Form 1125-A

Form 1125-A - Inventory at the beginning of the year, Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Edit, sign and save irs cost of goods sold form. Ad complete irs tax forms online or print government tax documents. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Refer to the following information to assist with screen 14, cost of goods sold questions. Finished goods or merchandise are sold reduce. The cost of goods sold. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the cost of goods sold (cogs). Complete, edit or print tax forms instantly.

However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Ad complete irs tax forms online or print government tax documents. Edit, sign and save irs cost of goods sold form. Finished goods or merchandise are sold reduce. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the cost of goods sold (cogs). The cost of goods sold. Inventory at the beginning of the year, This calculation must be separately reported on the return as set forth below. As discussed, appropriately capitalizable costs under sec.

Ad complete irs tax forms online or print government tax documents. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the cost of goods sold (cogs). However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. As discussed, appropriately capitalizable costs under sec. Inventory at the beginning of the year, This calculation must be separately reported on the return as set forth below. The cost of goods sold. Edit, sign and save irs cost of goods sold form. Complete, edit or print tax forms instantly.

Form 1125A Cost of Goods Sold (2012) Free Download

As discussed, appropriately capitalizable costs under sec. Inventory at the beginning of the year, However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Complete, edit or print tax forms instantly. The cost of goods sold.

1125 A Fillable and Editable PDF Template

Finished goods or merchandise are sold reduce. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. As discussed, appropriately capitalizable costs under sec. Edit, sign and save irs cost of goods sold form. Complete, edit or print tax forms instantly.

Form 1125A Edit, Fill, Sign Online Handypdf

Edit, sign and save irs cost of goods sold form. Inventory at the beginning of the year, The cost of goods sold. Refer to the following information to assist with screen 14, cost of goods sold questions. Ad complete irs tax forms online or print government tax documents.

Form 1125A Cost of Goods Sold (2012) Free Download

Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the cost of goods sold (cogs). Edit, sign and save irs cost of goods sold form. As discussed, appropriately capitalizable costs under sec. However, to use the form, a business must meet particular requirements that are generally entities that create goods to.

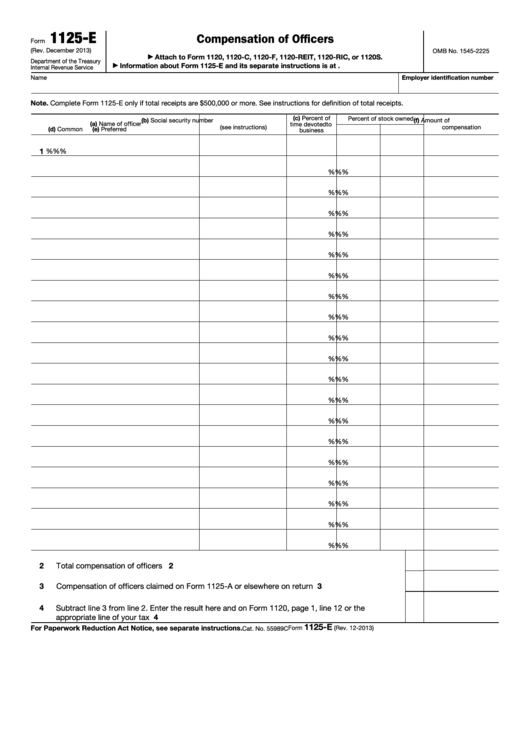

Fillable Form 1125E Compensation Of Officers printable pdf download

This calculation must be separately reported on the return as set forth below. Finished goods or merchandise are sold reduce. Edit, sign and save irs cost of goods sold form. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Ad complete irs tax forms online or print government.

Form 1125A Cost of Goods Sold (2012) Free Download

Ad complete irs tax forms online or print government tax documents. Refer to the following information to assist with screen 14, cost of goods sold questions. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses.

