Form 8958 Instructions

Form 8958 Instructions - Enter the taxpayer and spouse or partner amounts. Refer to the information below to assist with questions regarding screen 3.1 community property income allocation. Not all income is community income needing to be divided between spouses/rdps. Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were: The adjustment would typically only apply. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community property income. If you need more room, attach a statement listing the source of. Web how do i complete the married filing separate allocation form (8958)? Avoid using information from the prior year, as it may have changed. Hold down ctrl+e to display the detail window or select the expander icon in the field.

Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web about form 8958, allocation of tax amounts between certain individuals in community property states. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit lacerte. The adjustment would typically only apply. Not all income is community income needing to be divided between spouses/rdps. Web how do i complete the married filing separate allocation form (8958)? Enter amounts in the income allocation details subsection. The couple reports the total amount received from each source, then allocates a portion of the total to each person. Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were:

Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community property income. Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Avoid using information from the prior year, as it may have changed. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were: Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit lacerte. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay dividends, capital gains and tax refunds. Enter amounts in the income allocation details subsection. Web to generate form 8958, follow these steps: The adjustment would typically only apply.

Alcoholics Anonymous 12 Step Worksheets Universal Network

Enter the taxpayer and spouse or partner amounts. The couple reports the total amount received from each source, then allocates a portion of the total to each person. Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Web how do i complete the married filing separate.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

The couple reports the total amount received from each source, then allocates a portion of the total to each person. Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Go to screen 3.1, community property income allocation. Web to generate form 8958, follow these steps: Refer.

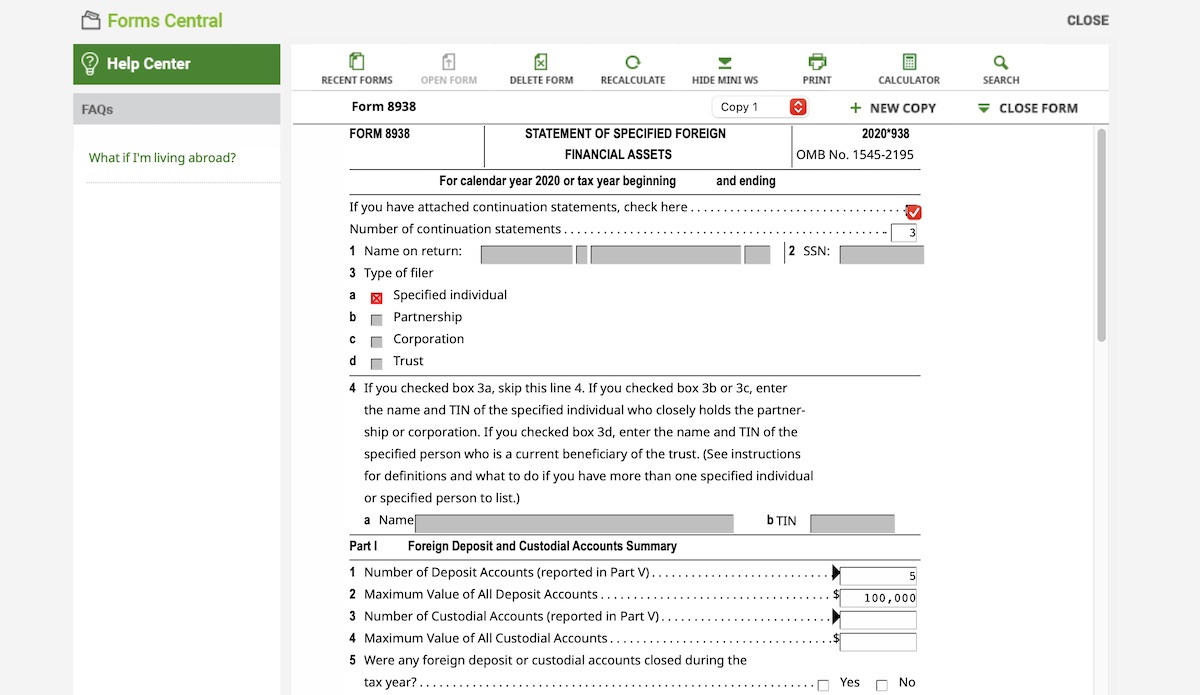

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community property income. Web to generate form 8958, follow these steps: Web about form 8958, allocation of tax amounts between certain individuals in community property states. Enter amounts in the income allocation details.

