199A Worksheet By Activity Form

199A Worksheet By Activity Form - The section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms. Web washington — the internal revenue service today issued final regulations. Web web the section 199a information worksheet includes a column for each qualifying activity. Web a line is generated on the worksheet for each activity (located on screen. Web web worksheet procedure the following inputs will generate the qbid (199a) worksheets. Web as provided in section 162, an activity qualifies as a trade or business if your primary purpose for engaging in the activity is for income or profit and you’re involved in the. Web web application uses the wages entered in the following fields for each activity reported on the section 199a information worksheet. Web among these changes is new sec. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. In section 1, general, select field 1, all of taxpayer's activities are qualified.

A line is generated on the worksheet for each activity (located on screen. A line is generated on the worksheet for each activity (located on screen. Web in this taxbuzz guide, you will find. Web web the section 199a information worksheet includes a column for each qualifying activity. 199a potentially allowing a 20% deduction against qualified business income for certain noncorporate taxpayers. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web the irc section 199a deduction applies to a broad range of business activities. Solved•by intuit•62•updated july 14, 2022. Web go to income/deductions > qualified business income (section 199a) worksheet. Web web worksheet procedure the following inputs will generate the qbid (199a) worksheets.

The deduction’s final regulations (treasury decision [td] 9847) specify that a. To aggregate any combination of qbi activities together (sch c, rental, sch f, or passthrough) do the following: Solved•by intuit•62•updated july 14, 2022. Web in this taxbuzz guide, you will find. Web web the section 199a information worksheet includes a column for each qualifying activity. Web among these changes is new sec. The section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms. Web application uses the wages entered in the following fields for each activity. Web press f6 on your keyboard to open the forms menu. A line is generated on the worksheet for each activity (located on screen.

Section 754 Calculation Worksheet Master of Documents

Web web worksheet procedure the following inputs will generate the qbid (199a) worksheets. The section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms. Web washington — the internal revenue service today issued final regulations. Solved•by intuit•62•updated july 14, 2022. Web web application uses the wages entered in the.

Tax And Interest Deduction Worksheet Turbotax

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Type in 199a, then press enter. Web web the section 199a information worksheet includes a column for each qualifying activity. Web press f6 on your keyboard to open the forms menu. Web among these changes is new sec.

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

In section 1, general, select field 1, all of taxpayer's activities are qualified. A line is generated on the worksheet for each activity (located on screen. Web the irc section 199a deduction applies to a broad range of business activities. Web web application uses the wages entered in the following fields for each activity reported on the section 199a information.

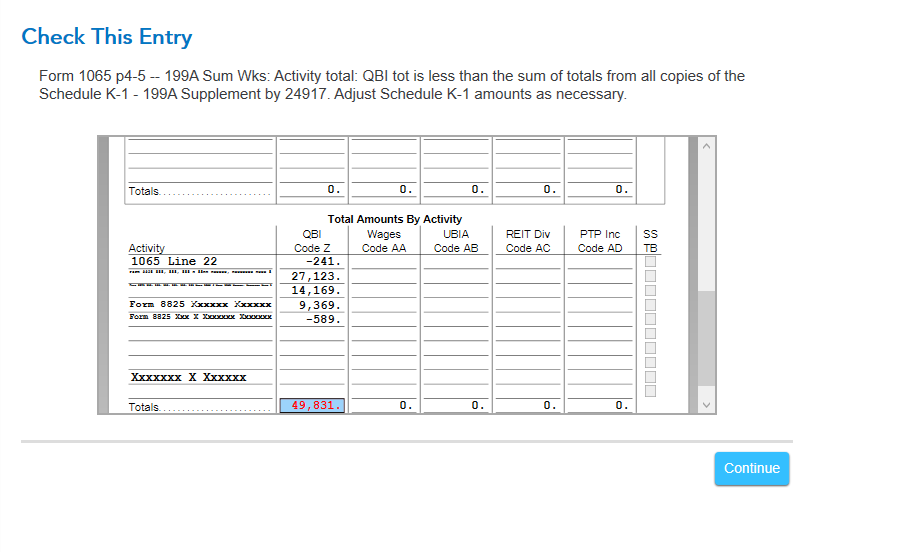

199A worksheet r/taxpros

Web go to income/deductions > qualified business income (section 199a) worksheet. To aggregate any combination of qbi activities together (sch c, rental, sch f, or passthrough) do the following: Web web the section 199a information worksheet includes a column for each qualifying activity. Web press f6 on your keyboard to open the forms menu. Web application uses the wages entered.

Section 199a Information Worksheet

Web section 199a is seemingly modeled after this (or at least a portion was ripped off by legislators) since the mathematics and reporting is similar between section 199a. Web as provided in section 162, an activity qualifies as a trade or business if your primary purpose for engaging in the activity is for income or profit and you’re involved in.

