Form 1099-G New York

Form 1099-G New York - Your employer will deduct premiums for the paid family leave program. Web social security income: You can find it at. For internal revenue service center. Web this tax form provides the total amount of money you were paid in benefits from nys dol in 2022, as well as any adjustments or tax withholding made to your benefits. Go to the new york department of. Shows the total unemployment compensation paid to you this year. New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Go to www.irs.gov/idtheftunemployment for more information. Claim weekly benefits (certify for benefits) from:

Information you need for ui income tax filing. Your employer will deduct premiums for the paid family leave program. New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Go to www.irs.gov/idtheftunemployment for more information. For internal revenue service center. Certain refundable credits, such as the empire state child credit, real. Web social security income: Ask questions about your claim via secure messaging; Claim weekly benefits (certify for benefits) from: Get ready to file your income tax return.

Ask questions about your claim via secure messaging; Web view and/or print out a 1099 tax form; Go to the new york department of. Your employer will deduct premiums for the paid family leave program. For internal revenue service center. Information you need for ui income tax filing. Shows the total unemployment compensation paid to you this year. Get ready to file your income tax return. Go to www.irs.gov/idtheftunemployment for more information. Web social security income:

How To Get The 1099 G Form Leah Beachum's Template

Ask questions about your claim via secure messaging; Web social security income: Go to the new york department of. Shows the total unemployment compensation paid to you this year. You can find it at.

Try This If You Can’t See Your 1099G in CONNECT NBC 6 South Florida

For internal revenue service center. Information you need for ui income tax filing. Shows the total unemployment compensation paid to you this year. You can find it at. Log in to your ny.gov id account.

State Of Nevada Combined Sales And Use Tax Return Form Form Resume

Get ready to file your income tax return. New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Log in to your ny.gov id account. Web view and/or print out a 1099 tax form; Go to www.irs.gov/idtheftunemployment for more information.

Form 1099G Definition

Web social security income: New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Information you need for ui income tax filing. Log in to your ny.gov id account. Certain refundable credits, such as the empire state child credit, real.

How To Get 1099 G Online California Leah Beachum's Template

Shows the total unemployment compensation paid to you this year. Ask questions about your claim via secure messaging; New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Web social security income: You can find it at.

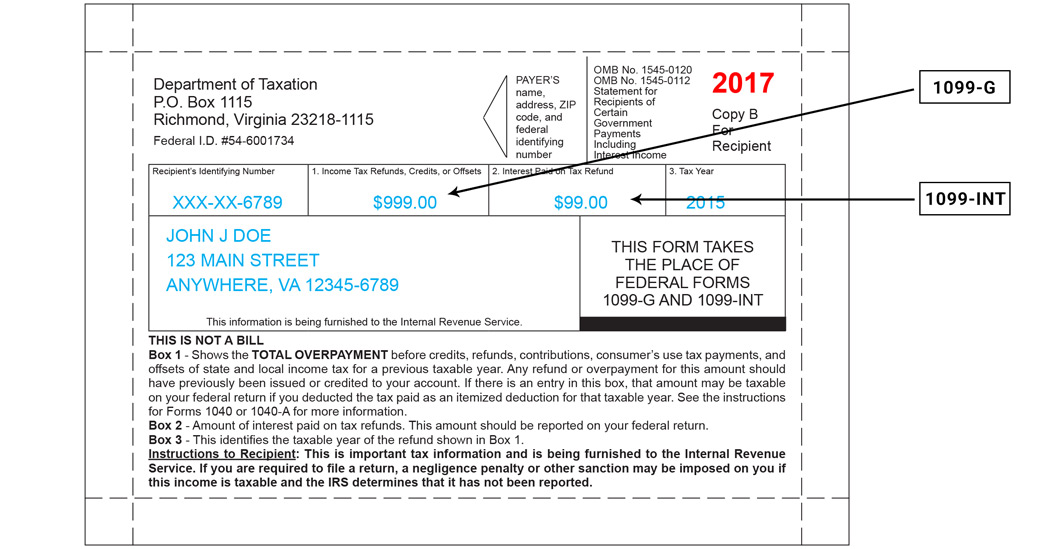

Your 1099G/1099INT What You Need to Know Virginia Tax

Web this tax form provides the total amount of money you were paid in benefits from nys dol in 2022, as well as any adjustments or tax withholding made to your benefits. New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Web social security income: Information you need for ui income tax filing..

When Will Unemployment 1099 Be Ready NEMPLOY

Web social security income: Claim weekly benefits (certify for benefits) from: Ask questions about your claim via secure messaging; Go to the new york department of. Log in to your ny.gov id account.

