Form 8846 Instructions

Form 8846 Instructions - You should only file form 8846 if you meet both of the following conditions: Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3 You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. For more information on the disclosure rules, see regulations. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Filing this form can help your business reduce its tax burden. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web published on december 19, 2022 last modified on may 30, 2023 category: 5 minutes watch video get the form!

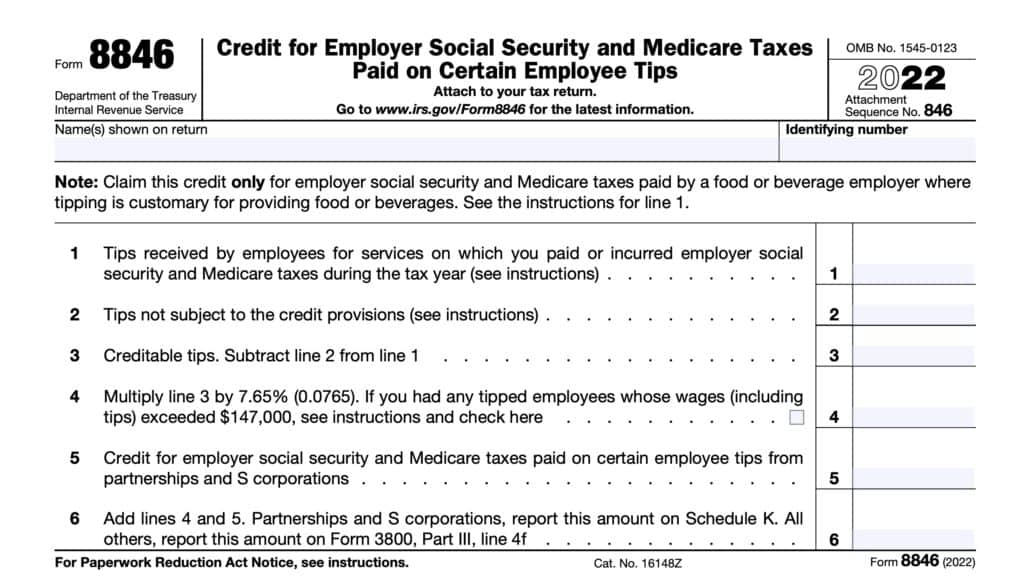

Web the fica tip credit can be requested when business tax returns are filed. It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Web who should file file form 8846 if you meet both of the following conditions. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. Determining if the fica tax tip applies to your business can be a challenge. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web form 8846 gives certain food and beverage establishments a general business tax credit. Filing this form can help your business reduce its tax burden.

Web instructions for form 8886 available on irs.gov. You should only file form 8846 if you meet both of the following conditions: Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3 Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web the fica tip credit can be requested when business tax returns are filed. Web published on december 19, 2022 last modified on may 30, 2023 category: 5 minutes watch video get the form! Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. For more information on the disclosure rules, see regulations. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary.

