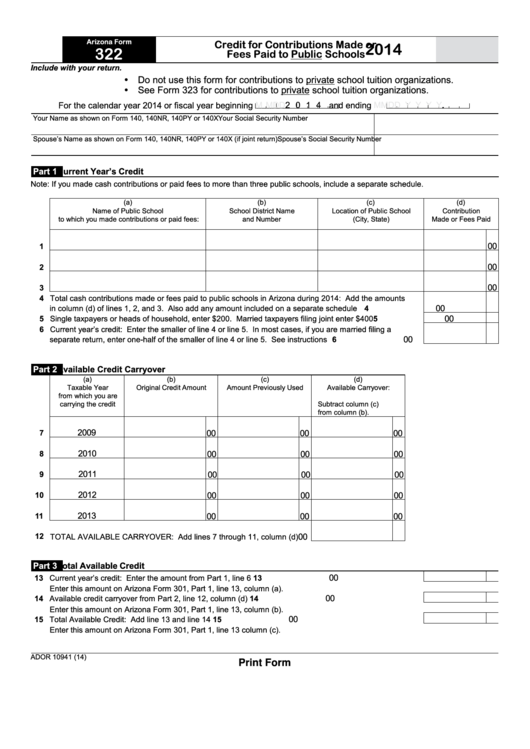

Az Form 322

Az Form 322 - Click on the new document button above, then drag and. 322 credit for fees to public schools 323 school tuition contribution credit. Details on how to only prepare and print an. Web how you can complete the arizona form 323 online: Save or instantly send your ready documents. Web taxslayer support arizona filing and tax deadline dates for 2022 tax returns according to the state of arizona, returns should be filed no later than friday, april 15, 2023. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web an individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible activities, programs or. Web complete az dor form 322 2020 online with us legal forms.

• do not use this form for contributions. Click on the new document button above, then drag and. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web add the printable 2020 arizona form 322 (credit for contributions made or fees paid to public schools) for editing. This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. Web an individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible activities, programs or. Web cash contributions that were made between january 1, 2023, and april 17, 2023, are required to be listed on part 1, section b of both arizona form 321 (for qco gifts) and. Business, tax, legal and other electronic documents need an advanced level of compliance with the legislation and protection. The advanced tools of the.

Web filling out form 322 arizona: Web complete az dor form 322 2020 online with us legal forms. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. • do not use this form for contributions. Web how you can complete the arizona form 323 online: Web add the printable 2020 arizona form 322 (credit for contributions made or fees paid to public schools) for editing. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. The advanced tools of the.

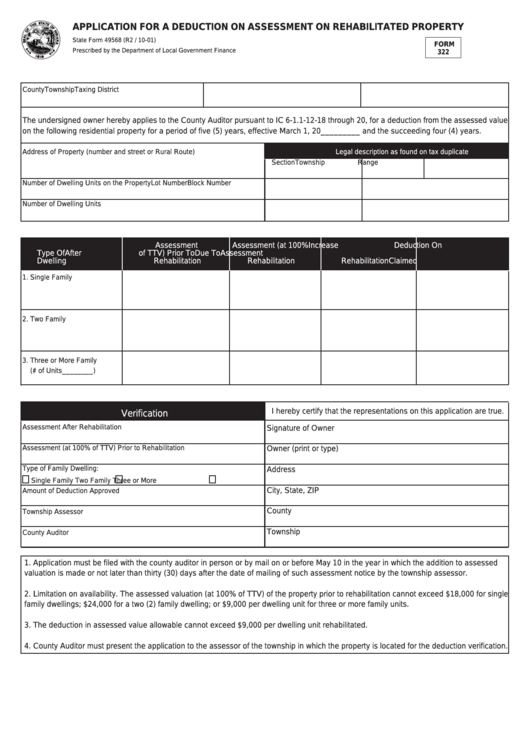

Fillable Form 322 Application For A Deduction On Assessment On

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web how you can complete the arizona form 323 online: Easily fill out pdf blank, edit, and sign them. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301.