Form 8958 Fill Out and Sign Printable PDF Template signNow

The adjustment would typically only apply. If you need more room, attach a statement listing the source of. Avoid using information from the prior year, as it may have changed. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web how do i complete the.

Instructions 9465 2018 Blank Sample to Fill out Online in PDF

Refer to the information below to assist with questions regarding screen 3.1 community property income allocation. Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Web home forms and instructions about publication 555, community property about publication 555, community property publication 555 discusses community property laws.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Hold down ctrl+e to display the detail window or select the expander icon in the field. If you need more room, attach a statement listing the source of. The adjustment would typically only apply. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay dividends,.

Fill Free fillable Allocation of Tax Amounts Between Certain

Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit lacerte. Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Enter amounts in the income allocation details subsection. Web.

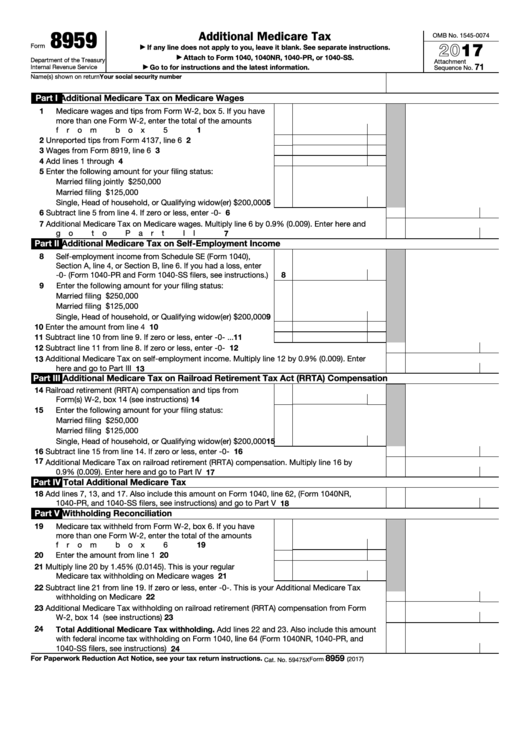

Top 9 Form 8959 Templates free to download in PDF format

If you need more room, attach a statement listing the source of. Refer to the information below to assist with questions regarding screen 3.1 community property income allocation. Avoid using information from the prior year, as it may have changed. Hold down ctrl+e to display the detail window or select the expander icon in the field. Web how to properly.

LEGO instructions Power Miners 8958 Granite Grinder YouTube

Web about form 8958, allocation of tax amounts between certain individuals in community property states. Hold down ctrl+e to display the detail window or select the expander icon in the field. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community property.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were: Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit lacerte. Not all income is community income needing to be divided.

Web Income Allocation Information Is Required When Electronically Filing A Return With A Married Filing Separately Or Registered Domestic Partner Status In The Individual Module Of Intuit Lacerte.

Web the first step in determining taxpayers’ filing status is to confirm their marital status on the last day of the tax year. Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were: Go to screen 3.1, community property income allocation. Web about form 8958, allocation of tax amounts between certain individuals in community property states.

Enter Amounts In The Income Allocation Details Subsection.

Web to generate form 8958, follow these steps: Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay dividends, capital gains and tax refunds. Web home forms and instructions about publication 555, community property about publication 555, community property publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community property state or country, and file separate. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights.

Web Use Form 8958 To Determine The Allocation Of Tax Amounts Between Married Filing Separate Spouses Or Registered Domestic Partners (Rdps) With Community Property Rights.

Not all income is community income needing to be divided between spouses/rdps. Hold down ctrl+e to display the detail window or select the expander icon in the field. Avoid using information from the prior year, as it may have changed. Refer to the information below to assist with questions regarding screen 3.1 community property income allocation.

The Couple Reports The Total Amount Received From Each Source, Then Allocates A Portion Of The Total To Each Person.

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). Enter the taxpayer and spouse or partner amounts. Web how do i complete the married filing separate allocation form (8958)? If you need more room, attach a statement listing the source of.