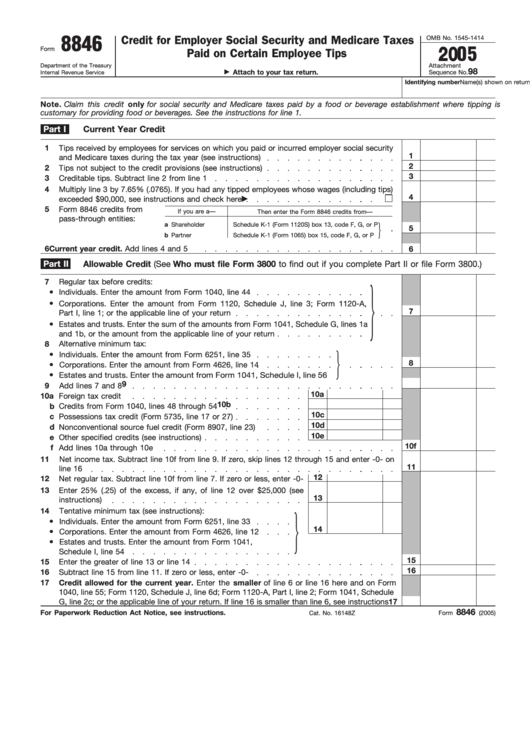

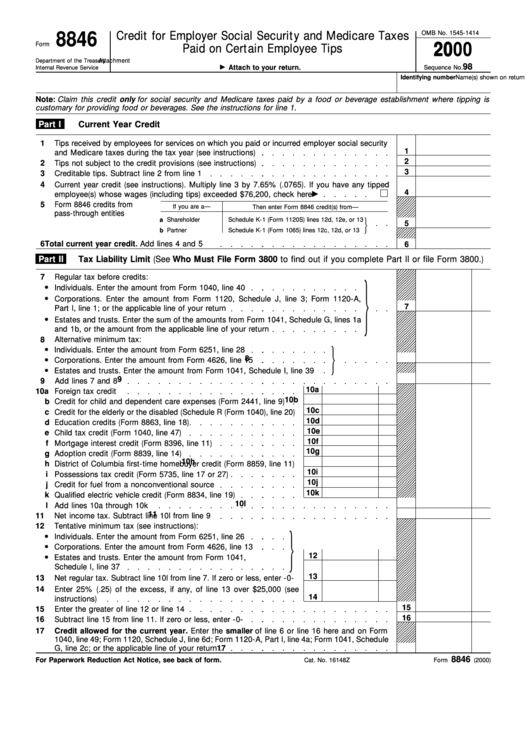

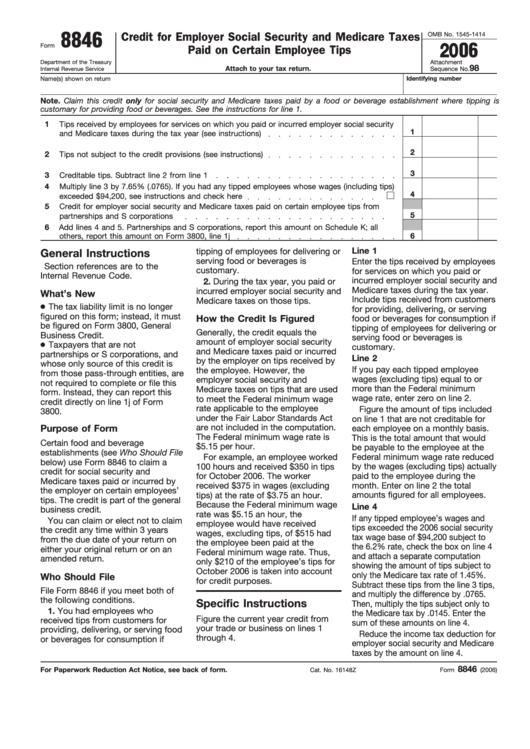

Fillable Form 8846 Credit For Employer Social Security And Medicare

5 minutes watch video get the form! For more information on the disclosure rules, see regulations. You should only file form 8846 if you meet both of the following conditions: Web who should file file form 8846 if you meet both of the following conditions. Web instructions for form 8886 available on irs.gov.

Form 8846 Credit for Employer Social Security and Medicare Taxes

See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. The credit applies to social security and medicare taxes that the employer pays on some employee tips. Web instructions for form 8886 available on irs.gov. Filing this form can help your business reduce its tax burden. It is reported on irs form 8846, which.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Web instructions for form 8886 available on irs.gov. Determining if the fica tax tip applies to your business can be a challenge. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. Web form 8846 gives certain food and beverage establishments a general.

Form 8846 In Quickbooks FORM.UDLVIRTUAL.EDU.PE

Filing this form can help your business reduce its tax burden. Web published on december 19, 2022 last modified on may 30, 2023 category: Step by step instructions comments the internal revenue code allows for certain business owners to take business tax credits to reduce their employee payroll costs. 5 minutes watch video get the form! Determining if the fica.

Credit For Employer Social Security And Medicare Taxes Paid On Certain

Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. For more information on the disclosure rules, see regulations. See participation in a reportable transaction,.

U.S. TREAS Form treasirs88462001

5 minutes watch video get the form! Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income completing form 8846 filing for prior years filing for employee tax credits there are currently 15.3 million employees in the restaurant industry. For more information on the disclosure rules, see regulations. You had employees who.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Web form 8846 gives certain food and beverage establishments a general business tax credit. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees.

Tax Forms Teach Me! Personal Finance

Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Determining.

Form 8846 Credit for Employer Social Security and Medicare Taxes

Web instructions for form 8846 are on page 2 of the form. Filing this form can help your business reduce its tax burden. You should only file form 8846 if you meet both of the following conditions: Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web form8846(1995) part i part ii.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Web instructions for form 8846 are on page 2 of the form. Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income completing form 8846 filing for prior years filing for employee tax credits there are currently 15.3 million employees in the restaurant industry. For more information on the disclosure rules, see.

Web Published On December 19, 2022 Last Modified On May 30, 2023 Category:

It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Step by step instructions comments the internal revenue code allows for certain business owners to take business tax credits to reduce their employee payroll costs. Web form 8846 gives certain food and beverage establishments a general business tax credit.

Web The Fica Tip Credit Can Be Requested When Business Tax Returns Are Filed.

You should only file form 8846 if you meet both of the following conditions: Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary.

5 Minutes Watch Video Get The Form!

Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web who should file file form 8846 if you meet both of the following conditions. Web irs form 8846 instructions by forrest baumhover july 5, 2023 reading time: For more information on the disclosure rules, see regulations.

Filing This Form Can Help Your Business Reduce Its Tax Burden.

Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3 Web instructions for form 8846 are on page 2 of the form. The credit applies to social security and medicare taxes that the employer pays on some employee tips. See participation in a reportable transaction, later, to determine if you participated in a reportable transaction.