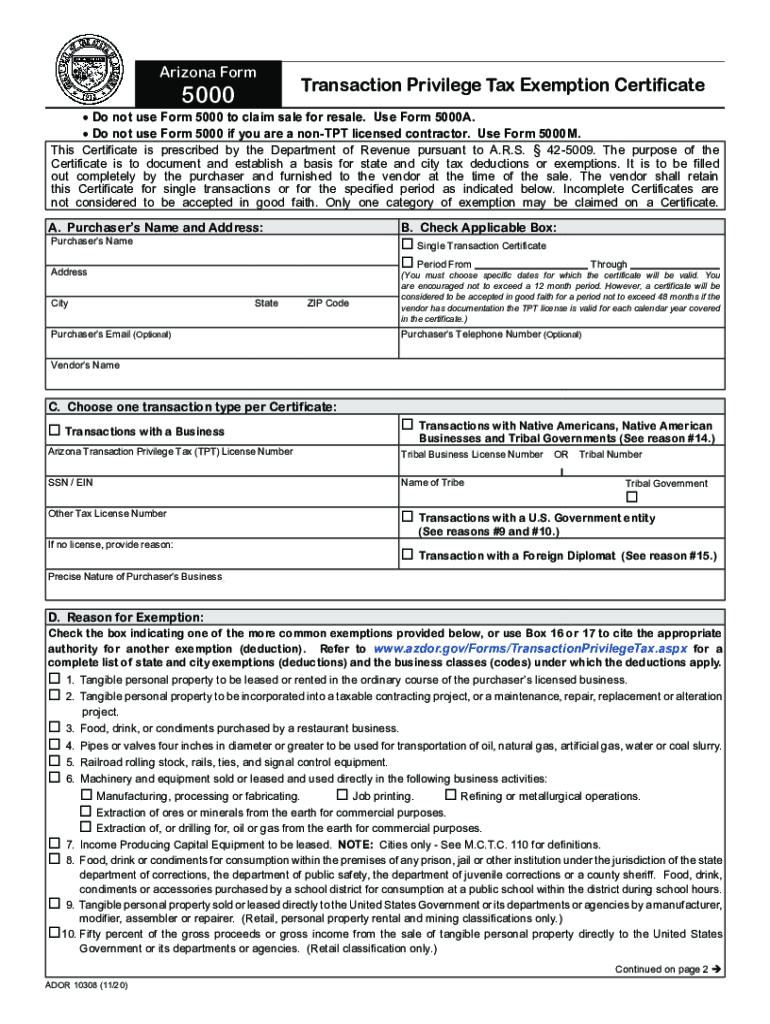

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona state income tax forms for tax year 2022 (jan. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web an individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible.

AZ Form 12 Inventory Of Property And Debts Complete Legal Document

Do not use this form for contributions to private school tuition. Save or instantly send your ready documents. Web filling out form 322 arizona: Business, tax, legal and other electronic documents need an advanced level of compliance with the legislation and protection. Click on the new document button above, then drag and.

FORM'a 322 FORM'a

Web arizona state income tax forms for tax year 2022 (jan. Business, tax, legal and other electronic documents need an advanced level of compliance with the legislation and protection. 322 credit for fees to public schools 323 school tuition contribution credit. Web cash contributions that were made between january 1, 2023, and april 17, 2023, are required to be listed.

