Who Can Sign Form 1096

Who Can Sign Form 1096 - This form is designed for small and corporate business owners. Web 1.6k views 1 year ago. Web the form 1096 must be signed and dated by the payer prior to sending to the irs. Form 1096 (officially the annual summary and transmittal of u.s. A transmitter, service bureau, paying agent, or disbursing agent (hereafter referred to as “agent”) may sign form 1096 on behalf of any person. Both of you should double check. Web a form 1096 is also known as an annual summary and transmittal of u.s. Information returns [1]) is an internal revenue service (irs) tax form used in the united states. Web who can sign the irs 1096 does the owner of a llc need to sign the 1096 or can the office manager sign? Unlike most tax forms, form 1096 serves as a summary.

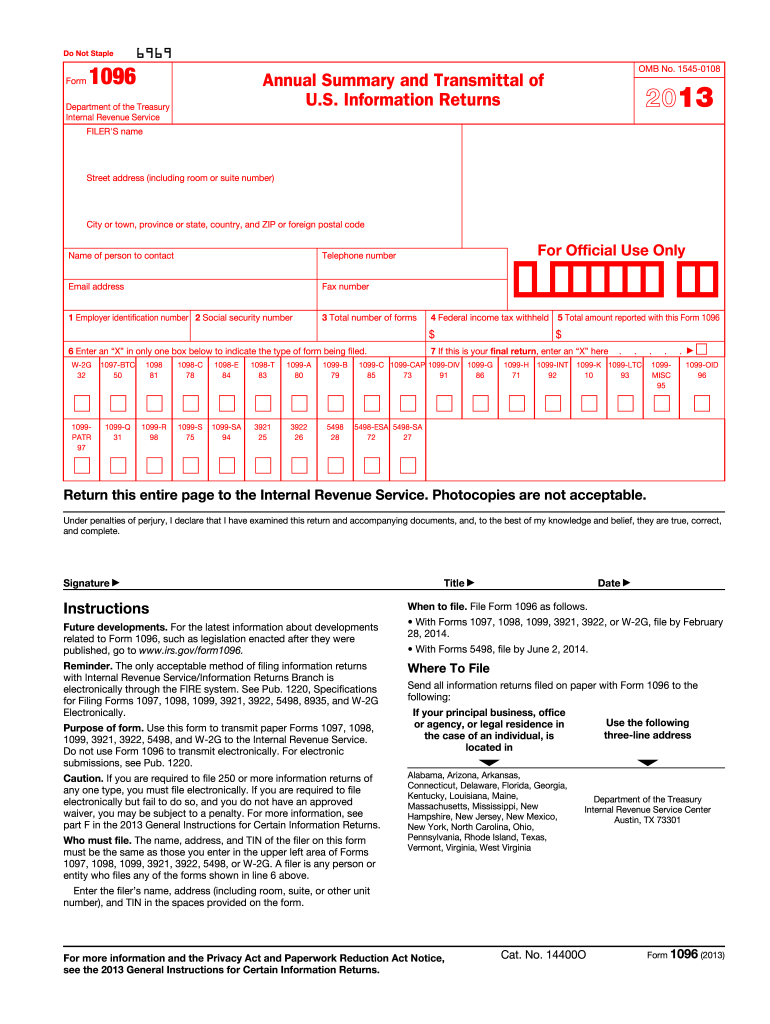

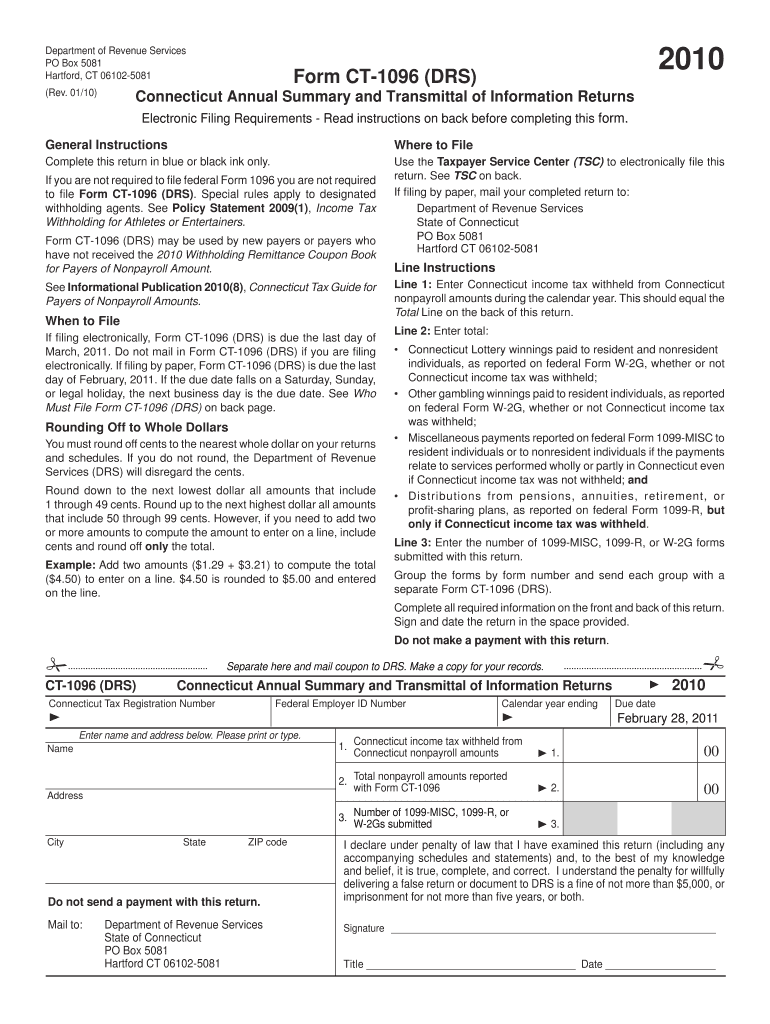

Check box 7 if you. Complete, edit or print tax forms instantly. Web as a small business owner, you’ll most likely use form 1096 to submit form 1099, which is a type of form used to report any income paid to independent contractors in excess of. Web a transmitter, service bureau, paying agent, or disbursing agent (hereafter referred to as “agent”) may sign form 1096 on behalf of any person required to. The majority of those whole fill out. Form 1096 (officially the annual summary and transmittal of u.s. Web signature title date instructions future developments. Web in box 6, enter an x in the box for the type of form you are submitting. Web if you are talking about the transmittal form that accompanies your forms that you send to the irs, yes. Complete, edit or print tax forms instantly.

Web signature title date instructions future developments. For the latest information about developments related to form 1096, such as legislation enacted after it was published,. Complete, edit or print tax forms instantly. Information returns. you must use it to provide the irs with details about one of seven. Complete, edit or print tax forms instantly. Web who needs to file form 1096? Web a transmitter, service bureau, paying agent, or disbursing agent (hereafter referred to as “agent”) may sign form 1096 on behalf of any person required to. Complete, edit or print tax forms instantly. Web transmitters, paying agents, etc. Check box 7 if you.

Printable Form 1096 Free W2, W3, 1099MISC, 1096 forms free Offer

Web 1.6k views 1 year ago. Web the form 1096 must be signed and dated by the payer prior to sending to the irs. Web in box 6, enter an x in the box for the type of form you are submitting. Web transmitters, paying agents, etc. Web a form 1096 is also known as an annual summary and transmittal.