Where To Find My Unemployment Tax Form

Ask questions about your claim via secure messaging; Go to www.irs.gov/idtheftunemployment for more information. Go to the new york department of. For internal revenue service center. Claim weekly benefits (certify for benefits) from:

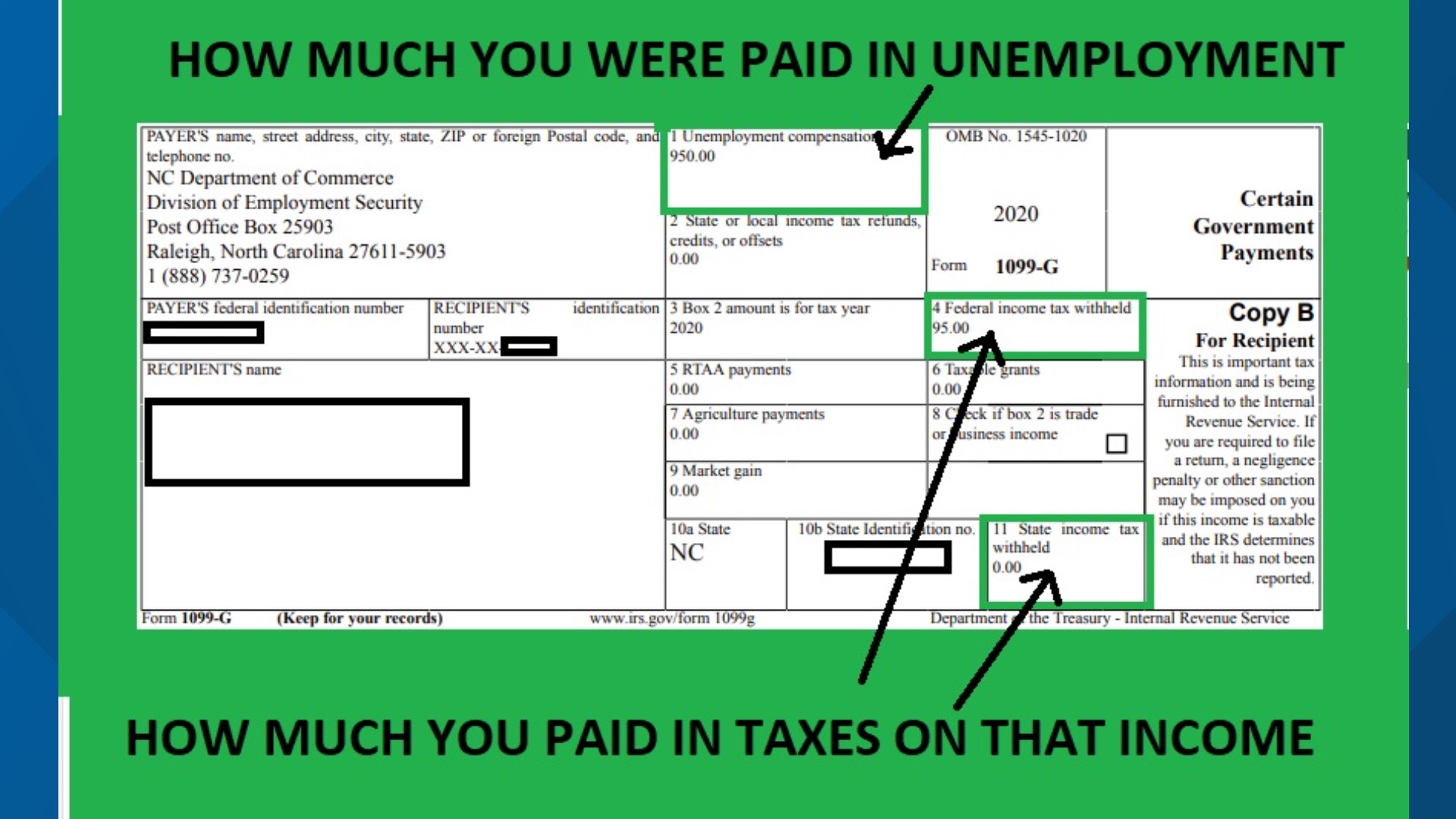

2020 tax filing Tips for people who got unemployment benefits

Claim weekly benefits (certify for benefits) from: Go to www.irs.gov/idtheftunemployment for more information. Get ready to file your income tax return. Go to the new york department of. Web this tax form provides the total amount of money you were paid in benefits from nys dol in 2022, as well as any adjustments or tax withholding made to your benefits.

Unemployment benefits are taxable, look for a 1099G form

New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Web view and/or print out a 1099 tax form; Information you need for ui income tax filing. Web social security income: Log in to your ny.gov id account.

You Can Find It At.

For internal revenue service center. Web social security income: Information you need for ui income tax filing. Go to the new york department of.

Log In To Your Ny.gov Id Account.

Your employer will deduct premiums for the paid family leave program. New york taxpayers who received unemployment compensation through the state excluded workers fund will receive a. Go to www.irs.gov/idtheftunemployment for more information. Ask questions about your claim via secure messaging;

Web This Tax Form Provides The Total Amount Of Money You Were Paid In Benefits From Nys Dol In 2022, As Well As Any Adjustments Or Tax Withholding Made To Your Benefits.

Web view and/or print out a 1099 tax form; Shows the total unemployment compensation paid to you this year. Get ready to file your income tax return. Claim weekly benefits (certify for benefits) from:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)