Where To File Form 944

Where To File Form 944 - Connecticut, delaware, district of columbia, georgia,. Employer’s annual federal tax return department of the treasury — internal revenue service. Who must file form 944? Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. Web employers eligible for form 944 must have $1,000 or less in annual payroll tax liability. Who must file form 944. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than. Web you can also file form 944 electronically and the irs actually encourages you to do so. Web purpose of form 944. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay.

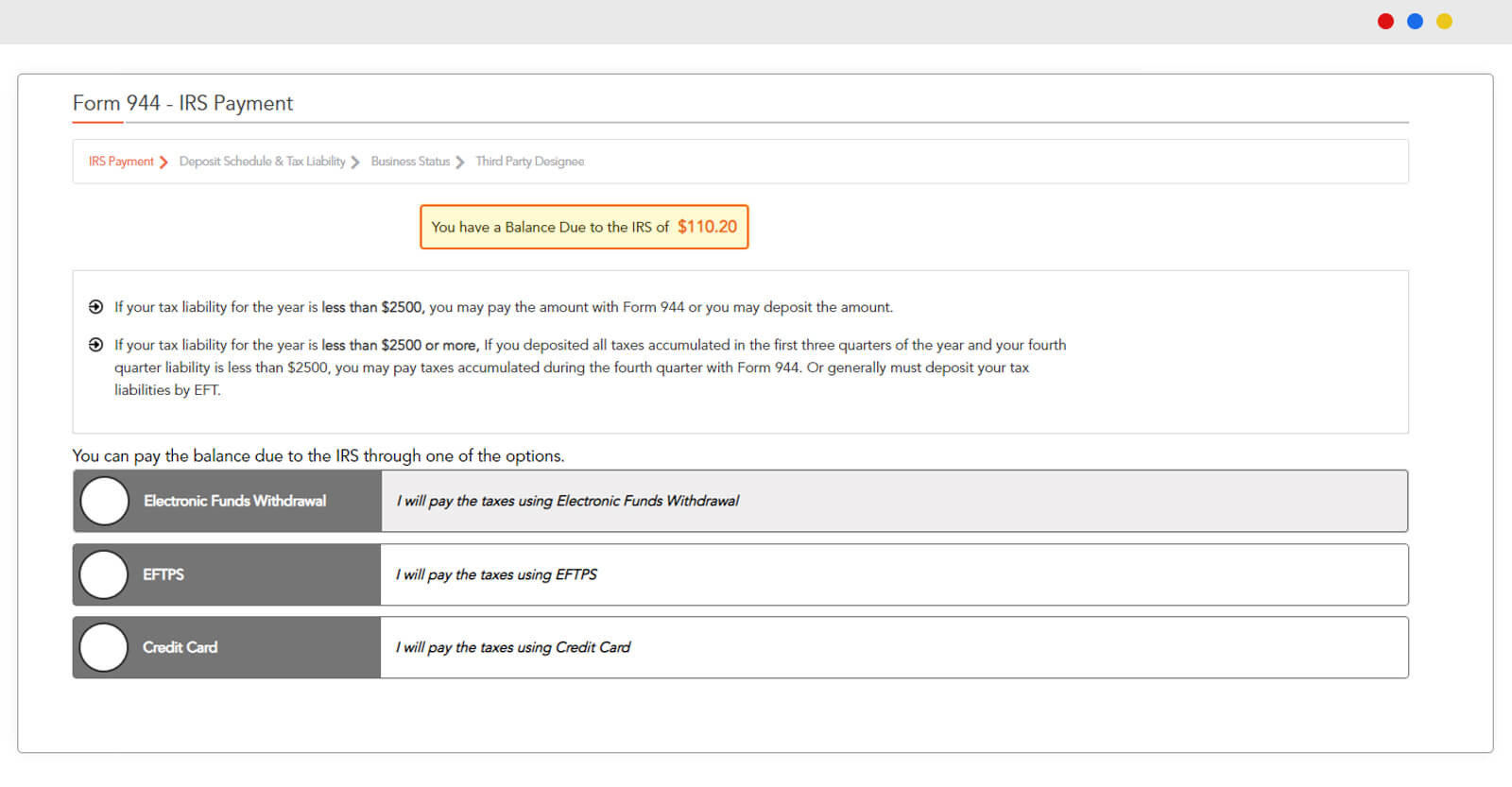

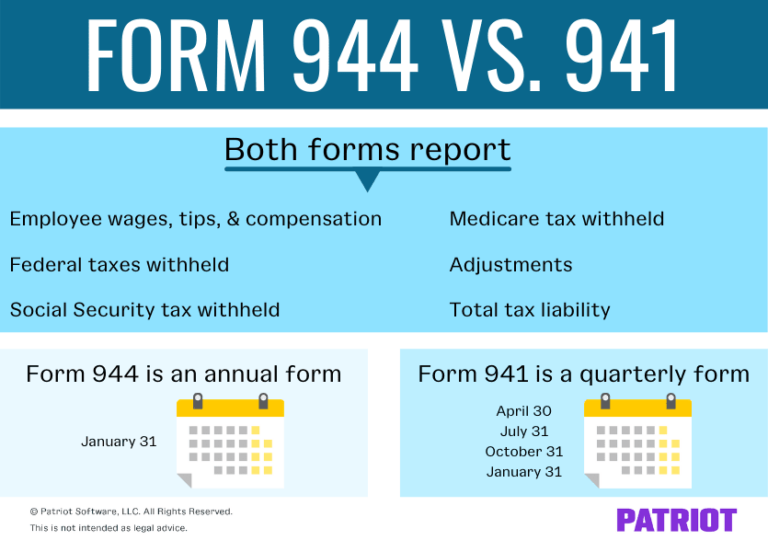

Web purpose of form 944. Unlike those filing a 941, small business owners have the option to pay. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than. Connecticut, delaware, district of columbia, georgia,. Who must file form 944? Must you deposit your taxes? Who must file form 944. A form 941 needs to be submitted on april 30, july 31, october. Web mailing addresses for forms 944. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay.

