Fake 1099 Form

Fake 1099 Form - Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. Web if you're caught faking this type of information, you can end up in jail. To keep yourself out of trouble, make sure all. This is a form of tax fraud and can result in. Web tax fraud includes: Web 1:24 imagine seeing a tax form pop up in the mail that indicates that you need to claim an extra $5,000 or more in taxable income on your federal income tax. For your protection, this form may show only the last four digits of your social security number. Web form 1099 misc must be completed and filed for each person paid by your company during the year: False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income organized crime failure to. It's fast, it's easy and no software installations are necessary.

This is a form of tax fraud and can result in. Web instructions for recipient recipient’s taxpayer identification number (tin). Web washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax professionals and financial. False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income organized crime failure to. Or even paying a large fine as high as $1 million. For your protection, this form may show only the last four digits of your social security number. At least $10 of royalties or brokerage payments instead of dividends or tax. Uslegalforms allows users to edit, sign, fill & share all type of documents online. It's fast, it's easy and no software installations are necessary. The 1099 tax forms are issued as part of the fraudulent.

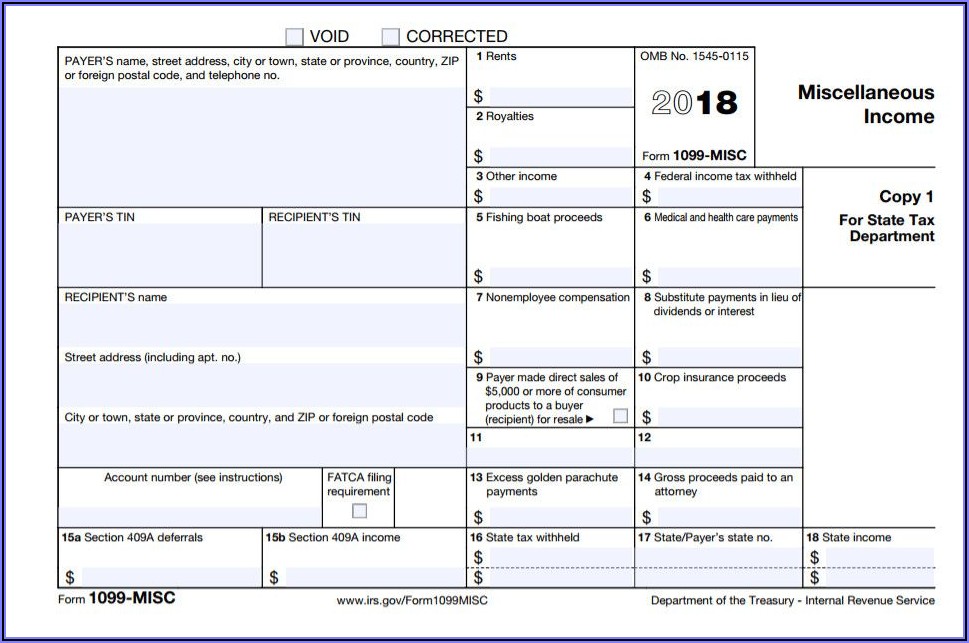

The 1099 tax forms are issued as part of the fraudulent. Web form 1099 misc must be completed and filed for each person paid by your company during the year: To keep yourself out of trouble, make sure all. Web some of our viewers may be receiving tax forms tied to those fake unemployment claims. Or even paying a large fine as high as $1 million. Web instructions for recipient recipient’s taxpayer identification number (tin). It's fast, it's easy and no software installations are necessary. Web tax fraud includes: For your protection, this form may show only the last four digits of your social security number. Web washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax professionals and financial.

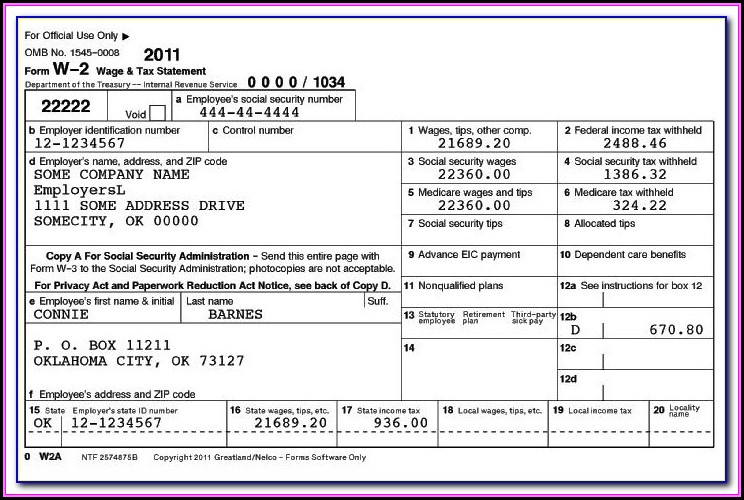

Fake 1099 Forms Form Resume Examples xz20dnd2ql

False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income organized crime failure to. Web form 1099 misc must be completed and filed for each person paid by your company during the year: Web contact the state agency that issued the 1099 and report the fraud. Web instructions for recipient recipient’s taxpayer identification number.