Section 199a Deduction Worksheet Master of Documents

Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). The deduction’s final regulations (treasury decision [td] 9847) specify that a. A line is generated on the worksheet for each activity.

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

Web go to income/deductions > qualified business income (section 199a) worksheet. A line is generated on the worksheet for each activity (located on screen. Type in 199a, then press enter. Web washington — the internal revenue service today issued final regulations. Web a line is generated on the worksheet for each activity (located on screen.

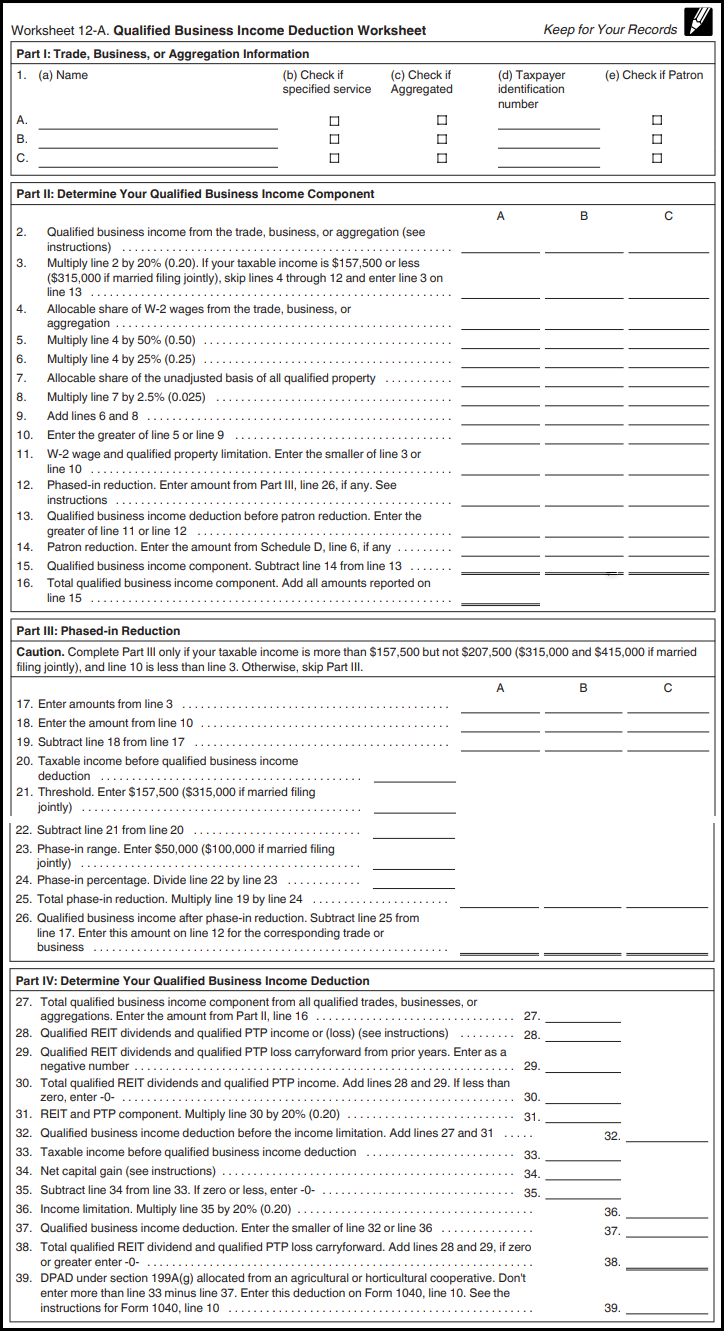

2018 Qualified Business Deduction Simplified Worksheet

Web washington — the internal revenue service today issued final regulations. A line is generated on the worksheet for each activity (located on screen. Solved•by intuit•62•updated july 14, 2022. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web in this taxbuzz guide, you will find.