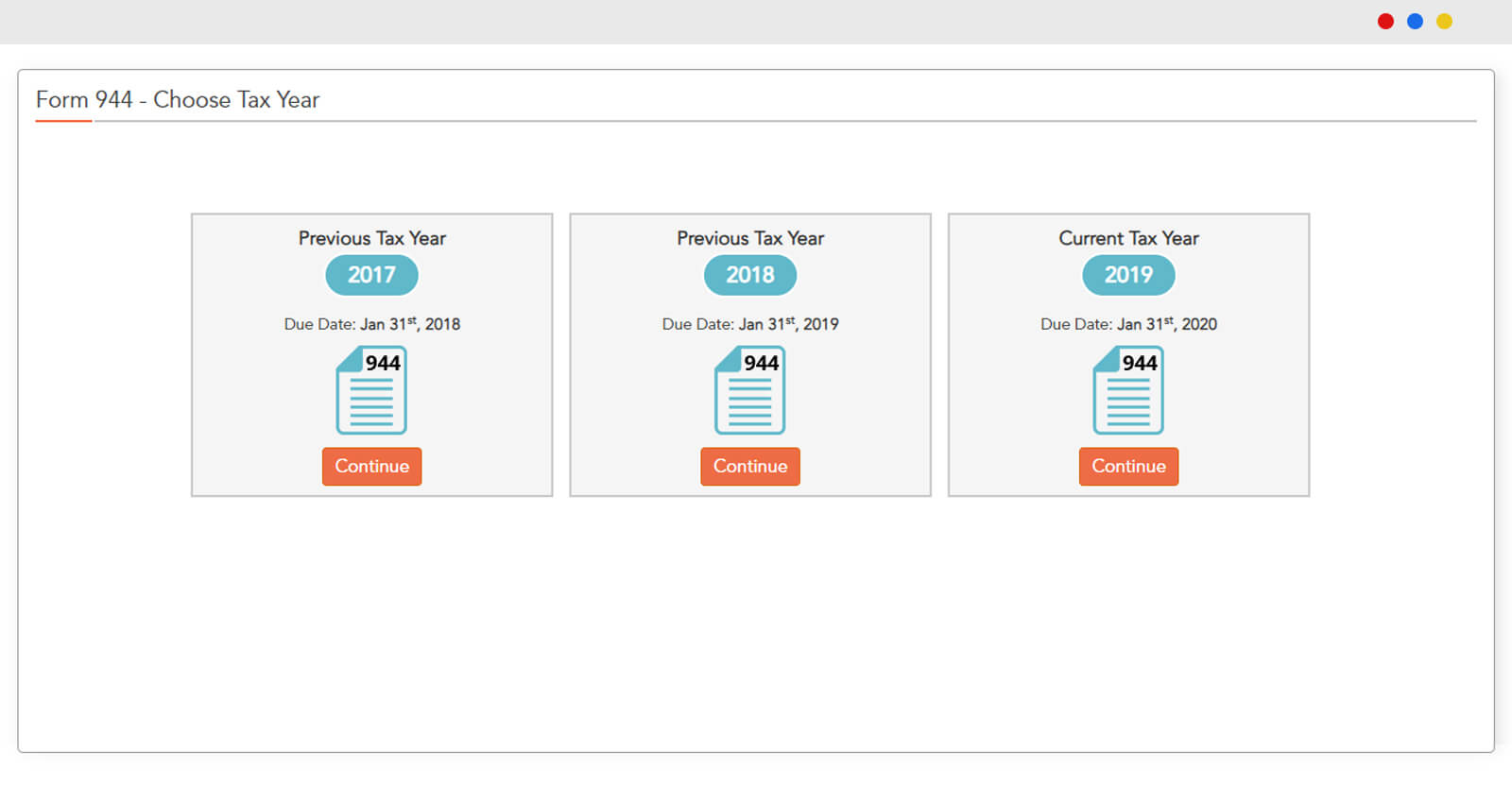

Who must file form 944? Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Who must file form 944. A form 941 needs to be submitted on april 30, july 31, october. Small business employers with an. Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. Web file form 944 online for 2022. Employer’s annual federal tax return department of the treasury — internal revenue service. Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. Connecticut, delaware, district of columbia, georgia,.

File Form 944 Online EFile 944 Form 944 for 2022

