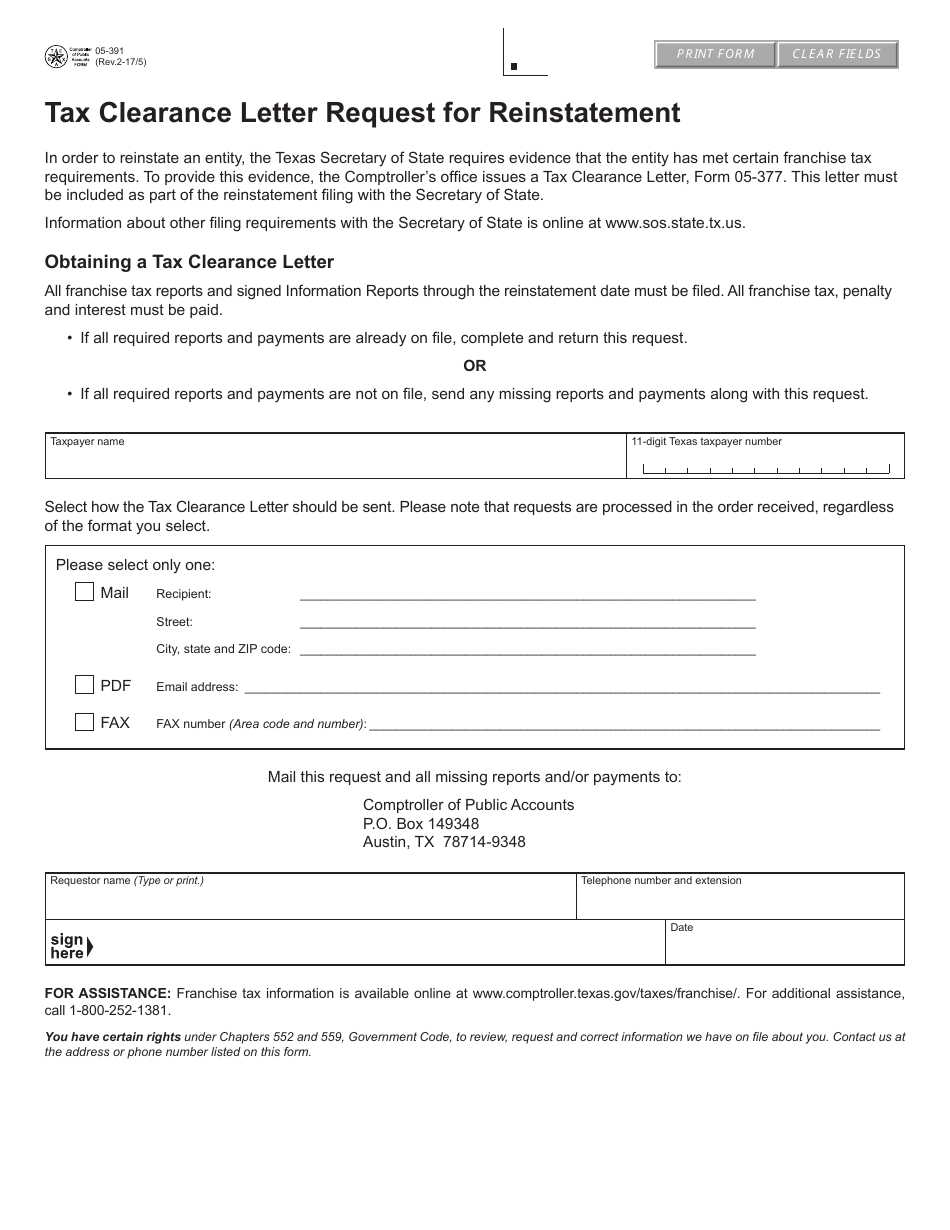

Form 05391 Download Fillable PDF or Fill Online Tax Clearance Letter

Web you should only file form 3911 if a substantial amount of time has passed since you filed your tax return or your economic impact payment was considered sent to. Maine, maryland, massachusetts, new hampshire, vermont; Find the state you live in and use the mailing address, or fax number list below. Web form 3911 is provided to individuals who.

