Form 5972 Michigan

Form 5972 Michigan - Web michigan form 5972 is a tax document used to certify an individual’s eligibility for certain state income tax credits. Sales includes gross receipts from sales of tangible. Web michigan compiled laws complete through pa 278 of 2022 house: Web city of detroit business & fiduciary taxes search tips search by tax area: The due dates are april 17, june 15, september 17 (2012),. Use this form to provide pii. Looking for forms from 2015 and earlier? Web 2018 fiduciary tax forms. Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Health insurance claims assessment (hica) ifta / motor carrier.

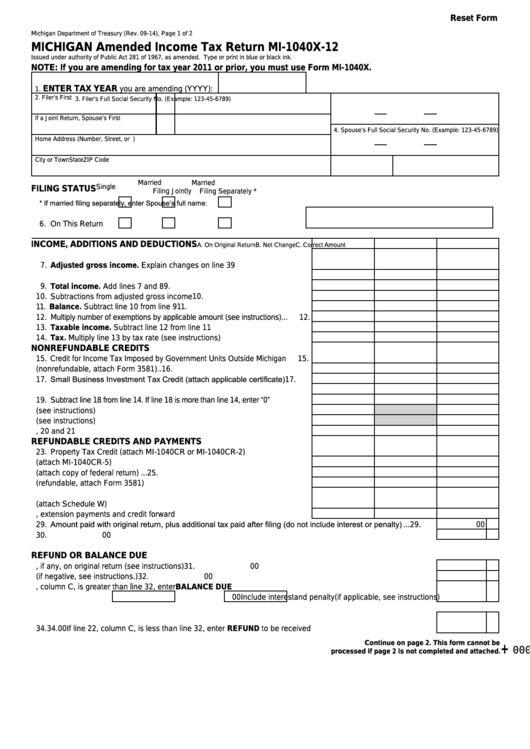

The current tax year is 2022, and most states will release updated tax forms between. Web you must file estimated tax returns on a quarterly basis if you are self employed or do not pay sufficient tax withholding. Sales includes gross receipts from sales of tangible. The irs sent letter 5972c to inform you of steps you need to take to avoid irs. Web taxformfinder provides printable pdf copies of 98 current michigan income tax forms. Web michigan form 5972 is a tax document used to certify an individual’s eligibility for certain state income tax credits. Instructions for 2021 sales, use and withholding taxes 4% and 6% m/q return. Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Health insurance claims assessment (hica) ifta / motor carrier. Web michigan department of treasury issued under authority of public act 281 of 1967, as amended.

The current tax year is 2022, and most states will release updated tax forms between. Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Instructions for 2021 sales, use and withholding taxes 4% and 6% m/q return. Health insurance claims assessment (hica) ifta / motor carrier. Web michigan department of treasury issued under authority of public act 281 of 1967, as amended. Web city of detroit business & fiduciary taxes search tips search by tax area: Use this form to provide pii. Use this option to browse a list of forms by tax area. Web taxformfinder provides printable pdf copies of 98 current michigan income tax forms. Instructions for 2021 sales, use and withholding taxes 4% and 6%.

