Canadian Uht Form

Canadian Uht Form - Web underused housing tax. Web underused housing tax forms. Report a problem or mistake on this page. On january 31, 2023, the. Web new annual tax with a new information return. This page is all about full form, long form, abbreviation, acronym and meaning of the given term uht. Web by varun sehgal | feb 24, 2023 | corporate tax, personal tax. Upper harbor terminal (minneapolis, minnesota) uht: Then you can submit the claim for through the cowan secure online portal. Web the underused housing tax act (uhta), which governs the underused housing tax, received royal assent on june 9, 2022.

Web what does uht mean? Web 2.24.2023 | denise deveau canadian citizens and residents who own residential properties should familiarize themselves with the uht’s various provisions to. This page is all about full form, long form, abbreviation, acronym and meaning of the given term uht. The underused housing tax took effect on. Web underused housing tax forms. Web by varun sehgal | feb 24, 2023 | corporate tax, personal tax. Web february 17, 2023. Web preparing for the underused housing tax (uht) on dec. Then you can submit the claim for through the cowan secure online portal. Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900).

Alternatively, you can physically mail the claim form,. Web 2.24.2023 | denise deveau canadian citizens and residents who own residential properties should familiarize themselves with the uht’s various provisions to. Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900). Web rules for the underused housing tax (uht) were enacted on june 9, 2022, and apply to residential properties owned on or after december 31, 2022. To provide more time for affected owners to take necessary actions to comply, the canada revenue agency (cra) is providing. Web february 17, 2023. Web the government of canada has introduced an underused housing tax (uht) on the ownership of vacant or underused housing in canada. Web in addition to setting out the rules for determining one’s tax liability, the uht act imposes a filing requirement for a broader group of property owners. Web an uht return for a residential property they own. This page is all about full form, long form, abbreviation, acronym and meaning of the given term uht.

Canadian Outdoor Recreation Trade Associations Form New Coalition

Web 2.24.2023 | denise deveau canadian citizens and residents who own residential properties should familiarize themselves with the uht’s various provisions to. On january 31, 2023, the. The underused housing tax (uht) is an annual 1% tax on the ownership of vacant or underused housing in canada. Web in addition to setting out the rules for determining one’s tax liability,.

Education is a Life Canadian History What We're Doing in Form 1

Web by varun sehgal | feb 24, 2023 | corporate tax, personal tax. Web rules for the underused housing tax (uht) were enacted on june 9, 2022, and apply to residential properties owned on or after december 31, 2022. Upper harbor terminal (minneapolis, minnesota) uht: Web first, you need to complete the uhip claim form. To provide more time for.

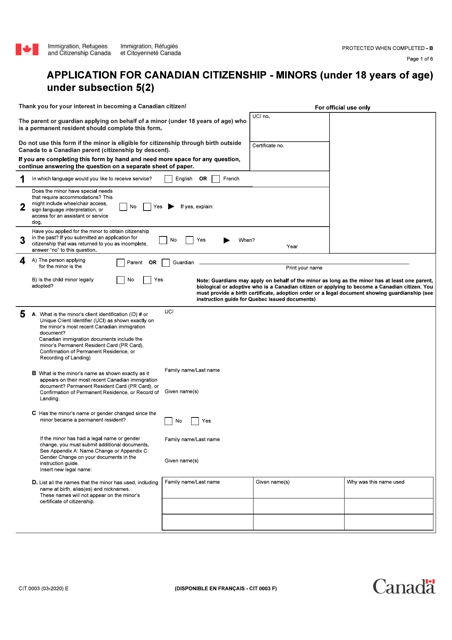

Form CIT0003 Download Fillable PDF or Fill Online Application for

Web the underused housing tax act (uhta), which governs the underused housing tax, received royal assent on june 9, 2022. Web in addition to setting out the rules for determining one’s tax liability, the uht act imposes a filing requirement for a broader group of property owners. Then you can submit the claim for through the cowan secure online portal..

Canadian Voice English School Nagano August 2013

Report a problem or mistake on this page. Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900). To provide more time for affected owners to take necessary actions to comply, the canada revenue agency (cra) is providing. Web 2.24.2023.