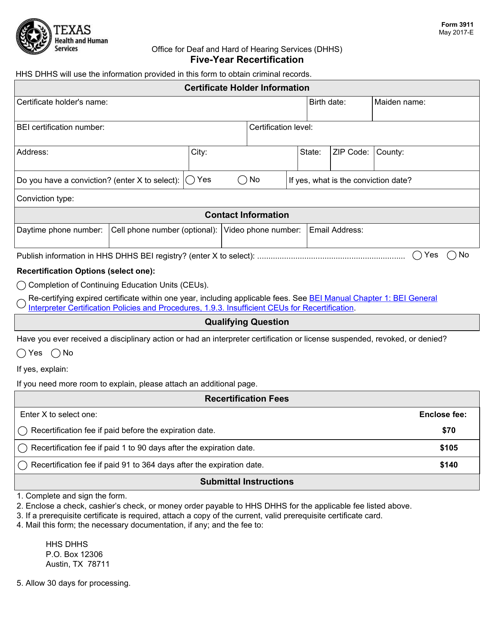

Form 3911 Download Fillable PDF or Fill Online FiveYear

Material changes (1) irm 21.4.2.1.2.2.2 (3) added authority for coordination. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero on. Web the irs will send you a form.

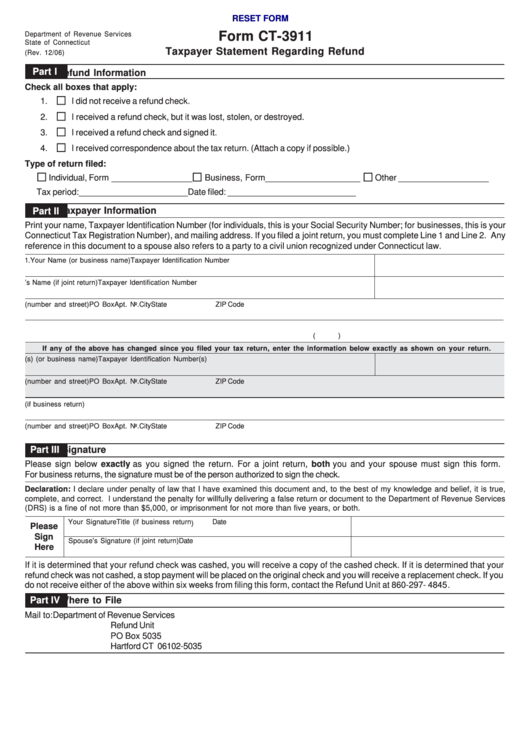

Fillable Form Ct3911 Taxpayer Statement Regarding Refund printable

With signnow, you cane sign as many documents in a day as you require at an. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process. Web sections i and iii of this form and send it back to us in the enclosed envelope.

MISSING IRS STIMULUS OR TAX REFUND PAYMENTS Prospera Credit Union

Web purpose (1) this transmits revised irm 21.4.2, refund inquiries, refund trace and limited payability. Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. Web completing the form 3911. If you live in alabama, florida, georgia, the carolinas, or virginia, mail form 3911 to the. Web form.

Fill Free fillable F3911 Form 3911 (Rev. 42009) PDF form

Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. If you're trying to obtain a. Andover internal revenue service, 310 lowell st., andover,. Do not send anything other than a form 3911 to the fax numbers below. The top section on the form and section iv is.

Form 3911 Taxpayer Statement Regarding Refund (Fillible) printable

Web sections i and iii of this form and send it back to us in the enclosed envelope or facsimile form to. Andover refund inquiry unit 310 lowell st mail stop. Complete, edit or print tax forms instantly. Maine, maryland, massachusetts, new hampshire, vermont; How do i get a new one?

Form 3911 Never received tax refund or Economic Impact Payment

Complete, edit or print tax forms instantly. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Instead, please use the envelope provided or mail the form to the. With signnow, you cane sign as many documents in a day as you.

Form 3911 Never received tax refund or Economic Impact Payment

Web purpose (1) this transmits revised irm 21.4.2, refund inquiries, refund trace and limited payability. Do not send anything other than a form 3911 to the fax numbers below. Complete, edit or print tax forms instantly. Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the.

IRS

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero on. Find the state you live in and use the mailing address, or fax number list below. Web completing the form 3911.

Web Where You File A Paper Tax Return/Mail Form 3911 Depends On Where You Live.

Complete, edit or print tax forms instantly. Maine, maryland, massachusetts, new hampshire, vermont; Complete, edit or print tax forms instantly. Be sure to complete sections i, ii, and iii.

Web Mail Or Fax Irs Form 3911, If You Live In:

How do i get a new one? Maine, maryland, massachusetts, new hampshire, vermont. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process. Get ready for tax season deadlines by completing any required tax forms today.

If You Live In Alabama, Florida, Georgia, The Carolinas, Or Virginia, Mail Form 3911 To The.

We will send you a new check within six weeks of the date we receive this. With signnow, you cane sign as many documents in a day as you require at an. Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the form. If you live in alabama, florida, georgia, the carolinas, or virginia, mail form 3911 to the department.

The Top Section On The Form And Section Iv Is For The Irs To Complete.

Material changes (1) irm 21.4.2.1.2.2.2 (3) added authority for coordination. Web form 3911 should be used as a last resort for the suspected fraudulent activity. Mail or fax the form. Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero on.