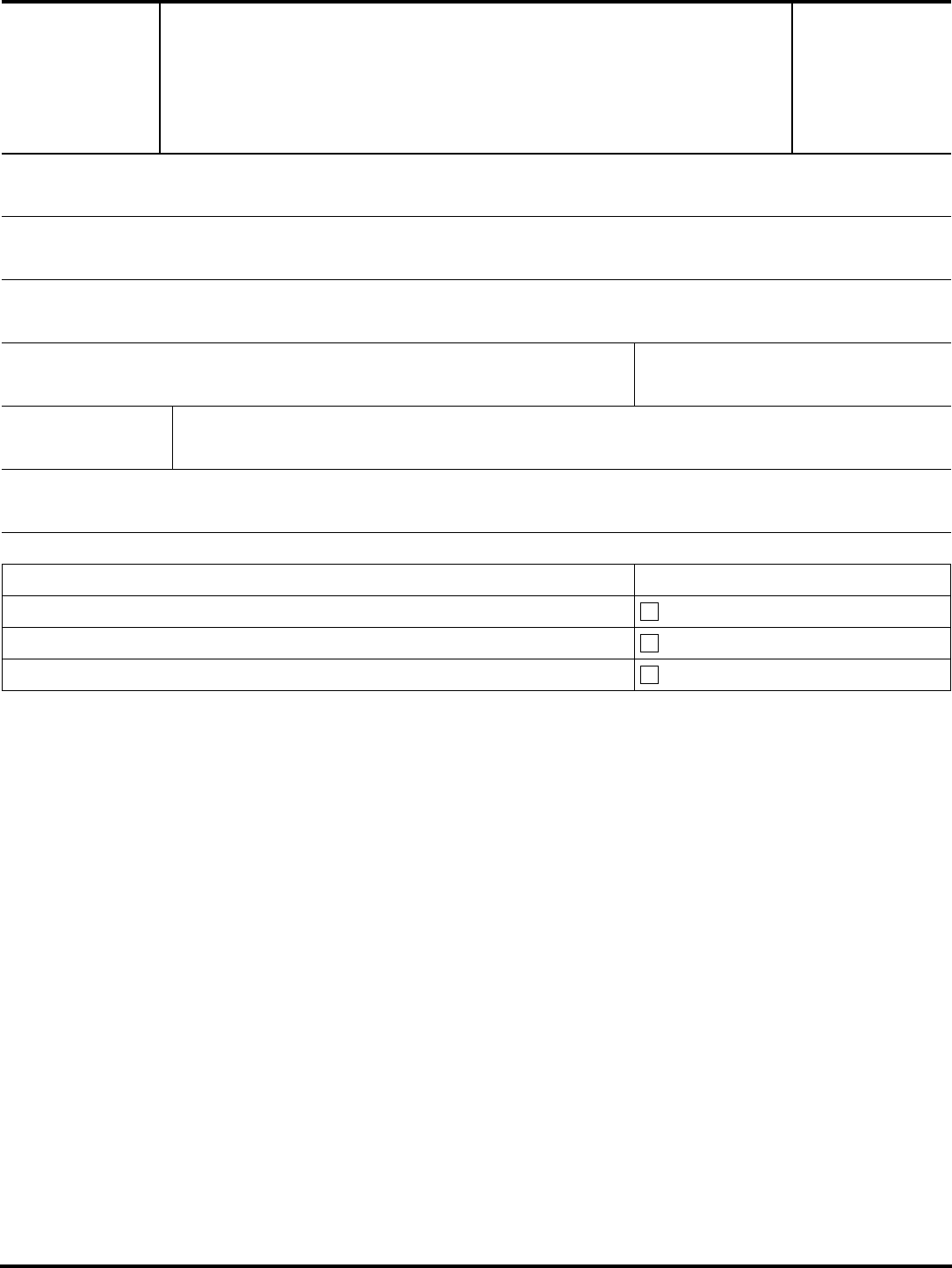

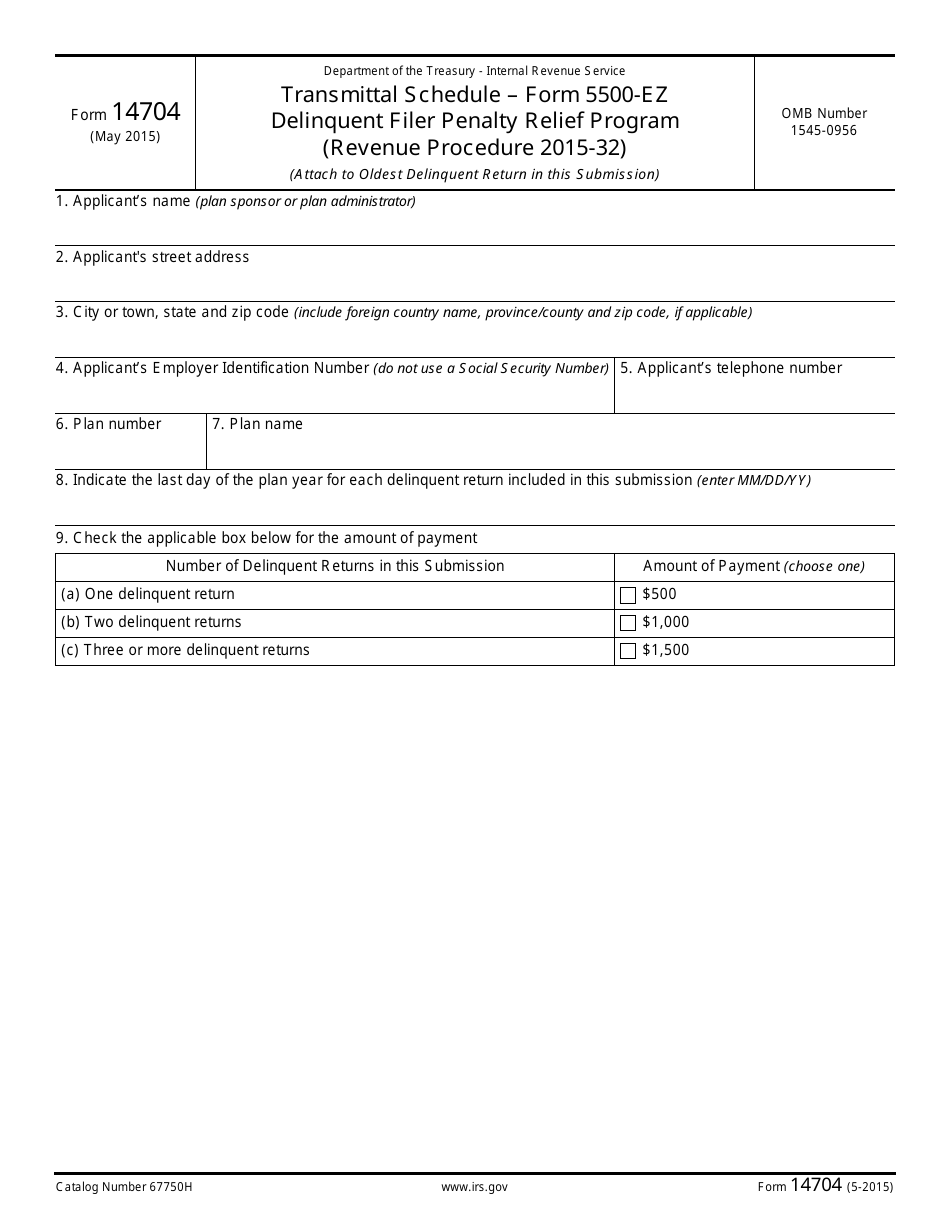

Form 14704 Instructions

Form 14704 Instructions - “delinquent return filed under rev. Web this cap is designed to encourage reporting compliance by plan administrators who have failed to file an annual report for a plan for multiple years. Applicant’s name (plan sponsor or plan. A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. A completed form 14704 must be attached to the front of. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Web the irs has created form 14704 to be used as a transmittal schedule and attached to the oldest delinquent return in the late filing submission. Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). Web form no.14704 (062513) installation guide: The “per plan” cap limits the penalty to $1,500 for a small plan and $4,000 for a large plan regardless of the number of late annual reports filed for the plan at the same time.

Each submission is limited to. A completed form 14704 must be attached to the front of. Each submission must include a completed paper copy of form 14704. Web form no.14704 (062513) installation guide: Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. Web (3) required form 14704. All payments under this program must be submitted by a check payable to the united states treasury and must be attached to the form 14704 that is included as part of the submission. Web this cap is designed to encourage reporting compliance by plan administrators who have failed to file an annual report for a plan for multiple years.

A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. “delinquent return filed under rev. Each submission is limited to. You must write in red at the top of each paper return: Web form no.14704 (062513) installation guide: Applicant’s name (plan sponsor or plan. Web the irs has created form 14704 to be used as a transmittal schedule and attached to the oldest delinquent return in the late filing submission. A completed form 14704 must be attached to the front of. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. The “per plan” cap limits the penalty to $1,500 for a small plan and $4,000 for a large plan regardless of the number of late annual reports filed for the plan at the same time.