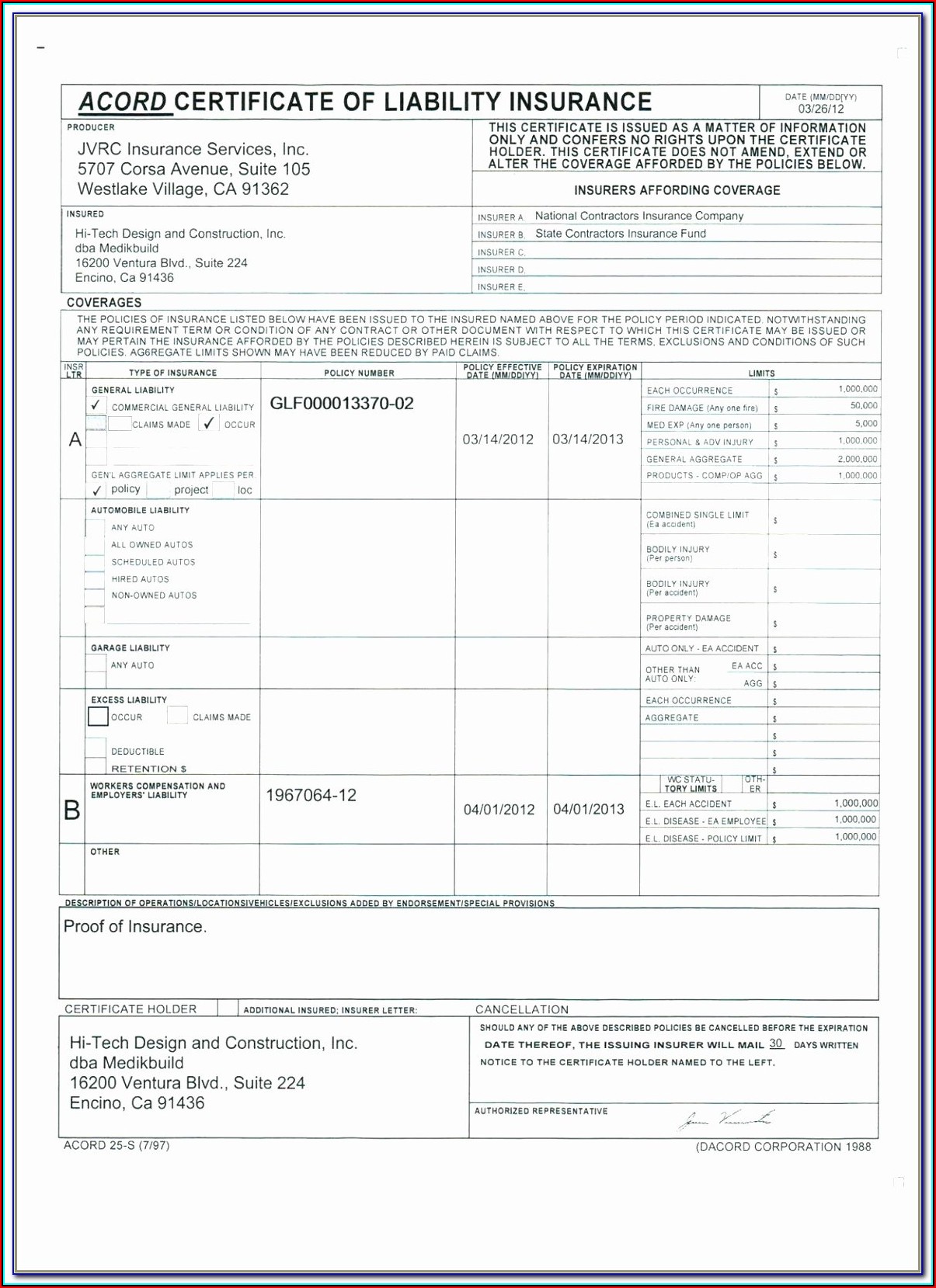

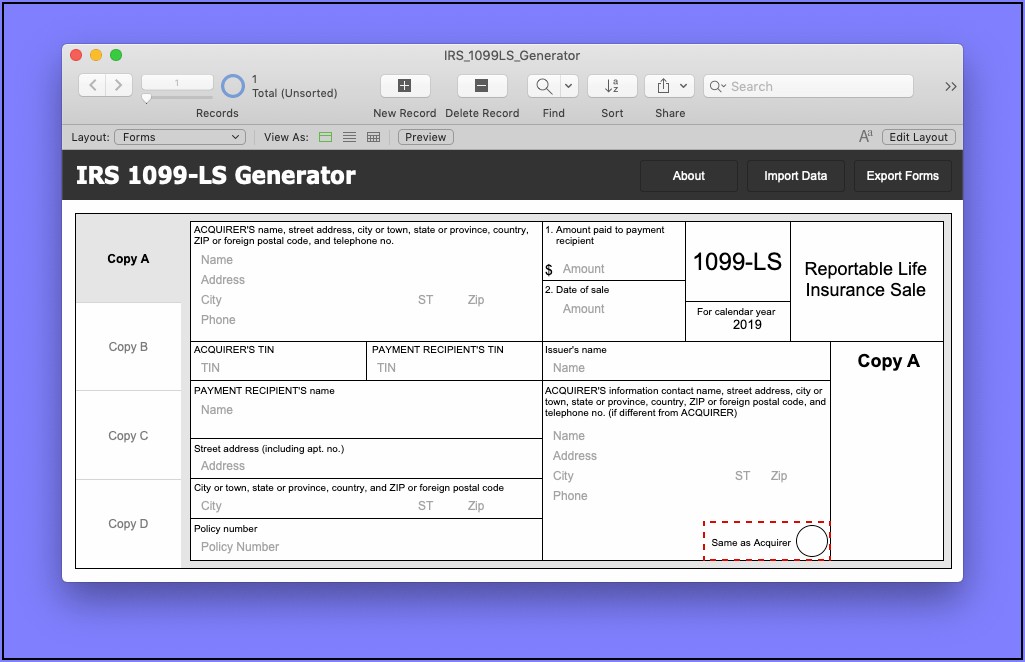

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Or even paying a large fine as high as $1 million. To keep yourself out of trouble, make sure all. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web if you're caught faking this type of information, you can end up in jail. False exemptions or deductions kickbacks a false or altered document failure.

