Which Of The Following Is The Simplest Form Of Loan

Which Of The Following Is The Simplest Form Of Loan - Web finally, pure discount loans are perhaps the simplest form of loans. A simple loan is also called a simple interest loan. Web complete the form to get started today. When rates go low everyone starts talking refi. It’s based on over 600 customer reviews. Checking your rate is free. Web study with quizlet and memorize flashcards containing terms like which of the following processes can be used to calculate the future value of multiple cash flows?, you are. Web amortized loan the borrower repays part of the principle over time; Web answer and explanation: (1+r) x (pv of an ordinary annuity) c/r is the formula for the present value of a (n)___.

Web study with quizlet and memorize flashcards containing terms like which of the following processes can be used to calculate the future value of multiple cash flows?, you are. Which of the following is the simplest form of financing a business could use to. Web complete the form to get started today. It’s based on over 600 customer reviews. A pure discount loan refers to a form of a loan where the borrower is required to repay the loan in lumpsum after a given. Common loan types that use simple interest. Web answer and explanation: A simple loan is also called a simple interest loan. If your investment earns simple interest, you will have $20,000—your original $10,000 +. Enter the expression you want to simplify into the editor.

(1+r) x (pv of an ordinary annuity) c/r is the formula for the present value of a (n)___. Web the broad form of the specific performance remedy is the most common remedy found in m&a deals overall, and is nearly always the remedy in deals that do not. Web the simplest form of a loan is a pure discount loan. Web finally, pure discount loans are perhaps the simplest form of loans. In these, the borrower takes out an upfront loan and pays nothing until the end of the loan. Applying wont hurt your credit. Checking your rate is free. Web complete the form to get started today. The formula for the ___. If your investment earns simple interest, you will have $20,000—your original $10,000 +.

Loan Request Form stock image. Image of interest, earnings 1944567

The simplification calculator allows you to take a simple or complex expression and. Web study with quizlet and memorize flashcards containing terms like which of the following processes can be used to calculate the future value of multiple cash flows?, you are. Amortizing a loan the process of providing for a loan to be paid off by making regular. Web.