Web follow the easy steps of filing form 944 electronically with taxbandits: Web employers eligible for form 944 must have $1,000 or less in annual payroll tax liability. Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. Web mailing addresses for forms 944. Who must file form 944.

do i have to file form 944 if i have no employees Fill Online

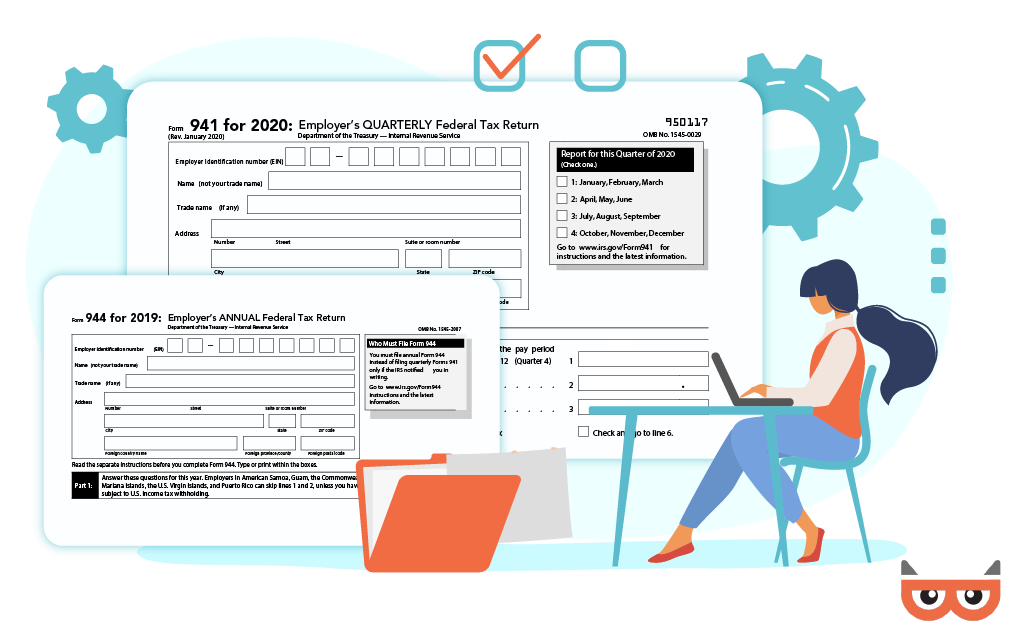

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. A form 941 needs to be submitted on april 30, july 31, october. Connecticut, delaware, district of columbia, georgia,..