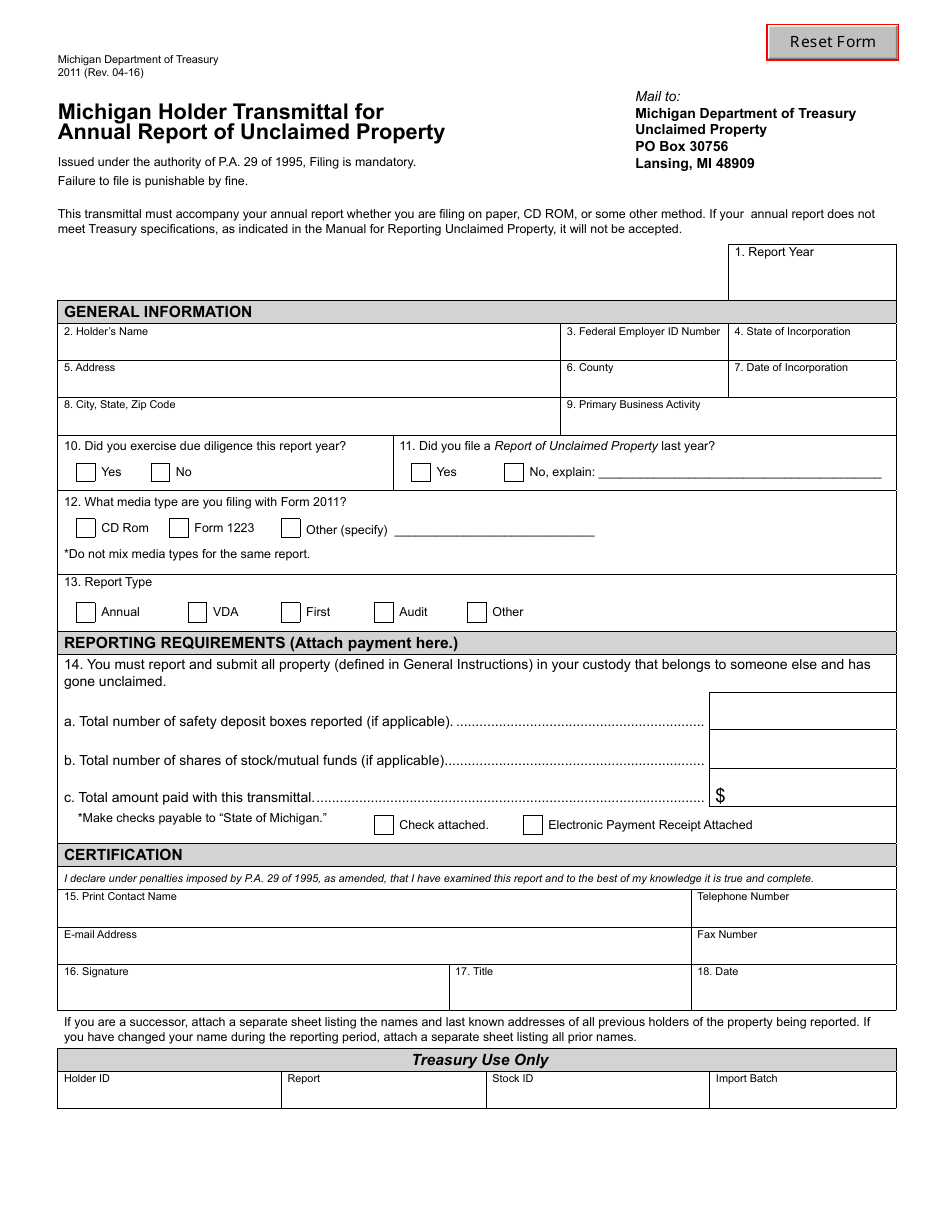

Form 2011 Download Fillable PDF or Fill Online Michigan Holder

For example, if you are interested in individual. Web 2018 fiduciary tax forms. Hb5972 history (house actions in lowercase, senate actions in uppercase) note: Looking for forms from 2015 and earlier? Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use.

Fill Michigan

Use this form to provide pii. Looking for forms from 2015 and earlier? Health insurance claims assessment (hica) ifta / motor carrier. Adjourned until tuesday, february 7,. It must be completed by the taxpayer and.