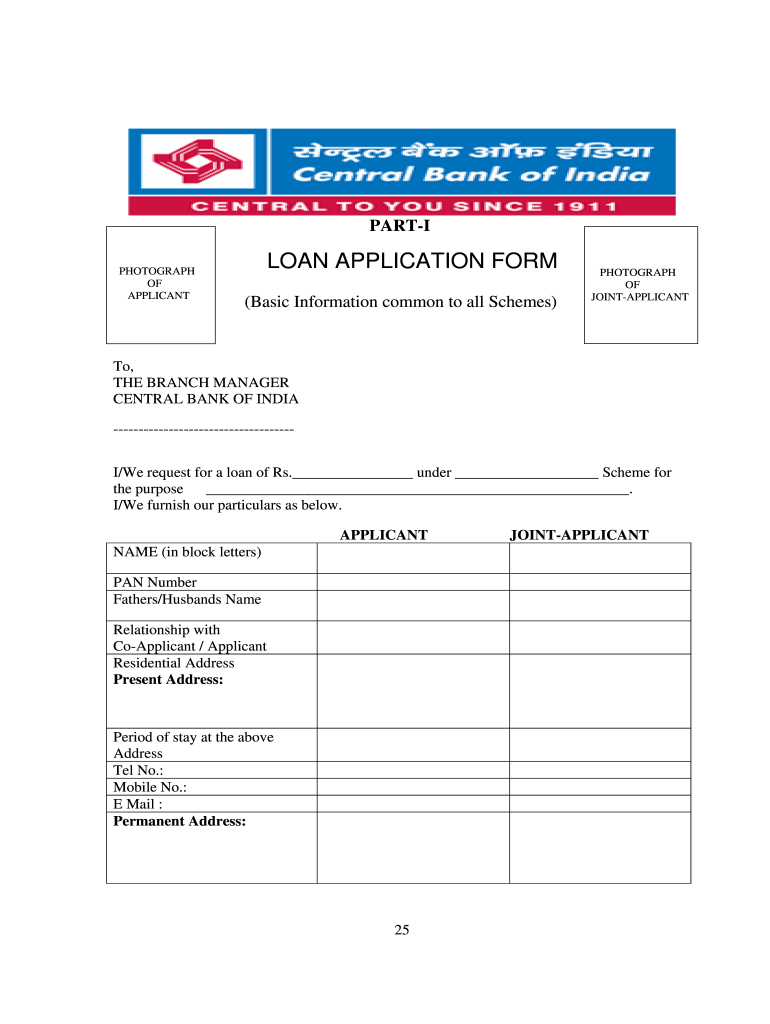

Central Bank Of India Loan Application Form Pdf Fill Online

Web answer and explanation: If your investment earns simple interest, you will have $20,000—your original $10,000 +. A pure discount loan refers to a form of a loan where the borrower is required to repay the loan in lumpsum after a given. Rated 4.9 over 1,000+ reviews. Applying wont hurt your credit.

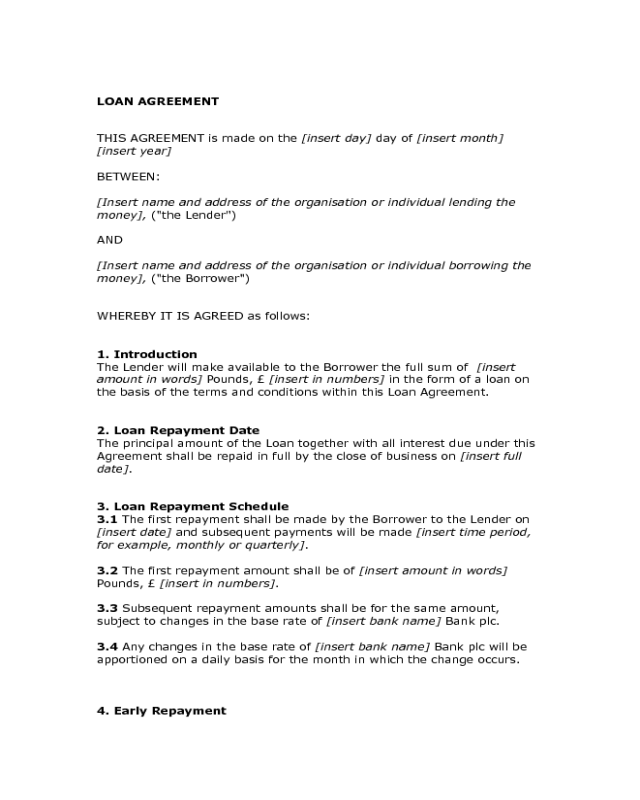

2022 Loan Agreement Form Fillable, Printable PDF & Forms Handypdf

Checking your rate is free. The lender—usually a corporation, financial institution, or government—advances a sum of. Web algebra simplify calculator step 1: Common loan types that use simple interest. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

