File Form 940 Electronically

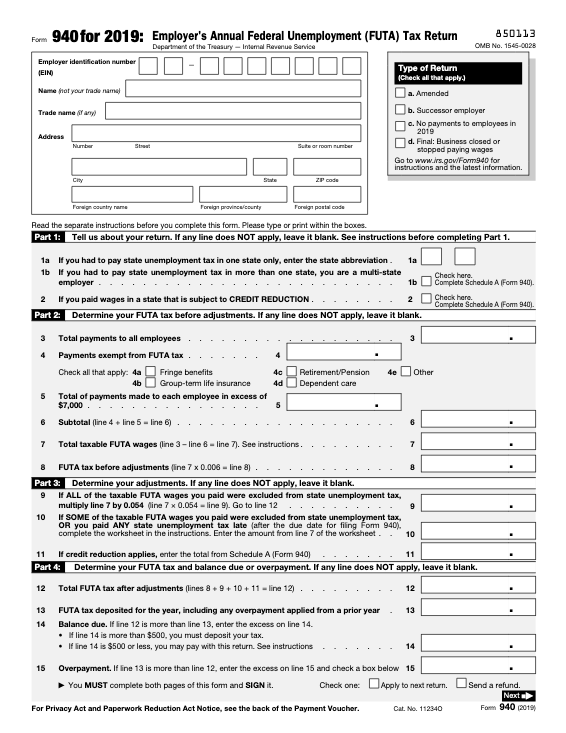

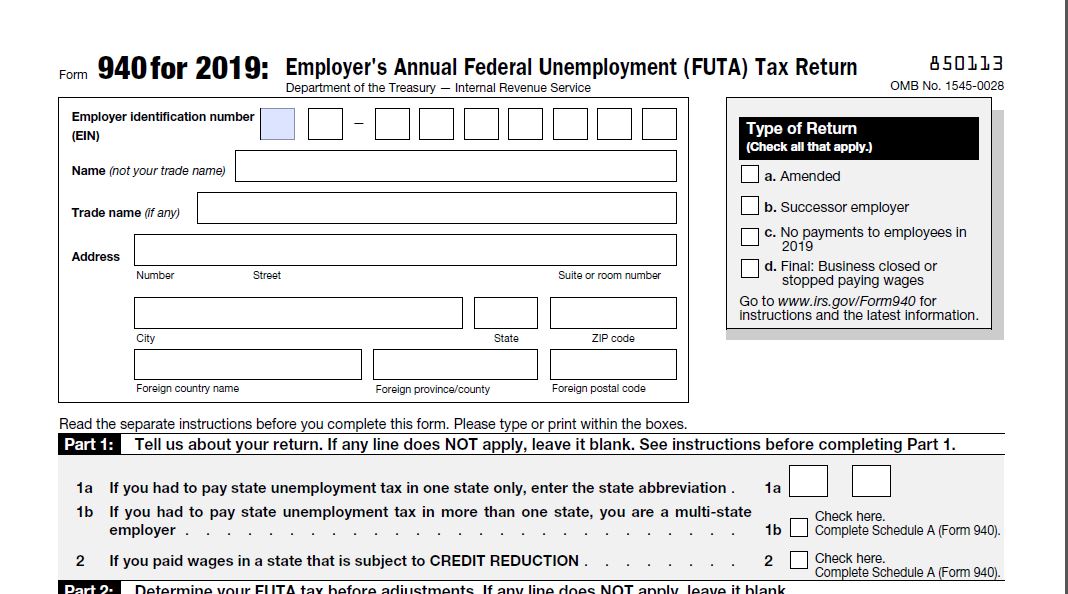

File Form 940 Electronically - If you file a paper return, where you file depends on. For more information about a cpeo’s. Form 940, employer's federal unemployment (futa) tax return; Enter information enter total wages paid to all. Get ready for tax season deadlines by completing any required tax forms today. Irs approved tax1099.com allows you to efile your 940 with security and ease, all online. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Web mailing addresses for forms 940. Web employers can file form 940 online by following a few simple steps. It will take only a few minutes to complete the filing process.

Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Web mailing addresses for forms 940. Complete, edit or print tax forms instantly. This is the fastest and easiest way to. For more information about a cpeo’s. Form 940, employer's federal unemployment (futa) tax return; Web information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on how to. Get ready for tax season deadlines by completing any required tax forms today. Web follow these steps to submit forms 940 and 941 electronically: Connecticut, delaware, district of columbia, georgia,.

Go to irs.gov/employmentefile for more information on electronic filing. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Download or email irs 940 & more fillable forms, register and subscribe now! Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. Ad get ready for tax season deadlines by completing any required tax forms today. Form 940, employer's federal unemployment (futa) tax return; Connecticut, delaware, district of columbia, georgia,. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web mailing addresses for forms 940.

File 940 Online Efile FUTA Tax IRS Form 940 for 2022

Form 940, employer's federal unemployment (futa) tax return; Web mailing addresses for forms 940. For more information about a cpeo’s. Complete, edit or print tax forms instantly. Connecticut, delaware, district of columbia, georgia,.

Form 940 How to File Your FUTA Tax Return Bench Accounting

Electronic filing options for employment taxes: Irs form 940 is the employer’s annual. Web file form 940 online. Form 940, employer's federal unemployment (futa) tax return; Enter information enter total wages paid to all.

Who is required to file Form 940 in USA?

Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Enter information enter total wages paid to all. Print and download pdf copies at anytime; Web visit eftps.gov to enroll. Irs form 940 is the employer’s annual.

File 940 Online Efile FUTA Tax IRS Form 940 for 2022

If you file a paper return, where you file depends on. Ad access irs tax forms. Download or email irs 940 & more fillable forms, register and subscribe now! In the print reports screen, select form 940/941 to print. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your.

How to File Form 940 for 2021 YouTube

Web follow these steps to submit forms 940 and 941 electronically: In the print reports screen, select form 940/941 to print. It will take only a few minutes to complete the filing process. Web you’re encouraged to file form 940 electronically. Complete, edit or print tax forms instantly.

File 940 Online Efile FUTA Tax IRS Form 940 for 2022

Web file form 940 online. Irs form 940 is the employer’s annual. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Print and download pdf copies at anytime; Electronic filing options for employment taxes:

What is Form 940 and How is it Used by Small Businesses? Paychex

Get ready for tax season deadlines by completing any required tax forms today. Web you’re encouraged to file form 940 electronically. Enter information enter total wages paid to all. Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. Web with these 940 instructions, you can easily.

File 940 Online Efile FUTA Tax IRS Form 940 for 2018

Form 940, employer's federal unemployment (futa) tax return; For more information about a cpeo’s. Go to irs.gov/employmentefile for more information on electronic filing. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Web are you looking for where to file 940 online?

File 940 Online EFile 940 for 4.95 FUTA Form 940 for 2022

Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. Download or email irs 940 & more fillable forms, register and subscribe now! Web visit eftps.gov to enroll. Web file form 940 online. Web employers can file form 940 online by following a few simple steps.

How to File Form 940 FUTA Employer’s Annual Federal Unemployment Tax

Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Web employers can file form 940 online by following a few simple steps. Get ready for tax season deadlines by completing any required tax forms today. If you file a paper return, where you file depends on. Edit, sign and save irs.

If You File A Paper Return, Where You File Depends On.

Ad access irs tax forms. Complete, edit or print tax forms instantly. In the print reports screen, select form 940/941 to print. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically.

Form 940, Employer's Federal Unemployment (Futa) Tax Return;

Get ready for tax season deadlines by completing any required tax forms today. Web employers can file form 940 online by following a few simple steps. Irs form 940 is the employer’s annual. Irs approved tax1099.com allows you to efile your 940 with security and ease, all online.

Download Or Email Irs 940 & More Fillable Forms, Register And Subscribe Now!

For more information about a cpeo’s. Web mailing addresses for forms 940. Electronic filing options for employment taxes: Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows.

Web Making Payments With Form 940 To Avoid A Penalty, Make Your Payment With Your 2022 Form 940 Only If Your Futa Tax For The Fourth Quarter (Plus Any Undeposited Amounts.

Web with these 940 instructions, you can easily fill out form 940 for 2022. Go to irs.gov/employmentefile for more information on electronic filing. Web visit eftps.gov to enroll. Ad get ready for tax season deadlines by completing any required tax forms today.