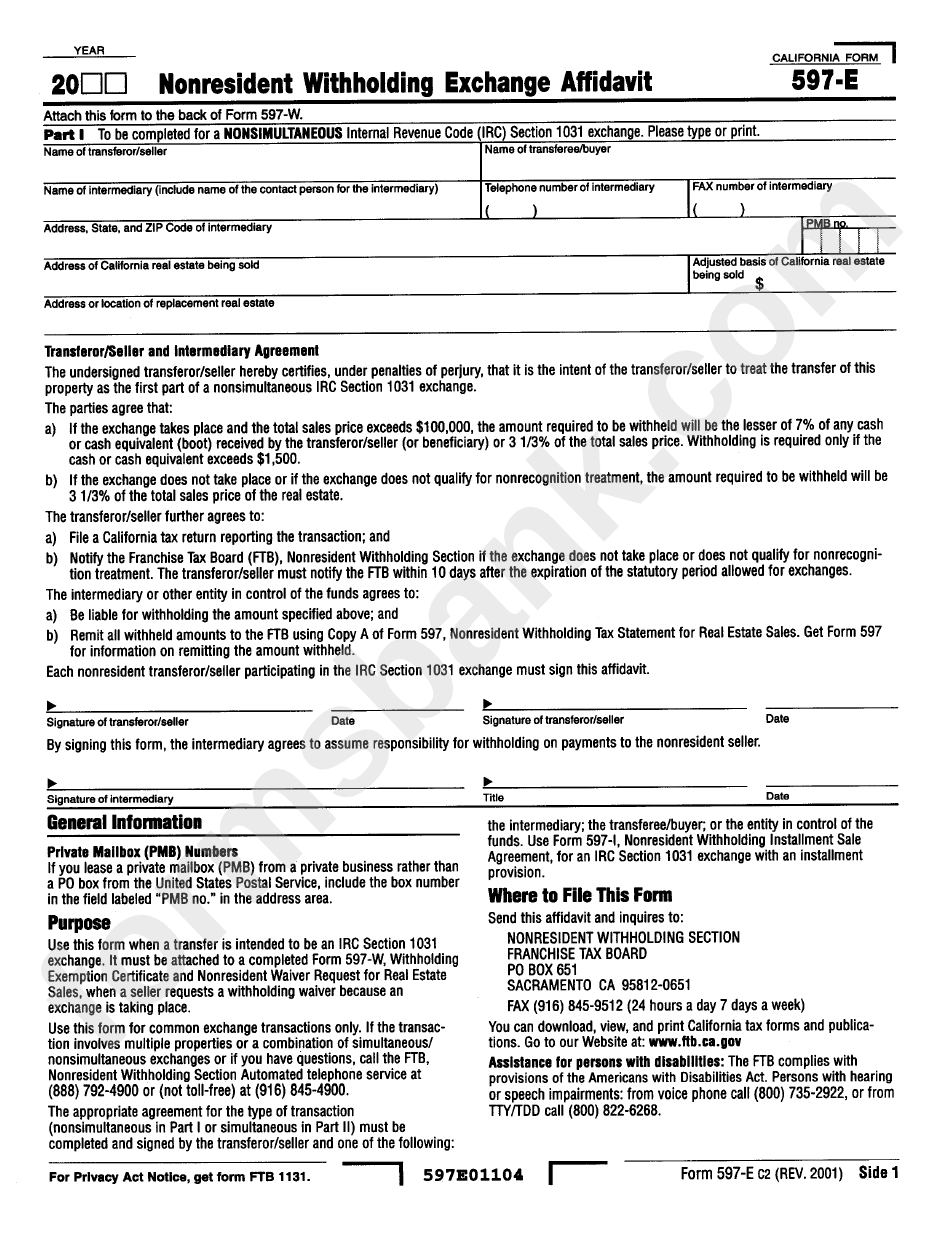

Form 597E Nonresident Withholding Exchange Affidavit printable pdf

The due dates are april 17, june 15, september 17 (2012),. Hb5972 history (house actions in lowercase, senate actions in uppercase) note: The law took effect february 9, 2022. Looking for forms from 2015 and earlier? Use this option to browse a list of forms by tax area.

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

Looking for forms from 2015 and earlier? Web why you received irs letter 5972c. Web you must file estimated tax returns on a quarterly basis if you are self employed or do not pay sufficient tax withholding. Web michigan form 5972 is a tax document used to certify an individual’s eligibility for certain state income tax credits. Web taxformfinder provides.

[useFieldArray] Type 'string' is not assignable to type 'never' · Issue

Instructions for 2021 sales, use and withholding taxes 4% and 6%. For example, if you are interested in individual. Hb5972 history (house actions in lowercase, senate actions in uppercase) note: Web city of detroit business & fiduciary taxes search tips search by tax area: Sales includes gross receipts from sales of tangible.

