Form 2210 Calculator

Form 2210 Calculator - You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Web calculate form 2210 the underpayment of estimated tax penalty calculator prepares and prints form 2210. If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Yes you must figure your penalty. You must file form 2210. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web your total underpayment amount. This form contains both a short and regular method for determining your penalty. Web form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section §6654 of the internal revenue code that is titled “failure by individual to pay estimated income tax.” Web you can use this form to calculate your penalty or determine if the irs won’t charge a penalty.

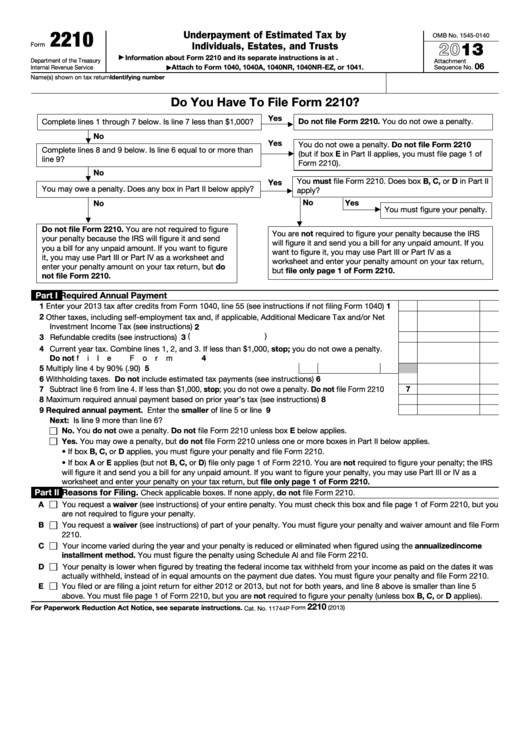

For instructions and the latest information. Is line 7 less than $1 ,ooo? Web your total underpayment amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. Underpayment of estimated tax by individuals, estates, and trusts. Web form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section §6654 of the internal revenue code that is titled “failure by individual to pay estimated income tax.” Web more about the federal form 2210 estimated. Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount.

Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. You may need this form if: Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Taxact cannot calculate late filing nor late payment penalties. Department of the treasury internal revenue service. No yes you may owe a penalty. Taxpayers who owe underpayment penalties are not always required to file form 2210 because. Does box b, c, or d in part il apply? To calculate the penalty yourself (other than corporations):