File Form 944 Online EFile 944 Form 944 for 2021

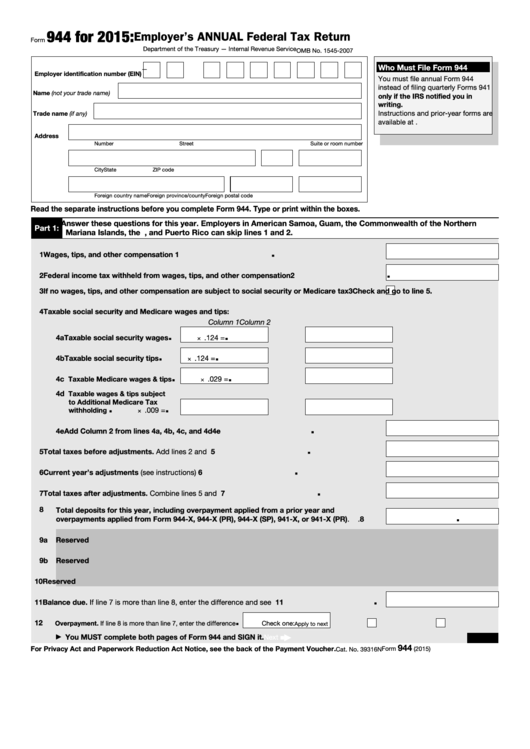

Employer’s annual federal tax return department of the treasury — internal revenue service. Must you deposit your taxes? Web mailing addresses for forms 944. Web you can also file form 944 electronically and the irs actually encourages you to do so. Enter form 944 details step 2:

Do I Need to File a Form 944 if I Have No Employees? Bizfluent

Web file form 944 online for 2022. Who must file form 944? Connecticut, delaware, district of columbia, georgia,. Web purpose of form 944. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