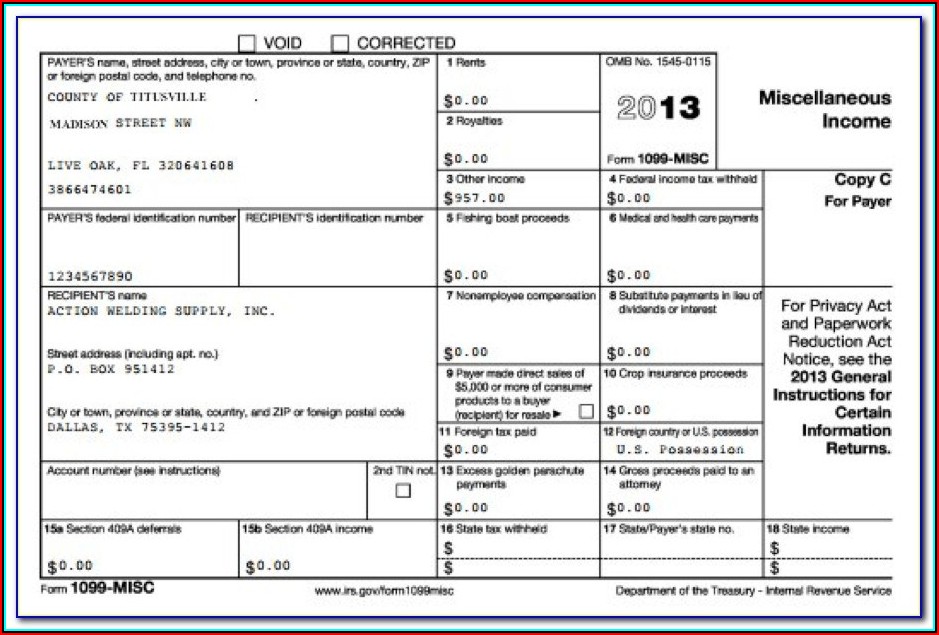

Ordering 1099 Forms Online Form Resume Examples Kw9kK6L9JN

At least $10 of royalties or brokerage payments instead of dividends or tax. Web instructions for recipient recipient’s taxpayer identification number (tin). Web form 1099 misc must be completed and filed for each person paid by your company during the year: Web washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for.

