1031 Tax Exchange Form

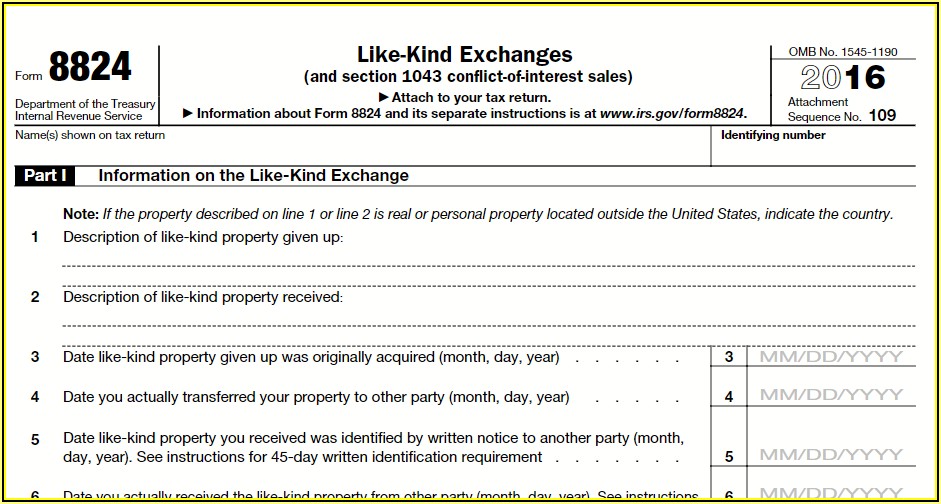

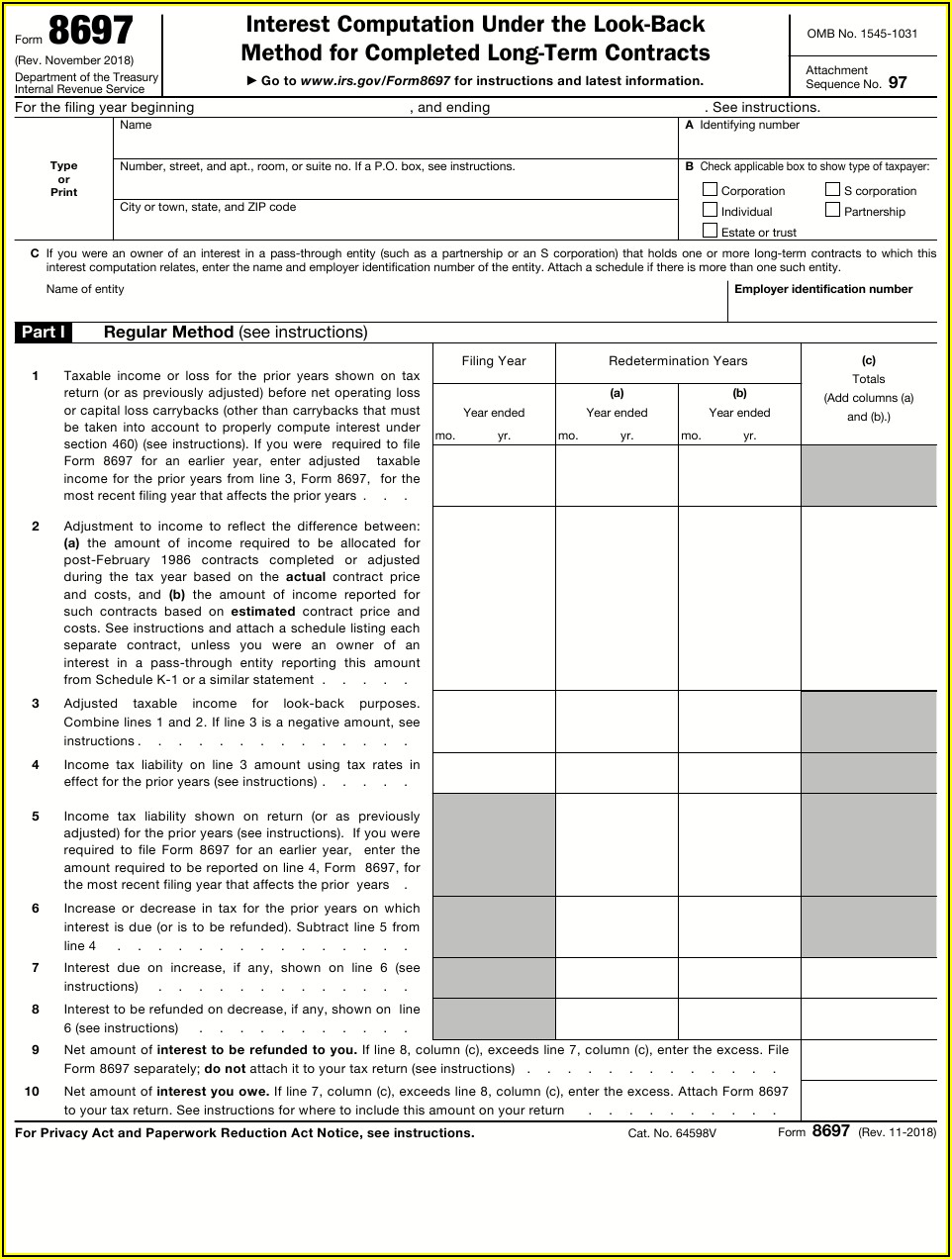

1031 Tax Exchange Form - An exchange of real property held primarily for sale still. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. The term—which gets its name from section 1031 of the internal. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. Web what is a 1031 exchange? See definition of real property, later, for more details. Web all 1031 exchanges are reported on irs form 8824. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time.

Web what is a 1031 exchange? Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web you can’t recognize a loss. Web all 1031 exchanges are reported on irs form 8824. See definition of real property, later, for more details. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. Web a 1031 exchange, named after section 1031 of the u.s.

Web what is a 1031 exchange? See definition of real property, later, for more details. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. So let’s say you bought a real estate property five years ago. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web all 1031 exchanges are reported on irs form 8824. Web you can’t recognize a loss. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties.

What is a 1031 TaxExchange? Mayfair RE by Alex Tiburzi

Web what is a 1031 exchange? Web you can’t recognize a loss. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. The term—which gets its name from section 1031 of the internal. Web a.