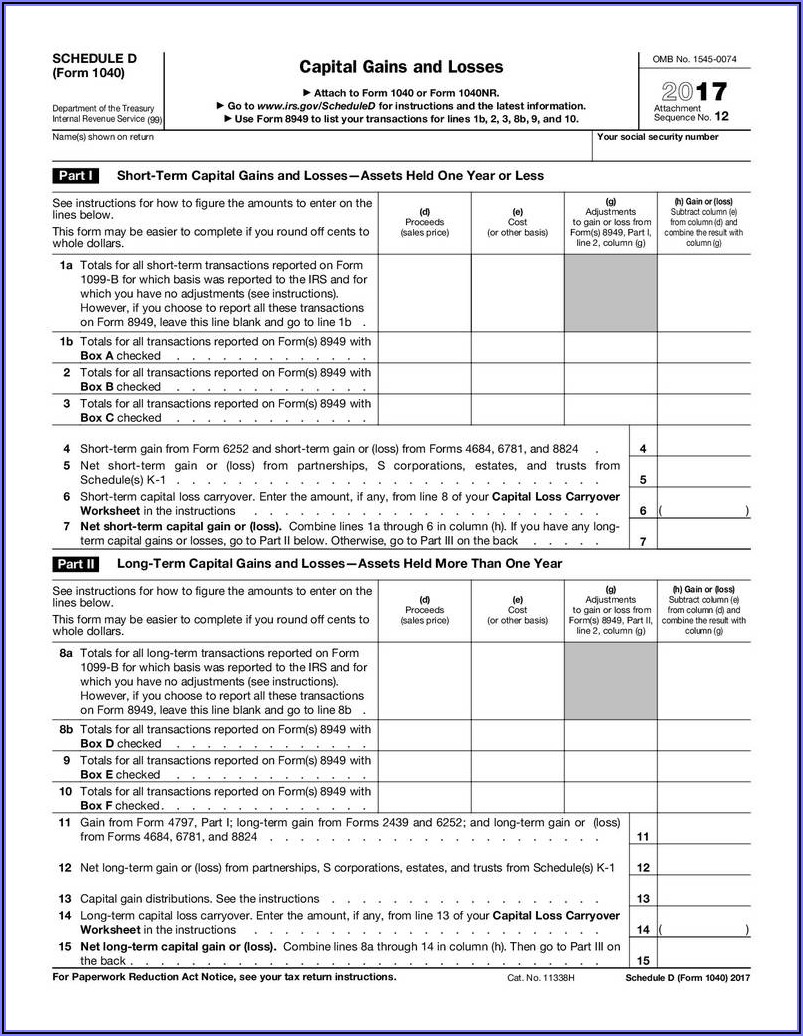

Irs 1096 Form 2017 Form Resume Examples mx2WQaezY6

Check box 7 if you. Form 1096 (officially the annual summary and transmittal of u.s. This form is designed for small and corporate business owners. Complete, edit or print tax forms instantly. Information returns [1]) is an internal revenue service (irs) tax form used in the united states.

1096 Form Fill Out and Sign Printable PDF Template signNow

Web as a small business owner, you’ll most likely use form 1096 to submit form 1099, which is a type of form used to report any income paid to independent contractors in excess of. Form 1096 (officially the annual summary and transmittal of u.s. A transmitter, service bureau, paying agent or disbursing agent may sign the form. Check box 7.

1096 Form eBay

Web as a small business owner, you’ll most likely use form 1096 to submit form 1099, which is a type of form used to report any income paid to independent contractors in excess of. Web transmitters, paying agents, etc. Web a form 1096 is also known as an annual summary and transmittal of u.s. Web signature title date instructions future.

1099 Tax Software Blog » 1099 Software How can I print Form 1096?

Web in box 6, enter an x in the box for the type of form you are submitting. The owner must use this form to mail the required information return to the irs. 176 tax expert feb 2, 2010,. Your cpa can sign that form. Check box 7 if you.

Form 1096 YouTube

The majority of those whole fill out. Complete, edit or print tax forms instantly. Web best answer copy form 1096 from the irs is for reporting the totals of the information returns that you are mailing to the irs. This form is designed for small and corporate business owners. Web who can sign the irs 1096 does the owner of.

Form 1096 Edit, Fill, Sign Online Handypdf

Unlike most tax forms, form 1096 serves as a summary. Both of you should double check. Web as a small business owner, you’ll most likely use form 1096 to submit form 1099, which is a type of form used to report any income paid to independent contractors in excess of. Web signature title date instructions future developments. Web a transmitter,.