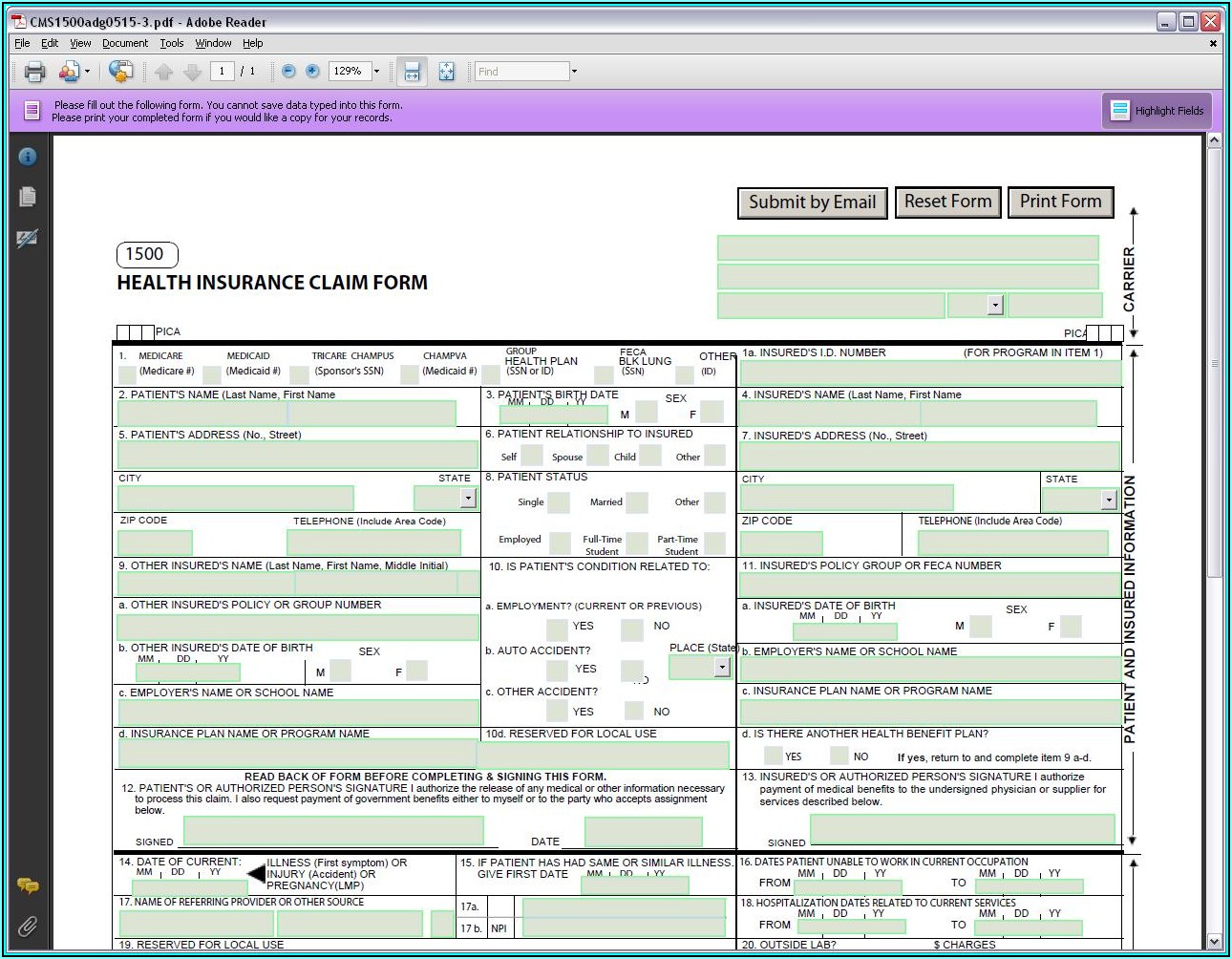

Form Cms 1500 Instructions Form Resume Examples Wk9y1XX93D

“delinquent return filed under rev. All payments under this program must be submitted by a check payable to the united states treasury and must be attached to the form 14704 that is included as part of the submission. Applicant’s name (plan sponsor or plan. The “per plan” cap limits the penalty to $1,500 for a small plan and $4,000 for.

Cms 1500 Claim Form Instructions 2016 Form Resume Examples XE8je6e3Oo

A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. The “per plan” cap limits the penalty to $1,500 for a small plan and $4,000 for a large plan regardless of the number of late annual reports filed for the plan at the same time. Each submission is limited to..

Fill Free fillable Form 14704 Transmittal Schedule Form 5500EZ

A completed form 14704 must be attached to the front of. Surface mount pioneer™ for warranty information regarding this product, visit www.whelen.com/warranty • proper installation of this product requires the installer to have a good understanding of automotive electronics, systems and procedures. “delinquent return filed under rev. Web this cap is designed to encourage reporting compliance by plan administrators who.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

You must write in red at the top of each paper return: A completed form 14704 must be attached to the front of. Each submission must include a completed paper copy of form 14704. All payments under this program must be submitted by a check payable to the united states treasury and must be attached to the form 14704 that.