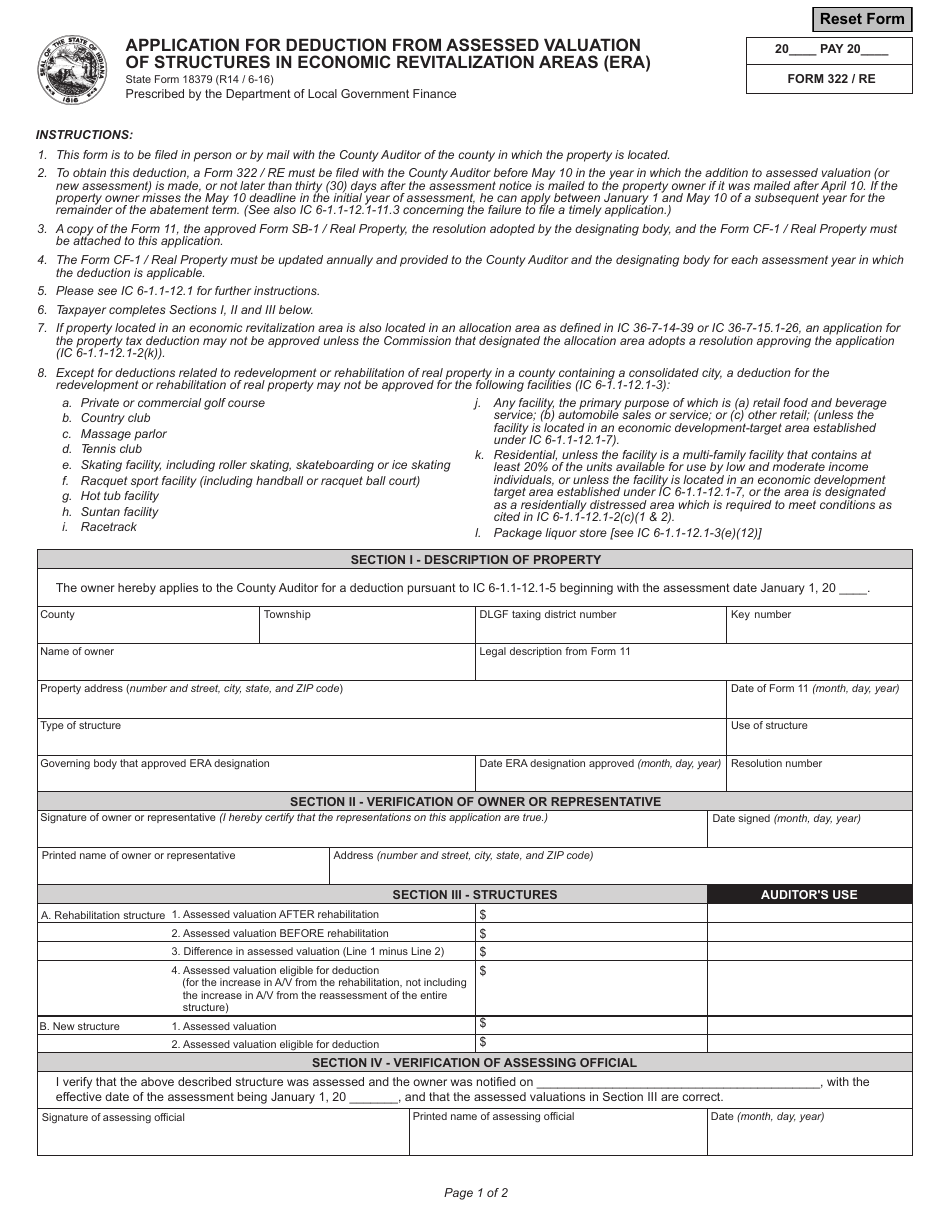

Form 322/RE (State Form 18379) Download Fillable PDF or Fill Online

Web filling out form 322 arizona: Web a nonrefundable individual tax credit for cash contributions to a private school tuition organization that provides scholarships or grants to qualified schools. Easily fill out pdf blank, edit, and sign them. Application for bingo license packet. This form is for income earned in tax year 2022, with tax returns due in april.

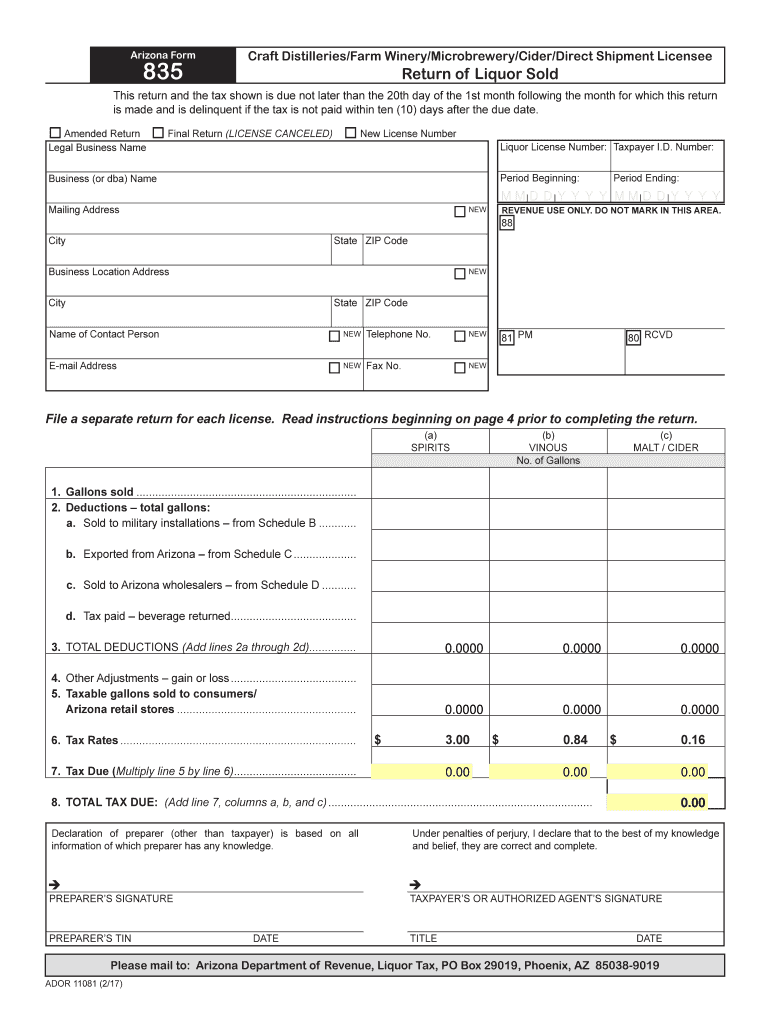

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. The advanced tools of the. Click on the new document button above, then drag and. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your.

