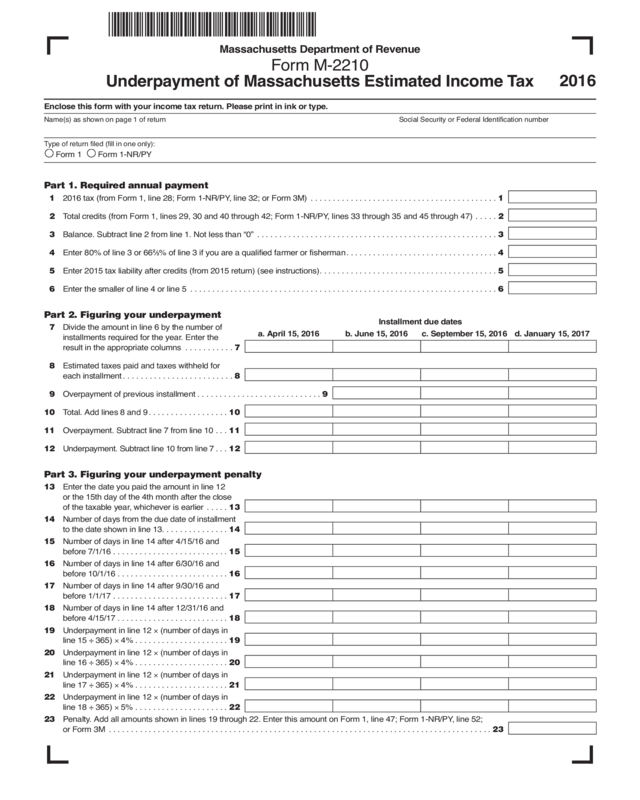

Form M 2210

Form M 2210 - 9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. This form is for income. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 283.39. This form is for income earned in tax year 2022, with tax. The irs will generally figure your penalty for you and you should not file form 2210. Total amount on line 28c. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Web requirements beyond reading a form’s instructions (subsection 1.4);

9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. The irs will generally figure your penalty for you and you should not file form 2210. This form is for income earned in tax year 2022, with tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web requirements beyond reading a form’s instructions (subsection 1.4); As discussed in this memorandum, “public benefits programs ” should be construed.

As discussed in this memorandum, “public benefits programs ” should be construed. Total amount on line 28c. The irs will generally figure your penalty for you and you should not file form 2210. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. If you have an underpayment on line 50 of. The irs will generally figure your penalty for you and you should not file form 2210. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 283.39. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. This form is for income. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

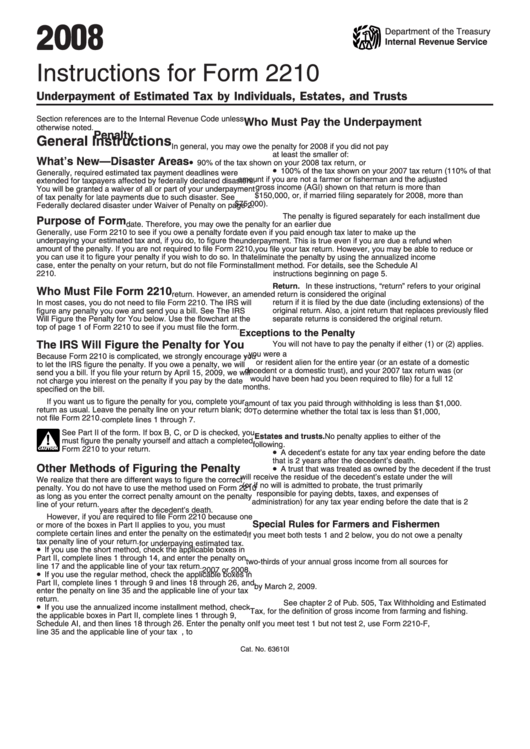

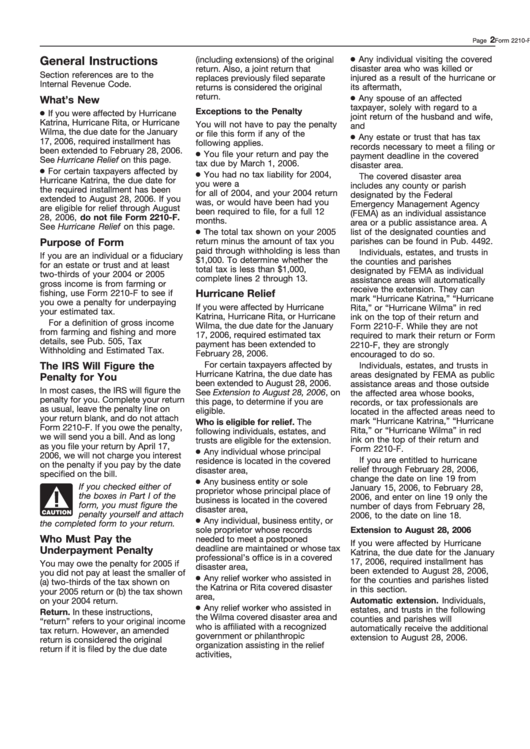

Instructions For Form 2210 2008 printable pdf download

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. If you have an underpayment on line 50 of. This form is for income earned in tax year 2022, with tax. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 283.39. Total amount on line 28c.

Ssurvivor Form 2210 Instructions 2020

The irs will generally figure your penalty for you and you should not file form 2210. This form is for income. Total amount on line 28c. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 283.39. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,.

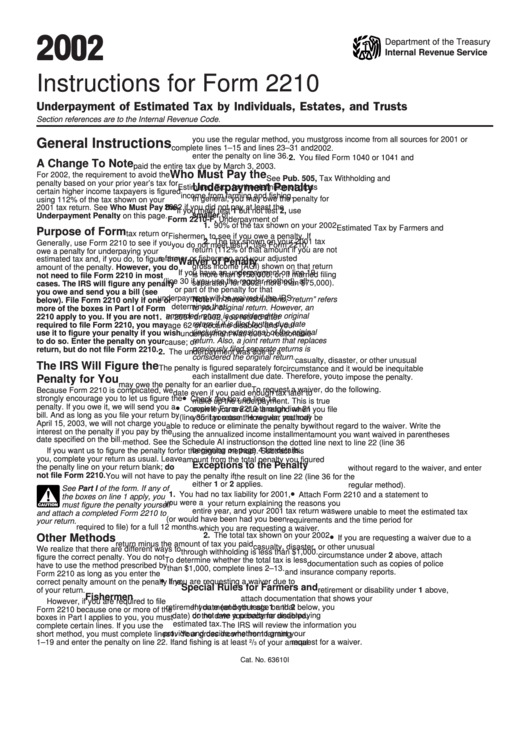

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web requirements beyond reading a form’s instructions (subsection 1.4); Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. This form is for income. If you have an underpayment on line 50 of.

Form 2210 Edit, Fill, Sign Online Handypdf

As discussed in this memorandum, “public benefits programs ” should be construed. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web requirements beyond reading a form’s instructions (subsection 1.4); This form is for income. The irs will generally figure your penalty for you.

Form M2210 Edit, Fill, Sign Online Handypdf

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web requirements beyond reading a form’s instructions (subsection 1.4); If you have an underpayment on line 50 of. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Total amount on line 28c.

Instructions For Form 2210F Penalty For Underpaying Estimated Tax

Total amount on line 28c. This form is for income. This form is for income earned in tax year 2022, with tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

This form is for income. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. 9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. The irs.

Form M2210 Edit, Fill, Sign Online Handypdf

This form is for income earned in tax year 2022, with tax. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 283.39. As discussed in this memorandum, “public benefits programs ” should be construed. 9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. If you have an underpayment on line 50 of.

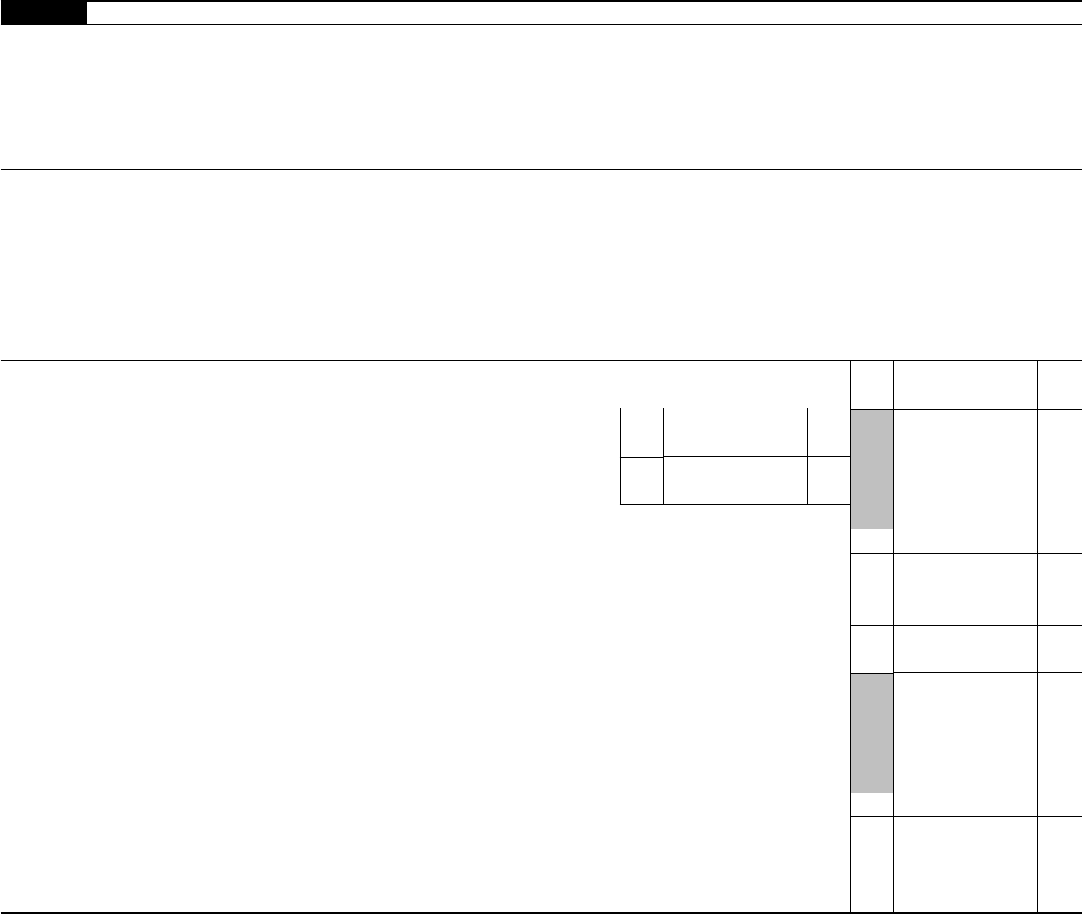

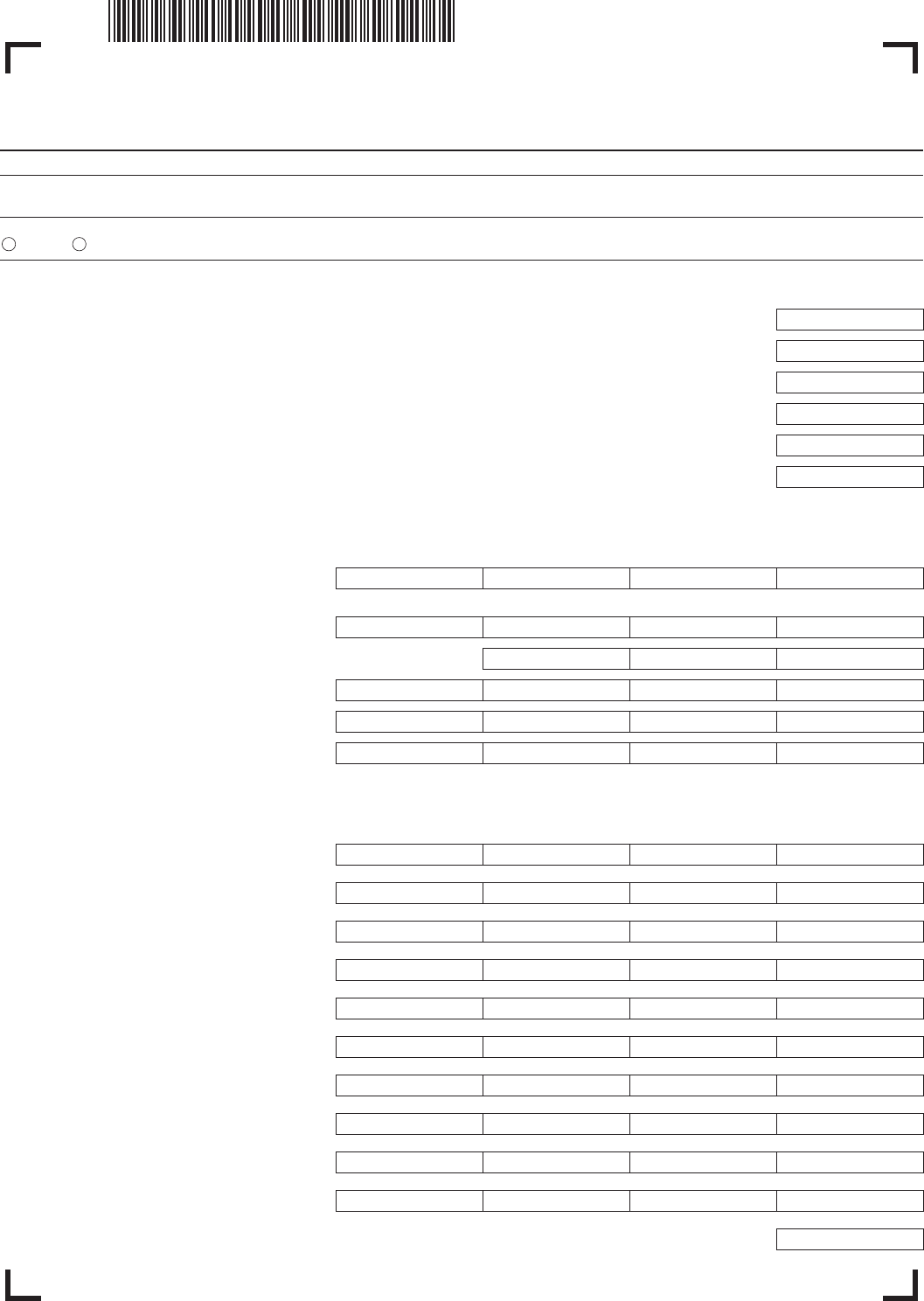

Form Il2210 Instructions Draft 2015 printable pdf download

The irs will generally figure your penalty for you and you should not file form 2210. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Total amount on line 28c. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the.

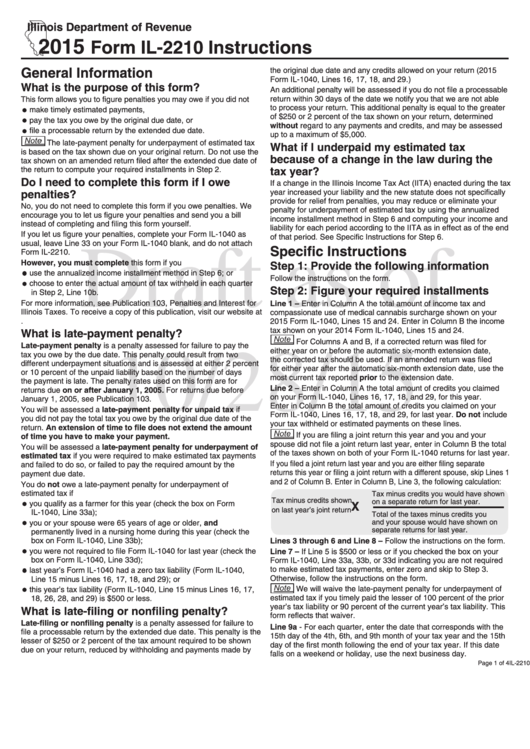

Form Il2210 Draft Computation Of Penalties For Individuals 2016

Total amount on line 28c. This form is for income. 9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. If you have an underpayment on line 50 of. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

If You Have An Underpayment On Line 50 Of.

9/15 massachusetts department of revenue payment period 11 taxable 5.15% income each period. Total amount on line 28c. The irs will generally figure your penalty for you and you should not file form 2210. The irs will generally figure your penalty for you and you should not file form 2210.

Web Requirements Beyond Reading A Form’s Instructions (Subsection 1.4);

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. This form is for income. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,.

Underpayment Of Massachusetts Estimated Income Tax (English, Pdf 1.69 Mb) Open Pdf File, 283.39.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. As discussed in this memorandum, “public benefits programs ” should be construed. This form is for income earned in tax year 2022, with tax.