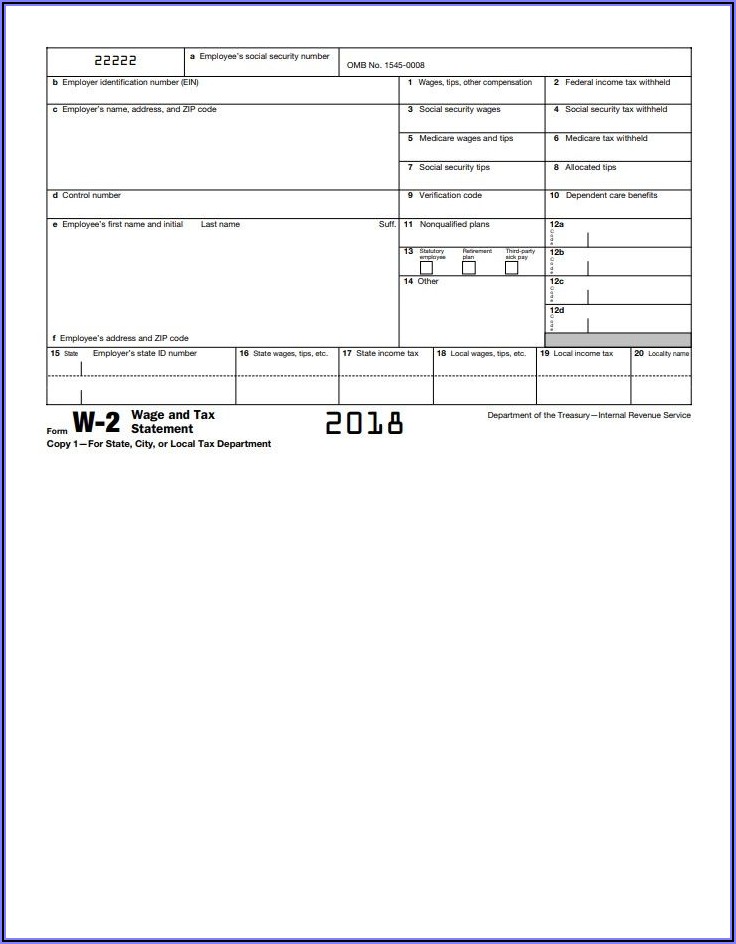

Irs Printable 1099 Form Printable Form 2022

Or even paying a large fine as high as $1 million. Web tax fraud includes: This is a form of tax fraud and can result in. Web form 1099 misc must be completed and filed for each person paid by your company during the year: Web some of our viewers may be receiving tax forms tied to those fake unemployment.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web contact the state agency that issued the 1099 and report the fraud. Or even paying a large fine as high as $1 million. Web 1:24 imagine seeing a tax form pop up in the mail that indicates that you need to claim an extra $5,000.

1099 Int Form Fillable Pdf Template Download Here!

False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income organized crime failure to. To keep yourself out of trouble, make sure all. Web instructions for recipient recipient’s taxpayer identification number (tin). This is a form of tax fraud and can result in. It's fast, it's easy and no software installations are necessary.

Fake 1099 Forms Form Resume Examples xz20dnd2ql

Web 1:24 imagine seeing a tax form pop up in the mail that indicates that you need to claim an extra $5,000 or more in taxable income on your federal income tax. The 1099 tax forms are issued as part of the fraudulent. Web some individuals or entities may create fake 1099 forms to falsely report income or payments made.