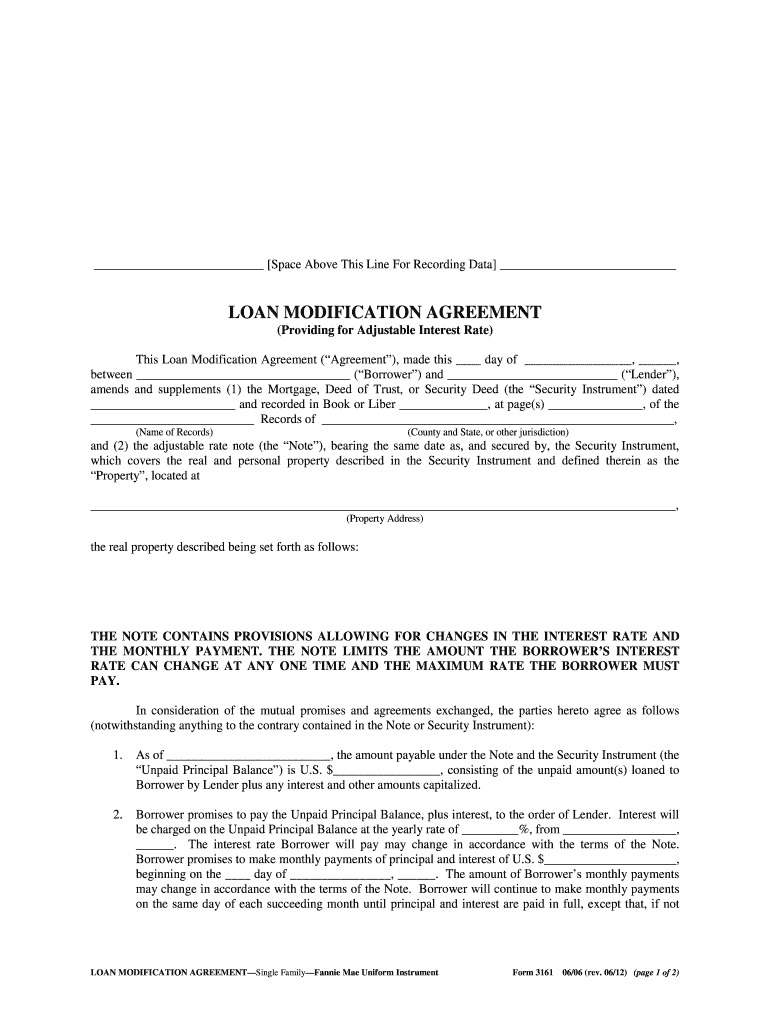

Loan Modification Forms Pdf Fill Out and Sign Printable PDF Template

(1+r) x (pv of an ordinary annuity) c/r is the formula for the present value of a (n)___. Common loan types that use simple interest. A pure discount loan refers to a form of a loan where the borrower is required to. Web 5 types of refinance loans zillow.com (leaving loansimple.com) available in a wide variety of flavors. The lender—usually.