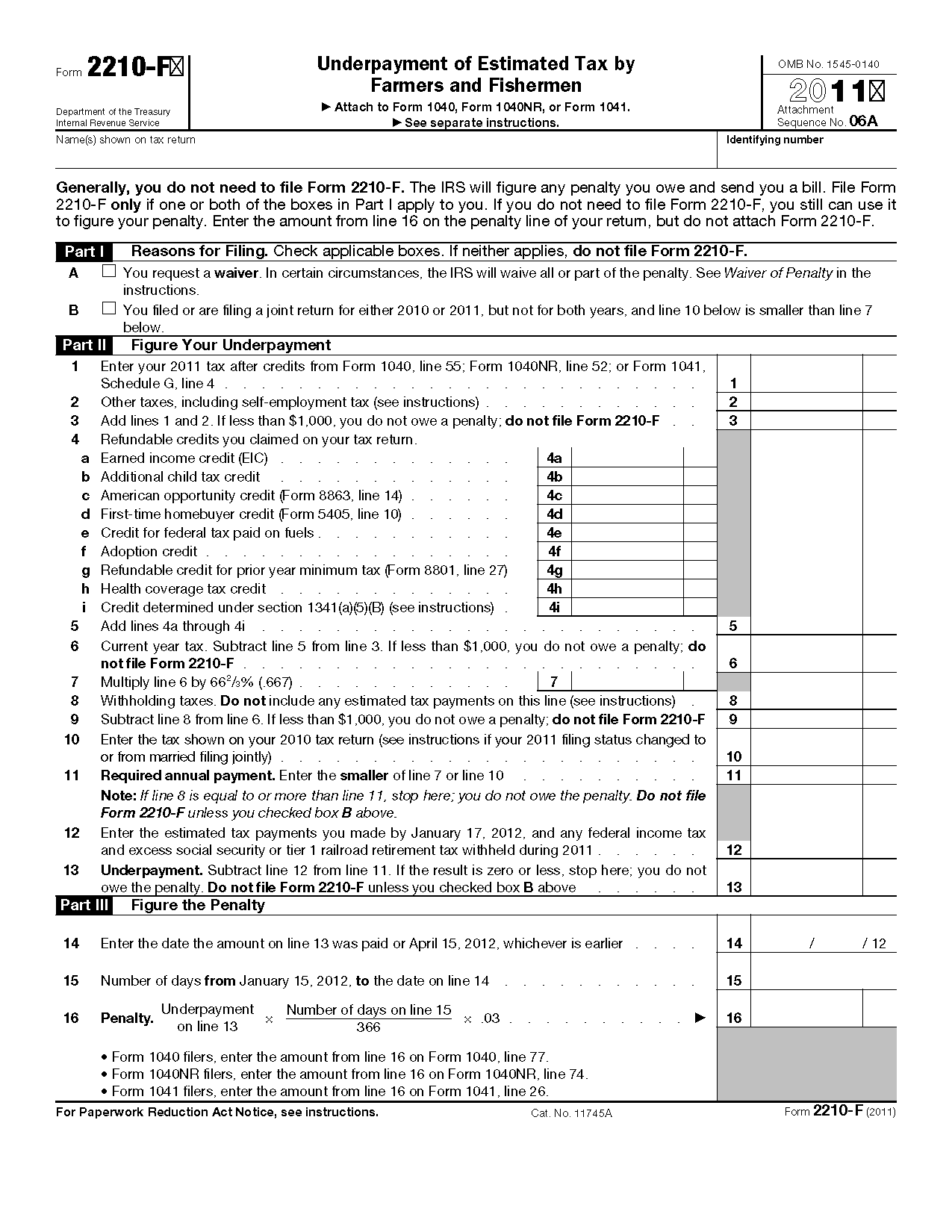

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Underpayment of estimated tax by individuals, estates, and trusts. The irs will generally figure your penalty for you and you should not file form 2210. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. * trial calculations for tax after credits under $12,000. No don't file form 2210.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. The irs will generally figure any penalty due and send the taxpayer a bill. For instructions and the latest information. Purchase calculations underpayment of estimated tax penalty calculator tax year: You should figure out.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

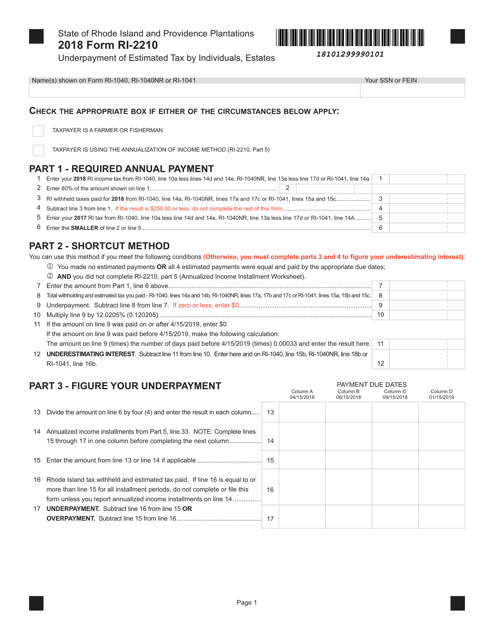

Taxact will calculate the underpayment penalty of estimated tax payments only. You should figure out the amount of tax you have underpaid. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. You can use form 2210, underpayment of estimated tax. Web the irs will send you a bill to notify you of the.