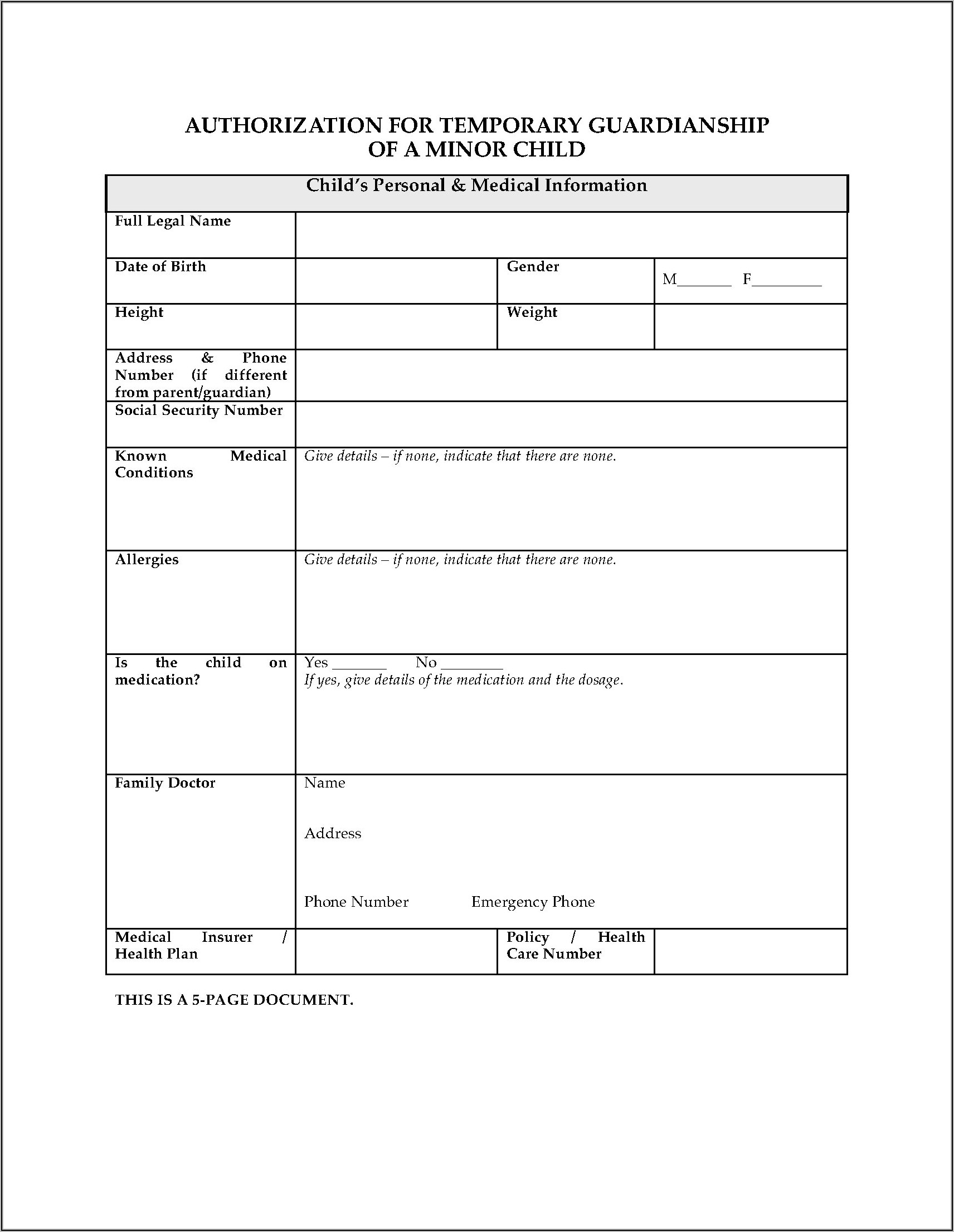

Temporary Guardianship Of A Minor Form Illinois Form Resume

Web you must file estimated tax returns on a quarterly basis if you are self employed or do not pay sufficient tax withholding. The current tax year is 2022, and most states will release updated tax forms between. For example, if you are interested in individual. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372).

California form 597 w Fill out & sign online DocHub

The irs sent letter 5972c to inform you of steps you need to take to avoid irs. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. You have an unpaid tax balance and/or an unfiled tax return. A page number of 1..

michigan sales tax exemption number Jodie Mccord

It must be completed by the taxpayer and. Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Web disclosure forms and information. Adjourned until tuesday, february 7,. The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income.

SSC Phase 10 Recruitment 2023 Application Form NVSCounselor

Web you must file estimated tax returns on a quarterly basis if you are self employed or do not pay sufficient tax withholding. It must be completed by the taxpayer and. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Instructions for.

Hp 5973 Mass Selective Detector Manual / The 5975 series mass selective

Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income. Instructions.

Web You Must File Estimated Tax Returns On A Quarterly Basis If You Are Self Employed Or Do Not Pay Sufficient Tax Withholding.

Sales includes gross receipts from sales of tangible. Web taxformfinder provides printable pdf copies of 98 current michigan income tax forms. The law took effect february 9, 2022. The current tax year is 2022, and most states will release updated tax forms between.

The Irs Sent Letter 5972C To Inform You Of Steps You Need To Take To Avoid Irs.

Hb5972 history (house actions in lowercase, senate actions in uppercase) note: Instructions for 2021 sales, use and withholding taxes 4% and 6% m/q return. You have an unpaid tax balance and/or an unfiled tax return. For example, if you are interested in individual.

Use This Form To Provide Pii.

The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income. Adjourned until tuesday, february 7, 2023 1:30:00 pm senate: Instructions for 2021 sales, use and withholding taxes 4% and 6%. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use.

Looking For Forms From 2015 And Earlier?

Use this option to browse a list of forms by tax area. Web michigan department of treasury issued under authority of public act 281 of 1967, as amended. Web michigan form 5972 is a tax document used to certify an individual’s eligibility for certain state income tax credits. Web why you received irs letter 5972c.

![[useFieldArray] Type 'string' is not assignable to type 'never' · Issue](https://user-images.githubusercontent.com/10513364/125942903-1a6258db-e8a8-48e4-aeb4-dd6fbb6e5cfc.png)