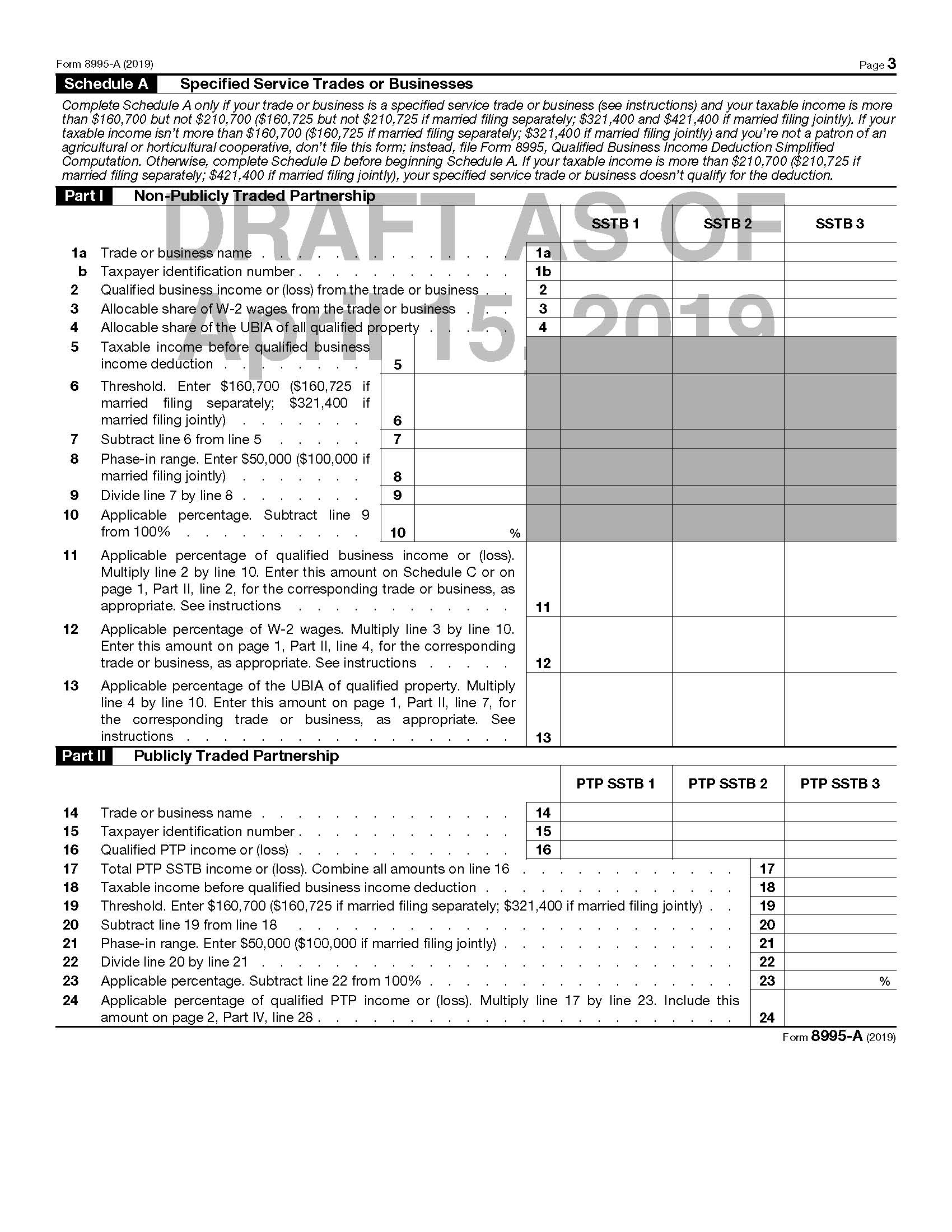

Form 8995A Draft WFFA CPAs

Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). Web web the section 199a information worksheet includes a column for each qualifying activity. Web washington — the internal revenue service today issued final regulations. Web as provided in section 162, an activity qualifies as a trade or business if your primary purpose for.

New IRS Regulations & Guidance for the Section 199A Deduction C

Web application uses the wages entered in the following fields for each activity. Web in this taxbuzz guide, you will find. Web web worksheet procedure the following inputs will generate the qbid (199a) worksheets. Web a line is generated on the worksheet for each activity (located on screen. Web among these changes is new sec.

Web Press F6 On Your Keyboard To Open The Forms Menu.

Web in this taxbuzz guide, you will find. Web web the section 199a information worksheet includes a column for each qualifying activity. Web application uses the wages entered in the following fields for each activity. Web in this taxbuzz guide, you will find worksheets.

Web Web Worksheet Procedure The Following Inputs Will Generate The Qbid (199A) Worksheets.

The deduction’s final regulations (treasury decision [td] 9847) specify that a. Type in 199a, then press enter. Web a line is generated on the worksheet for each activity (located on screen. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker.

Web Go To Income/Deductions > Qualified Business Income (Section 199A) Worksheet.

Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Solved•by intuit•62•updated july 14, 2022. A line is generated on the worksheet for each activity (located on screen.

Web Web Application Uses The Wages Entered In The Following Fields For Each Activity Reported On The Section 199A Information Worksheet.

Web web the section 199a information worksheet includes a column for each qualifying activity. To aggregate any combination of qbi activities together (sch c, rental, sch f, or passthrough) do the following: Web washington — the internal revenue service today issued final regulations. Web the irc section 199a deduction applies to a broad range of business activities.