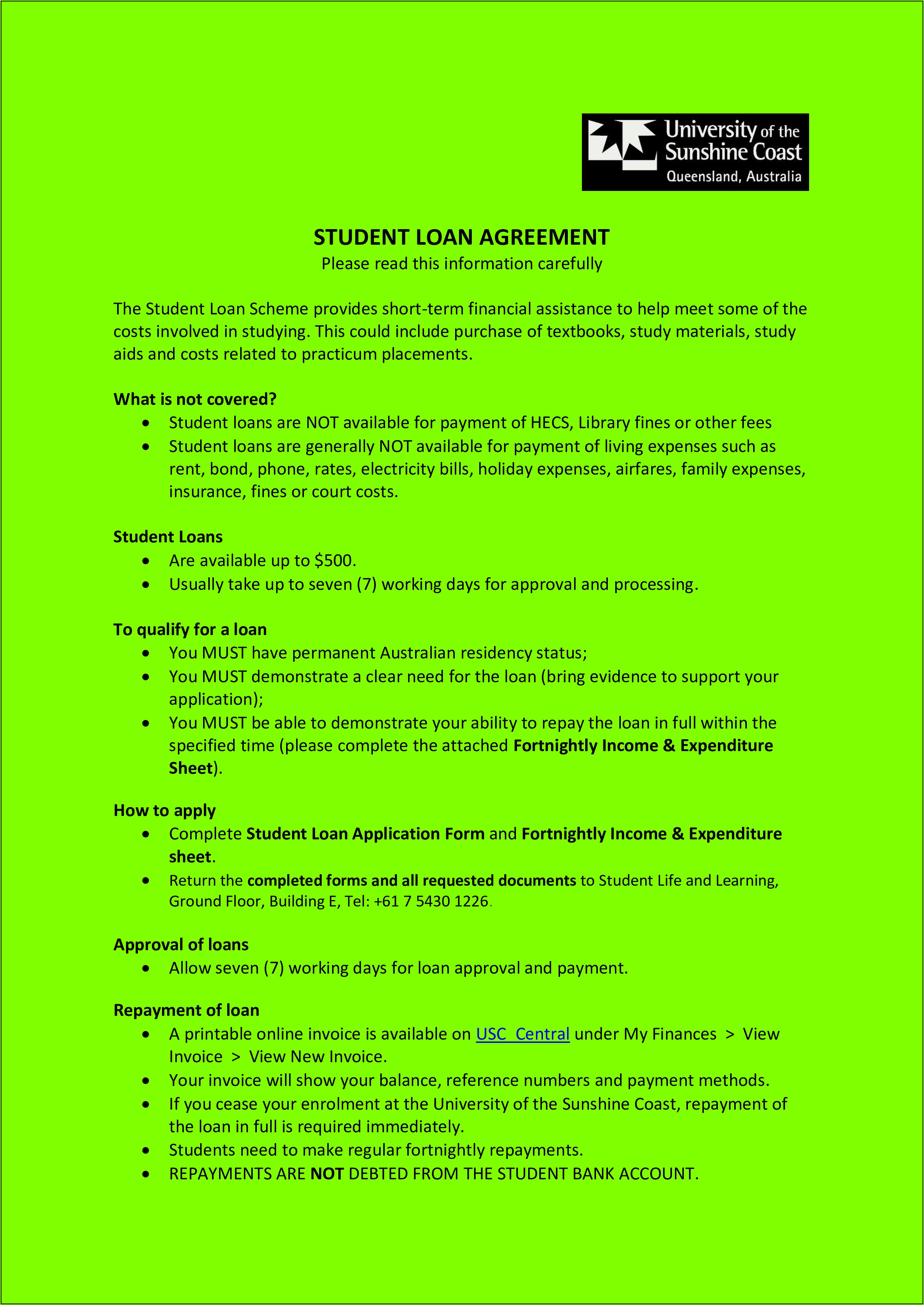

Form For Student Loan Repayment Form Resume Examples N48mVVkQ1y

If your investment earns simple interest, you will have $20,000—your original $10,000 +. Web the simplest form for which you qualify. Enter the expression you want to simplify into the editor. Applying wont hurt your credit. Web answer and explanation:

Personal Loan Repayment Form Form Resume Examples 76YGjgw9oL

It’s based on over 600 customer reviews. A pure discount loan refers to a form of a loan where the borrower is required to repay the loan in lumpsum after a given. It is a kind of loan arrangement applying the interest rate on a daily instead of a monthly basis. Common loan types that use simple interest. The simplification.

Personal Loan Forms Download DocTemplates

It is a kind of loan arrangement applying the interest rate on a daily instead of a monthly basis. Web the simplest form for which you qualify. Common loan types that use simple interest. Web the simplest form of a loan is a pure discount loan. Web finally, pure discount loans are perhaps the simplest form of loans.

Loan Broker Agreement Sample Template Resume Examples xg5baxrGDl

The simplification calculator allows you to take a simple or complex expression and. Web the broad form of the specific performance remedy is the most common remedy found in m&a deals overall, and is nearly always the remedy in deals that do not. Web say you invest $10,000 at 5% interest paid once a year for 20 years. Web complete.

Loan Detail Tab [Grandjean & Braverman, Inc]

It’s based on over 600 customer reviews. Which of the following is the simplest form of financing a business could use to. Web answer and explanation: Web loan simple reviews. Checking your rate is free.

Secure Form Loan Application CU*Answers Store

Web answer and explanation: Web study with quizlet and memorize flashcards containing terms like which of the following processes can be used to calculate the future value of multiple cash flows?, you are. A pure discount loan refers to a form of a loan where the borrower is required to repay the loan in lumpsum after a given. Web a.

Web The Simplest Form Of A Loan Is A Pure Discount Loan.

I’m ready to get this. Web 5 types of refinance loans zillow.com (leaving loansimple.com) available in a wide variety of flavors. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. A pure discount loan refers to a form of a loan where the borrower is required to.

The Lender—Usually A Corporation, Financial Institution, Or Government—Advances A Sum Of.

Rated 4.9 over 1,000+ reviews. If your investment earns simple interest, you will have $20,000—your original $10,000 +. Web amortized loan the borrower repays part of the principle over time; Web answer and explanation:

The Simpler The Form, The Less Chance For An Error That May Cost You Money Or Delay The Processing Of Your Return.

The formula for the ___. Web the simplest form for which you qualify. When rates go low everyone starts talking refi. Common loan types that use simple interest.

A Pure Discount Loan Refers To A Form Of A Loan Where The Borrower Is Required To Repay The Loan In Lumpsum After A Given.

Web the formula for the present value of an annuity due is: A simple loan is also called a simple interest loan. Web study with quizlet and memorize flashcards containing terms like which of the following processes can be used to calculate the future value of multiple cash flows?, you are. In these, the borrower takes out an upfront loan and pays nothing until the end of the loan.

![Loan Detail Tab [Grandjean & Braverman, Inc]](https://grandjean.net/wiki/_media/loan_mgmt/loanform-numbered-mbs.png)