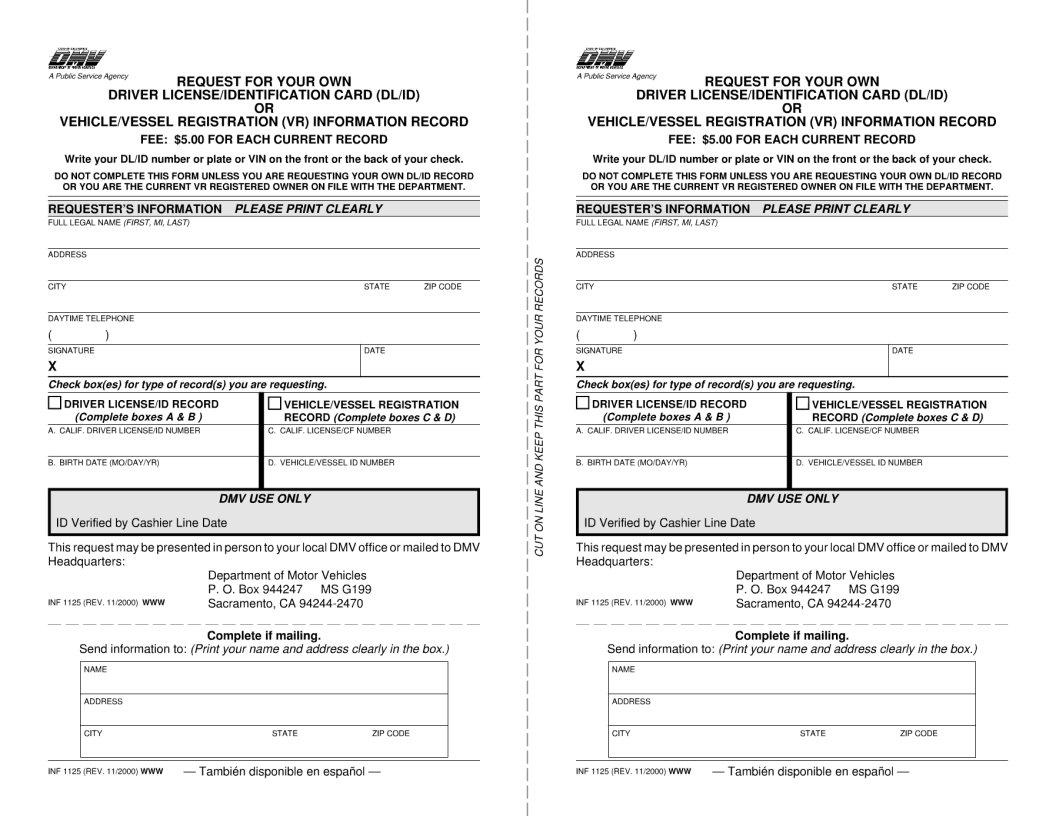

Inf 1125 Form ≡ Fill Out Printable PDF Forms Online

Ad complete irs tax forms online or print government tax documents. Edit, sign and save irs cost of goods sold form. Finished goods or merchandise are sold reduce. Refer to the following information to assist with screen 14, cost of goods sold questions. Inventory at the beginning of the year,

3.12.217 Error Resolution Instructions for Form 1120S Internal

Inventory at the beginning of the year, Edit, sign and save irs cost of goods sold form. This calculation must be separately reported on the return as set forth below. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Ad complete irs tax forms online or print government tax documents.

Figure 52. Example of DA Form 1125R

Inventory at the beginning of the year, The cost of goods sold. Finished goods or merchandise are sold reduce. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Complete, edit or print tax forms instantly.

Form 10 Attachment Sequence 10 Things To Avoid In Form 10 Attachment

However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Inventory at the beginning of the year, Refer to the following information to assist with screen 14, cost of goods sold questions. This calculation must be separately reported on the return as set forth below. Ad complete irs tax.

Knott 7.71K Subscribers Join Subscribe 27 2.3K Views 1 Year Ago For Businesses That Sell Inventory To Customers, The Cost Of Goods Sold (Cogs).

As discussed, appropriately capitalizable costs under sec. Edit, sign and save irs cost of goods sold form. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Finished goods or merchandise are sold reduce.

The Cost Of Goods Sold.

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Refer to the following information to assist with screen 14, cost of goods sold questions.

This Calculation Must Be Separately Reported On The Return As Set Forth Below.

Inventory at the beginning of the year,