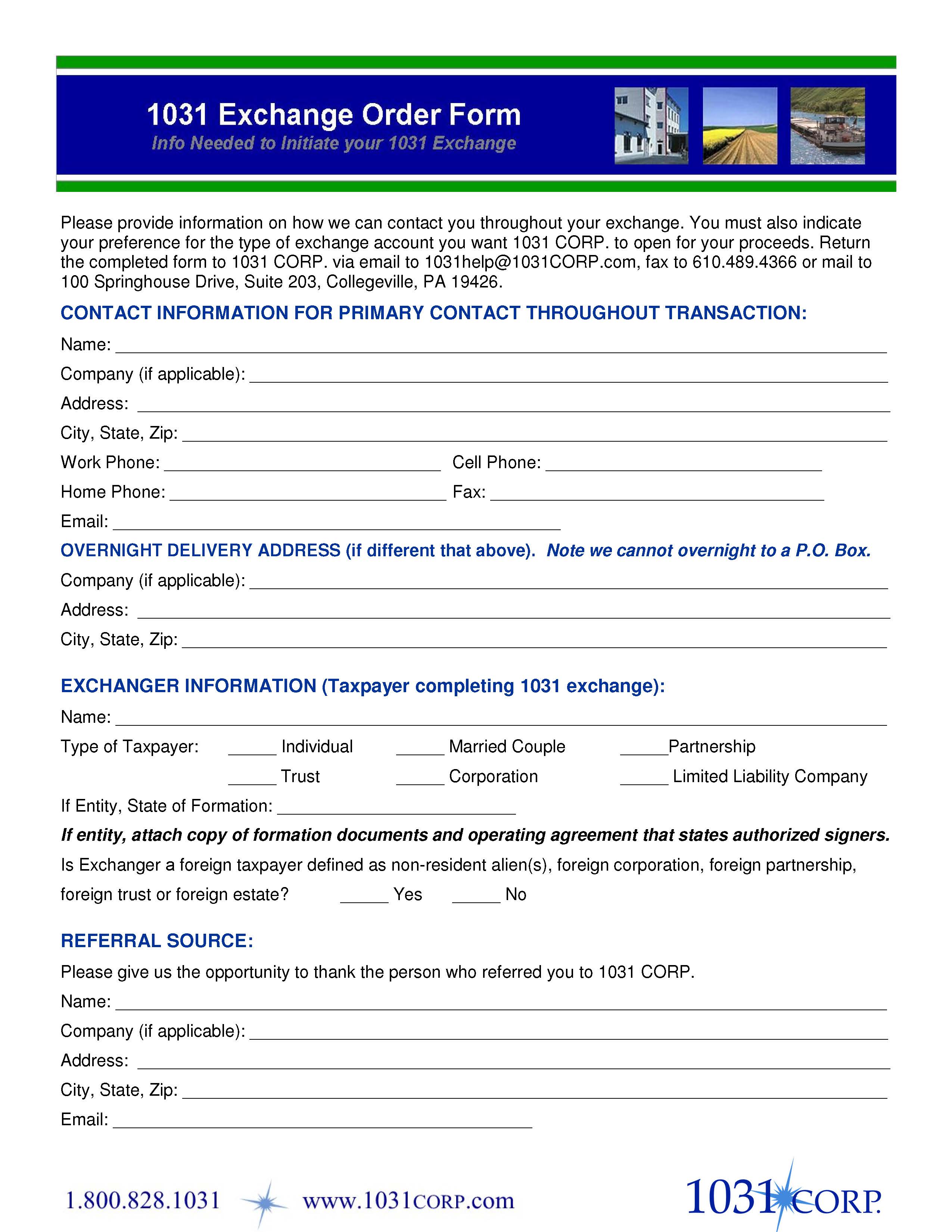

1031 Exchange Order Form

The term—which gets its name from section 1031 of the internal. Web all 1031 exchanges are reported on irs form 8824. An exchange of real property held primarily for sale still. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property.

Irs Form Section 1031 Universal Network

An exchange of real property held primarily for sale still. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web a 1031 exchange, named after section 1031 of the u.s. Web a 1031 exchange is a swap of one real estate investment property.

Tax Form 1031 Exchange Universal Network

See definition of real property, later, for more details. Web all 1031 exchanges are reported on irs form 8824. An exchange of real property held primarily for sale still. Web a 1031 exchange, named after section 1031 of the u.s. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

An exchange of real property held primarily for sale still. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. See definition of real property, later, for more details. Web you can’t recognize a loss. So let’s say you bought a real estate property five years ago..

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Web a 1031 exchange, named after section 1031 of the u.s. The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about.

IRS 1031 Tax Deferred Exchange Rules 1031 Exchange Rules 2021

See definition of real property, later, for more details. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Web what is a 1031 exchange? Web a 1031 exchange, named after section 1031 of the.

1031 Exchange Tax Forms Form Resume Examples xm1ezYDKrL

Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web you can’t recognize a loss. Yesno if both lines 9.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Web all 1031 exchanges are reported on irs form 8824. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of.

Web A 1031 Exchange Is A Swap Of One Real Estate Investment Property For Another That Allows Capital Gains Taxes To Be Deferred.

This is where you describe the relinquished and replacement property, the dates the relinquished property was acquired and transferred, the dates the replacement property was identified and received, and information about related parties. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. The term—which gets its name from section 1031 of the internal. An exchange of real property held primarily for sale still.

Web A 1031 Exchange, Named After Section 1031 Of The U.s.

Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. So let’s say you bought a real estate property five years ago. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web you can’t recognize a loss.

See Definition Of Real Property, Later, For More Details.

The form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web all 1031 exchanges are reported on irs form 8824. Yesno if both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Web what is a 1031 exchange?