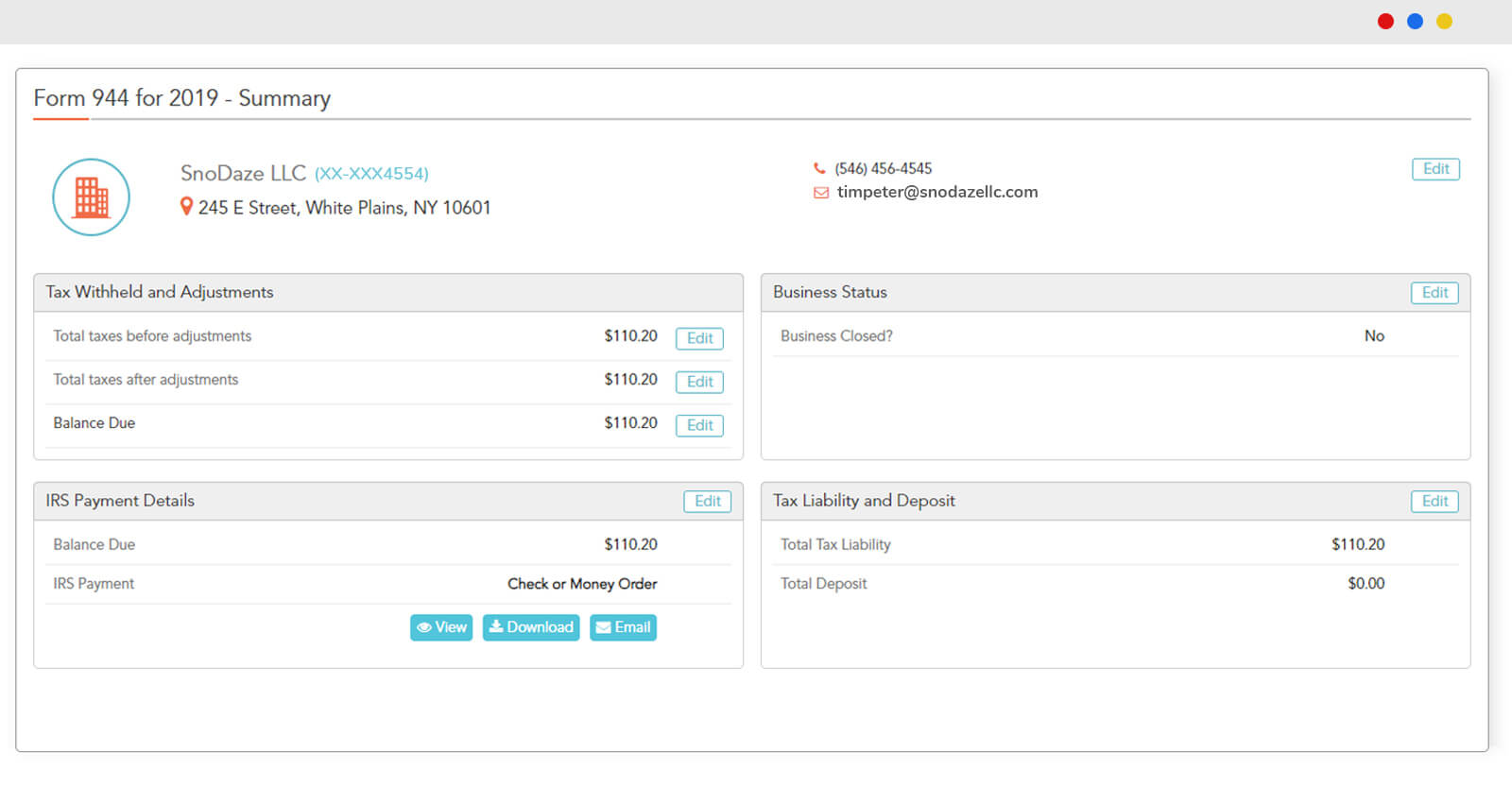

Web file form 944 online for 2022. Review the summary form 944; Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Unlike those filing a 941, small business owners have the option to pay. Web purpose of form 944.

Do I need to File form 944 if I have No Employees YouTube

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than. Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. Enter form 944 details step 2: Web the form 944 has an annual liability.

File Form 944 Online EFile 944 Form 944 for 2021

Web employers eligible for form 944 must have $1,000 or less in annual payroll tax liability. Web form 944 for 2021: Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. If the irs sends you a notice to use form 944 to report your federal income. Connecticut, delaware,.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Web file form 944 online for 2022. Review the summary form 944; Web you can also file form 944 electronically and the irs actually encourages you to do so. Web purpose of form 944. Web mailing addresses for forms 944.

Who is Required to File Form I944 for a Green Card? CitizenPath

Web follow the easy steps of filing form 944 electronically with taxbandits: Unlike those filing a 941, small business owners have the option to pay. Web file form 944 online for 2022. Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. Web form 944 for 2021:

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Web mailing addresses for forms 944. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay. Review the summary form 944; Web the form 944 has an annual liability and must be submitted by january 31 for the previous tax year. Who must file.

Web Up To $32 Cash Back The Deadline To File Your 2022 Form 944 Return Is January 31, 2023.

Employer’s annual federal tax return department of the treasury — internal revenue service. Web purpose of form 944. Enter form 944 details step 2: Small business employers with an.

Who Must File Form 944.

If the irs sends you a notice to use form 944 to report your federal income. How should you complete form 944? Web employers eligible for form 944 must have $1,000 or less in annual payroll tax liability. Web form 944 for 2021:

Web The Form 944 Has An Annual Liability And Must Be Submitted By January 31 For The Previous Tax Year.

Who must file form 944? Web file form 944 online for 2022. Web mailing addresses for forms 944. Must you deposit your taxes?

A Form 941 Needs To Be Submitted On April 30, July 31, October.

Unlike those filing a 941, small business owners have the option to pay. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than. Review the summary form 944; Web follow the easy steps of filing form 944 electronically with taxbandits: