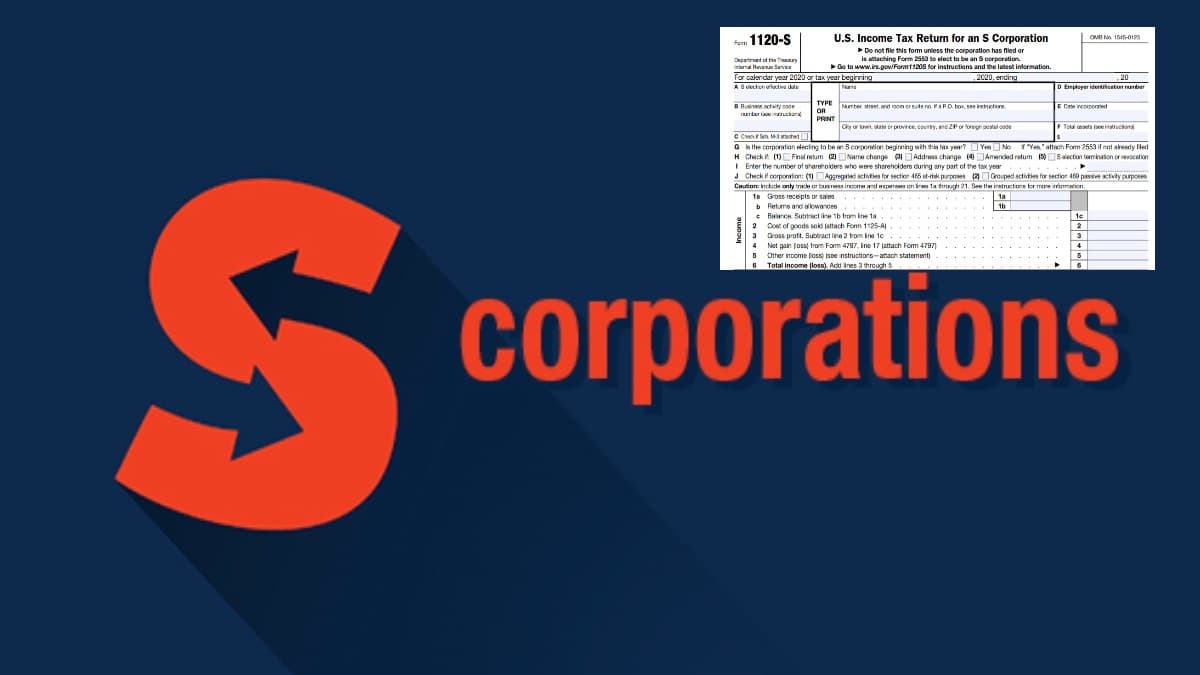

Form 1120S 2022 Instructions

Form 1120S 2022 Instructions - (for shareholder's use only) section references are to. Income tax liability of a foreign. Use this form to report the. Ad irs inst 1120s & more fillable forms, register and subscribe now! The irs form 1120s provides the irs with an overview of your business’s assets, liabilities, and equity. Follow these guidelines to quickly and properly fill out irs. Get ready for tax season deadlines by completing any required tax forms today. Other forms the corporation may have to. Ad complete irs tax forms online or print government tax documents. (for shareholder's use only) department of the.