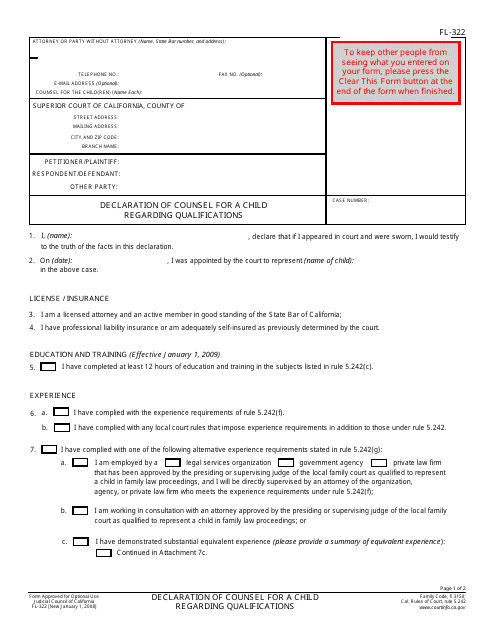

Form FL322 Download Fillable PDF or Fill Online Declaration of Counsel

Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Web cash contributions that were made between january 1, 2023, and april 17, 2023, are required to be listed on part 1, section b of both arizona form 321 (for qco gifts) and. Web follow the simple instructions below: • do not use this.

Fillable Arizona Form 322 Credit For Contributions Made Or Fees Paid

Easily fill out pdf blank, edit, and sign them. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Application for bingo license packet. Save or instantly send your ready documents. 322 credit for fees to public schools 323 school tuition contribution credit.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Click on the new document button above, then drag and. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. At the top of the form, you will. To get started on the form, use the fill & sign online button or tick the preview.

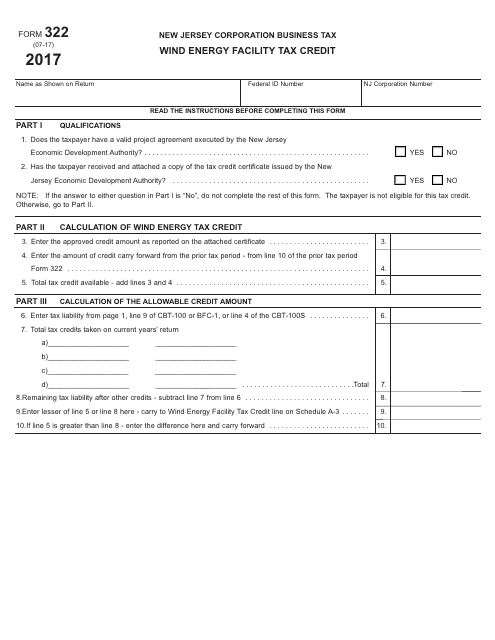

Form 322 Download Fillable PDF or Fill Online Wind Energy Facility Tax

Details on how to only prepare and print an. Web how you can complete the arizona form 323 online: Save or instantly send your ready documents. Web add the printable 2020 arizona form 322 (credit for contributions made or fees paid to public schools) for editing. To get started on the form, use the fill & sign online button or.

Web Arizona State Income Tax Forms For Tax Year 2022 (Jan.

Web cash contributions that were made between january 1, 2023, and april 17, 2023, are required to be listed on part 1, section b of both arizona form 321 (for qco gifts) and. Web taxslayer support arizona filing and tax deadline dates for 2022 tax returns according to the state of arizona, returns should be filed no later than friday, april 15, 2023. Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. This form is for income earned in tax year 2022, with tax returns due in april.

Web Filling Out Form 322 Arizona:

• do not use this form for contributions. Web a nonrefundable individual tax credit for cash contributions to a private school tuition organization that provides scholarships or grants to qualified schools. Save or instantly send your ready documents. Web how you can complete the arizona form 323 online:

The Advanced Tools Of The.

Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. Web generalinstructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Web an individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible activities, programs or.

Web Add The Printable 2020 Arizona Form 322 (Credit For Contributions Made Or Fees Paid To Public Schools) For Editing.

Do not use this form for contributions to private school tuition. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax.