Filing Injured Spouse Form Electronically

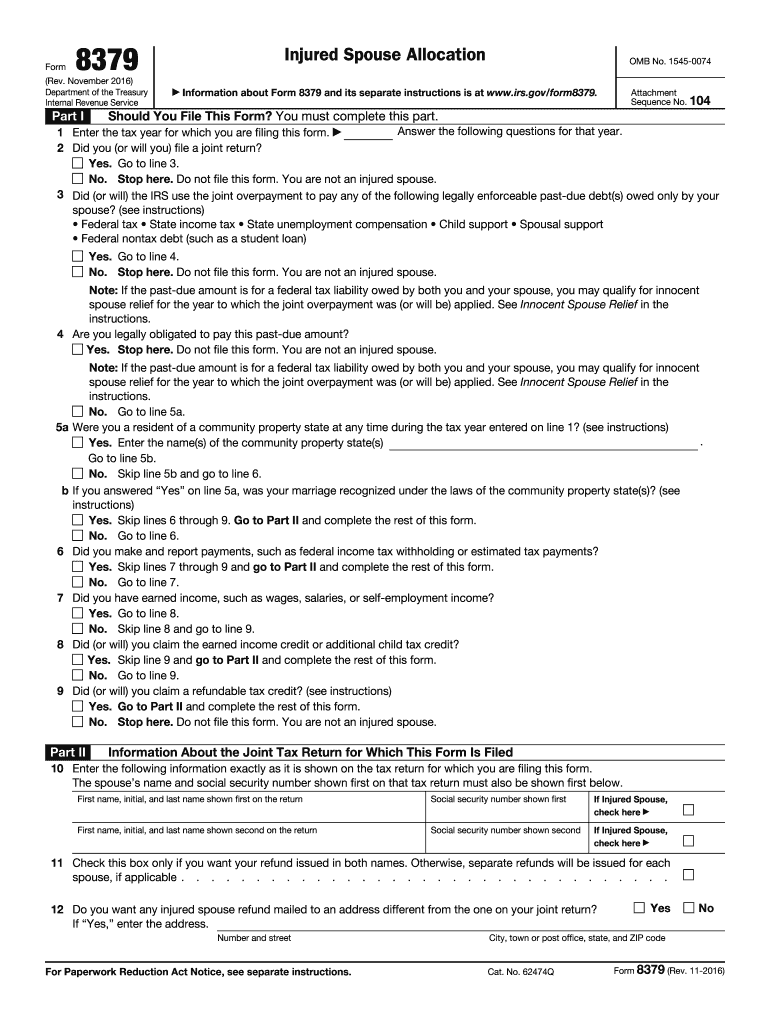

Filing Injured Spouse Form Electronically - Ad fill, sign, email irs 8379 & more fillable forms, register and subscribe now! Submit the form later (the irs. Web if you file form 8379 with your joint return or amended joint return, enter injured spouse in the upper left corner of page 1 of your joint return. The request for mail order forms may be used to order one copy or. Answer the following questions for that year. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. I've never had to wait this long to file my taxes. Web to file as an injured spouse, you’ll need to complete form 8379: I always file early because i know it will be a. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund.

Do not file this form. Web if you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send the form to the internal revenue service center for. On the top row of the turbotax online screen, click on search (or for cd/downloaded. Visit your state’s web site. Web use these steps to get started with the injured spouse form in turbotax: If you file form 8379 with a joint return electronically, the time needed to process it is. Answer the following questions for that year. Yes, you can file form 8379 electronically with your tax return. Ad download or email irs 8379 & more fillable forms, register and subscribe now! You can file this form before or after the offset occurs,.

I've never had to wait this long to file my taxes. Ad fill, sign, email irs 8379 & more fillable forms, register and subscribe now! Web level 1 why is it different this year as opposed to the last several years? If you file form 8379 by itself after a. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. If you file form 8379 with a joint return electronically, the time needed to process it is. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. As the current spouse, i understand that i have not and will not file an irs injured spouse allocation form (no. Web file form 8379 with your joint tax return amendment (note: I always file early because i know it will be a.

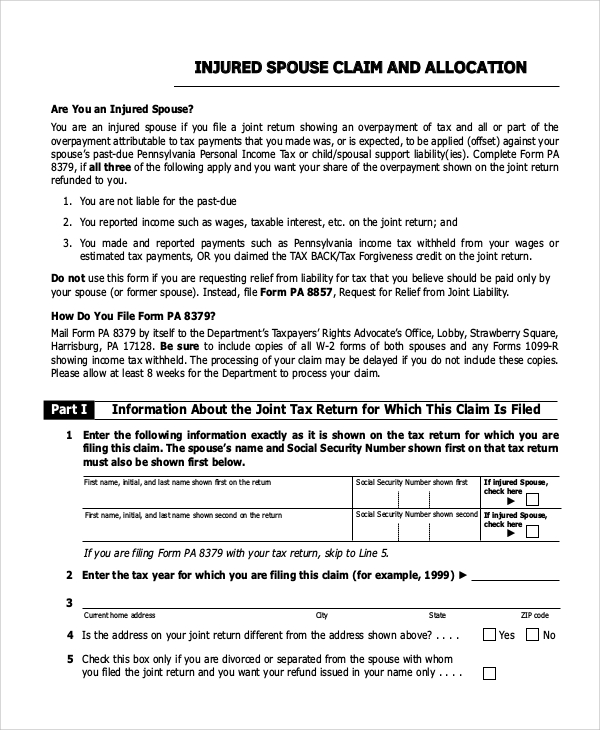

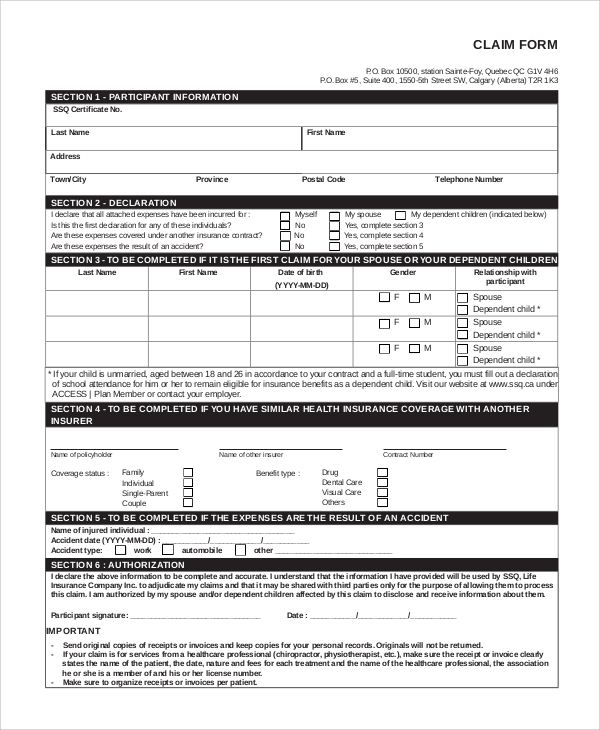

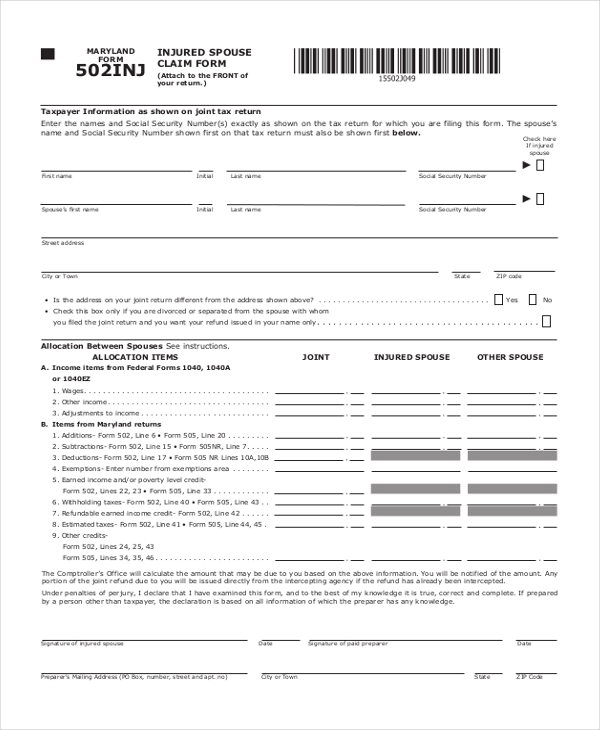

FREE 7+ Sample Injured Spouse Forms in PDF

Web file form 8379 with your joint tax return amendment (note: You are not an injured spouse. Web level 1 why is it different this year as opposed to the last several years? I've never had to wait this long to file my taxes. Web an injured spouse obtains his or her portion of the overpayment by filing a form.

FREE 7+ Sample Injured Spouse Forms in PDF

I always file early because i know it will be a. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Do not file this form. Web generally, if you file form 8379 with a joint return on paper,.

Can I File Injured Spouse Online After Filing Taxes Tax Walls

If you believe you're an injured spouse, you can file the federal form 8379 for each year you're seeking relief. Write or enter injured spouse in the top left corner of the first page of the joint return). Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. I.

FREE 9+ Sample Injured Spouse Forms in PDF

Answer the following questions for that year. Web if you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send the form to the internal revenue service center for. Write or enter injured spouse in the top left corner of the first page of the joint return). I always file.

Injured Spouse Form Fill Out and Sign Printable PDF Template signNow

Do not file this form. Web to file as an injured spouse, you’ll need to complete form 8379: Injured spouse claim and allocation. As the current spouse, i understand that i have not and will not file an irs injured spouse allocation form (no. On the top row of the turbotax online screen, click on search (or for cd/downloaded.

Injured Spouse Relief When to Use it and How It Works YouTube

Ad download or email irs 8379 & more fillable forms, register and subscribe now! Do not file this form. 3 did (or will) the irs use the joint. Web an injured spouse obtains his or her portion of the overpayment by filing a form 8379, injured spouse allocation. Web the child support arrearage.

Filing Injured Spouse Form 8379 for Student Loan Offsets

Ad fill, sign, email irs 8379 & more fillable forms, register and subscribe now! Answer the following questions for that year. Do not file this form. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. If you file form 8379 with a joint return electronically, the time needed.

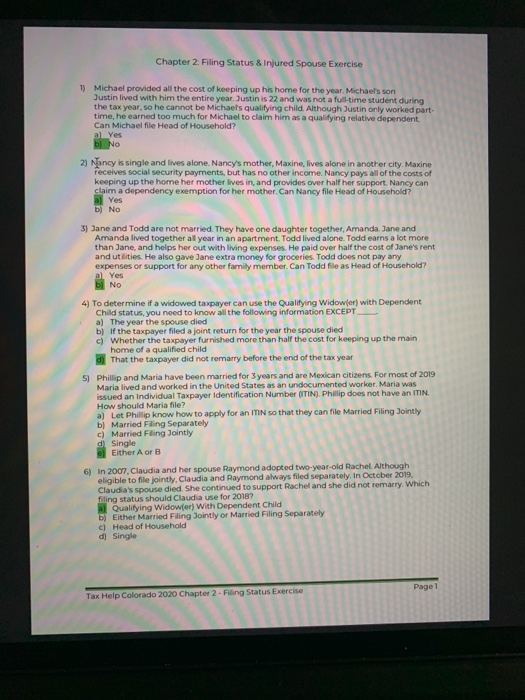

Solved Chapter 2 Filing Status & injured Spouse Exercise 1)

You are not an injured spouse. Web the child support arrearage. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. Write or enter injured spouse in the top left corner of the first page of the joint return). Ad download or email irs 8379 & more fillable forms,.

Filing Injured Spouse Form 8379 for Student Loan Offsets

Web level 1 why is it different this year as opposed to the last several years? Form 8379 is used by injured. Web to file as an injured spouse, you’ll need to complete form 8379: Ad fill, sign, email irs 8379 & more fillable forms, register and subscribe now! Visit your state’s web site.

Can I File Injured Spouse Online After Filing Taxes Tax Walls

If you file form 8379 with a joint return electronically, the time needed to process it is. If you believe you're an injured spouse, you can file the federal form 8379 for each year you're seeking relief. I always file early because i know it will be a. You can file this form before or after the offset occurs,. The.

Form 8379 Is Used By Injured.

Web file form 8379 with your joint tax return amendment (note: 3 did (or will) the irs use the joint. Web to file as an injured spouse, you’ll need to complete form 8379: If you file form 8379 with a joint return electronically, the time needed to process it is.

Web You May Qualify As An Injured Spouse, If You Plan On Filing A Joint Return With Your Spouse And Your Spouse Owes A Debt That You Are Not Responsible For.

Ad download or email irs 8379 & more fillable forms, register and subscribe now! Answer the following questions for that year. You can file this form before or after the offset occurs,. To file your taxes as an injured spouse, follow the steps below:

Web The Child Support Arrearage.

Do not file this form. Web an injured spouse obtains his or her portion of the overpayment by filing a form 8379, injured spouse allocation. Web you can file form 8379 with your tax return or on its own. Submit the form later (the irs.

Ad Download Or Email Irs 8379 & More Fillable Forms, Register And Subscribe Now!

Web if you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send the form to the internal revenue service center for. I've never had to wait this long to file my taxes. As the current spouse, i understand that i have not and will not file an irs injured spouse allocation form (no. Ad fill, sign, email irs 8379 & more fillable forms, register and subscribe now!