Ct 1096 Fill Out and Sign Printable PDF Template signNow

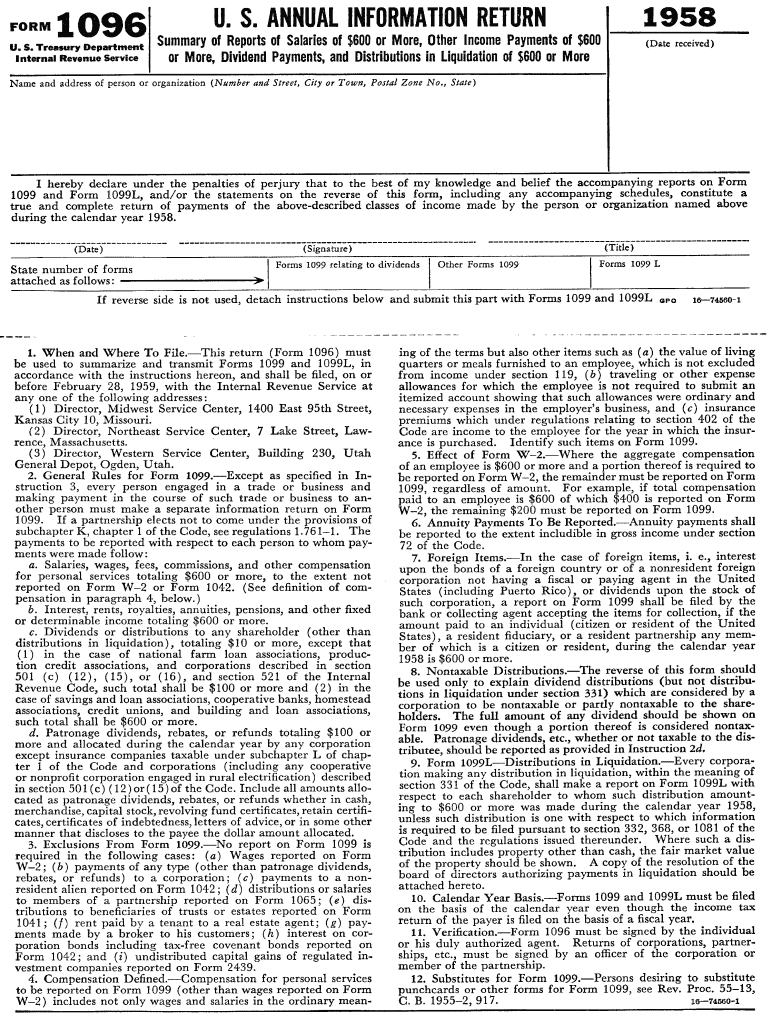

176 tax expert feb 2, 2010,. The owner must use this form to mail the required information return to the irs. Web transmitters, paying agents, etc. Form 1096 (officially the annual summary and transmittal of u.s. For the latest information about developments related to form 1096, such as legislation enacted after it was published,.

Who should sign Form 1096? YouTube

Irs form 1096 is the annual summary and transmittal of u.s. Your cpa can sign that form. Web transmitters, paying agents, etc. Web the form 1096 must be signed and dated by the payer prior to sending to the irs. Web a form 1096 is also known as an annual summary and transmittal of u.s.

FORM 1096 1958 Irs Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web who needs to file form 1096? Web 1.6k views 1 year ago. Web if your poa doesn't include the form you want signed, the embassy in the phillipines does offer notarial services by appointment so it's conceivable that you could.

Complete, Edit Or Print Tax Forms Instantly.

Web signature title date instructions future developments. Web if your poa doesn't include the form you want signed, the embassy in the phillipines does offer notarial services by appointment so it's conceivable that you could. Web in box 6, enter an x in the box for the type of form you are submitting. Web 1.6k views 1 year ago.

Both Of You Should Double Check.

The owner must use this form to mail the required information return to the irs. Web what is form 1096? For the latest information about developments related to form 1096, such as legislation enacted after it was published,. 176 tax expert feb 2, 2010,.

Web A Transmitter, Service Bureau, Paying Agent, Or Disbursing Agent (Hereafter Referred To As “Agent”) May Sign Form 1096 On Behalf Of Any Person Required To.

Web signature title date instructions future developments. Web a form 1096 is also known as an annual summary and transmittal of u.s. Web irs form 1096 is titled annual summary and transmittal of u.s. Check box 7 if you.

This Form Is Designed For Small And Corporate Business Owners.

Complete, edit or print tax forms instantly. A transmitter, service bureau, paying agent or disbursing agent may sign the form. Information returns. you must use it to provide the irs with details about one of seven. Web as a small business owner, you’ll most likely use form 1096 to submit form 1099, which is a type of form used to report any income paid to independent contractors in excess of.