Ssurvivor Form 2210 Line 4

Web your total underpayment amount. Department of the treasury internal revenue service. The form doesn't always have to be completed; Purchase calculations underpayment of estimated tax penalty calculator tax year: To review which situations apply to you and determine if schedule ai needs to be attached:

Form 2210 Calculator Find if you owe estimated tax penalty ? https

A recent kiplinger tax letter reported that the irs has a backlog of some 6 million 2010 paper returns yet to be processed. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make.

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Yes you must figure your penalty. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. To calculate the penalty yourself (other than corporations): Web calculate form 2210 the underpayment of estimated tax penalty calculator prepares and prints form 2210. To review which situations apply to you and determine if schedule ai needs to be.

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

06 name(s) shown on tax return Web your total underpayment amount. The irs states that you do not need to file form 2210 if: You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. To review which situations apply to you and determine if schedule ai needs to be attached:

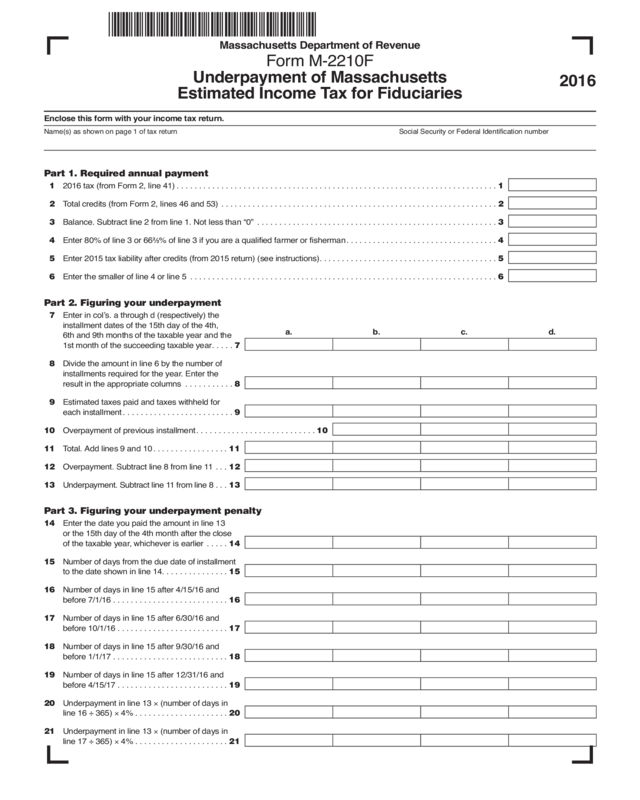

Form M2210F Edit, Fill, Sign Online Handypdf

Web you can use this form to calculate your penalty or determine if the irs won’t charge a penalty. You must file form 2210. Web form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section §6654 of the internal revenue code that is titled “failure by individual to pay.

Ssurvivor Form 2210 Line 4

The interest rate for underpayments, which is updated by the irs each quarter. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. For instructions and the latest information. Underpayment of estimated tax by individuals, estates, and trusts. To review which situations apply.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Even if you underpaid your taxes during the year, the irs might not charge a penalty if you meet one of the safe harbor tests. Department of the treasury internal revenue service. Complete lines 1 through 7 below. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). What is your tax after credits from.

Department Of The Treasury Internal Revenue Service.

The irs will generally figure your penalty for you and you should not file form 2210. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming.

Web Use Form 2210 To Determine The Amount Of Underpaid Estimated Tax And Resulting Penalties As Well As For Requesting A Waiver Of The Penalties.

Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. The irs states that you do not need to file form 2210 if: Taxact will calculate the underpayment penalty of estimated tax payments only. You should figure out the amount of tax you have underpaid.

You Can Use Form 2210, Underpayment Of Estimated Tax.

No yes you may owe a penalty. Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web your total underpayment amount. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

No Yes Complete Lines 8 And 9 Below.

Is line 7 less than $1 ,ooo? You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Does any box in part il below apply? Even if you underpaid your taxes during the year, the irs might not charge a penalty if you meet one of the safe harbor tests.