Form 14704 Edit, Fill, Sign Online Handypdf

A completed form 14704 must be attached to the front of. “delinquent return filed under rev. Web the irs has created form 14704 to be used as a transmittal schedule and attached to the oldest delinquent return in the late filing submission. Web this cap is designed to encourage reporting compliance by plan administrators who have failed to file an.

Form 14704 Transmittal Schedule 5500EZ Delinquent Filer Penalty Relief

Web (3) required form 14704. Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. A check for the fee payment for each submission, payable to the united states treasury, attached to the.

LEGO PART 14704 Plate Special 1 x 2 5.9mm Centre Side Cup Rebrickable

Web the irs has created form 14704 to be used as a transmittal schedule and attached to the oldest delinquent return in the late filing submission. Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). Web (3) required form 14704. Surface mount pioneer™ for warranty information regarding this product, visit www.whelen.com/warranty •.

Form Cms 1500 Instructions Form Resume Examples Wk9y1XX93D

“delinquent return filed under rev. You must write in red at the top of each paper return: Web this cap is designed to encourage reporting compliance by plan administrators who have failed to file an annual report for a plan for multiple years. All payments under this program must be submitted by a check payable to the united states treasury.

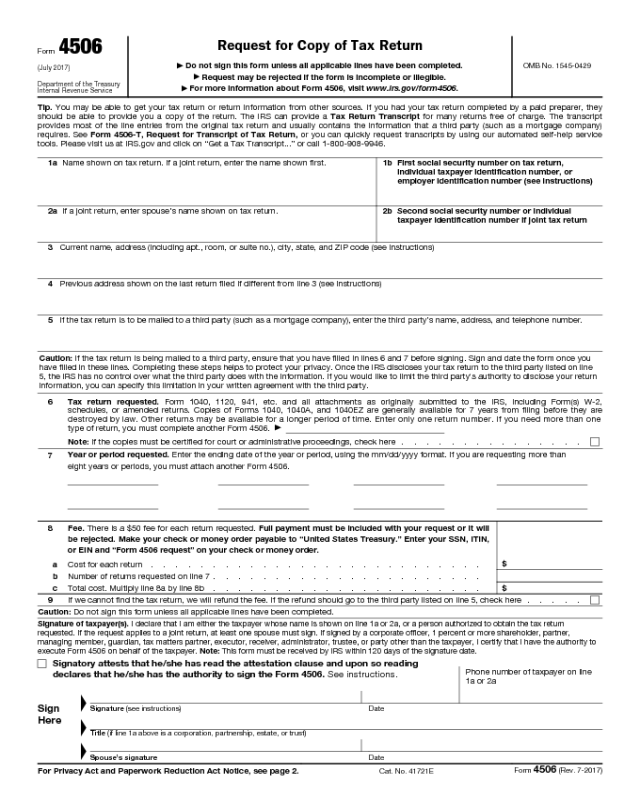

Form 4506 Edit, Fill, Sign Online Handypdf

You must write in red at the top of each paper return: Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). Each submission must include a completed paper copy of form 14704. Applicant’s name (plan sponsor or plan. Web this cap is designed to encourage reporting compliance by plan administrators who have.

IRS Form 14704 Download Fillable PDF or Fill Online Transmittal

A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Web this cap is designed to encourage reporting compliance by plan administrators who have failed to file an annual report.

Each Submission Must Include A Completed Paper Copy Of Form 14704.

Web form no.14704 (062513) installation guide: “delinquent return filed under rev. You must write in red at the top of each paper return: Surface mount pioneer™ for warranty information regarding this product, visit www.whelen.com/warranty • proper installation of this product requires the installer to have a good understanding of automotive electronics, systems and procedures.

Web This Cap Is Designed To Encourage Reporting Compliance By Plan Administrators Who Have Failed To File An Annual Report For A Plan For Multiple Years.

All payments under this program must be submitted by a check payable to the united states treasury and must be attached to the form 14704 that is included as part of the submission. A completed form 14704 must be attached to the front of. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Applicant’s name (plan sponsor or plan.

The “Per Plan” Cap Limits The Penalty To $1,500 For A Small Plan And $4,000 For A Large Plan Regardless Of The Number Of Late Annual Reports Filed For The Plan At The Same Time.

A check for the fee payment for each submission, payable to the united states treasury, attached to the form 14704. Web completed form 14704 pdf attached to the top of your submission (that includes all delinquent returns). Web (3) required form 14704. Each submission is limited to.