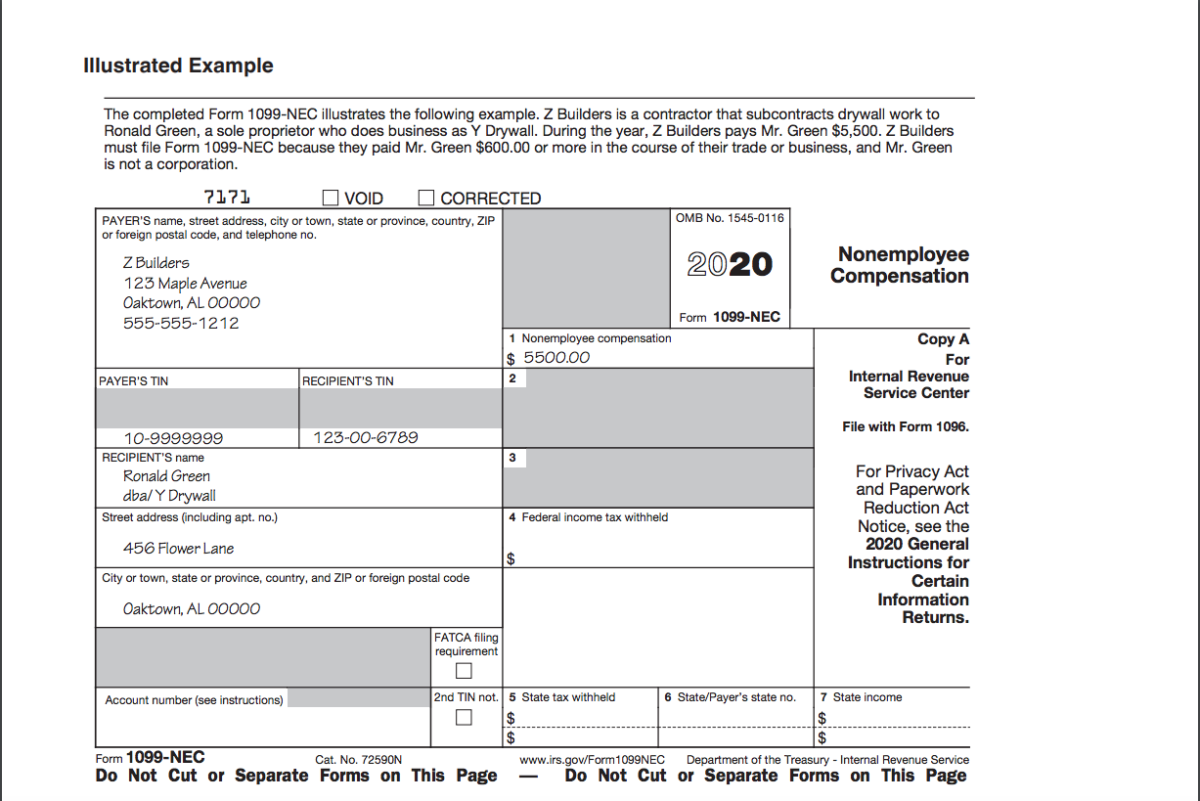

Introducing the New 1099NEC for Reporting Nonemployee Compensation

For your protection, this form may show only the last four digits of your social security number. Web if you're caught faking this type of information, you can end up in jail. Or even paying a large fine as high as $1 million. It's fast, it's easy and no software installations are necessary. This is a form of tax fraud.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Web tax fraud includes: Or even paying a large fine as high as $1 million. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web if you're caught faking this type of information, you can end up in jail. False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Web form 1099 misc must be completed and filed for each person paid by your company during the year: Uslegalforms allows users to edit, sign, fill & share all type of documents online. This is a form of tax fraud and can result in. False exemptions or deductions kickbacks a false or altered document failure to pay tax unreported income.

False Exemptions Or Deductions Kickbacks A False Or Altered Document Failure To Pay Tax Unreported Income Organized Crime Failure To.

Web 1:24 imagine seeing a tax form pop up in the mail that indicates that you need to claim an extra $5,000 or more in taxable income on your federal income tax. Uslegalforms allows users to edit, sign, fill & share all type of documents online. It's fast, it's easy and no software installations are necessary. This is a form of tax fraud and can result in.

To Keep Yourself Out Of Trouble, Make Sure All.

The 1099 tax forms are issued as part of the fraudulent. Or even paying a large fine as high as $1 million. Web instructions for recipient recipient’s taxpayer identification number (tin). Web some of our viewers may be receiving tax forms tied to those fake unemployment claims.

Web Some Individuals Or Entities May Create Fake 1099 Forms To Falsely Report Income Or Payments Made To Someone.

At least $10 of royalties or brokerage payments instead of dividends or tax. Web form 1099 misc must be completed and filed for each person paid by your company during the year: For your protection, this form may show only the last four digits of your social security number. Web tax fraud includes:

Web If You're Caught Faking This Type Of Information, You Can End Up In Jail.

Web washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax professionals and financial. Web contact the state agency that issued the 1099 and report the fraud.