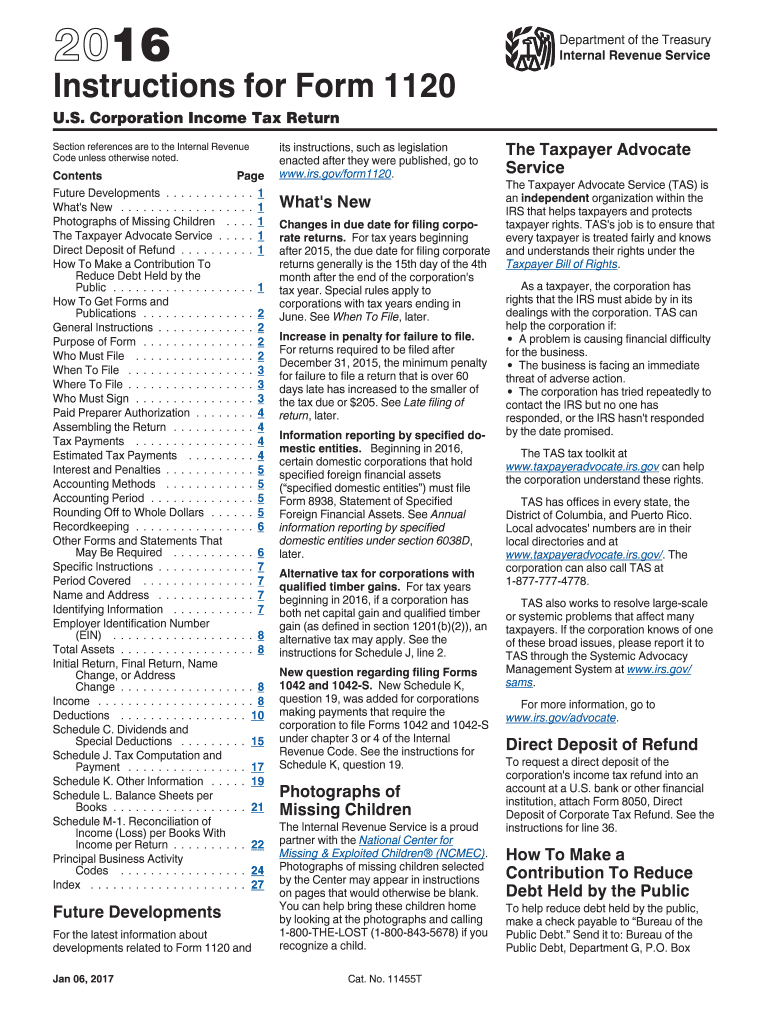

Income tax liability of a foreign. Use this form to report the. (for shareholder's use only) department of the. Follow these guidelines to quickly and properly fill out irs. The irs form 1120s provides the irs with an overview of your business’s assets, liabilities, and equity. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Must be removed before printing. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web information about form 1120, u.s. Web our online software proposes the utility to make the process of submitting irs documents as easy as possible.

Get ready for tax season deadlines by completing any required tax forms today. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Ad complete irs tax forms online or print government tax documents. The irs form 1120s provides the irs with an overview of your business’s assets, liabilities, and equity. Web for tax year 2022, please see the 2022 instructions. Web our online software proposes the utility to make the process of submitting irs documents as easy as possible. Any corporation that uses the regular calendar year would need to file. Other forms the corporation may have to. Use this form to report the. (for shareholder's use only) section references are to.

1120s Instructions 2022 IRS Forms Zrivo

Ad complete irs tax forms online or print government tax documents. Income tax liability of a foreign. Web for tax year 2022, please see the 2022 instructions. Any corporation that uses the regular calendar year would need to file. (for shareholder's use only) section references are to.

Irs Form 1120 Instructions Fill Out and Sign Printable PDF Template

The irs form 1120s provides the irs with an overview of your business’s assets, liabilities, and equity. Income tax liability of a foreign. Ad irs inst 1120s & more fillable forms, register and subscribe now! Any corporation that uses the regular calendar year would need to file. Web our online software proposes the utility to make the process of submitting.

2014 Form 1120s K1 Instructions Ethel Hernandez's Templates

In this article, you can find the. Get ready for tax season deadlines by completing any required tax forms today. (i) if the llc is to be. Signnow allows users to edit, sign, fill and share all type of documents online. Web information about form 1120, u.s.

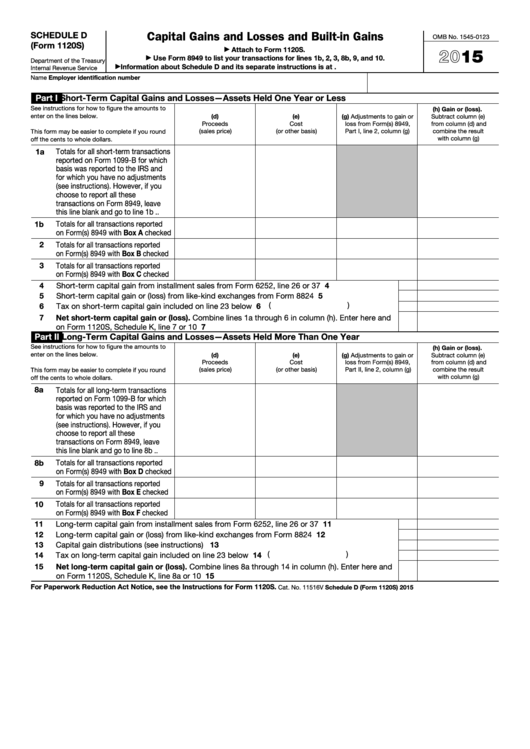

Fillable Schedule D (Form 1120s) Capital Gains And Losses And Built

(for shareholder's use only) department of the. Use this form to report the. Signnow allows users to edit, sign, fill and share all type of documents online. It is important to remember that the extension is only valid if you file your return by april 18,. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120!

IRS Form 1120F Schedule M1 & M2 2018 2019 Fill out and Edit

Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web for tax year 2022, please see the 2022 instructions. Any corporation that uses the regular calendar year would need to file. Corporation income tax return, including recent updates, related forms and instructions on how to file. Signnow allows users to edit, sign, fill and share.

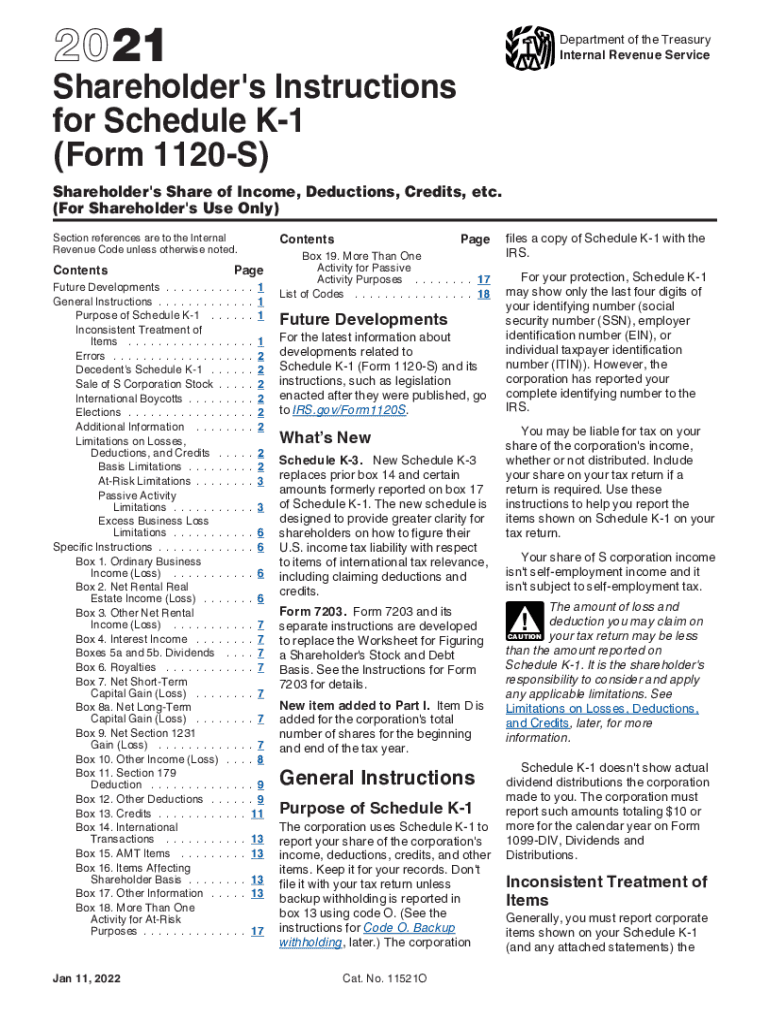

What Is K1 Form For Taxes Fill Out and Sign Printable PDF Template

Must be removed before printing. Web information about form 1120, u.s. Web our online software proposes the utility to make the process of submitting irs documents as easy as possible. Other forms the corporation may have to. (for shareholder's use only) department of the.