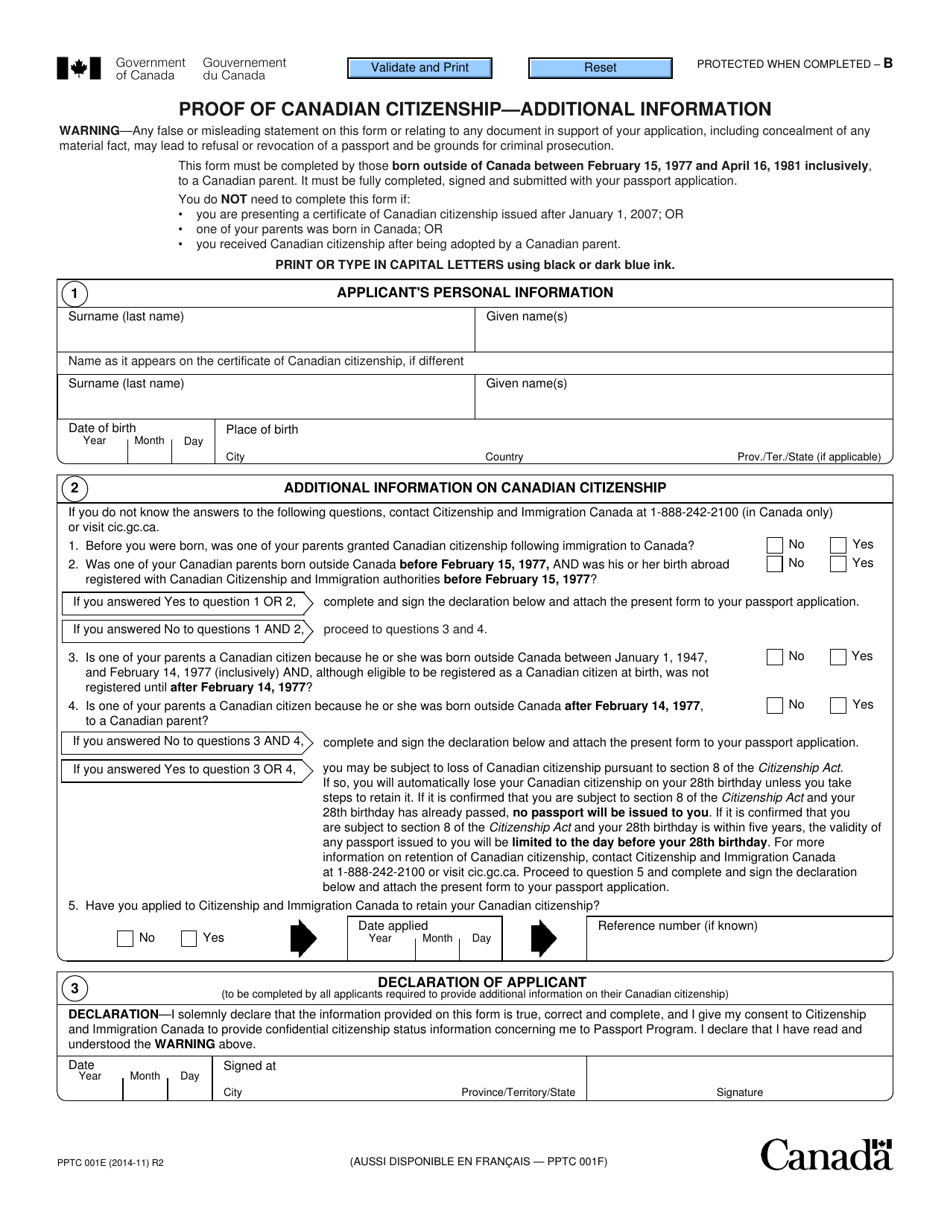

Form PPTC001 Download Fillable PDF or Fill Online Proof of Canadian

Web february 7, 2023. On january 31, 2023, the. Then you can submit the claim for through the cowan secure online portal. This page is all about full form, long form, abbreviation, acronym and meaning of the given term uht. The underused housing tax act,.

Canadian Beneficiary form IUPAT

Then you can submit the claim for through the cowan secure online portal. Web february 17, 2023. On january 31, 2023, the. Web in addition to setting out the rules for determining one’s tax liability, the uht act imposes a filing requirement for a broader group of property owners. The underused housing tax act,.

Canadian Customs Form John B. Flickr

Web an uht return for a residential property they own. Web underused housing tax forms. Web february 17, 2023. Web rules for the underused housing tax (uht) were enacted on june 9, 2022, and apply to residential properties owned on or after december 31, 2022. The underused housing tax act,.

Canadian Will Form Editable Forms

Web in addition to setting out the rules for determining one’s tax liability, the uht act imposes a filing requirement for a broader group of property owners. Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900). Then you can.

Banner University Family Care Prior Auth Fill Online, Printable

Web preparing for the underused housing tax (uht) on dec. Upper harbor terminal (minneapolis, minnesota) uht: The underused housing tax took effect on. Web the underused housing tax act (uhta), which governs the underused housing tax, received royal assent on june 9, 2022. Web 2.24.2023 | denise deveau canadian citizens and residents who own residential properties should familiarize themselves with.

Canadian tax form. stock photo. Image of form, cash, office 48808520

Web the underused housing tax act (uhta), which governs the underused housing tax, received royal assent on june 9, 2022. On january 31, 2023, the. The underused housing tax act,. Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900)..

Web First, You Need To Complete The Uhip Claim Form.

Web if the above criteria are met, the person (an “affected owner” as described by the canada revenue agency (cra)) will need to file the uht return ( form uht‑2900). Web underused housing tax. The underused housing tax act,. Web in addition to setting out the rules for determining one’s tax liability, the uht act imposes a filing requirement for a broader group of property owners.

Web Rules For The Underused Housing Tax (Uht) Were Enacted On June 9, 2022, And Apply To Residential Properties Owned On Or After December 31, 2022.

Alternatively, you can physically mail the claim form,. Then you can submit the claim for through the cowan secure online portal. To provide more time for affected owners to take necessary actions to comply, the canada revenue agency (cra) is providing. Web underused housing tax forms.

Web February 7, 2023.

Web what is the uht? The underused housing tax (uht) is an annual 1% tax on the ownership of vacant or underused housing in canada. Web 2.24.2023 | denise deveau canadian citizens and residents who own residential properties should familiarize themselves with the uht’s various provisions to. Web february 17, 2023.

Web Preparing For The Underused Housing Tax (Uht) On Dec.

Web an uht return for a residential property they own. Web what does uht mean? Report a problem or mistake on this page. This page is all about full form, long form, abbreviation, acronym and meaning of the given term uht.