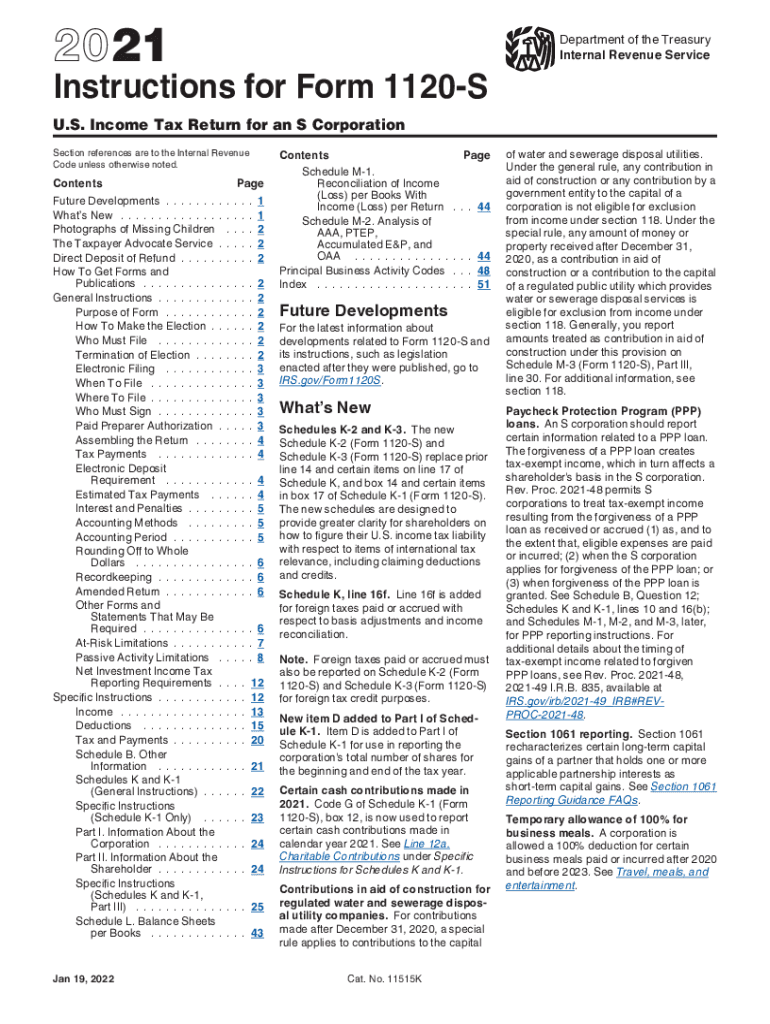

IRS Form 1120S Instructions 2022 2023

Web for tax year 2022, please see the 2022 instructions. (i) if the llc is to be. Use this form to report the. Ad complete irs tax forms online or print government tax documents. Follow these guidelines to quickly and properly fill out irs.

1120s instructions 2023 PDF Fill online, Printable, Fillable Blank

Ad complete irs tax forms online or print government tax documents. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad irs inst 1120s & more fillable forms, register and subscribe now! Web for tax year 2022, please see the 2022 instructions. Use this form to report the.

Can you look over this corporate tax return form 1120 I did based on

Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today. Ad irs inst 1120s & more fillable forms, register and subscribe now! It is important to remember that the extension is only valid if you file your return by april 18,. Web enter on form 1120.

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

(for shareholder's use only) department of the. Any corporation that uses the regular calendar year would need to file. Follow these guidelines to quickly and properly fill out irs. Income tax liability of a foreign. The irs form 1120s provides the irs with an overview of your business’s assets, liabilities, and equity.

Corporation Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

Web our online software proposes the utility to make the process of submitting irs documents as easy as possible. Use this form to report the. Any corporation that uses the regular calendar year would need to file. (for shareholder's use only) section references are to.

Other Forms The Corporation May Have To.

Get ready for tax season deadlines by completing any required tax forms today. Web for tax year 2022, please see the 2022 instructions. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Must be removed before printing.

The Irs Form 1120S Provides The Irs With An Overview Of Your Business’s Assets, Liabilities, And Equity.

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. It is important to remember that the extension is only valid if you file your return by april 18,. (i) if the llc is to be. Ad complete irs tax forms online or print government tax documents.

In This Article, You Can Find The.

Ad irs inst 1120s & more fillable forms, register and subscribe now! Follow these guidelines to quickly and properly fill out irs. Income tax liability of a foreign. (for shareholder's use only) department of the.